Macroeconomic indicators: Retail sales - the pulse of the economy

The Retail Sales Report is one of the most important macroeconomic indicators analyzed by investors and economists around the world. What is the "added value" of this indicator? What causes is being closely followed by both market practitioners and economic commentators?

Consumption is one of the main "Engines" economy. It is thanks to the growing consumption that the demand for production goods and services is growing. This in turn allows for an increase in economic activity. Of course, consumption must go hand in hand with investment for economic growth to have a "more durable basis".

Read: Macroeconomic indicators: GDP, Inflation

Consumption is one of the most "sensitive" macroeconomic indicators. For this reason, the decline in retail sales may herald a slowdown in economic growth. This is due to the fact that the decline in consumption reduces the demand for goods and services, and this reduces economic activity.

Consumption growth is correlated quite well with real growth in disposable income (remember that correlation is not the same as causation). As disposable income increases, three different situations can arise:

- Income growth entirely allocated to consumption

- Income growth entirely dedicated to savings or debt reduction

- The additional income was broken down into consumption and savings

In the first case, consumption stimulates consumption, which will be visible in retail sales. In the latter case, the savings rate or household debt will increase.

Another factor that may affect the level of consumption is household wealth. A change in the value of an asset (e.g. real estate, stock, bond) causes an appearance "Property effect". Consumers feel more confident when the value of an asset increases (appreciation). As a result, the level of consumption increases.

In the case of a decrease in the value of assets, eg due to a market bear market, the "net wealth" of the household is smaller. This, in turn, prompts consumers to reduce their level of consumption. The wealth effect occurred, among others, during the Great Depression of 1929 in the United States, when the bear market was one of the factors causing the contraction in consumption. The wealth effect is particularly visible on the American market due to the high level of savings invested in the capital market.

Fluctuating retail sales can be one of the drivers of the short-term economic cycle. In such a case, GDP growth will be driven mainly by consumption growth. At the same time, the increase in internal consumption will stimulate domestic production and import.

Retail sales - GUS

Data is presented weekly by Central Statistical Office (GUS). Retail sales are presented in both current and constant prices. Thanks to the analysis in constant prices, a "fuller" picture of the real change in the level of consumption in the economy is obtained.

The retail sales index is a macroeconomic index that aggregates the value of own and commission goods sold (otherwise new and used) available at retail outlets, catering establishments and other points of sale. Retail sales are carried out at the final prices paid by consumers (VAT included).

Retail sales, on the other hand, do not take into account the value of sales defined as marketplace (e.g. fairs) made by sellers who pay only the place fee. The sale of scrap and waste is also ignored.

The retail sales index is also published broken down into individual product categories. In its monthly reports, the CSO specified the following components in 2010-2021:

- Motor vehicles, motorcycles and parts

- Solid, liquid and gaseous fuels

- Food, beverages and tobacco products

- Other retail sale in non-specialized stores

- Pharmaceuticals, cosmetics, orthopedic equipment

- Textiles, clothing and footwear

- Furniture, RTV, household appliances

- Newspapers, books and other sale in specialized stores

- Other

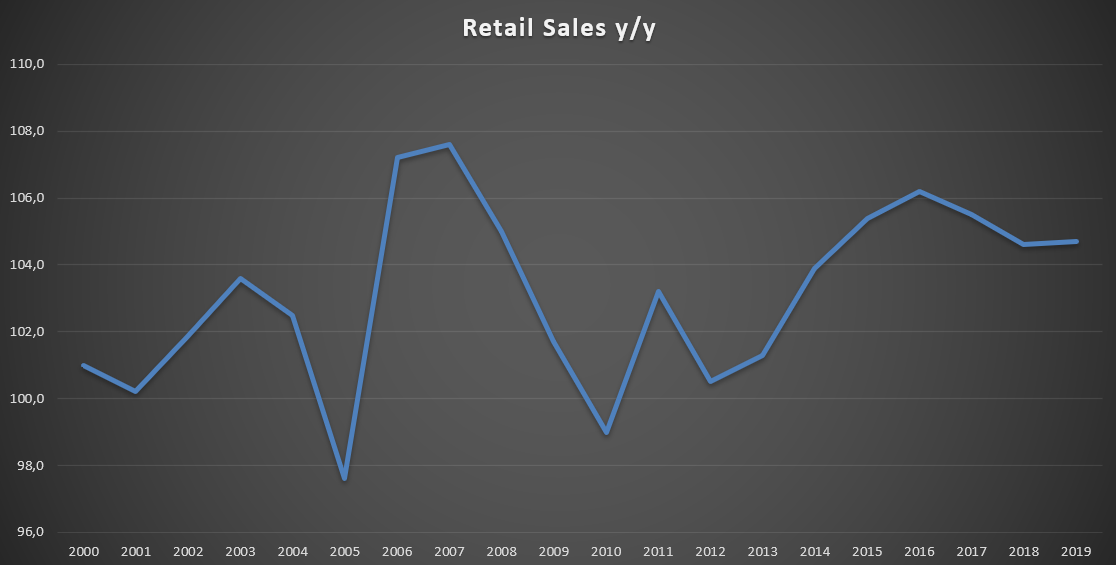

Below is a chart showing the value of retail sales (in constant prices) in Poland in the years 2000 - 2019. A value above 100 means an increase in sales y / y. In the analyzed period, sales decreased y / y in only two years (2005 and 2010).

The Covid-19 Times and Retail Sales

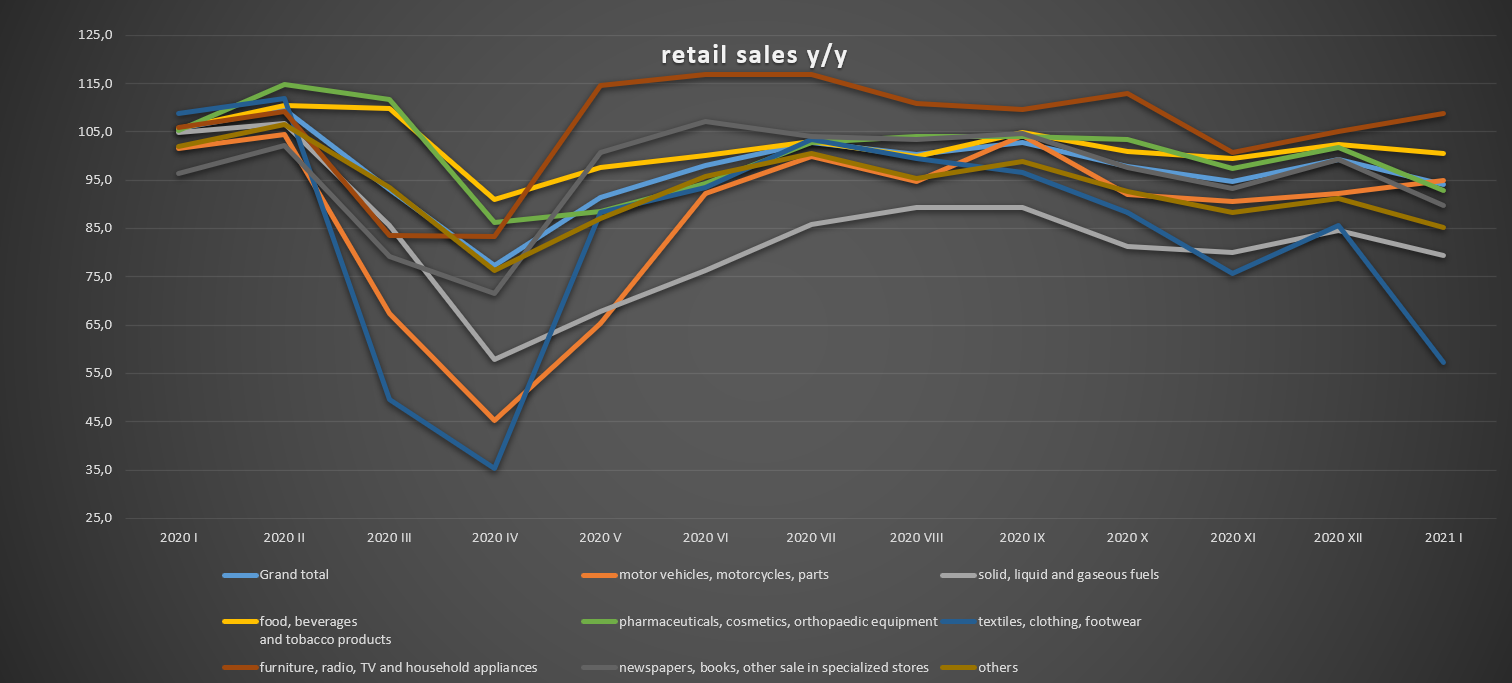

Looking at the individual components of retail sales, you can look at historical trends in the economy. A great example is 2020. Government restrictions introduced to minimize COVID-19 cases resulted in a decline in economic activity in the country. It was evident in retail sales. Between March and June 2020, a very large decline in economic activity was visible. April was particularly severe, when retail sales fell by as much as 22,6% y / y. It was caused, among others, by "Collapse" of sales of motor vehicles (-54,8% y / y), fuels (-42,2% y / y) or clothing and footwear (-64,6% y / y).

Closing shopping malls and limiting mobility caused the sale of footwear and clothing to be very weak throughout 2020. Thanks to this data, the investor could himself estimate the weaker financial results of companies from the footwear and clothing industry before the publication of quarterly reports of companies from these industries.

On the other hand, lower expenses on restaurants or travel resulted in savings in household budgets. These funds were partly spent on home repairs, replacement of furniture, and electronics and household appliances. This component of retail sales did the best throughout 2020.

Summation

Retail sales data is published monthly by the Central Statistical Office (GUS). It is an indicator that synthetically measures the condition of households. In normal market situations, sales growth occurs when disposable income increases. This may be due to an increase in real wages (increases or as a result of tax cuts) or a decrease in the savings rate. In the worsening of the financial situation of households, a reduction in consumption is visible. Stagnation in expenditure can then be seen in retail sales.

Information on retail sales is also important information for investors who own shares or bonds of companies operating on the clothing, footwear, furniture or household appliances market. Weaker results of retail sales in these components mean that the probability of worse financial results of enterprises operating in them increases. This, in turn, may translate into a decline in stock prices (lower profits) and bonds (worsening liquidity).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)