Macroeconomic indicators: GDP, CPI inflation [part AND]

Anyone interested in economics, finances or investing their money on the stock exchange or the currency market has encountered a lot of information about the economic situation of a given country. The article will describe macroeconomic indicators such as GDP and CPI - one of the key indicators reflecting the economic situation of a given country.

CBA

The most popular macroeconomic indicator is GDP, i.e. Gross Domestic Product. Most comparisons between economies use GDP. The comparisons apply to both dollar-valued GDP, purchasing power parity, and GDP per capita.

The economic development of a country or region is also measured by GDP. At the end of each quarter and year, the results of GDP growth or decline are presented. However, the very concept of GDP development is often misunderstood.

GDP is one of the basic macroeconomic indicators. In simple terms, GDP is the monetary value of all final goods and services produced in a country at a given time (e.g., a quarter or a year). Only the final goods and services are added together to avoid double counting. So the GDP indicator is different from the amount of assets accumulated by households and companies.

In short, GDP is the sum of the added value generated by all economic entities operating in a given country or region. It doesn't matter who owns the entity. GDP can be divided into nominal (current prices are taken into account) and real (after "cleansing" of inflation using the GDP deflator).

Calculating GDP

Due to the way GDP is measured (only final goods and services), there are three methods for calculating Gross Domestic Product:

- expense - GDP is equal to the expenditure of buyers of final goods,

- profitable - GDP equal to the income of all owners of factors of production,

- production - GDP is calculated by including from total production the value of intermediate goods and services (consumed in the creation process).

The expenditure method assumes that GDP is equal to the expenditure of all buyers of final goods produced during a given period. GDP on the demand side is calculated according to the formula:

GDP = consumption + investments + government expenditure (excluding transfers) + stock changes.

Where applicable income method, for the calculation of GDP, it is assumed that the size of the Gross Domestic Product is equal to the income of all owners, i.e. factors of production (employees, capital owners and the state). The formula for the income method is as follows:

GDP = labor income + capital income + state income + depreciation.

Where applicable production method the value of final goods and services is calculated to estimate GDP and by subtracting from it the value of the goods and services consumed in their production. The formula for GDP according to this method is as follows:

GDP = country's output - intermediate consumption = sum of value added from all branches of the national economy.

Below is a list of countries with the highest GDP in US dollars (USD)

| 2019 | GDP in billion USD |

| United States | 21 427,7 |

| China | 14 342,9 |

| Japan | 5 081,7 |

| Germany | 3 845,6 |

| Indie | 2 875,1 |

Source: own study based on World Bank data

Additional GDPR Considerations

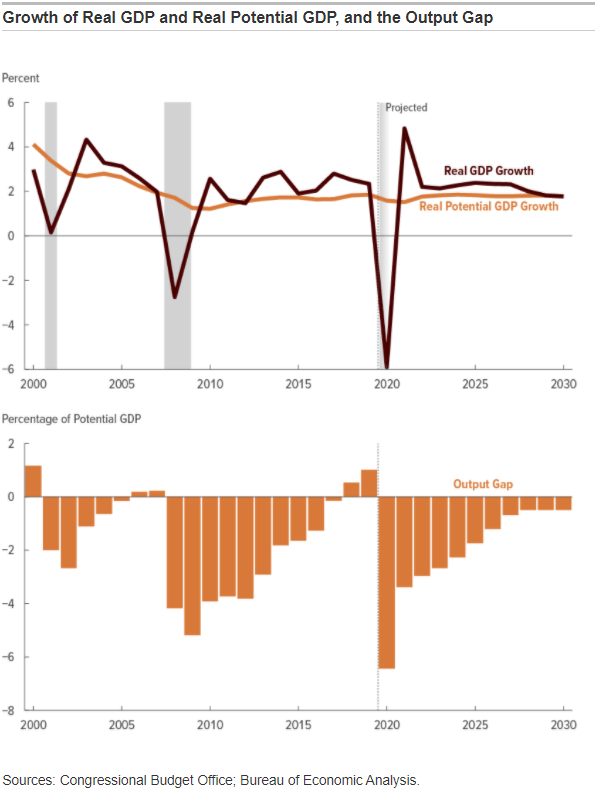

Potential GDP - it is an estimate of the maximum value that an economy is able to generate while maintaining price stability and in full employment. The level of potential GDP is determined by the potential of a given economy. It depends on the available capital, labor and land inputs.

GDP gap - this is the difference between potential and real GDP. The GDP gap is calculated using the following formula:

(Current GDP - Potential GDP) / Potential GDP

An example of a large GDP gap was the United States following the burst of the subprime mortgage bubble. The global financial crisis caused the US economy to grow below its potential. It was the same during the coronavirus pandemic. The GDP gap in July 2020 has been estimated by the Congressional Budget Office at around 6% of GDP.

Source: cbo.gov

GDP at purchasing power parity - it is a GDP calculation based on the actual purchasing power of the currency. Purchasing power parity is sometimes called the law of one price because the exchange rate of currencies is set to make the prices of the same goods equal. Thanks to this application, it is possible to better reflect the potential of a given economy.

As you can see, according to World Bank data, China is the largest economy in the world, taking into account the purchasing power parity.

| 2019 | PPP GDP ($ billion) | GDP in billion USD |

| China | 23 460,1 | 14 342,9 |

| United States | 21 427,7 | 21 427,7 |

| Indie | 9 611,7 | 2 875,1 |

| Japan | 5 459,2 | 5 081,7 |

| Germany | 4 659,8 | 3 845,6 |

Source: own study based on World Bank data

GDP - per capita

The sheer size of GDP does not say much about a country. It also depends largely on the size of the population. It is obvious that a country with a population exceeding 1 billion (eg India) will have a greater GDP than Poland, whose population is lower by 38 million.

| 2019 | GDP in billions of dollars | GDP per capita |

| USA | 21 427,7 | 65 281 |

| China | 14 342,9 | 10 262 |

| Indie | 2 875,1 | 2 104 |

| Poland | 592,2 | 15 595 |

Source: own study based on World Bank data

For this reason, very often, the amount of GDP per capita is used. This means the size of the Gross Domestic Product per capita. GDP per capita is a better measure of productivity between countries than normal GDP. Very often GDP per capita is given in purchasing power parity (PPP).

Below is a comparison of GDP per capita and GDP per capita PPP according to World Bank data.

| 2019 | GDP per capita | PPP GDP per capita |

| Poland | 15 595 | 34 431 |

| Germany | 46 259 | 56 278 |

| USA | 65 281 | 65 298 |

| South Korea | 31 762 | 43 143 |

Source: own study based on World Bank data

Disadvantages of GDP

However, GDP is not an ideal indicator. It is an indicator of economic activity, not of economic and social well-being. It does not take into account the quality of life of a given country or region (environmental pollution, quality of education or life expectancy). It does not include free services, which include, for example, search engines, social networks or childcare provided by a parent). The GDP does not include the negative effects of economic activity such as environmental pollution. The index also ignores the impact of illegal production (drugs, black market). Another problem is the gray area, which is hard to quantify.

GDP and the investor

GDP can be an important macroeconomic indicator that informs investors about the economic situation in a country.

An investor looking for investments in developed countries will prefer large capital markets where GDP per capita will be at a high level. On the other hand, an investor looking for investments in countries with high growth dynamics will choose countries with high GDP growth. Obviously, GDP is not a decisive indicator, but it can be one of the first "filters" in diversifying your investment portfolio.

Sometimes a shrinking GDP may herald a temporary economic slowdown, which may lead to a temporary sell-off of stocks. In such a situation, it is sometimes worthwhile to increase involvement in such a market as it heralds an opportunity to buy shares at a favorable price. Investments in the American stock market (e.g. ETFs), during the contraction of the American economy at the turn of 2008/2009. Another example is investing in Russian equities (eg VanEck Vectors Russia ETF) at the turn of 2015 and 2016. In 2015, Russia's GDP contracted by more than 2%.

CPI inflation

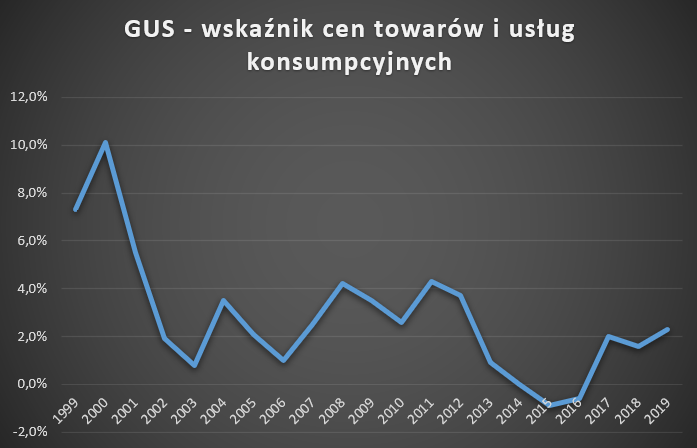

According to the basic definition, inflation is a process of rising prices in an economy related to a decline in the purchasing power of money. In Poland, inflation is measured, inter alia, using the Consumer Price Index (CPI). However, there are different types of inflation - PPI (Industrial Producer Price Index) or core inflation.

Current information on price changes in Poland is provided by the Central Statistical Office (GUS). Please note that the price change is not always positive. If the price dynamics becomes negative (an increase in the purchasing power of money) it is referred to as deflation, i.e. a decrease in the general price level.

In Poland, the authority is responsible for maintaining a stable level of inflation National Bank of Poland, which is the Monetary Policy Council. The council's aim is to keep the CPI close to the inflation target of 2,5%. The allowable fluctuation range around the target is 1%. This means that the allowable range for inflation has been set at 1,5% -3,5%. Too high inflation encourages interest rate hikes, while the risk of deflation encourages the Council to cut the interest rate or implement non-standard methods of easing monetary policy.

Inflation is often a misunderstood macroeconomic indicator. It results from treating this indicator "on peasant reason". It is often mentioned that "governments manipulate inflation" or deceive the public about the extent of "real" inflation. Very often, such terms result from submitting your own household budget to the entire economy. For this reason, some people seeing that the price of butter has increased from PLN 3 to PLN 6, and a kilogram of chicken from PLN 7 to PLN 10, are convinced that inflation in the entire economy is double-digit. Nothing could be more wrong.

As a rule, people only remember the prices of goods or services, which have increased significantly. A great example is the high price of parsley in the summer of 2018, when a kilogram of this vegetable was over PLN 14. In the fall of 2019, the same parsley already cost PLN 4 per kilogram. Butter too had an episode of significant price increases in 2017. It was similar in 2011, when the price of sugar in retail stores exceeded PLN 5 per kilogram. However, this does not mean that the general level of prices in the economy as a whole or in the basket of consumer goods rose just as much.

It should be understood that each household has a different "inflation basket". For this reason, it may feel inflation more or less depending on the price movements of individual products.

For this reason, CPI inflation is not a measure of the cost of living of households. It should also be remembered that information on the price levels is needed to calculate inflation the same goods and services in two comparable periods and information on the structure of household expenditure. In order to properly define the level of inflation, an "inflation basket" is used. The aforementioned "basket" is different for measuring CPI inflation and different for PPI.

What influences the price level?

As a rule, the economy is not closed to external factors. For this reason, the price level of many products is affected by changes in world prices of raw materials or changes in exchange rates. A great example of the impact of changes in world prices and the exchange rate is the price of fuel at petrol stations. The price of fuel is strongly influenced by the crude oil price (expressed in dollars) and the USD / PLN exchange rate.

In the event of an incorrect policy of the central bank, hyperinflation may occur, i.e. a rapid loss of the purchasing power of a country's currency. The most striking example is Venezuela, whose hyperinflation forced the government to denominate the currency (a few zeros were cut off) and the currency was devalued (the official value of the bolivar was reduced to foreign currencies).

In Poland, the last hyperinflation took place in the 90s. From the beginning of the 2015st century, the dynamics of price growth decreased. In 2016-XNUMX, there was even deflation in Poland. Below is the history of the change in the consumer price index:

Source: own study based on data stat.gov.pl

In the case of CPI inflation, the basket includes goods and services grouped into the following sections:

- Food and non-alcoholic drinks

- Alcoholic beverages and tobacco products

- Clothing and footwear

- Use of an apartment or house and energy carriers

- Furnishing the apartment and running the household

- Health

- Transport

- Communication

- Recreation and culture

- Education

- Restaurants and hotels

- Other goods and services.

The CSO systematically changes the weights of the inflation basket to better adjust it to household spending. The research covers full-time employees, farmers, self-employed, retirees, pensioners and farms living on unearned sources.

Below is a summary of selected components of the CPI basket in individual years.

| CPI - weights | 2015 | 2017 | 2019 |

| Food and non-alcoholic drinks | 24,36% | 24,28% | 24,89% |

| Use of the apartment and energy carriers | 21,06% | 20,53% | 19,17% |

| Transport | 9,02% | 8,63% | 10,34% |

| Clothing and footwear | 5,35% | 5,68% | 4,94% |

Source: own study based on CSO data

Problems in estimating inflation

Estimating the level of inflation is not as easy as it seems intuitively. It is not enough to aggregate price changes for all goods between December 31, 2019 and December 31, 2020. There are a number of issues that must be considered when measuring CPI.

Entering the market of goods or services with lower prices but of similar utility may change the purchasing preferences of consumers. As a result, it may cause that the components of inflation selected for research are purchased in smaller amounts, as consumers adapt to changing economic conditions. As a result, the cost of maintaining a household may be actually lower than indicated by inflation.

Another example is the price substitution effect (substitution bias). It is a situation where, as a result of an increase in the price of one product, consumers switch to a "substitute". An example may be a significant increase in the price of butter, which in many households will change their purchasing habits and replace butter with margarine. As a result, the share of butter in the inflation basket will be overestimated, while margarines will be understated compared to real household expenditure. For this reason, the weighting system needs to be frequently updated to better reflect the real average price change in the economy.

Another problem to be solved is the effect of new goods (new good bias). This is where the proliferation of a new invention causes a drastic change in household spending. An example is the introduction of mobile phones, which drastically reduced the demand for fixed telephones.

Another problem faced by statistical offices is the change of customers' places of purchase (outlet substitution bias). An example of such a situation is the opening of a new supermarket, which caused an outflow of customers from local stores. Economies of scale made it easier for local households to buy goods at a lower price than in local stores. As a result, in the following year, the statistical office has to correct the place where prices are obtained from a given region. This also applies to the growing share of e-commerce, which is taking over the traffic of brick-and-mortar stores and putting pressure on retail prices. The aforementioned changes necessitate frequent verification of the set of selected points of sale where prices are tested.

In order to counteract these problems, the Central Statistical Office carries out

- Weighing system updates,

- Verifies lists of goods and services,

- Makes qualitative adjustments,

- Updates lists of points of sale.

Inflation, exchange rate and the investor

Inflation has a devastating effect on investor savings. The holders of savings in the Venezuelan bolivar or the Turkish lira have found out about it. In the case of these currencies, hyperinflation (Venezuela) and high inflation (Turkey) resulted in a significant real drop in the value of savings.

For this reason, investors should diversify their investment portfolio to limit the risk of wrong policy of the central bank and the government. At the same time, the investor should accept greater risk by entrusting part of his portfolio to investments with a higher interest rate (e.g. stocks, corporate bonds or ETFs).

Information provided by national centers or international institutions on inflation can help in assessing a country's stability. Inflation control problems can have a devastating effect on foreign investment. Investments in the iShares MSCI Turkey ETF saw it. Over the past 10 years, the Turkish BIST100 index has increased by more than 100 percent, however, due to the decline in the lira, the investment in dollars has lost more than 40%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Macroeconomic indicators: GDP, CPI inflation [part AND] macroeconomic indicators - gdp inflation cpi](https://forexclub.pl/wp-content/uploads/2021/01/wskazniki-makroekonomiczne-pkb-inflacja-cpi.jpg?v=1610471796)

![Macroeconomic indicators: GDP, CPI inflation [part AND] Financial markets](https://forexclub.pl/wp-content/uploads/2021/01/rynki-finansowe-102x65.jpg?v=1610457611)

![Macroeconomic indicators: GDP, CPI inflation [part AND] NBP, the Monetary Policy Council](https://forexclub.pl/wp-content/uploads/2021/01/Narodowy-Bank-Polski-RPP-102x65.jpg?v=1610531703)