Vitamins in the wallet - How to invest in orange juice [Guide]

For centuries, people have traded goods with each other. At the beginning, it was held in barter, then it was moved to monetary exchange. However, along with the development of civilization, mankind faced more and more problems. One of them was to ensure the supply of the raw material in a few months. This was due to the need to stockpile to ensure the continuity of operating activities. At the same time, the recipients wanted to be able to determine the price of the goods before their actual delivery. The solution was contracts for the delivery of a given grain, vegetable or fruit on a specific day at a predetermined price. With the development of the financial market, such contracts took the form of standardized futures contracts. They are traded on specialized exchanges. Currently, the investor has the opportunity to earn money by changing the price of many goods. In today's text, we will explain how to invest in orange juice.

A orange can be a financial asset

The cultivation of orange trees has been known to mankind for centuries. The first mentions of sweet oranges appeared in Chinese literature in 314 BC In Europe, the cultivation of oranges began at the turn of the XNUMXth and XNUMXth centuries. It was then that Portuguese and Italian merchants acquired orange trees in Asia and began growing oranges in the Mediterranean Basin. The conditions in this area were ideal for the development of this tree's crops. Cultivation in Sicily and Spain was particularly successful. In turn, the cultivation of oranges in South and Central America was possible thanks to Spanish travelers, colonists and missionaries. The cultivation in Florida, the most important place for producing this fruit in the United States, dates back to the mid-XNUMXth century. Among the most popular varieties of oranges is Valencia and hamlin. Valencia variety, which was very successful in the United States, was especially popular. He owed his popularity to the work of William Wolfskill and Irvine Ranch. The fruit is grown for consumption, but the investor can use the oranges to make a profit. How? Having an exposure to orange juice. We invite you to read.

The cultivation of orange trees has been known to mankind for centuries. The first mentions of sweet oranges appeared in Chinese literature in 314 BC In Europe, the cultivation of oranges began at the turn of the XNUMXth and XNUMXth centuries. It was then that Portuguese and Italian merchants acquired orange trees in Asia and began growing oranges in the Mediterranean Basin. The conditions in this area were ideal for the development of this tree's crops. Cultivation in Sicily and Spain was particularly successful. In turn, the cultivation of oranges in South and Central America was possible thanks to Spanish travelers, colonists and missionaries. The cultivation in Florida, the most important place for producing this fruit in the United States, dates back to the mid-XNUMXth century. Among the most popular varieties of oranges is Valencia and hamlin. Valencia variety, which was very successful in the United States, was especially popular. He owed his popularity to the work of William Wolfskill and Irvine Ranch. The fruit is grown for consumption, but the investor can use the oranges to make a profit. How? Having an exposure to orange juice. We invite you to read.

Orange juice as a financial instrument

To be exact, this financial asset is called FCOJ (frozen concentrated orange juice). It is an ideal benchmark for orange juice prices because it is easier and cheaper to store and transport. Of course, there are many varieties of oranges themselves, but the most popular of them is still Valencia. It is used in the food industry, among others for the production of orange juice.

How is frozen orange juice concentrate made? Simply put, FCOJ is formed when the finished orange juice is heated to evaporate the water. Then the concentrate is frozen and packed. The concentrate is purchased by a beverage manufacturer who mixes it with water to make juice. The finished juice is packaged and sold to retailers or wholesalers.

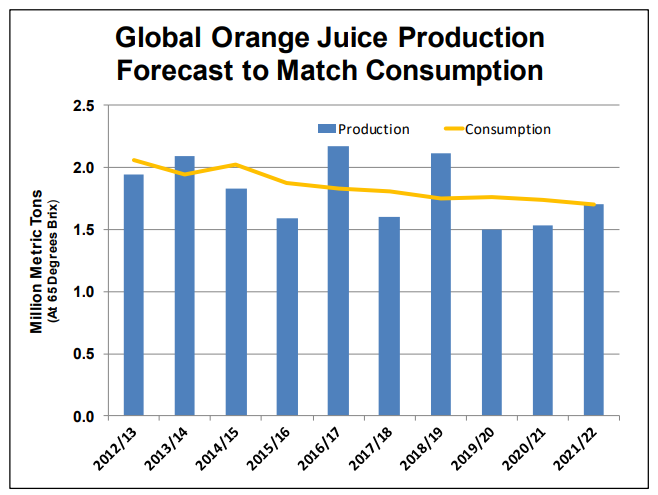

According to data collected by the US USDA agency, world orange juice consumption is declining. It is related to changing nutritional trends (limiting the consumption of products with a lot of sugar).

Source: USDA Citrus: World Markets and Trade 2022

According to the report Citrus: World Markets and Trade (2022) the largest producer of orange juice was Brazyliawhich produced 1,1 million tons of it. The United States was next with a production of 0,21 million tonnes.

Why is it worth investing in orange juice?

One of the advantages of investing in raw materials is portfolio diversification. The correlation between the price of orange juice and stocks or bonds is not very high. Therefore, by adding this financial asset to the portfolio, one can expect greater diversification.

The second reason is to take advantage of high volatility. The price of orange juice depends on a number of factors that can significantly affect the price. Examples of factors may be the weather, plant diseases or a decline in demand. Thanks to the high volatility, the investor can earn both from increases in concentrate prices as well as from their decline.

What affects the price of orange juice?

In the previous section, we explained what factors may affect the prices of the concentrate futures contract. If an investor intends to invest in orange juice, he should carefully investigate which factors have the greatest impact on the price of this commodity.

Supply

The supply of the raw material has a great influence on the prices of orange juice. The largest producer of FCOJ is Brazil, which is responsible for approx 62% of world production orange juice concentrate. The United States is in second place with 15% share. Disruptions in the supply of oranges can have a significant impact on the prices of orange juice concentrate. The reasons may be civil unrest in Brazil or the influence of meteorological factors.

Weather

The weather has a large influence on the supply of oranges. Orange trees tolerate long-term drought on average and when temperature is below 10-15 degrees Celsius. It is also important the quality of the landwhich has the appropriate PH. For this reason frosts or long Drought can cause the supply of oranges to decrease significantly. Another reason for supply limitation is hurricane seasonthat destroys the orange crop. On the other hand, when the weather conditions in Brazil and the United States are perfect, there is a risk "Harvest disasters", which drives the price of orange juice down.

Diseases

Orange trees are also susceptible to disease that can significantly reduce the orange's harvest. To counteract this, many growers use spraying to counteract the risk of, for example, fungal diseases.

Demand in developed countries

Developed countries are the largest consumers of orange juice. The greatest demand for this drink is in the United States and Western European countries. However, it is worth remembering that the consumption of orange juice from the concentrate is under the pressure of falling demand. One of the reasons is that high blood sugar is not recommended for diabetics. On the other hand, orange juice is recommended as one of the sources of vitamin C.

Demand in developing countries

As societies in developing countries are getting rich, the consumption of orange juice is increasing. Especially large markets for juice are China and Brazylia. The increasing demand for orange juice in developing countries is a factor supporting the rise in the price of this product.

Regulation

In 2012, the FDA (Food & Drug Administration) banned the import of orange juice from Brazil due to the use of banned plant protection products by local growers to protect against fungus and mold.

How to Invest in Orange Juice?

If you are wondering how to invest in orange juice, let us reassure you immediately - the investor does not have to create his own plantation to be able to earn money on oranges. A much simpler way is to use financial assets that give you orange juice exposure. The solution is to invest in:

- ETF / ETN for orange juice

- Juice Futures

- Orange juice options

- Stocks of companies related to this sector

- Trading in CFDs

ETN

At the very beginning it is necessary to distinguish what it is ETNand what ETF. ETN stands for Exchange Traded Notes. Loosely translated, this can be translated as notes (i.e. debt) trading on the stock exchange. The ETN is a debt instrumentthat is listed on the stock exchange. By purchasing such a product, the investor simply lends money to the issuer who invests the funds in a particular market. In return, the issuer values the certificate based on a specific benchmark. The ETN has no guarantee of a rate of return, so it is not a typical corporate bond. An ETN therefore has an embedded investment risk (uncertainty as to the achievement of a certain rate of return) and credit risk (the collapse of the ETN issuer).

An ETF, on the other hand, is a publicly traded fund with no credit risk as the funds are not borrowed but transferred to acquire certain assets (and held by a separate entity - the depositary).

Unfortunately, there is no pure ETN that gives exposure to just orange juice. Buying may be the solution Elements Rogers International Commodity Agriculture Total Return ETNwhich has exposure to a large number of agricultural raw materials. The orange juice itself only has 1,9% participation in the RICA index.

Orange Juice Futures

You can invest in orange juice using futures. This gives you the option of using leverage as the minimum deposit is much less than the face value of the futures contract.

Each futures contract is worth £ 15 of concentrate.

Contracts are billed with physical delivery. If the investor waits for the contract to expire, he will have to pick up the concentrate in one of the licensed warehouses located in Florida, New Jersey and Delaware.

A futures contract is listed on The Ice FCOJ-A, which is a benchmark for the global orange juice concentrate market. The supplied concentrate is made of Grade A juice (provided by the US Department of Agriculture). The juice can be made from oranges grown in the United States, Brazil, Costa Rica, and Mexico. These futures contracts are traded in New York, London and Singapore. Contracts expire 6 times a year. The following series are traded on the market: January, March, May, July, September and November.

Shares of companies listed on the stock exchange

One of the ideas that an investor can come up with is to look for companies that produce orange concentrate or a company that grows oranges. Unfortunately, in the largest and most liquid markets, you cannot find a company that only operates in this industry. Of course, there are a lot of producers of orange-based drinks, however, this is not a good way to display concentrated orange juice in the market.

CFD

Retail CFDs for orange juice is possible for investors with accounts with brokers with access to a wide range of commodity instruments. Relatively few companies offer Orange Juice CFDs but we can find them with some of the world's leading brokers. CFDs provide greater flexibility in position size compared to futures. However, it is worth remembering about swap points and rollovers when a series of contracts expires.

Forex / CFD brokers offering orange juice

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Orange juice options

This is another way to take advantage of derivatives in your portfolio. The underlying asset of this type of option is the concentrated orange juice futures. Thanks to the options, the investor can build strategies that allow you to earn both during declines, increases and consolidation. When investing in this type of instrument, it is worth learning about the investment strategies (bull spread, bear spread, rack, short frame, butterfly) as well as Greek coefficients (delta, vega, gamma, theta, rho).

More on options trading we write in this section.

Watch out for USDA reports

Orange juice prices largely depend on production levels in Brazil and Florida. For this reason, it is useful to follow the orange production levels in these regions. The report is very important USDA (The U.S. Department of Agriculture), which reports monthly US production levels of Valencia oranges. On the other hand in January and June, comprehensive reports on the global orange market are published. The semi-annual reports provide information on the supply of oranges, demand for them and inventory levels. This gives more information that will help create a more complete picture of the global orange market.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Vitamins in the wallet - How to invest in orange juice [Guide] how to invest in orange juice](https://forexclub.pl/wp-content/uploads/2022/06/jak-inwestowac-w-sok-pomaranczowy.jpg?v=1654766384)

![Vitamins in the wallet - How to invest in orange juice [Guide] dollar - revolution of the financial system](https://forexclub.pl/wp-content/uploads/2021/06/dolar-102x65.jpg?v=1624018478)

![Vitamins in the wallet - How to invest in orange juice [Guide] forex scam warnings](https://forexclub.pl/wp-content/uploads/2020/07/ostrzezenia-forex-scam-102x65.jpg?v=1596119176)