The Great Depression of the XNUMXth century - a painful lesson and economic consequences

Usually Great Depression we associate with the period 1929 - 1933, which caused the development of state interventionism and a new look at the economy (Keynesianism). However, until the end of the 20-ies of the twentieth century the term Great Depression it was reserved for events in the years 1873-1879 or 1873-1896 (depending on the adopted criteria). In today's text, we will briefly present the history of this period in the development of the economy of Europe and the United States. We invite you to read!

Pre-crisis environment

Proclamation of the German Empire at Versailles. Source: wikipedia.org

The years preceding the Great Depression were full of events that changed the course of world history. In 1865, the Civil War endedwhich led to the abolition of slavery throughout the United States and the subjugation of the States of the South to the political will of the (economic and political) elites in the North. Not much later, the European hegemon - France - was defeated in the war with Prussia. As a result of the Prussian victory in the war, the establishment of the German Empire was announced in Versailles under the leadership of the Hohenzollern dynasty. In the center of Europe, a unified economic area was created, which over time shed the gloves of the greatest power of the time - Great Britain. The rivalry between the German Empire and Great Britain ended with the tragedy of World War I, which was the beginning of the end of Europe's domination in the world (but that is another story).

Economic expansion in Central Europe

Prussia's winning war with France meant that France was forced to pay a huge war contribution. This, combined with the deeper economic integration of Germany, resulted in the emergence of an economic boom in the central part of Europe. He radiated from German throughout Central Europe. The invention of the Bessemer converter allowed for the production of better quality steel. This, in turn, led to a faster expansion of the railway lines. The real estate market developed dynamically and more and more capital was invested in heavy industry and railway companies. The main centers of economic expansion were the German Empire and Austria-Hungary.

Germany and Austria-Hungary

The great victory over France caused euphoria in Germany. The enthusiasm for the reunification of Germany, combined with receiving huge contributions from France, caused a veritable investment fever in the German Empire. Investments were made in railway lines, steel mills, new mines and shipyards. Obviously, the big investments needed huge capital expenditures. As a result, the credit expansion of both German banks and other major European banks began. British and Austrian banks played a special role. On the wave of euphoria in the German Empire, it was decided to introduce a gold standard. The highlight was on July 9, 1873, when the golden mark was introduced to replace the old local currencies. Thus, the transition to the gold standard was almost simultaneous on both sides of the Atlantic (Germany and the United States).

The inflow of short-term speculative capital triggered a strong boom in the German and Austrian stock markets. New companies that needed capital for development emerged like mushrooms after the rain. Of course, there were many financial fraudsters who had investors with a vision of above-average profits, but shortly after raising the capital, companies encountered "Unforeseen difficulties". After the crisis, some stock exchanges took steps to seal and professionalise the capital market. Among them were, among others Vienna Stock Exchange.

Bethel Henry Strousberg. Source: Wikipedia.org

At the same time, the trend of consolidation in industries intensified. The best example was empire Bethel by Henry Strousbergwhich, thanks to good contacts with the Prussian government and obtaining cheap financing from British banks, quickly became a consolidator of the railway market in Germany. He included i.a. Tylża railway lines (now Soviet) - Interburg, Berlin - Gorlice or Hannover - Altenbeken. The difficult situation of this industrial and railway magnate came around 1873, when he had problems with financing numerous investment projects, including a project in Romania. It was the financial and organizational flop in Romania that triggered Strousberg's enormous financial problems that lasted until his death in 1884. In 1873, they were a signal that there was a shortage of capital to finance long-term investments cheaply. The bursting of the speculative bubble led to a sharp sell-off of shares and numerous bankruptcies of companies and banks.

Expansion in the United States

In turn, the reunion of the United States resulted in another wave of territorial and economic expansion. The period of another wave of "Expansion to the West" has begun. Railroads were built and more cities were founded in the area of the Western States. The Homestead Act played a huge role in thiswhich after the Civil War was no longer blocked by senators from the "South". Under this law, citizens could get free land (usually 160 acres). Obviously, the expansion of the settlers caused a significant deterioration in the standard of living of the Indians, who were losing their hunting grounds and were relegated to less favorable areas.

The arrival of settlers and the development of railway lines were an impulse for economic expansion. At the same time, the end of the wars encouraged banks from many countries to expand their lending. The inflow of capital made it possible to finance investments with dubious foundations. However, while capital was readily available, many traders and speculators had a greater appetite for risk. Between 1868 and 1873, approximately 53 kilometers of railroads were built in the United States. Such an economic expansion was financed with both government aid and massive credit expansion. The problem was that loans were taken for long-term investments. In the case of financing long-term projects with short-term loans, there was a risk of a liquidity gap.

Coinage Act of 1873 and the problems of Jay Cooke & Company

The economic expansion was interrupted by temporary problems which, however, did not contribute to a major economic slowdown. It was like that in case of Black Friday 1869, the Chicago fire of 1871, Czy the Boston fire of 1872. This was also the case in 1873 when a law was introduced that demonetized silver from the US monetary system. The aforementioned act is the Coinage Act. This had a negative effect on the entire American silver mining industry. Many silver mine owners called the law "The Crime of the 73rd". Under the law, a de facto gold standard was introduced because silver it ceased to be purchased for the purpose of issuing dollars. Under previous law, there was bimetallism, where any owner of silver could bring the ore to a special mint and receive a "silver dollar" in return. Most of the time, silver was supplied by small mines, but with the opening of the huge silver mine in Comstock Lode, there was an increase in the supply of silver, which was reflected in the monetary expansion (an increase in the supply of "silver" money "). During bimetallism, both silver and gold were legal tender.

However, from the mid-nineteenth century on, more and more financiers raised their voices to introduce a gold standard that was to be much more stable than the silver and gold system. The Act of 1873 put pressure on the fall in silver prices. This was the second blow to the US silver mining sector, as the minting of silver thalers was stopped in Germany in 1871. As a result, the demand for American silver fell. These factors caused the price of silver to drop sharply and the pace of monetary expansion in 1873 to slow down. As a result, there was an increase in market interest rates. This, in turn, hit farmers who financed the modernization of their farms with loans. In addition, the increase in interest rates also affected the costs of financing large investment projects.

Jay Cooke creator of Jay Cooke & Company. Source: Wikipedia.org

One of the most high-profile symptoms of problems in the US financial market was trouble Jay Cooke & Company. In September 1873, the company struggled to find funding for the Northern Pacific Railway. The company has not been able to find people willing to buy bonds worth several million dollars. Jay Cooke & Company was in trouble because it was the majority shareholder of the company. It secured its liabilities with shares of the Northern Pacific Railway. Due to the problems on the European financial markets, the company had no one to sell its shares to or find anyone willing to continue financing the railway company. As a result, on September 18, 1873, Jay Cooke & Company declared insolvency. Between 1873 and 1879, 18 companies in the United States went bankrupt, including 000 railroad companies.

The first "world" crisis

The panic of 1873 was the first crisis that spread very quickly to other countries and even continents. The reason was the increasing integration of the international capital and banking system. Two years after the panic, in 1875, Baron Carl Meyer von Rotshild wrote to Gerson von Bleichroeder that "the whole world has become one stock exchange center." In mutual arbitration of stock prices it helped relatively easy capital flows and new inventions such as telegraph.

On May 9, 1873, panic broke out on the Vienna Stock Exchange. As a result, many banks with lower capital collapsed, which resulted in liquidity problems in many indebted enterprises. The panic in Vienna spread very quickly to Italy, the Netherlands and Belgium. Then it hit Great Britain and hit the American capital market with a slight delay. The reason why the United States was "infected with the crisis" was, inter alia, the fact that short-term German capital has invested in railway companies and invested in American plots (mainly in "western" US states). Problems in Germany have dried up the source of cheap financing for railway companies. This in turn caused Jay Cooke & Company's solvency problems. As a consequence, it led to the collapse of several American banks. The problems of the American financial sector translated into problems of financial institutions from Europe. Suddenly, the loans, bonds, and stocks of many American companies had become worthless. The second wave of financial panic struck Vienna again in early November. Panic also reached London, Paris and the Russian Empire.

READ: Austrian stock exchange - how to invest in Austrian companies?

Problems of European agriculture and the rise of protectionism

The crisis of 1873 was followed by a depression in European agriculture. The factor responsible for this was lower production costs in the United States and Canada. The reason for the lower production costs was that many farms in North America were modernized. As a result, the productivity of the farm in the United States was often higher than that of European competitors. Another factor was the lower cost of transport (both land and sea). As a result, the cost of transporting a ton of grain from Chicago to Liverpool fell from £ 37 in 1873 to £ 21 in 1880. Four years later it was only £ 14. Lower production costs and falling transport prices made it cheaper to import grain and other agricultural products from overseas than to buy goods from local producers.

Between the 70s and the end of the XNUMXth century, American imports wheat and flour to Great Britain increased by 90%, while meat imports increased by 300%. In turn, the import of butter and cheese increased by 110% at the same time. The increase in imports resulted in a drop in the prices of agricultural products. In 1895, agricultural commodity prices fell to their lowest level in 150 years. The decline in the profitability of agricultural production caused that from 1873 to 1898 the arable acreage in Great Britain decreased by 22%. Falling prices have worsened the condition of British households. This led to people migrating from the countryside to the cities. As a result, the industry received an inflow of cheap labor, which eased the wage pressure. This is evidenced by the data on the population. Between 1871 and 1901 the population of England and Wales increased by 43%, while the rural population decreased by a third during this time.

Another effect of the crisis of 1873 was the increase in protectionism, as the fall in the prices of agricultural products worsened the condition of native farmers. In 1879, duties protecting against cheaper agricultural produce were introduced in the German Empire. Meline duties were introduced in France in 1892. Of course, not all countries have entered the protectionist path. Great Britain and the Netherlands were among the countries trying to fight for greater freedom of trade.

The Consequences of the Panic 1873

The panic of 1873, combined with the financial crisis, affected the condition of many enterprises. Bankruptcies contributed to an increase in the unemployment rate. Some countries experienced a sharp economic downturn. An example would be Great Britain, for which the period from 1873 - 1896 is called the "Long Crisis". At that time, many British industries were stagnating. The periods of economic development interrupted the periods of economic downturn, especially in the years 1873, 1886 and 1893. It is worth noting, however, that it was a period of increased productivity and price deflation.

The crisis on the silver market caused the ratio of silver to gold to drop sharply. This resulted in the devaluation of the rupee (the currency was based on silver). As a result, there was an increase in the cost of imported goods. This event is known as the "fall of the rupee". This is another example of the international consequences of the crisis of 1873.

The crisis has affected the economic problems also of peripheral countries. One of them was - "Sick Man of Europe" - Turkey. The level of trade has decreased. At the same time, the decline in the prices of cereals and other agricultural products meant that a significant part of farmers experienced a deterioration in the economic situation. Additionally, the deterioration of the situation on the global capital market meant that many Turkish entities had problems with refinancing their foreign debt.

After the crisis of 1873, the new monetary standard was confirmed. From 1873, most of the leading economies had a currency based on gold (the so-called gold standard). This year, the gold standard was adopted by the German Empire, the United States. In the following years, the gold standard was introduced by the countries of the Scandinavian Monetary Union, the Netherlands and several countries of the Latin Monetary Union (the convertibility of silver into coins was suspended). Some of the last major European economies to adopt the gold standard were Austria-Hungary (1892) and the Russian Empire (1897). The introduction of the gold standard facilitated international trade and capital flows between the world's largest economies. The gold standard allowed interest rates to stabilize. The moderate increase in the money supply, coupled with the increase in productivity, resulted in the downward pressure on prices. It is worth remembering, however, that most undeveloped countries have not introduced a gold standard. The gold standard was at its best until the outbreak of World War I. Then war spending forced countries participating in the war to suspend the gold standard.

One of the consequences of the crisis of 1873 was a significant slowdown in industrial production. In Great Britain, between 1873 and 1890, the average increase in industrial production was 1,7%. However, in the years before the crisis (1850 - 1873), industrial production grew at an average rate of 3% per year. The slowdown in economic development also affected the German Empire, the United States and France.

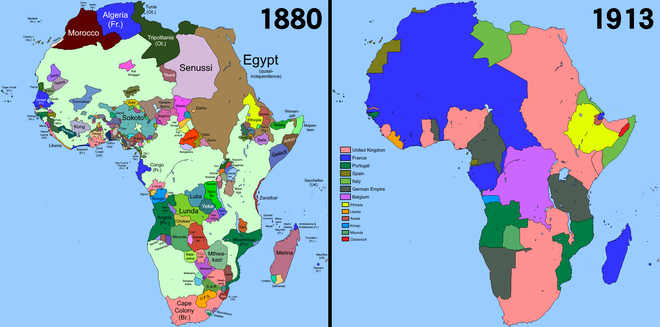

The crisis of 1873 was one of the catalysts of the European struggle for the colonies. Deflationary pressure forced enterprises to increase productivity and access to cheap raw materials. The place of the clash was mainly Africa, where there was a veritable race of the main European powers for the largest part of the continent. The leading players at that time were: Great Britain, France, Germany, Belgium, Italy, the Netherlands and Portugal. It was a great achievement of European diplomacy, and a tragedy for the colonized peoples Berlin Conferencewhich "divided" Africa into spheres of influence. There was a colony race, where the speed and brutality of the colonists decided. A tragic example is the Congo, which was initially privately owned by King Leopold II of Belgium. Most likely, several million inhabitants of the Congo died as a result of the colonial robbery policy.

Source: wikipedia.org

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)