Vanguard - one of the "big three" of the ETF market

For many Americans, Vanguard is a symbol of cheap investment in the capital market. It was this institution that changed the asset management industry. Thanks to this company, low fees and simple investment products have become available to the individual investor. Together with Blackrock and State Street, the company is one of the "big three" index funds in the United States.

It is worth mentioning that the name of the movement was created from the name of the company's founder - Jack Bogle Bogleheads. These are people who want to achieve financial independence by saving and investing regularly in low-cost investment products (such as ETFs and index funds).

John Clifton "Jack" Bogle

John C. Bogle, Vanguard

It is an "icon" of the asset management market. Thanks to his persistence, he has opened up wide investment opportunities for individual investors at an affordable price. It was Vanguard, founded by Jack Bogle, that revolutionized the asset management market in the United States and "forced" the industry to press down on management fees.

Thanks to the creator of Vanguard, the investment strategy of regularly investing in cheap index funds and using DCA (dollar cost averaging) has gained popularity.

The beginnings of interest in the asset management market date back to the turn of the 40s and 50s. While studying at Princeton University, Bogle noticed that few funds can beat the index in the long term. This was due to either the wrong choice of companies or very large management fees that had eaten up the fund's advantage over the index. After graduating with honors from college, Bogle found employment with Wellington Management very quickly. After initial successes at work, he was dismissed from the company in 1974. Over the next year, he founded his own asset management company, Vanguard. Thanks to his stubbornness and the right choice of people. The company from a small "boutique" has become one of the largest companies in the asset management industry.

History of Vanguard

The company was founded in 1975. There is a sailing ship in the company's logo. This is not a coincidence. The name Vanguard comes from Admiral Nelson's flagship ship during the Battle of the Nile in 1798.

The first milestone for the company was in 1976 when a passive fund was created to follow S&P 500 index. However, the beginnings of the product were not successful. Vanguard's managers assumed that they would manage to raise $ 150 million from investors in the first round. However, only $ 11 million was initially raised. The banks involved in the IPO advised Jack Bogle to drop the fund because of little interest. However, the Vaguard manager declined. As the fund did not pay brokers a commission for selling units, assets grew very slowly. After one year, the assets under management were $ 17 million. Three people worked in the fund - Bogle and two analysts. It was only after the assets of one Wellington fund were merged with the flagship Vanguard index fund that this led to an increase in AUM (assets under management) To the level $ 100 million.

The popularity of the solution started to grow during the bull market of 1982. Then passive solutions began to beat "ordinary" actively managed funds that charged large management fees. The success of Vanguard meant that more and more financial institutions "tested" passive solutions. However, competitors did not gain much popularity due to much higher fees.

In late 1986, Vanguard introduced the first passive fund investing in the bond market (Total Bond Fund), which was available to individual investors. However, this was not the end of innovation. A year later, Vanguard launched a third fund, which allowed it to gain exposure to the entire US stock market (excluding the S&P 500 index). The solution was called Vanguard Extended Market Index Fund.

In the following years, he increased the scale of operations. In 2001, Vanguard introduced ETFs to the offer. Two years later, the company started to offer TRFs (Target Retirement Funds), which is a fund that invests based on the investor's life cycle.

In 2013, the assets under management exceeded $ 3 billion. Four years later, Vanguard opened branches in Shanghai, which is to allow for geographic diversification of revenues. In 2020, assets under management exceeded $ 6 billion.

The main products of the company

As one of the largest asset management companies in the world, Vanguard is known for its low cost investment product offering. The company mainly offers two types of products: mutual funds and ETFs.

Vanguard index funds generally require a minimum deposit of $ 1 - $ 000. For actively managed funds, the minimum deposit is between $ 3 - $ 000. For institutional clients, the minimum deposit was $ 50 million. The annual management fee varies from 000% to as much as 100% depending on the type of fund.

Vanguard also has ETFs that allow you to invest more flexibly in investment products. The value of one ETF unit ranges from several dozen to several hundred dollars. With the introduction of commission-free brokers, the individual investor obtains a flexible tool for regular savings. In most cases, the management fees of ETFs are lower than those of mutual funds.

It is worth comparing the mentioned products. Vanguard S&P 500 ETF (VOO), which is one of the flagship ETFs managed by the company. The annual management fee is 0,03%. Conversely, a fund that invests in the S&P 500 index, the Vanguard 500 Index Fund Investor Shares (VFINX), has a management fee of 0,14% per annum.

ETF related products

In addition to passive funds, Vanguard has a lot of ETFs. It is one of the leaders in this segment of the asset management market. Vanguard has a wide range of ETFs on the stock, bond, money and alternative assets markets. At the beginning of September 2020, assets under management (AUM) of ETFs owned by Vanguard amounted to over $ 1 billion.

ETFs for the stock market

Vanguard has a fairly wide exposure to the stock market. Offers 56 ETFs related to the stock market. The investment products relate to both the American and "international" segment. The product offer applies to both "value" companies and growth companies.

The investor can also choose from ETFs covering the segment of large, medium and small companies. Vanguard has also created ETFs that give exposure to specific industries (real estate market, financial industry, technology companies). Polish individual investor may also have access to these ETFs. All you need is a broker with access to foreign markets.

Examples of equity related ETFs are:

Vanguard FTSE All-World UCITS ETF (VWRD)

It gives exposure to the largest and most liquid companies from the most important stock exchanges in the world (50 countries). The selected companies cover 95% of the global capitalization of the main exchanges. At the end of January 2021, the ETF comprised 3 companies. Assets under management exceed $ 514 billion. In mid-6,9, the ETF included, inter alia, such companies as Microsoft (2020%), Apple (3,16%) and Amazon (3,09%). The annual management costs are 2,42%.

Vanguard FTSE All-World UCTIS ETF Chart, Interval W1. Source: xNUMX XTB.

Vanguard REIT ETF (VNQ)

It gives exposure to the companies being REITs. The benchmark is the MSCI US Investable Market Real Estate index. The ETF consists of 174 companies. Assets under management totaled $ 2021 billion at the end of January 61,4. The largest components are the Vanguard Real Estate II Index Fund (12%), American Tower Corporation (7,3%), Prologis (5,5%), Crown Castle International (5%). The annual management costs are 0,12%.

Vanguard REIT ETF chart, interval W1. Source: xNUMX XTB.

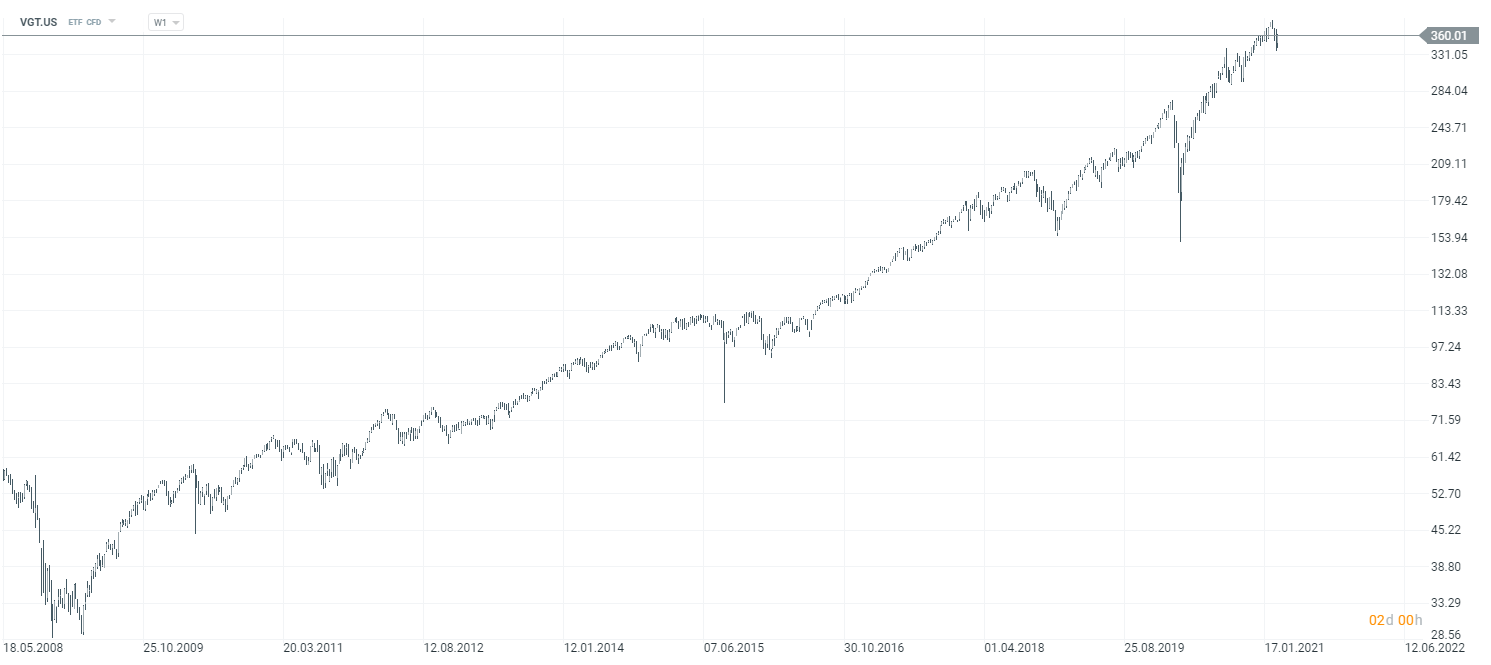

Vanguard Information Technology ETF (VGT)

It gives exposure to companies related to the technology market. The benchmark is the MSCI US IMI Information Technology 25/50 Index. The ETF consists of 345 companies. Assets under management totaled $ 2021 billion at the end of January 46,4. The biggest components are Apple Lossless Audio CODEC (ALAC), (21,8%), Microsoft (16,1%), NVIDIA (3,1%), Visa (2,9%), Mastercard (2,7%) and PayPal (2,5%). The annual management costs are 0,10%.

Vanguard Information Technology ETF Chart, Interval W1. Source: xNUMX XTB.

ETFs for the bond market

Vanguard also offers ETFs with exposure to the debt market. Its offer includes 19 investment products giving the investor the opportunity to invest in debt securities of the American and international markets.

Examples of equity related ETFs are:

Vanguard Total Bond Market (BND)

Gives exposure to US bonds. The average duration of a bond is 6,6 years. YTM (Yield to Maturity) for ETF assets is 1,2%. The BND consists mainly of US government bonds (63,2%). Another group of assets are bonds rated Baa (17%). The index benchmark is Spliced BloomBarc USAgg Flt AdjIx. Assets under management are $ 305,4 billion. The annual management cost (TER) is 0,035%.

Vanguard Total Bond Market ETF chart, interval W1. Source: xNUMX XTB.

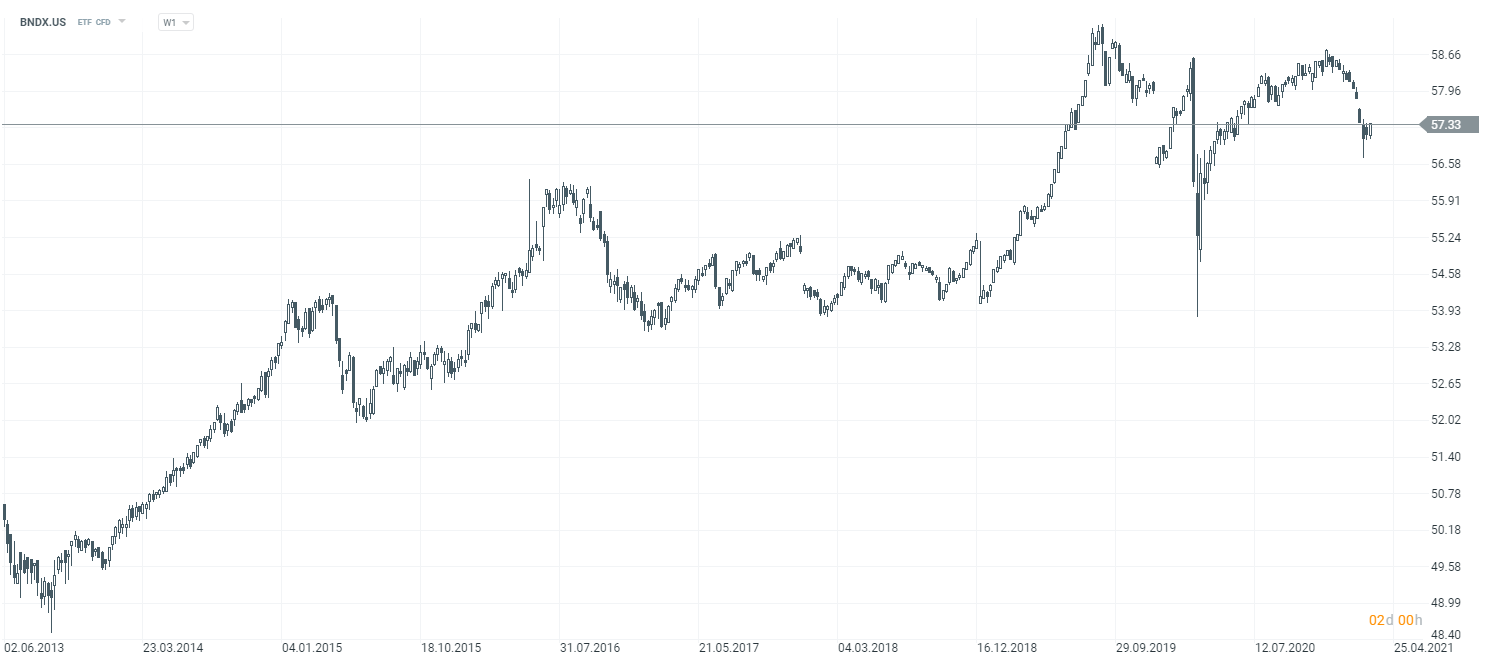

Vanguard Total International Bond ETF (BNDX)

Gives exposure to international bonds (excluding the US). The average duration of a bond is 8,4 years. YTM (Yield to Maturity) for ETF assets is 0,3%. The index benchmark is Bloomberg Barclays Global Aggregate ex-USD. Japanese (16,8%), French (12,1%), German (10%) and Italian (7,6%) bonds dominate. Assets under management total $ 168,6 billion. The annual management cost (TER) is 0,08%.

Vanguard International Bond ETF chart, interval W1. Source: xNUMX XTB.

Vanguard Intermediate-Term Bond ETF (BIV)

It gives exposure to bonds with maturities from 5 to 10 years. Bonds must be investment grade. The average duration of a bond is 6,5 years. YTM (Yield to Maturity) for ETF assets is 1,2%. The benchmark for the index is Bloomberg Barclays US 5-10 Year Government / Credit Float Adjusted Index. The BIV consists mainly of US government bonds (50,2%). Another group of assets are bonds rated Baa (26,2%). Assets under management total $ 41 billion. The annual management cost (TER) is 0,05%.

Vanguard Intermediate-Term Bond ETF Chart, Interval W1. Source: xNUMX XTB.

Summation

Vanguard is one of the world's largest asset management companies. The offer is dominated by passive solutions (mainly index funds). Vanguard also has a wide range of ETFs that give exposure to assets related to the stock, bond and money market. The company belongs to the "big three" of the ETF and index funds market. At the same time, Vaguard has its finger on the pulse and adds products to its offer that reflect market trends. An example would be the Vanguard ESG US Stock ETF, which invests in companies that meet sustainability criteria and omits investments in "harmful" companies (eg, companies related to the alcohol, tobacco, armaments, gambling, etc. industries). Trading ETFs Vanguard is available incl. on the platform XTB and Saxo Bank.

Forex brokers offering ETFs

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain / Cyprus |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)