The fall of Arthur Andersen - The Big Five goes down in history

In previous articles, we mentioned the stories of Enron and WorldCom. Both companies operated in different industries, but they had one thing in common - an auditor. He was Arthur Andersonwhich then belonged to the so-called "Big Five"which grouped the largest audit firms in the world. In today's article, we will tell the story of this auditor. The collapse of Arthur Andersen is a learning lesson for all investors. There is only one conclusion - nothing is given once and for all. Reputation and organizational culture must be taken care of every day.

Arthur Andersen - Beginnings

Source: wikipedia.org

The founder of the company was Arthur Edward Andersen, who lived in the years 1885 - 1947. It was him who, thanks to his reputation, laid the foundations for the subsequent dynamic development of the organization. Arthur E. Andersen was born in Plano, Illinois. Parents came from Norway and Denmark.

At the age of 16, Arthur Andersen had to leave his family home as a result of the death of his parents. Despite the difficult start, the young boy did not give up. For many years he combined hard work with education. As a result, at the age of 23, he graduated from the Kellogg School at Northwestern University with a bachelor's degree (graduated in business education). In the same year, he gained the position of assistant controller at Allis-Chalmers. 1908 is also the year young Arthur E. Andersen was certified as a CPA (Certified Public Accointant) in Illinois. He was the youngest certificate holder in the entire state.

Obtaining the certificate allowed for the development of a career in the financial industry. Increasing earnings, combined with the acquisition of permanent contacts, allowed for another important step. In 1913, Andersen and Clarence Delaney purchased The Audit Company from Illinois. After the acquisition, the company name was changed to Andersen, Delaney & Co. In turn, in 1918 the company changed its name again. This time at Andersen & Co.

Arthur Edward Andersen, source: Wikipedia.org

Following his professional career, Arthur Andersen embarked on a scientific path. Between 1909 and 1922 he taught at Northwestern University. Over time, he earned the position of a professor. After 13 years as a lecturer, Andersen decided to focus solely on developing his business. The following years brought further dynamic development of the organization. At the time of Arthur Andersen's death, his company was one of the largest enterprises of this type in the world. Leonard Spacek took over Arthur's legacy in 1947.

Andersen was famous for his unprecedented honesty. High audit standards made investors like working with Andersen & Co. What is important, Arthur Andersen did not differentiate the quality of services in relation to the client's wealth. Thanks to this, customers were always sure that Andersen's company would treat each contractor with due respect.

Arthur Andersen's motto was the maxim:

"Think clear, tell the truth."

As a result, Andersen preferred to lose a dishonest customer (and his money) rather than sully his reputation.

After Arthur Andersen's death, his successors continued to maintain high standards and ensure the transparency of the financial market. For example, in the XNUMXs there was a boom in paying part of your salary in the form of stock options. Arthur Andersen was the first major accounting firm to propose to the FASB (Financial Accounting Standards Board) that employee stock options be treated as an expense and charged to the company's net income. In their opinion, omitting this type of remuneration as a cost resulted in "inflating" the net result. Investors, analyzing such financial statements, could come to an incorrect assessment of the company's potential to generate net profit from the company's operations.

In 1973, Spacek retired. At this point, the company had 16 offices in the United States alone and 25 overseas offices. This meant that Arthur Andersen & Co. was one of the largest companies of its kind in the world.

He appeared in the position of CEO Harvey Kapnickwho decided to aggressively develop consulting services. As a result, after only 5 years, consulting generated 20% of the company's revenue. Harvey tried to convince partners to spin off two companies from Arthur Andersen: consulting and "original" (accounting, auditing, taxes). Upon his refusal, Kapnick resigned from managing the entire company. Duane Kullberg, who had been with the company since 1954, took his place.

80s the beginning of problems

Since the XNUMXs, there has been a slow erosion of standards in the company. This resulted from the pressure imposed on the company by the competition. Large audit firms have discovered that they can monetize clients with consulting services. Consulting related to the technological transformation that began in those years seemed particularly profitable. If Arthur Andersen had not joined the consulting services offering, he would have started to lose his distance from the competition over time. Wealthier companies could pay more to their employees, which would lead to a brain drain within the company.

While the decision to diversify income can be understood and even supported, however lowering audit standards was contrary to Arthur E. Andersen's philosophy. Over time, there was even pressure on the audit department to try to convince clients to use consulting services. Unfortunately, this resulted in a conflict of interest. If the client was willing to use consulting services, he could "persuade" the auditors to be a bit more liberal. Thanks to this, Arthur Andersen will not lose consulting revenue. As a result, the quality of audit services decreased.

The pressure to increase results caused Andersen to regularly breach his hitherto impassable "red lines". Of course, as long as customers were solvent and no financial scandal was uncovered, both sides were winning. Andersen kept the auditing and consulting services, and the client got what he wanted - less nosy auditors.

Sometimes the desire to have more liberal auditors was dictated by the laziness of companies that did not want to devote company resources to meet the expectations of auditors. There were situations when the reluctance to control resulted from the company's awareness of its unlawful activities.

Problems with dissatisfied customers and paid fines resulting from Arthur Andersen's errors were already evident in the XNUMXs. Between 1980 and 1985, the partners had to pay more than $120 million in settlements. In the same period, competitors were burdened with up to 10 times lower costs.

Over time, the consulting business became more and more important to Arthur Andersen. As a result, the company became a "hostage" of its own policy. Submission to clients and a “flexible” approach to professional ethics was a recipe for a beautiful disaster. This, however, did not take place either in the XNUMXs or in the following decade. This confirmed the board as to the rightness of the chosen path.

In 1985, Arthur Andersen was the largest company in its industry by revenue. The following places were:

- Peat, Marwick, Mitchell & Co.,

- Ernst & Whinney,

- Coopers & Lybrand,

- Price Waterhouse,

- Arthur Young & Co.,

- Deloitte, Haskins & Sells,

- Touche Ross.

Source: logos-world.com

In 1986, the Big Eight began to consolidate. Peat, Marwick, Mitchell & Company merged with the German company Klynveld Main Goerdelor (KMG) to form KPMG Peat Marwick. Another consolidation took place in the XNUMXs. Ernst & Whinney merged with Arthur Young to form Ernst & Young. Deloitte, Haskins & Sells merged with Touce Ross to form Deloitte Touche. In 1998, Price Waterhouse merged with Cooper's & Lybrand. After the merger, Pricewaterhouse Cooper's (PwC) was formed. In the late XNUMXs, the Big Eight turned into the Big Five. Consolidation in the market put pressure on Arthur Andersen, which further encouraged the management to focus on short-term financial results and growth at all costs.

Focusing on short-term profits was very fashionable in the last two decades of the XNUMXth century. Arthur Andersen was no exception in this case. The auditor has been involved in numerous accounting scandals, including such stories as Sunbeam Products, Asia Pulp & Paper, Baptist Foundation of Arizona and "cherry on the cake" stories World Com and Enron.

Andersen Consulting

As we have already mentioned, the consulting segment has been growing since the XNUMXs. Consulting was developing much faster than the basic activity related to accounting, auditing and tax consulting. The rapid increase in the scale of operations meant that people responsible for consulting gained more and more influence on the strategy of Arthur Andersen. In 1988, 40% of revenue came from consulting services. A year later there was a split between Arthur Andersen and Andersen Consulting. Despite this, auditing, tax and accounting activities were only tools to sell lucrative consulting services.

Over time, there were increasing disputes between Andersen Consulting and the rest of Arthur Andersen's business. The point was that the consulting firm no longer wanted to share its profits with Arthr Andersen. In 2000, an arbitration award was made between Arthur Andersen and Andersen Consulting. The consulting firm agreed to pay a $1,2 billion fee in exchange for Andersen Consulting's independence, which lost its right to the "Andersen" member. As a result, on January 1, 2001, Andersen Consulting changed its name to Accenture.

For many commentators, it was a victory for Andersen Consulting. A few hours after the announcement of the arbitration, Jim Wadia - CEO Arthur Andersen he resigned. The reason for the resignation was pressure from the supervisory board, which made Wadia promise that if Andersen Consulting did not pay a minimum of $4 billion for "independence from Arthur Andersen" will have to resign.

The split between Arthur Andersen and Andersen Consulting did not happen without mutual accusations of fraud, breach of gentlemen's agreements and greed. The bone of contention was, among others, the activity of AABC (Arthur Andersen Business Consulting), which was a direct competitor of Accenture. According to Accenture, this was a breach of the non-competition agreement. AABC has been growing rapidly in the tech and healthcare segments. The dynamic development of AABC was interrupted by the bankruptcy of Arthur Andersen.

After the split: problems and scandals

It should be mentioned that Arthur Andersen's client portfolio in 2002 was impressive and included companies such as Delta Airlines, Fressie Mac, FedEX, Hilton Hotles and Halliburton.

In early 2001, Arthur Andersen found himself in a difficult situation. They were cut off from the income from the consulting business developed for more than two decades. AABC, on the other hand, was in its infancy and did not have the scale to replace Accenture. What's more, the strategy of "stroking" clients and agreeing to lower audit standards began to hiccup. As a result, there were problems with large customers: Enron and WorldCom.

Source: Wikipedia.org

Enron

Enron Corporation was one of the largest energy companies in the world at the turn of the XNUMXst century. Along with the change of Enron's business model, from a "boring" company operating in a stable industry, it became the creator of an extensive trading department and investment segment. The faces of the "new Enron" were Jeffrey Skilling and Jerry Fastow. The change in strategy combined with the deregulation of the energy market in California created a climate for dynamic development of the company.

READ: Enron's bankruptcy - One of the largest financial scams in history

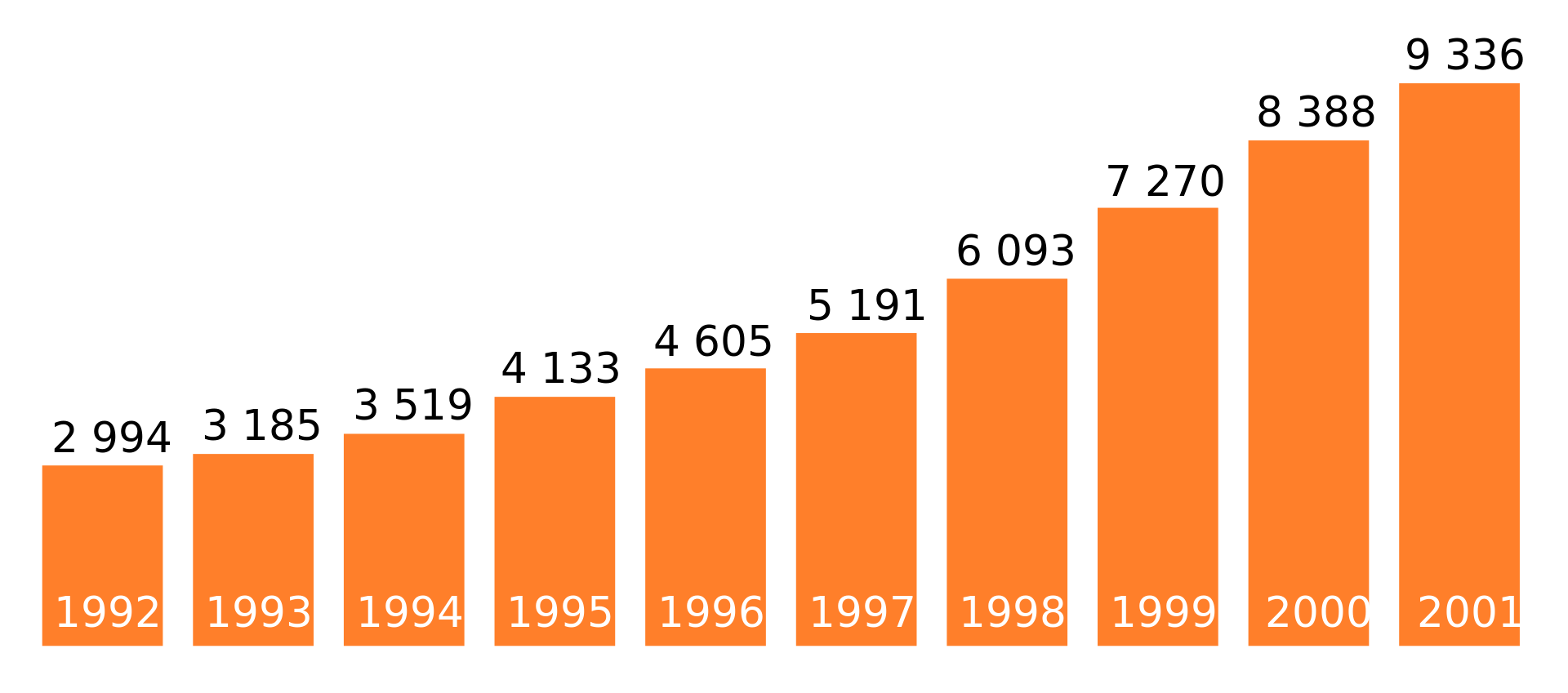

Enron has become one of Wall Street's darlings. In addition, the company has collected awards from the press. Fortune magazine awarded the company the title six times in a row (1996-2001). "America's Most Innovative Company". In 2000, the company reported $110 billion in revenue, which placed the company on the 7th position in the United States. The success was largely due to creative accounting, hiding losses in special purpose vehicles or speculation on the energy market. In 2001, the company declared protection from creditors. It was the largest bankruptcy in US corporate history.

In October 2001 SEC launched an investigation into the company's accounting reporting and auditing activities. Moreover, as a result of Enron's bankruptcy, CEO Arthur Andersen Worldwide was questioned before Congress. During the investigation, it turned out that the auditor was not fulfilling his basic functions. The audit team at Enron was David Duncan, who had been with the company for twenty years. Under Duncan's direction, the team destroyed documents "in accordance with Andersen's policy" to hinder the SEC investigation. In April 2002, Duncan was convicted of "obstructing an investigation." David Duncan finally decided to cooperate with the justice system to get a lesser sentence. Arthur Andersen's reputation was badly damaged. From the opinion of a very reliable auditor, only the story of the founder remained. The nail in the coffin came a bit later.

World Com

Just weeks after the court's verdict on the destruction of Enron's records was handed down, Arthur Andersen's other big client was in trouble. It was WorldCom, which operated in the telecommunications sector and had ambitions to surpass AT&T in terms of scale. At the time of the company's bankruptcy, the company's assets totaled $107 billion. This made WorldCom the largest bankruptcy in US history. So Arthur Andersen scored in just one year "scandalous double".

READ: WorldCom Bankruptcy - The Great Scam of the DotCom Era

It should be noted that Arthur Andersen was dismissed from the function of auditor by WorldCom back in 2001, in connection with the Enron case. After WorldCom's bankruptcy, Arthur Andersen employees were asked during an investigation how such a large accounting fraud could have been missed. Arthur Andersen's employees claimed that accounting documents were hidden by WorldCom's CFO, Scott Sullivan. Arthur Andersen was not formally charged with fraud but was blamed for improper audit oversight. This caused the company's reputation to be damaged.

The fallout of Enron and WorldCom

On August 31, 2002, Arthur Andersen lost his CPA license. Therefore, he could not act as an auditor on the American market. This meant that it was practically impossible to conduct normal business without a thorough restructuring. As a result, the company laid off 28 workers who had to find other jobs. The fall of Arthur Andersen was a godsend for competitors. The Big Five became the Big Four. The other auditors increased their piece of the pie.

The fall of Arthur Andersen began a real exodus of workers. Most of the branches were taken over by Ernst & Young, which took over about 60%. The next place of "emigration" of employees was Deloitte. KPMG took over branches in California, Seattle, Kansas City and Philadelphia. Smaller players also fed on Arthur Andersen. An example is Protiviti, which took over 700 employees from the internal audit, technology and consulting departments. In turn, Navigant Consulting acquired 11 partners from Chicago and Washington.

Interestingly, In 2005, the Supreme Court overturned the conviction, the damage done to the reputation was beyond repair. Arthur Andersen has not returned to the market. However, numerous "post-pogroms" appeared. In 2013, WTAS Global was founded by WTAS LLC. WTAS LLC was a consulting firm focusing on tax and wealth management issues. It was founded in 2002 by 23 former employees of Arthur Andersen. In 2014, WTAS Global changed its name to Andersen Global and WTAS LLC to Andersen Tax. In 2019, Andersen Tax changed its name to Andersen. Currently, the company operates in 170 countries around the world through a network of 1800 partners.

Summation

Arthur Andersen was an American audit firm headquartered in Chicago. The company offered audit, tax, advisory and consulting services. Andersen's clients were large American corporations. The scale of the company's operations was so large that it was among the five largest companies of this type in the world. The story ended in mid-2002 as a result of the overlapping financial scandals of Enron and WorldCom. The scandal surrounding the two companies led to the passing of the Sarbanes-Oxley Act to end the lack of compliance by auditors. In 2002, as a result of scandals, the company found itself in a tragic situation. Multi-million dollar fines, loss of clients and loss of CPA (Certified Public Accountants) licenses meant that Arthur Andersen was unable to operate in the United States. As a result, he had to immediately lay off more than 60 percent of the workforce, which numbered 28 at the time of the collapse. It is worth remembering that part of the company is still operating. In 2000, the part related to consulting services was separated from Arthur Andersen and operates to this day under the name Accenture. What's more, after many years, the Andersen name was reactivated and continues to provide advisory and consulting services.

The story of Arthur Andersen tells us that even an unblemished reputation is not given once and for all. Sometimes making small compromises for short-term gains can have far-reaching negative effects. Arthur Andersen's main partners found out about it. The pursuit of rapid development of consulting services meant that auditing activities were performed superficially, so as not to alienate consulting clients. Low corporate culture, lack of care for reputation led to the collapse of one of the largest audit firms in the world.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)