Tourism and entertainment - investment prospects after Covid-19 [Guide]

The beneficiaries of Covid-19 were companies related to telemedicine (e.g. Teladoc), e-commerce (e.g. Amazon, Wayfair), technologies related to video calling (e.g. Zoom), or Gig Economy (including Fiverr, Upwork). However, on the other side of the coin, there have been a number of companies that have faced travel restrictions or a reduction in maximum attendance. The industries that have been affected by the coronavirus include: tourist, entertainment or cruise ships. The article briefly describes how the following companies dealt with this situation:

- Royal Caribbean Group;

- Carnival Corp. (CCL);

- Six Flags;

- CTS Eventim;

- TUI.

Cruise ships

One group of companies that experienced a large drop in revenues was the cruise liner. In February, some of them became history's infamous heroes "Coronavirus infections". At the end of 2019, the industry organization CLIA (Cruise Lines International Association) expected 2020 million cruise passengers in 32. However, the industry was hit by bad PR. In February 2020, 10 guests were infected with the coronavirus on the Diamond Princess cruise ship. Due to the fact that the main customers of cruise lines are elderly people (retirees, rentiers), the “fear of getting infected” caused the resignation from trips. This caused the companies' revenues to drop to around zero. Since the costs were not perfectly flexible (there was a significant proportion of fixed costs), significant losses occurred. This worsened the liquidity situation of companies in this industry. As a result, it has forced many cruise liner management companies to seek additional capital. In the case of many companies, there was an issue of shares combined with the issuance of additional debt. It must be remembered that the cruise line activity allows you to generate a very large amount of cash from operating activities. However, if you want to increase the scale of operations, large investment expenditure is required for the modernization of cruise ships or for the purchase of new units. Before 2020, many companies had embarked on ambitious fleet modernization projects and the purchase of new units. This was to meet the increasing demand from the Asian market.

The article will describe the effects of Covid-19 on the activities of companies such as:

- Royal Caribbean Group:

- Carnival Corp ..

Carnival Corp.

It is one of the world leaders in the cruise liner market. In 2019, the company had over 110 cruise ships and generated revenues of $ 20,8 billion. In the same year, the company generated approximately $ 3 billion in net profit. Carnival generated approximately $ 5,5 billion. However, capital expenditures for the maintenance and development of the fleet cost $ 5,4 billion. As a result, free cash flow (FCF) amounted to approximately $ 100 million. At the same time, the company decided to donate approximately $ 600 million to buy back treasury shares. The company entered 2020 with a fairly stable business model, but also with high debt (around $ 10 billion in interest debt). The collapse of the business model caused the company to face liquidity problems.

The suspension of operations in mid-March 2020 caused the source of revenues to dry up, while expenses related to the refund of prepayments made by customers appeared. In 2020, some 260 seats on cruise ships were returned and the process of reimbursing customer returns has begun. Liquidity problems also made it necessary to postpone deliveries of around 000 cruise ships. This forced the company to raise approximately $ 16 billion in additional capital. For this purpose, shares were issued and additional debt was incurred. At the end of 18, the company had approximately $ 2020 billion in cash.

2020 was a very difficult year for the company, which can be seen in the revenues. In 2020, the company recognized approximately $ 5,5 billion in revenue. This meant a drop by over 73% y / y. Due to the fact that the company has a very large share of fixed costs, the operating leverage negatively affected Carnival's profitability. Operating profit of $ 3,3bn turned into a loss of $ 8,8bn (-$ 6,6bn net of the impact of the C&I update). At the same time, the increase in debt caused an increase in interest costs. The net loss exceeded $ 10 billion.

The large losses (a large portion of "cash"), coupled with the return of some deposits to customers, resulted in a significant outflow of cash. Operating cash flow was - $ 6,3 billion. At the same time, the company was unable to keep part of the most necessary capital expenditure, which cost an additional $ 3,6 billion. As a result, FCF amounted to $ -9,9 billion. To fill this hole, the company incurred more than $ 15bn in additional debt and issued stocks worth $ 3,3bn. Another issue was the sale of ships for over $ 300 million. These actions made it possible to "fill the operational hole" and create a liquidity cushion at the level of $ 9,5 billion. The company thus emerged battered, much more indebted and with a smaller fleet of cruise ships after the coronavirus. In the coming years, the "hump of debt" will have a negative impact on the financial results. The reason will be high interest costs that will lower the company's net profitability.

Carnival Corp. chart, interval W1. Source: xNUMX XTB.

Royal Caribbean Group (RCL)

It is one of the largest cruise ship fleet management companies. Royal Caribbean Group has a fleet of 61 cruise ships and has committed to acquiring a further fifteen. The expansion of the fleet was to increase the scale of operations and chase the market leader, which is Carnival. In addition to cruise ships under its own brands, the company also has a joint venture (50% of shares) with the German company TUI under the name of TUI Cruises and Hapag-Lloyd Cruises. In 2020, the company had approximately 138 rooms. The RCL fleet allows you to offer over 000 destinations.

In 2019, the company reported good results. The company's revenues were approximately $ 10,95 billion. The company's activity was very profitable. Operating profit was $ 2,1 billion. The company generated approximately $ 3,7 billion in operating cash. At the same time, the Royal Caribbean Group allocated about $ 3 billion to capital expenditures (purchase of new cruisers and modernization of existing ones). The generated free cash flow (FCF) was used to pay dividends and buy back shares.

Last year was very difficult for the company. This was due, inter alia, to the fact that most of the clients are elderly (risk group) and the governments of many countries have significantly reduced the possibility of gatherings in confined spaces. As a result, cruiser travel has been severely limited. In 2020, recognized revenues amounted to just $ 2,2 billion (decrease by 79,9%). Due to the fact that the company's costs are much less flexible, the operating margin deteriorated significantly. The operating loss was over $ 3 billion. In turn, the net loss exceeded $ 5,7 billion.

Losses on the company's operations, combined with the return of some customer deposits, contributed to a significant outflow of cash. Operating cash flow amounted to $ 3,7 billion. Combined with an investment of approximately $ 2 billion, they brought the FCF to $ -5,7 billion. Such a large amount of cash-burning meant that RCL had to look for liquidity.

The suspension of operations caused by the coronavirus epidemic prevented the company from generating revenues. At the same time, RCL undertook to pay overpayments to its clients. At the same time, problems with liquidity caused that some capital expenditures were postponed. In order to deal with the liquidity gap, the company increased its liquidity by $ 10,2 billion. The company obtained funds from such sources as:

- $ 600 million in revolving loan;

- $ 6,7bn from new debt issuance (net of debt repayment);

- $ 700 million of short-term debt;

- $ 300 million in support from the government program;

- $ 1,6 billion from the capital increase (share issue);

- $ 300 million from other sources.

By incurring debt and increasing the capital, it was possible to "cover up" the losses caused by the coronavirus and to raise the liquidity cushion. At the end of 2020, the cash level was $ 3,7 billion. It is also worth mentioning that in the second half of January 2021, the company announced the sale of the Azamara brand (with 3 vessels) to Sycamore Partners for $ 201 million.

Royal Caribbean Group chart, interval W1. Source: xNUMX XTB.

Rozrywka

Another segment of the economy affected by COVID-19 was the entertainment industry. Due to restrictions in movement and distance requirements, many businesses have found themselves in an unprecedented position. As far as restaurants, they could search for customers using companies related to Food delivery, some companies were not able to sell their services remotely. One of such industries were amusement park operators.

The main clients of amusement parks are families with children. Fear of consumers and government restrictions caused the number of visitors to amusement parks to drop sharply. Due to the fact that the costs are not perfectly flexible (a large part of the costs are fixed). Burning through cash meant that many companies were forced to look for additional capital.

Six Flags

One such company is Six Flags, which is an amusement park operator in the United States, Mexico and Canada. While in "normal" times the company belonged to stable companies that generated large amounts of cash, during the lockdown times it was deprived of most of its revenues.

Six Flags owns and operates 26 amusement parks and water parks. As many as 23 of them are located in the United States, two are in Mexico and one is located in Montreal (Canada). The parks cover approximately 6000 acres and have approximately 700 acres of land for further expansion. Six Flags has over 150 roller coasters and around 800 thrill rides. The company is one of the largest such companies in the United States.

Competition is limited due to the upfront costs that are necessary to create a good quality amusement park. Six Flags estimates that opening one park will cost anywhere from $ 500 million to $ 700 million. At the same time, the construction time of the park is estimated at around 4 years. As a result, such costs and construction time drastically limit those willing to "enter" this market.

In 2019, the company generated approximately $ 1 million in revenue and generated over $ 490 million in operating profit and 435 million in net profit. Due to the fact that Six Flags has a relatively short cash conversion cycle (190-9 days in 22-2017), it is a cash machine. In 2019, operating cash flow was $ 2019 million. At the same time, capital expenditures this year amounted to $ 410 million.

In turn, 2020 was a very difficult year for the company. After the initial closure, the company was unable to invite as many customers as it wanted. For many months there were restrictions on the maximum occupancy of the playground, first up to 25%, then up to 50%. As a result, Six Flags revenues fell to just over $ 355 million (-76% y / y). Costs could not be reduced on a similar scale.

It was only in October 2020 that the company decided to reduce employment by 10%. In 2020, pilot projects were created in which, according to the company, a more optimal employment model was tested. Due to the much lower cost reduction, Six Flags generated a large net loss of $ 423 million.

The company generated negative operating cash flows of approximately $ 191 million. At the same time, capital expenditures were reduced by $ 40 million to $ 100 million. Six Flags, expecting to face liquidity problems, offered $ 700 million in bonds that bear a 7% interest rate and expire in 2025 in April. The aforementioned bonds were used, inter alia, to pay off the revolving loan and raise the liquidity cushion.

Six Flags survived 2020, but at the cost of increasing net debt. In the coming years, the company will try to refinance costly debt. In previous years, the company was a cash machine, operating in an industry with high entry barriers. Currently, the business model cannot cope with the restrictions. Expensive theme parks were not operating at full capacity for most of 2020.

Six Flags Chart, Interval W1. Source: xNUMX XTB.

CTS Eventim

The coronavirus has also hit the mass event industry. Due to concerns about the spread of the virus, governments of many countries have limited or even banned mass events. As a result, the number of concerts, cultural and sports events with an audience has been severely limited. Since it was not possible to buy tickets, the intermediary companies in the sale of tickets were also affected. Such a company was CTS Eventim, which is listed on the Frankfurt Stock Exchange. It is a component of the German mDAX index.

CTS Eventim is a German company that deals, among others, with the distribution of tickets via the Internet. Eventim is a "quasi-monopoly" in this market in Europe. It operates on 18 European markets (also in Poland) as well as in Brazil, the United States and Israel. CTS offers sales through its platform (Eventim.net). Before 2020, about 250 million tickets per year passed through the Eventim sales system (stationary, online and mobile). The company has won many prestigious contracts in its history. An example is the agreement to distribute tickets for the 2006 World Championships, held in Germany, or being the sole distributor of tickets for the Olympic Games in Rio.

In 2019, the company generated sales of more than € 1 million. CTS Eventim reached over 2019 million in 230 € operating profit and € 133m net profit. The "light" business model makes the company a cash machine. In 2019, operating cash flow from operating activities was € 141 million and Eventim also spent € 2019 million in CAPEX in 41. As a result, FCF amounted to € 100 million. EUR 70 million was paid to the co-owners in the form of a dividend.

2020 was much worse for the company. Sales were only € 256 million. The company's costs fell much more slowly as the company did not want to significantly cut jobs due to the "short-term" nature of the epidemic. The operating loss was € 63m and the net loss was € 82m. CTS Eventim had negative operating cash flows of € 125 million and negative FCF of € 140 million. The company was not in danger of losing liquidity as CTS had more than € 2019m in cash at the end of 750. After one year, the cash level was € 740 million.

The company survived 2020 and its situation is still stable. CTS may use the coming years to take over some of its weakened competitors, which will further increase the company's advantage over European competitors.

Travel agencies

Tourism was another industry hit by the coronavirus epidemic. Flight restrictions and the fear of infection caused a significant decline in tourist traffic. Companies operating as travel agencies have been hard hit. Some customers asked for refunds for early holiday bookings. However, some customers agreed to postpone their holidays to the next season. On the one hand, such action improved the liquidity situation of travel agencies in 2020, but at the cost of future cash flows.

TUI

An interesting example is TUI AG, which is one of the largest vertically integrated travel agencies in the world. At the end of 2019, the company had 15 cruise ships (in JV), 400 hotels (with partner facilities) and 140 aircrafts. Thanks to the vertical integration, TUI can guarantee its customers a more flexible offer than is the case with "classic" travel agencies.

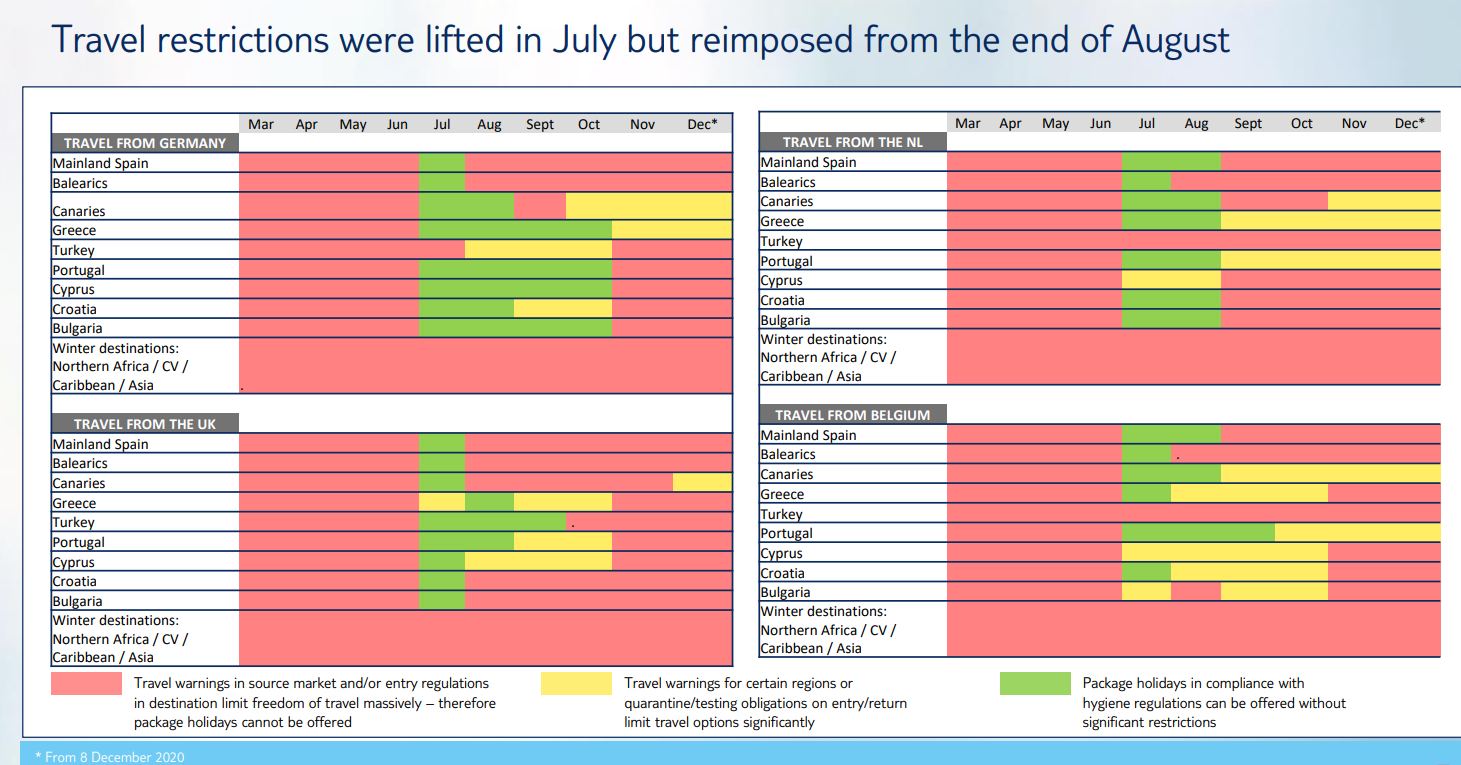

The pandemic has disrupted the functioning of the tourism industry. For most of the year, the offer of travel agencies was very limited, as evidenced by the table below.

Fortunately, for part of the holiday season, travel restrictions have been reduced. This allowed us to partially limit the losses caused by the governments' response to the coronavirus pandemic. Although we managed to “save” part of the season, many travel agencies found themselves in a very difficult position. One example is Thomas Cook, a travel agency that has filed for bankruptcy.

In the case of TUI, the most difficult quarter was the second quarter of 2020. The company's revenues amounted to just € 72 million. This meant a drop by as much as 98,5% y / y. This quarter saw a loss of more than € 1,4bn. The huge drop in revenues is not surprising if only 15% of the hotels operated, with an average occupancy rate of 23%.

The company's liquidity situation has become very weak. This forced TUI to suspend the payment of dividends, find sources of additional capital and reduce costs. In 2020, TUI received two "aid" tranches from the German governmentwhich expire between October 2021 and June 2022. The aid amounted to approximately € 3,3 billion.

In 2020, TUI generated € 7,9 billion in revenues, which was less than half of 2019 sales (€ 18,9 billion). Last year's operating loss was just under € 3bn. For comparison, in 2019 TUI generated an operating profit of € 770 million. Losses were also reflected in the cash level. TUI reported negative operating cash flows of more than € 3bn. The company drastically reduced its capital expenditure, which allowed it to generate a positive balance (due to the sale of some assets). As a result, FCF amounted to € -2,8bn. For comparison, in 2019 the company generated € 1bn in operating flows and spent € 1,1bn in capital expenditure (CAPEX).

TUI company chart, interval W1. Source: xNUMX XTB.

2020 impossible to make up for

2020 was a lost year for the industry and it will not be able to "make up" in the coming years. Travel funds were used in 2020 to renovate homes or increase consumer spending. In the following years, clients of travel agencies will not be willing to go on vacation twice to "make up" for the lost year. However, this does not mean that people will stop traveling. Along with the enrichment of societies in regions such as CEE, Asia-Pacific or South America, further increase in travel expenses should be expected in the next decade. If TUI uses this time to grow faster, it could be a long-term "pandemic beneficiary." Of course, it is not easy and the company will have to deal with huge debt.

Where to invest in stocks from the travel and entertainment industry

Below is a list of selected offers Forex brokers offering a wide stock offer, including shares in the tourism and entertainment industry.

| Broker |  |

|

|

| End | Poland | Denmark | Poland |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 1 - stocks + CFDs on stocks 5 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Tourism and entertainment - investment prospects after Covid-19 [Guide] tourist entertainment covid-19 actions](https://forexclub.pl/wp-content/uploads/2021/07/branza-turystyczka-rozrywkowa-covid-19-akcje.jpg?v=1625642473)

![Tourism and entertainment - investment prospects after Covid-19 [Guide] germany cryptocurrencies](https://forexclub.pl/wp-content/uploads/2021/07/niemcy-kryptowaluty-102x65.jpg?v=1625575180)

![Tourism and entertainment - investment prospects after Covid-19 [Guide] green energy](https://forexclub.pl/wp-content/uploads/2021/07/zielona-energia-102x65.jpg?v=1625644219)