Trading in consolidation - useful tips

One of the basic investment truths says that markets are not always in trend movements, moving up and down. Equally often, and in some cases definitely more often, the prices of financial instruments move in consolidationwithout a clear directional tendency. It is in lateral movements that most of the strategies following the trend cease to work, which leads to the recording of a series of lossy positions. A good trader can find himself in all conditions, which is why in this article we will present some tips to facilitate trade in consolidations.

Be sure to read: Key concepts in the context of trend reversal - exhaustion and reversal

#1. Investigate the specific value

Determine whether it is worth trading on it at any given time. If we are dealing with consolidation, trading on a given instrument makes sense only when the price sets certain limits and moves from the upper to the lower limit we have identified. Such a picture shows us that despite the lateral movement, the price oscillates between certain levels, which prevent the buyer and the seller from gaining an advantage.

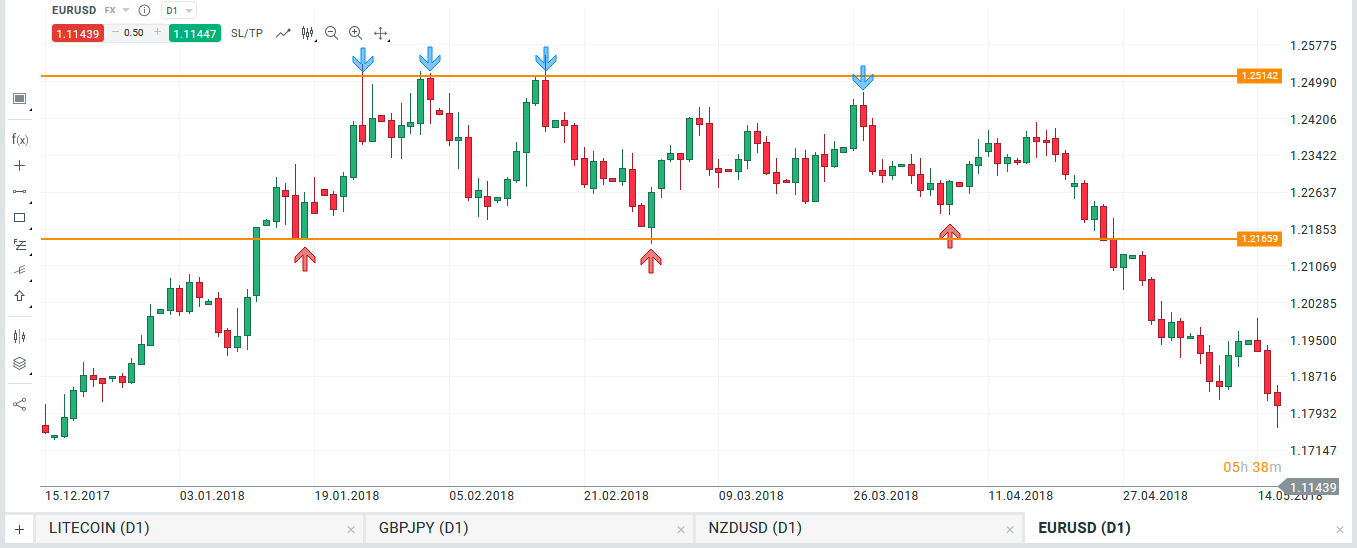

A good idea, if we are not sure if the market is attractive at the moment due to the lack of advantage of a particular party, is to look at the graph from the perspective of a higher interval. Looking at a larger range of prices, it is easier to identify individual downward and upward movements. A very important aspect is to determine if the consolidation is in the form of range trading (the price respects certain levels in the upper and lower range of the lateral movement), or is there an indefinite movement where horizontal levels can not be identified. Of course, in the first case, the price does not always have to reach the top or bottom of the movement every time.

Example of range consolidation. EURUSD, D1 interval. Source: xNUMX XTB xStation

It is always worth noting that in such cases between support and resistance there is a slightly greater distance. Purchase signals should be sought at the lower limit, while sales at the top.

#2. Avoid "Stormy" market

In the simplest terms, an agitated market is one where movement lateral takes place in a narrow one the field. Such conditions are extremely difficult to trade, so in most cases it is better to stand aside and calmly wait for the situation to develop. If the price moves between levels, which are located very close to each other, it is extremely difficult to obtain a favorable profit / risk ratio. These types of movements usually occur after strong swinging. Investors do not notice the transition to side traffic and try to join the continuation losing their capital.

An example of a turbulent market. EURUSD, D1 interval. Source: xNUMX XTB xStation

#3. Define the entry points accordingly

Here, the most difficult thing is what the trader trading in consolidation has to face. How to determine where to enter the position? Signals are very helpful price action. On the market where we deal with range consolidation, the first thing to do is mark the key support and resistance, where you see the price response. False breaks are also very important. It is worth waiting for the moment when the price is trying to leave the consolidation, but eventually it returns to the given scope. In each of these types of lateral movement there is at least one false dislocation, creating a pulse in the opposite direction. It is not worth trading immediately at the minting. If leaving the consolidation really takes place and is not proverbial, the price usually stays out of the range for a few days and once again tests the level that before beat. An effective re-test also confirms the exit from lateral movement.

25 An example of a false break in consolidation. EURUSD, D1 interval. Source: xNUMX XTB xStation

#4. Never enter the market forcefully

Finally, the rule that every trader should be guided by, and not only in the case of consolidation. If you are not convinced about the entry, and the market moves in a range that prevents you from obtaining a favorable R: R, it is better to stand aside and let the trade go. Capital protection is always a better option than excessive overtrading, which in most cases leads to a loss. When a given couple does not meet certain assumptions, it is always possible to analyze other markets on which the conditions for trading will be simply better.

Sometimes the best position is the lack of position.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)