Trader of the Month earned over 92 000 $ in December [Tickmill Competition]

Trader of the month - December 2018

We have the results of the next edition of the competition"Trader of the Month"whose broker is an oranizatora Tickmill. A trader named Haibo was awarded, who showed his nerves of steel, incredible efficiency and most importantly - generated a substantial profit of over $ 92 in December. Congratulations!

How trader traded the month? About this below. We also encourage you to have an extensive interview for Tickmill.

From September 2017, the broker selects not one and two traders of the month, where each of them receives a prize of 1000 $.

Always with TP, (almost) never with SL

Haibo's strategy contradicts what “everyone” says - Reduce Risk, Always Have Stop Loss. In the trader's history of December 2018, we caught only 16 of the nearly 400 positions that had a Stop Loss set. And usually it was quite distant. Interestingly, comparatively few items had NO Take Profit set.

Haibo traded primarily in gold and major currency pairs, with occasional WTI crude oil. Volume? Mostly around 1.0 - 5.0 lots, but also quite a lot of 8.0-10.0 lots. Several large transactions were very often active at one time: gold, GBP / USD, EUR / USD, EUR / JPY ...

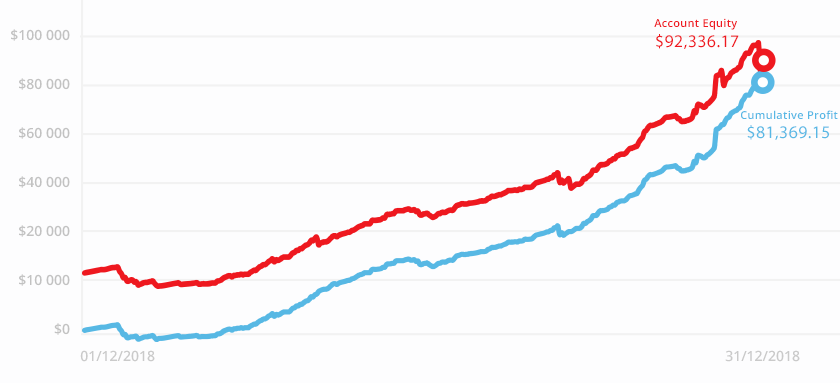

There was no doubt that the risk was high. The trader of the month relied on relatively frequent small gains and rare large losses. The advantage was to give him great efficiency. But at the beginning, the threat was visible - a decrease in capital from $ 11 to around $ 800 (Drawdown -39%) in just a few days. However, on the wave of many appropriate games, we finally managed to achieve a profit of 92 000 $, which is almost 800% profit in just one month.

Transaction history in numbers:

- Profit: 92 336 $

- Return: 782,31%

- Total number of transactions: 367

- Profitable transactions: 88.56%

Statement trader (PDF)

Interview with a trader

How long have you been involved in trade?

I entered the FX market in January of the year 2018, so over a year.

How did your adventure with Forex trading begin?

I deal with administrative management in a large company. The work is relatively stable, but the salary is not high. I have been working in this company for a very long time and there is not much room for personal development. As part of my work, I devote a lot of attention to and research on investment products and technologies, such as shares, funds, futures and currency futures (Forex).

First of all, let's talk about series A shares in China. Within ten years, GDP growth has increased sharply, but A series shares are stagnating. Retailers suffer huge losses on the stock market, so I always treat the stock exchange with a bear mentality. Even if there is a recovery, it tends to be small. I'm focused on the stock market, but I do not trade it. Retail investors can not compete with bankers.

On the other hand, FX is relatively simple and flexible, and you can open long and short positions. In comparison to the stock market, the information and technology of the currency market is easier to catch. There are not only bankers on the market, so you can rely on candles during trading. Due to this, after several rounds of demo trade, I made a cautious decision to enter the currency market in January 2018 year. It was a challenge for me. First, I chose XAUUSD for trading. Information fundamentally about USD have a big impact on the gold market, which has 80% of the reverse correlation in relation to the dollar index. As long as investors pay attention to the development trend of the American economy and some risk factors, and also trade with this trend, they are able to capture more traffic. Trading in gold is simple and can be profitable.

What is your trading style?

My style of trading is radical. I prefer an unstable market and I buy low with support and sell high on resistance. In general, I'm an intraday trader, and the share of my day trading is around 75%. I think that in this way I can avoid most risky moves. But on the market of trends, such as the increase in gold from 1240 to 1298 at the end of last year due to the seasonal factor, my profits were not so large.

I am currently adapting to commercial trends, I try to make long-term transactions and I learn from proven traders. In general, strategies that meet my criteria and allow for constant profit are the best.

Do you have any risk management policies?

When it comes to risk management, this is one of my personal disadvantages. I had a few hard times because of that. In January, 2018 traded in gold and my account doubled during the first 3 months, with 6000 dollars to 22000 dollars. I was too confident. In March of the 2018 year, a trade war broke out between America and China, and gold rose to the 1365 year due to risk aversion. With these increases, I opened a short position against the trend and reset my account.

Without careful analysis, I wanted to continue and pay 20000 dollars to my account in April. I thought gold would rise due to risk aversion. As a result, when the US stock market reached record highs, and gold prices fell to new minima, I re-zeroed my account. It was June of the year 2018 and I decided to stop trading for three months. From October XUMMX, I returned to the market.

Thanks to a friend's recommendation, I registered in TICKMILLand my total deposit was 7000 dollars. After previous bad experiences I have established the following rules:

- Do not take big positions.

- Do not add to the position against the trend

- Place a stop loss.

- Do not let losses be kept

Based on the principle that risk control is a priority, my income from the account increased by 1000% over 3 months. Risk management has a huge impact on profits.

What good habits should investors be fooled about?

In my opinion, wise traders should have the following habits:

- Market analysis. Do not open positions in a hurry. During the Asian session, you can look at price trends with indicators and understand news and external markets such as the US economic situation, recent sensitive events in America and US stock dynamics / Dow Jones / s & p 500.

- For example, the collapse of US shares will cause capital to flow into safe assets in the currency market, especially gold (XAU) and yen (JPY). The recent Brexit decision will lead to large fluctuations in GBP pairs. During the European session, you can correctly choose the entrance. If the trend in the Asian session persists, you can buy low or sell high. During the session in the United States, there are more variations and more data-driven moves. After understanding the trend, you can choose to exit the market or re-enter the market. Regarding the technique, in the absence of market messages, I personally use a combination of trend lines, bollinger bands, resistance lines, support lines and candles from different periods to assess the future trend. In addition, I also use a combination of minute and hour 30 candles to assess the trend and find the entrance.

- Risk control. The "first risk control, then income" principle must be followed. After entering the market, you must set a stop loss and stick to it. Do not let yourself hold a lossy position. If the position is positive, you can close it by taking a profit or trailing stop.

- The principle of adding to the position. Investors often lose by adding new positions in the event of a loss. If the market trend does not reverse, adding to the losing position will lead to a high position and eventually you can reset your account. Only if the item is on the plus side, you can add another one. When the sum of positions is under control, you can enter the market with 20% the first time, 30% the second time and 50% the third time, or 2: 3: 5. The total position should not exceed 30% of the size of your account.

- Be calm. You should not be happy about your profit or feel bad about one or two stop losses. The investment is a long-term process and its goal is overall profit and capital protection. Only peace allows you to achieve a steady profit and allow profits to flow. Secondly, you need to be confident, eliminate external interference and do not relate too much to the strategies of others. Otherwise, you will never develop. Investing is actually very simple and boils down to the strategy and its implementation. Act like a lonely trader.

Describe your best / most-remembered transaction (How much did you earn? What strategy did you use? On which pair?)

3 January 2019 in the morning Japanese yen led to a rapid collapse in the currency market. GBPJPY dropped to 132 from 137. At the time, I had 24 long-term flights on the medium level 138. I thought it would drop to 135 the most. But after the morning market opening, the rate dropped practically vertically. My level of security was close to 50%, so I kept 20 on short flights with an average 135.945 level. But due to the delay of the operation, I could not lock the position in the real sense, which caused that my long position stopped at 135. The price fell to the new low level 132, and my short position gained 56000 dollars, because my "masterstroke" saved me most of the items. It is a strategy that is the fastest, the most impressive, the most profitable and the most suitable for blocking the position that I have seen since I was in the foreign exchange market.

What advice would you give to novice investors?

My advice for new investors has been analyzed in detail above and can be summarized in the following paragraphs:

- analyze traffic, do not put transactions in a hurry;

- risk control and strict compliance with the rules;

- adding to the position gradually, do not invest firmly in the position;

- keep calm and confident. In addition, several points should be added

- strengthen the learning process, pay more attention to compliance with rules, use of tools, indicators, information control, learning technical analysis, candles, moving average, trend lines, etc. and improve the ability to analyze the market;

- Intraday is about quality, not quantity. If there are large data-driven movements that can not be understood, wait;

- losses do not matter, and we can not win in every transaction. As long as you can make profits as a whole and protect your capital, you can make up for any losses.

Considering the current market situation, what do you think data / investors should pay attention to?

During macroeconomic events, such as federal reserve decisions, Trump's speech, Brexit, traders should anticipate price movements and develop a strategy for this move.

When prices rise immediately after a decline or fall after an increase, investors should be careful with entering the market. The most important thing is to set the stop loss level. After macroeconomic events, the reaction may be delayed and this movement may have an impact on the further trend. Setting your own strategy and stop loss is the best way to deal with such situations.

What is the most important thing you expect from a Broker?

When looking for an FX broker, I pay attention to the following issues:

- Trade security. This is the basis of trade and mainly relates to the platform's qualifications and reputation. The selected broker must have a license and good reputation. If the broker was founded recently, it is not regulated, there are many complaints about the service, it can be concluded that its effect is weak.

- Quality of trade. It's mainly about the speed of order processing, easy navigation on the website, fast deposits and withdrawals. When large slides appear, the order can not be executed, the investor may be exposed to unplanned losses. Investors, including myself, are most worried about deposits and withdrawals. They expect fast payments and no problems with payouts.

- The cost of the transaction. Only when the commission and spread are low, you can achieve a higher profit in trend.

- Customer service. Solving misunderstandings and problems in a short time is also a key element.

- Daily promotions and contests are a way to attract new customers, I'm also interested in this type of activities.

Finally, I would also like to thank Tickmill for letting me present my investment skills. After reviewing the offer, I found that the broker is regulated, has a high security of assets and a good reputation and has gained popularity among many investors.

My opinion after three months: Deposits are booked in real time, payments are made within 48 hours. Customer service reacts quickly and some of my problems are solved on time via online communication. Compared to other platforms, the spread and commission at Tickmill are lower. Winning in a live competition is a surprise for me, so I will continue trading in Tickmill, share my trading experience and recommend your platform. Thank you very much!

competition rules

The winner of the competition is selected by the Tickmill Jury. The win is not only determined by the rate of return - it is the total that matters. Factors such as earned profit, position management, risk and trading skills are taken into account. There is also one more necessary condition - interviewing the broker and consent to make the account history public. Only then does the prize of $ 1 go to the trader's investment account.

The principles introduced are aimed not only at showing that you can make money on the Forex market, but also consciously educate and encourage sharing experience with other traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trader of the Month earned over 92 000 $ in December [Tickmill Competition] trader of the month](https://forexclub.pl/wp-content/uploads/2018/09/trader-of-the-month-tickmill-contest.jpg)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Trader of the Month earned over 92 000 $ in December [Tickmill Competition] xtb trading club](https://forexclub.pl/wp-content/uploads/2019/01/xtb-trading-club-1-102x65.png)

![Trader of the Month earned over 92 000 $ in December [Tickmill Competition] cysec banner](https://forexclub.pl/wp-content/uploads/2018/02/cysec-szyld-102x65.jpg)