Tinder, Bumble, Badoo and others - how to make money on dating apps? [Guide]

As the world is digitized, people's behavior and the way they solve their problems are transformed. A great example is how to find a partner. Nowadays, more and more people meet their partner on dating sites. tinder, Badoo or Bumble are known and used in many countries around the world. On foreign exchanges, you can invest in companies that own many well-known dating sites.

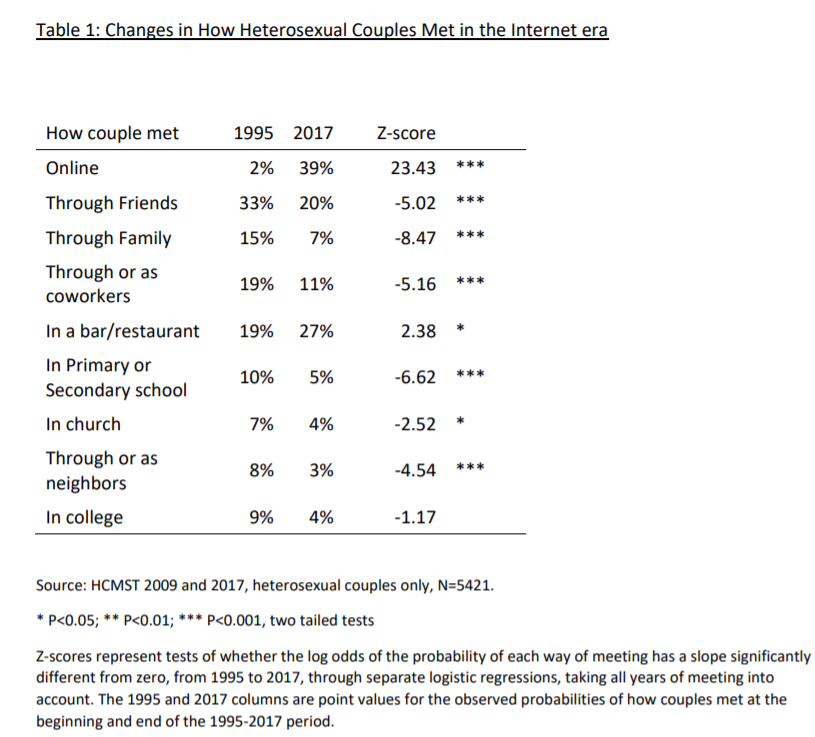

Dating apps have disrupted traditional methods of finding a partner. According to a Stanford University study, until 2013 for heterosexual people, the most popular way to find a partner was through friends (from work, school, neighborhood). However, since the development of the Internet, the way of searching for the "other half" has started to change. Below is a tabular presentation of changes in the way of finding a partner:

In 1995, finding an online partner was estimated to be around 2%. The biggest, initial barrier was, among others, uncertainty about the "authenticity" of dating profiles and low proportion of the population that uses the internet frequently. Despite the initial skepticism, "online dating" found more and more followers. The simplicity of making new friends resulted in a significant increase in the communities using the platform. In 2009, it was already 22% of heterosexual couples. In 2017, the percentage increased to over 35%.

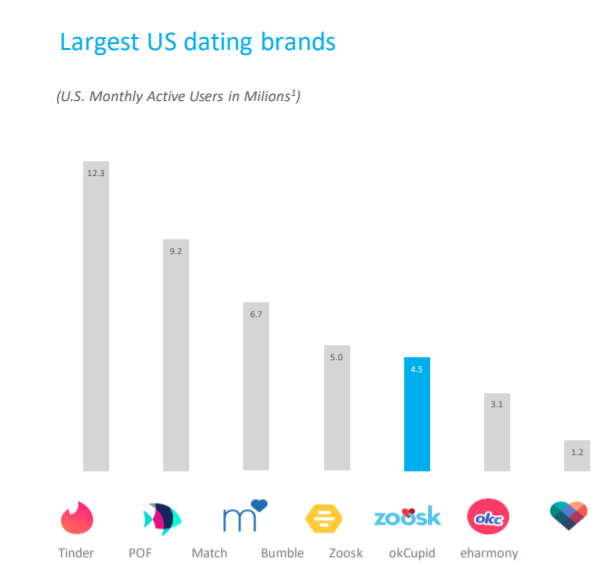

A network effect has worked for many applications - the more people used the application, the easier it was to find a partner on it. The easier it was to find a partner, the more people wanted to join the platform. Dating portals are tailored to the expectations of customers. Some offer opportunities to connect users in a "short-term relationship", ie ONS (One night stand), others focus on creating long-term relationships. Below we present a short summary of selected companies operating on the dating application market.

Match group

It is a world leader in the dating application market. The company has an entire portfolio (several dozen) of dating applications. Among them, there can be mentioned: Tinder®, Match®, Meetic®, OkCupid®, Hinge®, Pairs ™, PlentyOfFish®, OurTime®. The beginning of the Match Group company dates back to 2009, when IAC, which was the owner of many dating sites, decided to form a company with such a development profile. As a result, the solutions were grouped under one brand, which was Match Group. Below is a brief description of the most important brands belonging to Match Group:

The most important platform in the company's portfolio is tinder. The application was created in 2012 in the startup incubator (Hatch Labs), it was organized by the owner of the Match Group (IAC). Due to the simplicity of creating a profile and accepting or rejecting the contact proposal (moving the photo right or left), Tinder has found a large group of supporters. The application is based on the freemium model, which means that its basic functionalities are free. However, if the user wants to use additional functionalities (eg Tinder Plus, Gold or Platinum), he has to pay extra. At the end of 2019, there were over 5,9 million paying subscribers.

Application Match.com is the oldest application in the Match Group portfolio. The first beta version of the program was introduced in 1995. In 1999, the company was included in the Ticketmaster portfolio (owned by IAC). The purchase price was approximately $ 50 million. The seller was Cendant. Match.com operates in over 50 countries and has 12 different language versions. It is one of the most popular dating apps in the United States. According to Statista.com data, the application was in fourth place in terms of popularity (after Tinder, Bumble, POF).

PlentyOfFish This is a Canadian app that was acquired by Match Group in 2015 for $ 575 million. The company's main markets are the United States, Canada and the United Kingdom. POF is also available on non-English speaking markets (e.g. Brazil, Meksyk).

It is also worth mentioning applications such as Meetic and Paris. Meetic operates in a similar way to Match.com, but its offer is aimed at European users. Meetic was founded in 2001 in France. IAC acquired the company in 2011 with 71% of the shares for less than $ 350 million. This gave the enterprise a valuation of approximately $ 490 million. In turn, the application Paris was founded in 2012 and was initially aimed at Japanese users. In the following years, the application gained popularity in Taiwan and South Korea. Match Group likes to take over local solutions, as evidenced by the acquisition of the startup Harmonica (Egyptian dating application) established in 2019.

Operational data

The company mainly earns from fees paid by users (subscribers). The second source of income is the fees paid by advertisers.

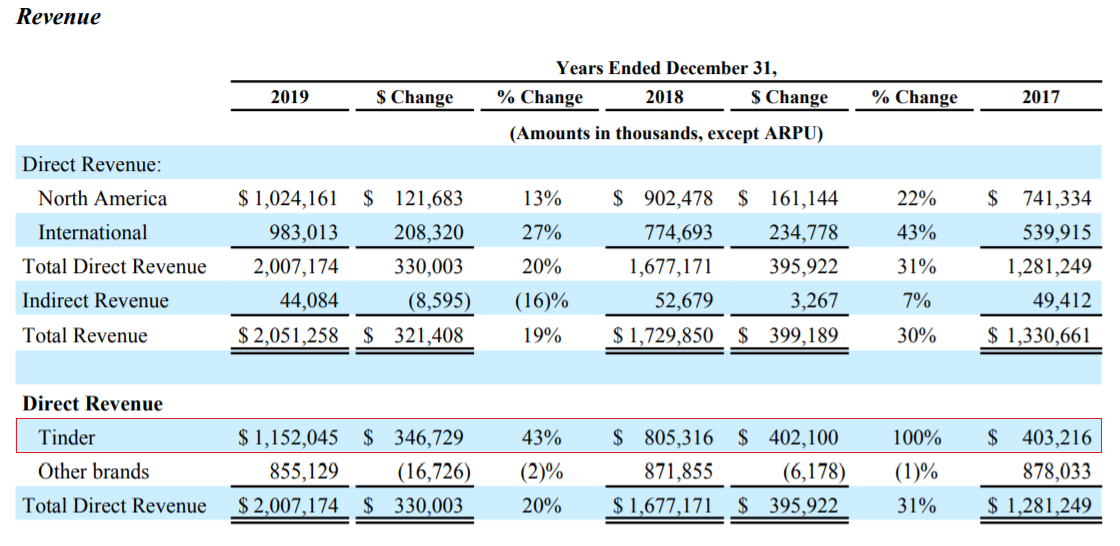

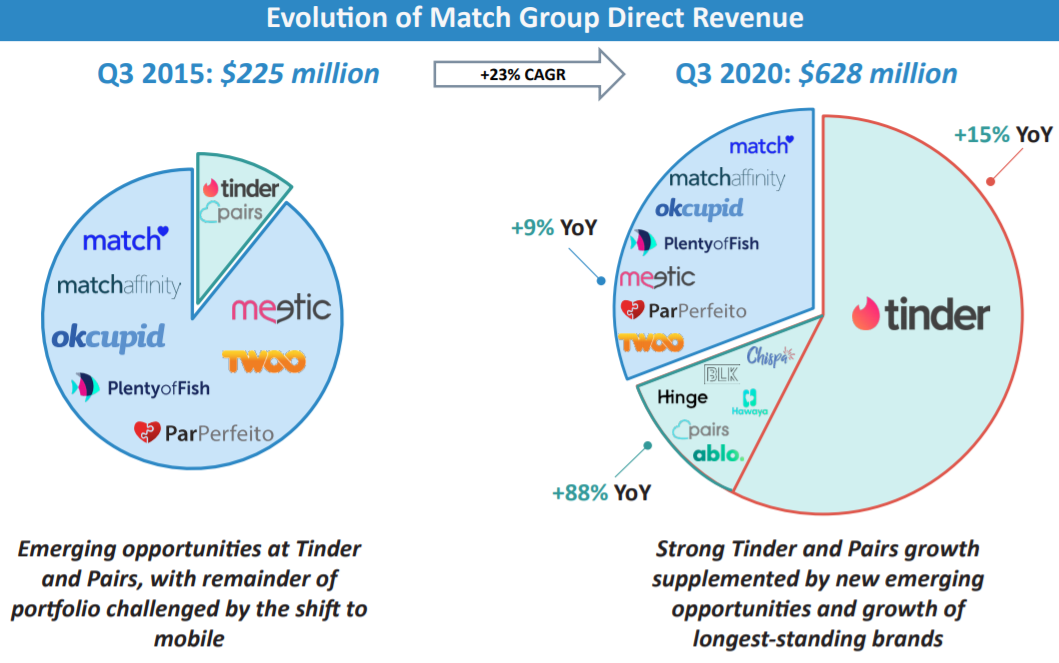

The most profitable application is Tinder, which generates over 57,4% of revenues, classified as Direct (revenues from subscribers). Match Group has managed to improve the monetization of its leading application. From 2017 to 2019, Tinder revenues increased by 185%.

The tremendous success of the Tinder app is also evident in the charts below that show how the direct revenue mix has changed over the past 5 years. Interestingly, even mature brands such as Match.com can increase their revenues.

Match Group, due to the rich portfolio of applications, strong market position and dynamic market growth, caused the scale of the company's operations to increase significantly.

| Match group | 2016 | 2017 | 2018 | 2019 |

| revenues | $ 1 million | $ 1 million | $ 1 million | $ 2 million |

| Operational profit | $ 315,5 million | $ 360,5 million | $ 553,3 million | $ 648,5 million |

| Operating margin | 28,2% | 27,1% | 32,0% | 31,6% |

| Net profit | $ 171,5 million | $ 350,1 million | $ 477,9 million | $ 534,7 million |

Source: own study based on the company's annual reports

ARPU

An important measure of per-user relationship with dating platforms is the ARPU (Average Revenue per Subscriber). It is the average daily earnings per subscriber measured over a period of one year.

| ARPU | 2016 | 2017 | 2018 | 2019 |

| USA | 0,56$ | 0,56$ | 0,59$ | $ 0,61 |

| Abroad | 0,50$ | 0,51$ | 0,56$ | 0,56$ |

| Together | 0,54$ | 0,54$ | 0,57$ | 0,58$ |

Source: own study based on the company's annual reports

Subscribers

Subscribers are users who use paid solutions available on dating sites belonging to Match Group. In 2019, the number of paid subscribers exceeded 9 million users.

| Subscribers (million) | 2016 | 2017 | 2018 | 2019 |

| USA | 3,268 | 3,569 | 4,161 | 4,554 |

| Abroad | 2,140 | 2,839 | 3,712 | 4,729 |

| Together | 5,408 | 6,408 | 7,873 | 9,283 |

Source: own study based on the company's annual reports

Match Group stock chart, interval W1. Source: xNUMX XTB.

Bumble

Andrey Andreyev

The history of the current company begins in 2014. When 79% of shares in Bumble were acquired by the owner of the Badoo application - Andrei Adreev, paying for them $ 10 million. The company that owned the Bumble and Badoo shares was called MagicLab. In 2018, Match Group wanted to take over the company, offering over $ 450 million. However, the main owners abandoned the offer. In 2019, Andiejew's shares were bought by Blackstone for $ 3,3 billion.

Bumble debuted on the New York Stock Exchange on February 11, 2021, raising $ 2,2 billion from the market after selling 50 million shares. The debuting company has two well-known brands, they are Bumble and Badoo. Each month, both portals are used by 40 million unique users. The IPO's price was $ 43, however in the debut session it increased to $ 76, ie by over 70%.

A leading figure in Bumble Inc. is Whitney Wolfe. Since 2012, she has tied her career with technology companies building dating apps. She was one of the first people to work in Tinder (still operating under the name MatchBox). application name. In 2014, she ended her work with the "icon" of dating applications in an atmosphere of scandal. Whitney Wolfe Herd accused one of Tinder's employees of sexual harassment. She signed a settlement, receiving over $ 1 million and a stake in the company. Shortly after leaving Tinder, she started her own app - Bumble. After her recent debut on the stock exchange, Whitney Wolfe Herd became the youngest billionaire in history (31 years old), with assets estimated at over $ 1,5 billion. Currently, he is the CEO of Bumble Inc.

Application Bumble was founded in 2014 as the first dating app that was built for women. It is their decisions that constitute the center around which the platform was created. Bumble is based on the premise that women must make the first move to start a relationship with other users. In the last 6 years (from September 2014 to September 2020), women performed over 1,7 billion contact initiatives. According to data collected by Sensor Tower, in September 2020 the application had a monthly number of users (MAU) of 12,3 million. The Bumble application is very popular in countries such as the United States, Canada, United Kingdom or Australia. The platform works on a freemium basis. This means that using the application is free, but you can buy additional functionalities that expand the range of possibilities. Subscription plans last for 7, 30 or 90 days. One of the functionalities is, for example, the possibility of better positioning of the profile in the search result (Spotlight). At the end of the third quarter of 2020, the number of App Paying Users (APU) was 1,1 million. The company tries to activate the community around Bumble. This brings results because in Q2020 30 the number of messages sent by women was 2019% higher than in QXNUMX XNUMX.

The second application that belongs to the company is Badoowhich was founded in 2006 by Andrei Andreyev. According to data provided by Sensor Tower, Badoo is the fourth most popular dating app in the world. The average number of monthly customers (MAU) in Q2020 28,4 was 59 million. The application is very popular in European (especially Russian-speaking) and Latin American markets. Badoo is available in 1,3 countries around the world. Like most, the application works in the freemium model. The number of paying customers was 2020 million in QXNUMX XNUMX.

Operational data

The company achieved revenues of $ 2019 million in 488,9, an increase of 35,8% over the year. The Bumble app has a larger share in total sales, generating revenues of $ 2019 million in 275,5 (+ 69,7% y / y). The mature Badoo application (and other applications) had a much weaker growth, whose revenues in 2019 increased by 7,9% to $ 213,4 million.

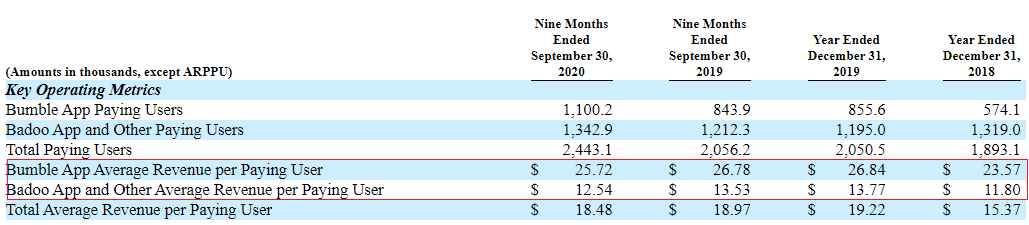

It is not hard to guess that since the Badoo application has a higher number of paying subscribers and generates lower revenues, the average ARPU per client is lower than in the case of the Bumble application. This is confirmed by historical data that can be seen in the excerpt from the company's prospectus below:

ARPPU is calculated on a monthly basis, which is different from Match Group (which prefers daily ARPU). In 2019, Match Group generated monthly ARPU of $ 17,4.

In 2019, Bumble Inc. became profitable with a net profit of $ 85,8 million. A year earlier, the company generated a net loss of $ 23,7 million. The company's operating margin in 2019 was approximately 19,1%.

Spark Networks

It is the company with the smallest "strength" of the three shown. In the United States, only one brand is included in the top 5 applications (in terms of MAU). The current portfolio structure resulted from the acquisition by Spark of competitor Zoosk Inc. for $ 258 million.

Spark Networks is known in Poland, among others thanks to the eDarling platform. In addition, it has 11 more dating apps operating in the US as well as overseas markets. However, in its plan for 2021, the company intends to focus on the development of four major brands: Zoosk, EliteSingles, SilverSingles and Christian Mingle.

The company has a much smaller number of paying subscribers. This translates into lower revenues. The monthly ARPU, before the merger with Zoosk, was similar to Bumble. In the first half of 2019, it was € 18,44. However, after taking over about 600 paying subscribers (previously the company had 444), led to a decline in the monthly ARPU to around € 16,37. Below is a brief summary of the company's financial results:

| Spark | 2016 | 2017 | 2018 | 2019 |

| revenues | $ 77,4 million | $ 100,2 million | $ 118,5 million | $ 167,3 million |

| Operational profit | $ 3,7 million | $ 0,4 million | $ 1,4 million | -$ 4,5 million |

| Operating margin | 4,8% | 0,4% | 1,2% | -2,7% |

| Net profit | $ 0,7 million | -$ 8,5 million | -$ 4,4 million | -$ 17,0 million |

Where to buy stocks of Bumble, Match Group and more

Below is a list of offers from selected brokers offering both ETFs, CFDs on ETFs, stocks and CFDs on shares.

| Broker |  |

|

| End | Poland | Denmark |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Summation

Dating apps are an interesting type of activity. Companies operating in this business model do not incur large capital expenditure. This means that they are asset-light companies. They don't have to spend billions of dollars on factories or a stationary sales network. The biggest challenge for companies of this type is to build a "mass" that will attract a significant number of users. Then the network effect has a chance to take effect. The greater the number of users, the greater the benefits of creating a profile in a given application. Increasing the number of users will translate into an increasing number of subscribers over time. The basic operating model for companies in this industry is the freemium model. It is offering the basic version of the program for free, but at the same time encouraging its use from "additional" services that significantly expand the functionality of the application.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Tinder, Bumble, Badoo and others - how to make money on dating apps? [Guide] how to buy bumble tinder badoo stocks](https://forexclub.pl/wp-content/uploads/2021/02/jak-kupic-akcje-bumble-tinder-badoo.jpg?v=1613295673)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Tinder, Bumble, Badoo and others - how to make money on dating apps? [Guide] mexican market](https://forexclub.pl/wp-content/uploads/2021/02/meksyk-inwestycje-102x65.jpg?v=1613120720)

![Tinder, Bumble, Badoo and others - how to make money on dating apps? [Guide] forex club - tax](https://forexclub.pl/wp-content/uploads/2021/02/forex-club-podatek-102x65.jpg?v=1613372146)

Leave a Response