Dukascopy PAMM invoice: Test of PLN 20

Dukascopypopular ECN broker, expanded its offer with a unique service. It is the bill Wealth Management LP PAMM. PAMM investments managed by a broker are something that was once available in the Dukascopy offer. At that time, investment plans with three profiles were available:

- conservative

- dynamic,

- aggressive.

Over time, it was abandoned, but the products themselves enjoyed considerable popularity. This is evidenced by the fact that relatively quickly the broker gathered capital that was satisfactory for him and stopped accepting new payments.

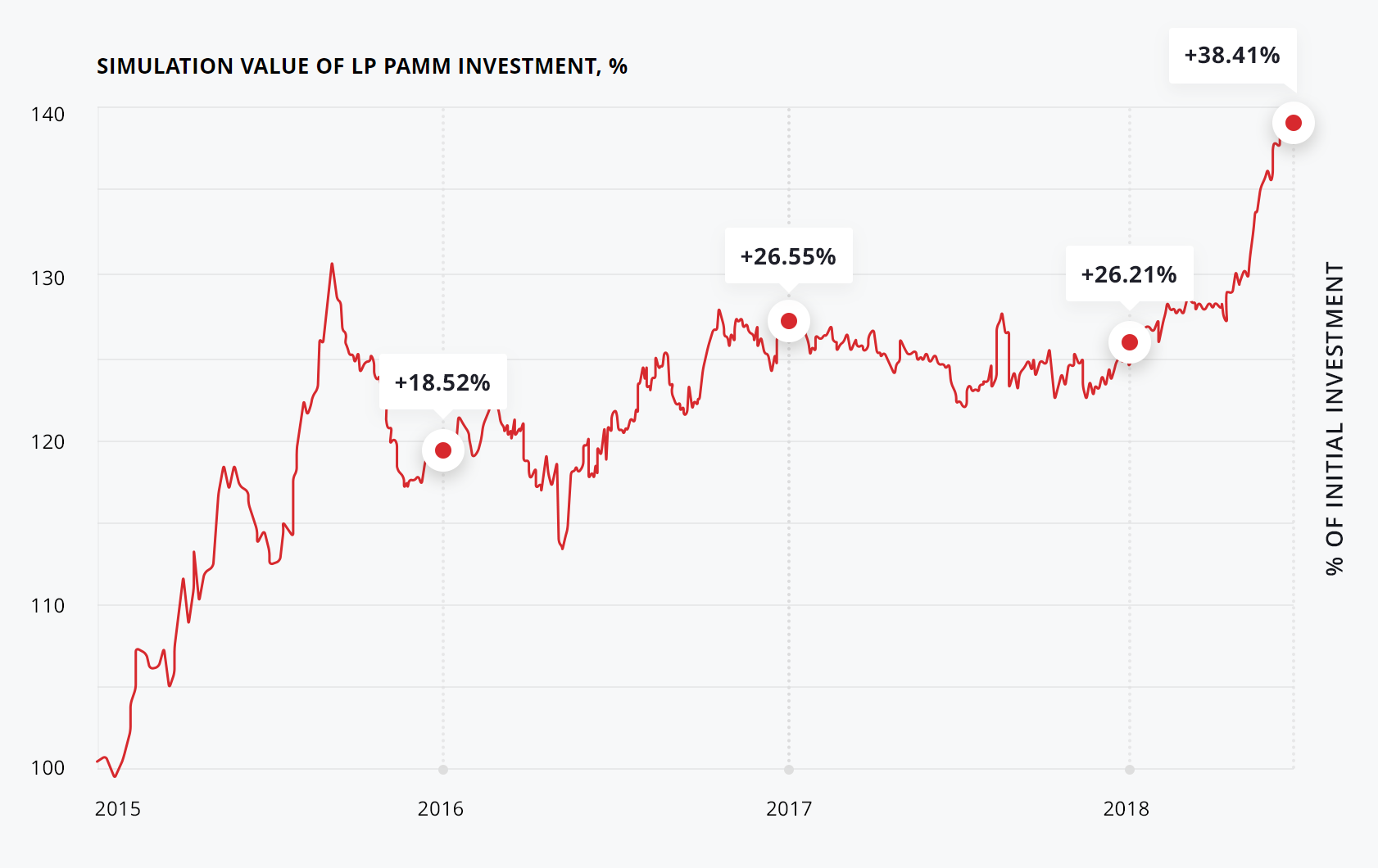

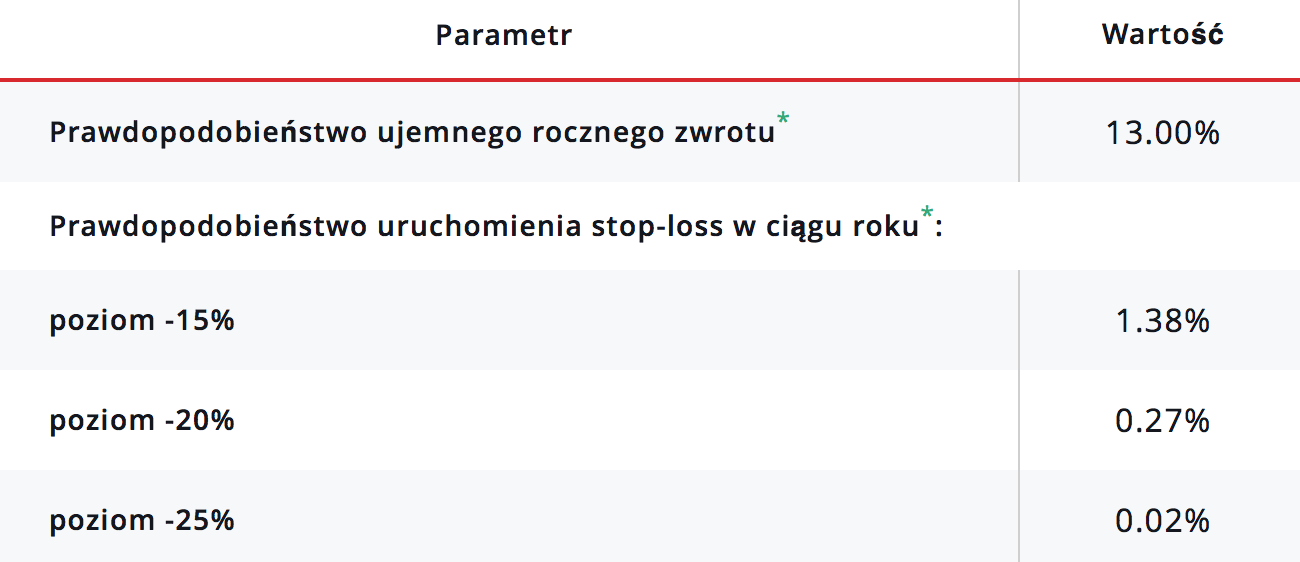

This time we are returning to the PAMM investment in a new formula. A product that we have not encountered before. The investment itself looks extremely interesting in numbers. Minimum 1000 USD for the investment, the average annual rate of return is around 11%and the probability of ending the year in the minus is 13%.

READ: WHAT ARE PAMM ACCOUNTS

We decided to start our test. We spend 20 000 on real investment. We will keep you updated on monthly basis in our monthly summaries.

But what is it really about?

What is WM LP Dukascopy PAMM

Many shortcuts, so it's worth explaining everything from the beginning:

- WM - Wealth Management - it is a service consisting in managing entrusted assets.

- LP - Liquid Providing - from the English "liquidity delivery". This is the foundation of the strategy used by Dukascopy managers. This is also the main goal of the venture itself from the broker's point of view, but more on that in a moment.

- PAMM - expanding the abbreviation: Percent Allocation Management Module, that is literally translating the percentage allocation management module. Otherwise, a managed account to which the investor and the manager have access. It's just that the first one has no impact on transactions and the latter on deposits and withdrawals. We describe in detail principle of operation of PAMM accounts in a separate article.

So what do we get from this mix? Asset management service on the basis of PAMM accountswhere the manager's main strategy is to animate the market with investor capital.

But how does it work? Based on its own technology, Dukascopy automatically adjusts the investors' sale transactions to the purchase transactions of other clients at the same Ask price and their purchase transactions to the sale of other customers at the same Bid price. Due to the high frequency of transactions, liquidity providers are able to earn half of the spread at their turnover.

Personally, I have not encountered a similar service before Forex market. The idea is interesting, both for the investor and the broker. Why?

What the investor gains

What usually interests us the most - i.e. how much can we gain, in what time and at what risk? Dukascopy is fully transparent here and transmits a large amount of detailed data.

The minimum deposit is set at $ 1000, there is no upper limit, but it may be someday. Risk? Precisely estimated taking into account the probability intervals. An additional security is the optional Stop Loss set on the entire account capital and suspension of further trading. The suggested investment time by the broker is at least one year. The assumed capital fluctuations in the account are even -15%, which is worth taking into account when using the SL function.

If you keep reading, chances are you will be tempted. The estimated annual rate of return is 11%. Obviously, no one guarantees such results in the future - they can be both better and worse.

This is a ready recipe for additional portfolio diversification. If you are losing or spinning around, then you can level the market opportunities.

The rate of return is not spectacular, but in return we get security - funds are managed by a proven, automated system. This is no guarantee, but is considered a relatively safe solution. Funds are held in a licensed Swiss bank with a capital guarantee of up to CHF 100 per customer. You can sleep reasonably well.

And the last thing. Being a trader and at the same time a liquidity provider, you help yourself. The more liquidity, the better spreads, and the smaller the spreads, the lower your transaction costs on the market. It's great, right? 🙂

How much is it

Interestingly, the only cost we incur is the commission on the order and possibly a negative swap (depending on the transaction). The basic commission rate is USD 20 for USD 1 million in currency trading. For metals, it is 50% more, and for CFD according to the specification of the instruments, with the difference that the minimum rate was abandoned. Exchange rate risk? There is no. You can keep an account in any currency offered by Dukascopy Bank.

There is nothing in the form "Percentage of profits", Czy "Management fee". Not only that, it was introduced the possibility of reimbursement of costs incurred. However, there are some conditions:

- you must keep the investment through 260 trading days,

- you must achieve a negative result,

- the refund is only up to the amount of loss incurred,

- the withdrawal of funds "resets" the trading day balance to zero.

It sounds reasonable, right? But why the broker would like to play with it? Answer in the next paragraph.

What the broker gains

Above all, better liquidity. It is a brilliant idea of a broker, thanks to which it is able to collect capital and independently, at a relatively low cost, increase the level of market liquidity, without the need to enter into agreements with animators.

Achieving positive results is also in his interest. Only in this way will it attract more capital permanently.

We invest in the Dukascopy PAMM account

To start an investment, several conditions must be met - first of all, you need to open a real account at Dukascopy Bank. Currently, it takes an average of 1 day (+ time to post the transfer). The procedure is standard. Then only the required payment, account activation, handing over the authorization to Dukascopy and we are off.

Our test starts at the beginning of September. We will keep you informed about the results. Wish us (or the managers of Dukascopy 🙂) good luck!

More information about the service itself can be found on the broker's website at the following link.

The material should be treated only as an educational article with the presentation of own, subjective opinions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)