Supply / Demand levels. The most important assumptions of the methodology

Levels Supply / Demand | One may be tempted to say that support and resistance levels are one of the basic tools used by traders. They are the basis of classic technical analysis and are known to every investor, no matter if he is just taking his first steps on Forex marketwhether he has been investing for many years. When it comes to supply and demand terminology demand and supply), such nomenclature appears a bit less often and is often by investors as levels of support and resistance. Is this approach certainly correct? In this article, we will try to answer the question what supply / demand levels are and why they are / should be important for investors wanting to be successful in the market.

At the outset, it is worth noting that supply / demand levels do not necessarily have to be related to any other investment methodology. In themselves, they are a great base for investment, and their accurate determination allows you to take advantage of many interesting opportunities on the market. Why are they so important? For a very simple reason, because what we can actually see on the chart is nothing else "Struggle" of supply and demand. No matter which market we prefer, this analysis will work for everyone. The laws of supply and demand are the basic laws of economics that actually drive the entire economy. The relationship between offerors (supply) and buyers (demand) is crucial for determining the price of a given service or a given good. The same principle applies to the currency market.

definitions

How to generally define what are the levels of supply and demand? These can be areas where there is some kind of balance between buyers and sellers, such as through periodic consolidation.

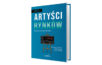

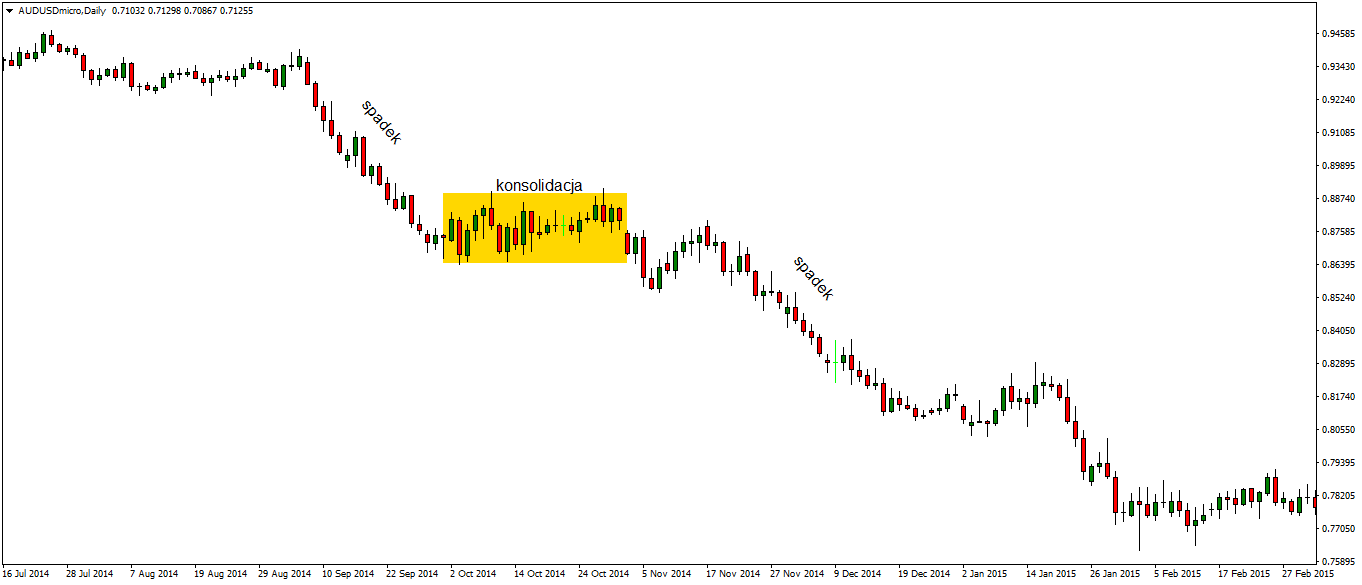

Sample demand level - AUDUSD daily chart. Source: MetaTrader 4, XM.

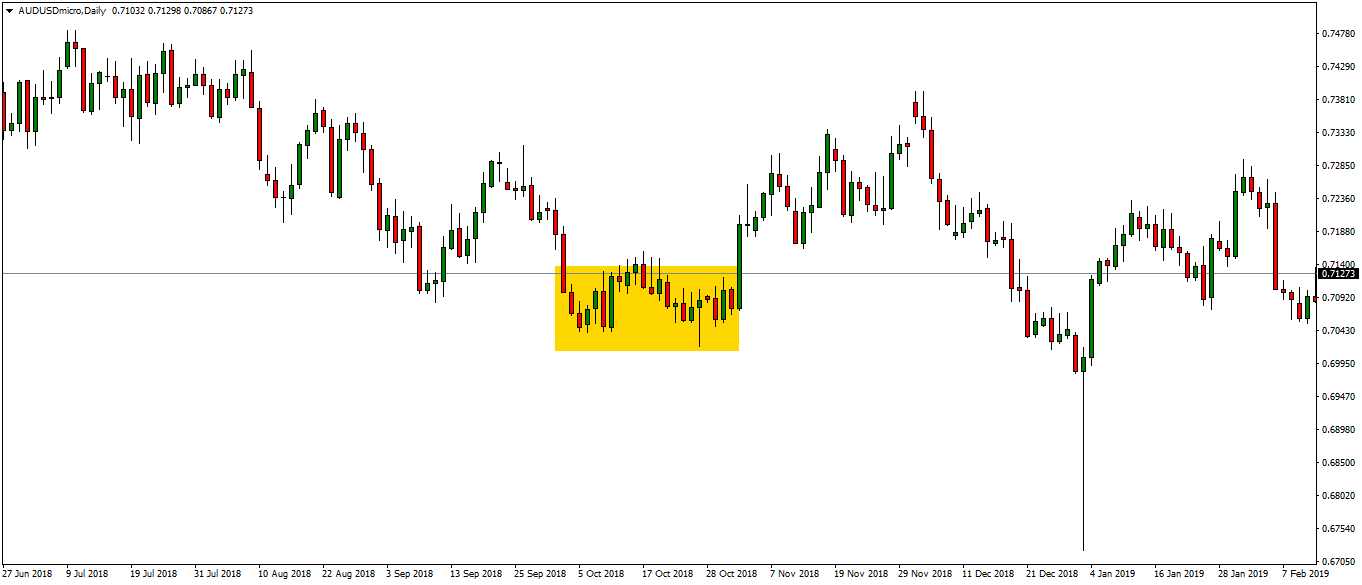

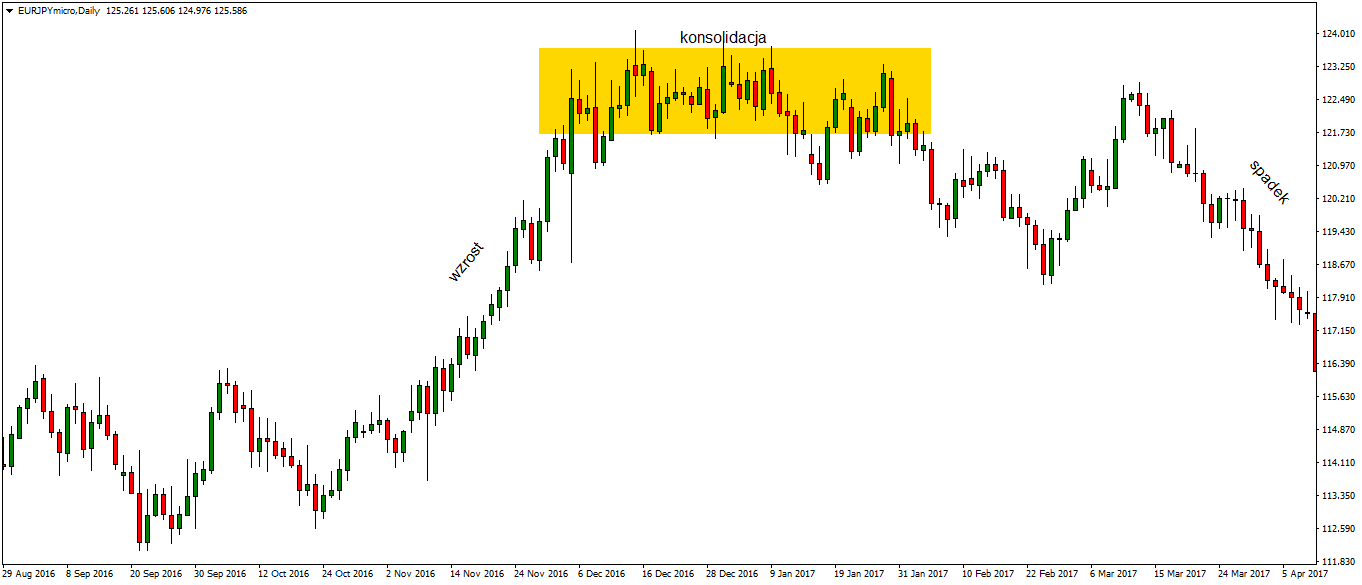

Sample supply level - EURJPY daily chart. Source: MetaTrader 4, XM.

Often also at given levels, the reaction of one of the market's sides is immediately visible.

Demand level - level where before there was a strong reaction from buyers. This may result, for example, from the fact that not all investors have managed to execute their orders at a favorable price for them and may want to buy in a given zone again.

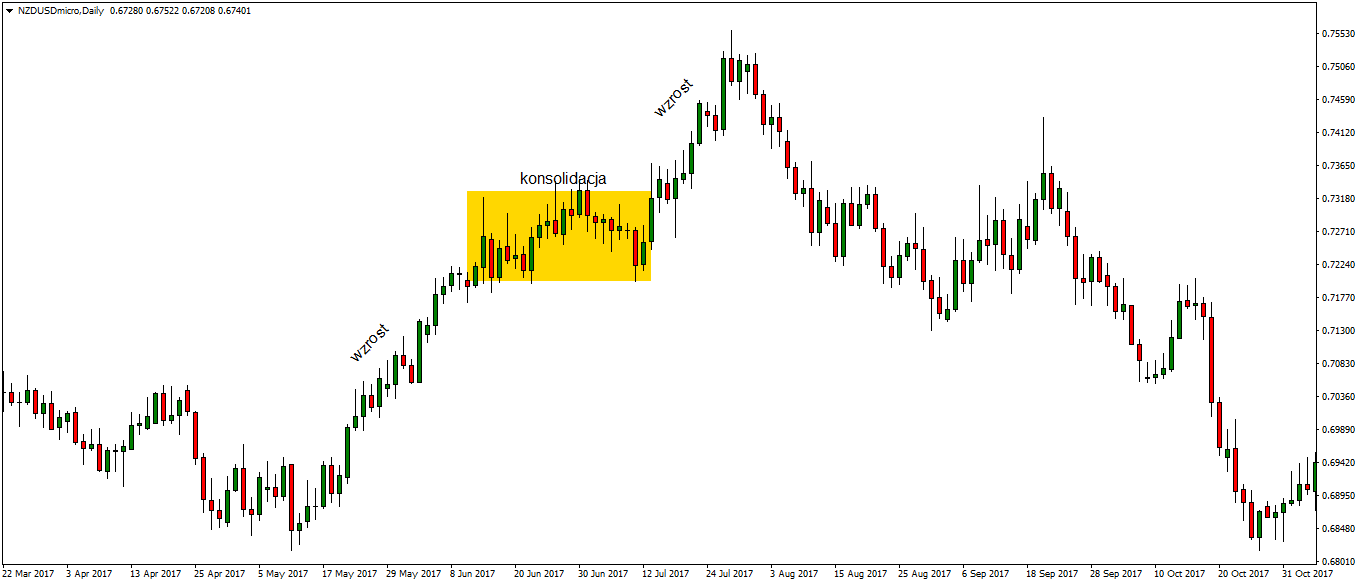

Demand level - NZDUSD Daily chart. Source: MetaTrader 4, XM.

Supply level - level where before there was a strong reaction from the sellers. Analogously to the demand level, it could happen that not all investors managed to sell at a good price for them, therefore they want to renew their orders in a given zone.

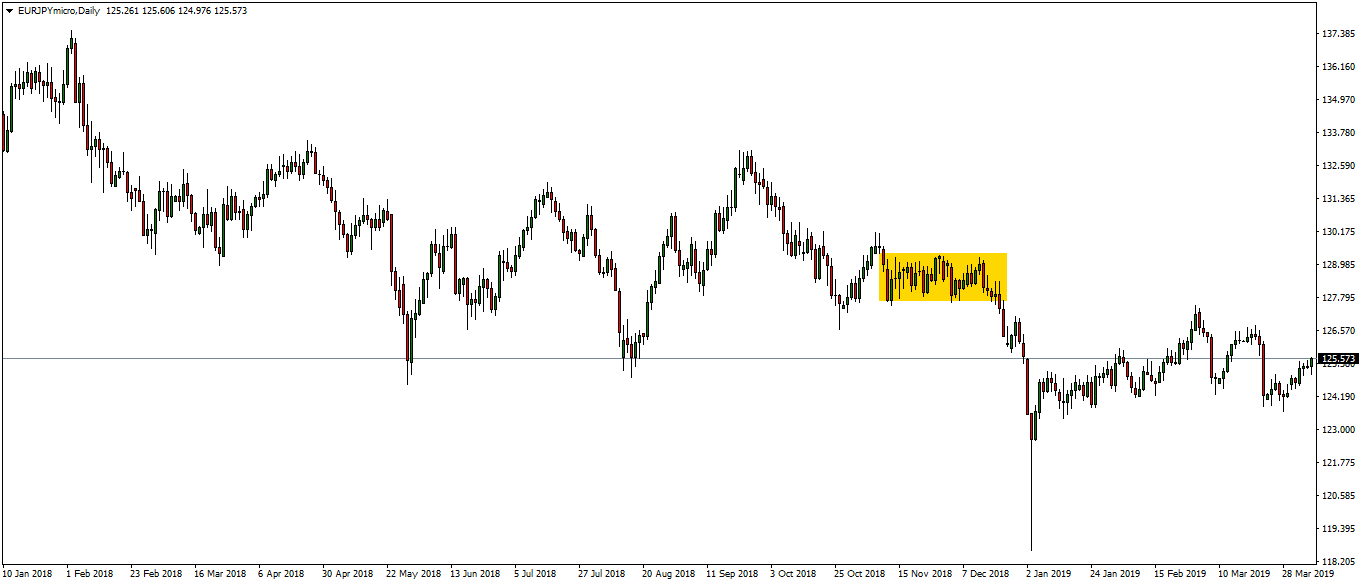

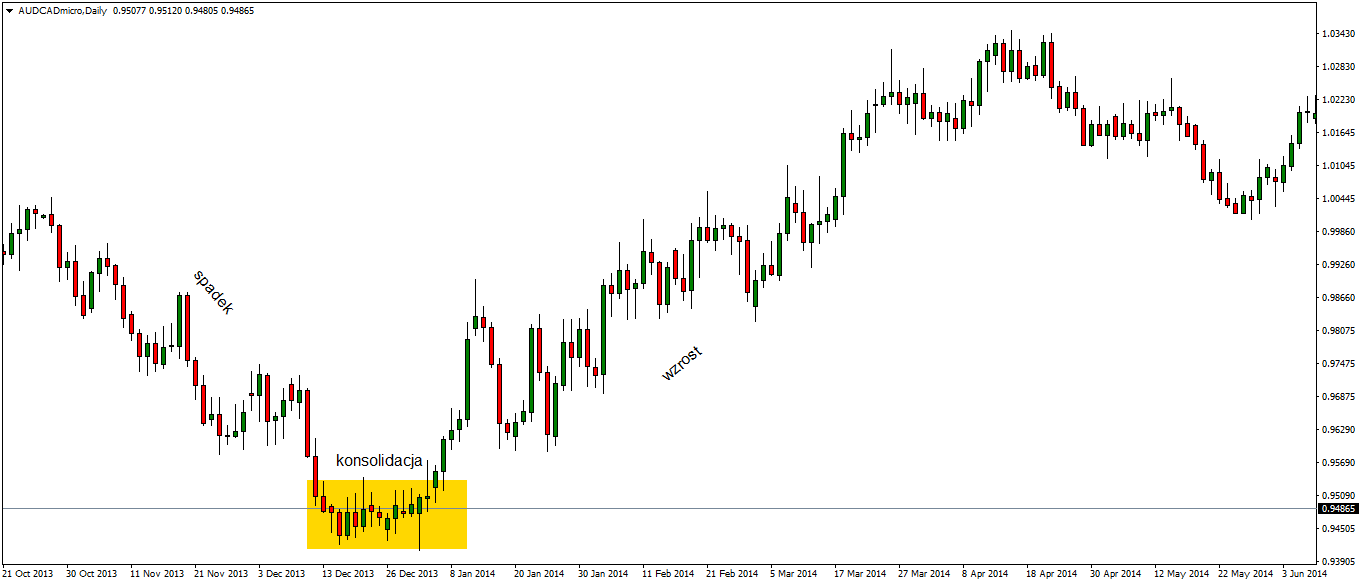

Supply level - AUDCAD Daily chart. Source: MetaTrader 4, XM.

Types of supply / demand levels

We can distinguish two basic groups of demand / supply levels. The first group are levels that are a continuation of a given downward or upward trend. We can distinguish two types of zones:

- Growth-Consolidation-growth,

- The fall-Consolidation-Fall.

Example of Eventing Zone - NZDUSD Daily chart. Source: MetaTrader 4, XM.

SKS zone example - AUDUSD Daily chart. Source: MetaTrader 4, XM.

The second group consists of levels that are the reversal of a given trend direction. Here we can distinguish:

- Consolidation-growth-decline,

- Consolidation-decline-growth.

WKS zone example - EURJPY Daily chart. Source: MetaTrader 4, XM.

An example of SKW zone - AUDCAD Daily chart. Source: MetaTrader 4, XM.

Determining the strength of Supply Demand zones

The most important factor proving the strength of a given zone is maintaining the price within it. The faster the market leaves the level, the stronger it is. It is also important that consolidation lasts relatively short. Another important factor is the number of "tests" of a given level. If the level is tested first, possibly the second time, the probability of reflection is greatest, with each subsequent test, the strength of the given zone decreases. The market context is also extremely important. One of the basic rules says: swim with the flow, not against the current. This is also reflected in the supply / demand zones, it is better to select and select zones in line with the current trend.

In a nutshell:

- strength of movement - the faster and stronger the price reaction, the more important the level

- number of tests - the less, the greater the probability of a reflection

- context - selection of zones compliant with the current trend.

It is also worth remembering a very important issue, namely each demand or supply level will be support or resistance, while not all support or resistance are levels of demand or supply.

Summation

In my opinion, the levels of supply demand are one of the most effective methods of market analysis and selecting investment opportunities, as they are based on the basic principles governing the market. They can be both a separate methodology on the basis of which we make investment decisions, as well as a great complement to the strategy used. Skilful determination of them allows you to identify key turning points on the market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)