Significant sell-out on the silver market

Silver it is a metal that on one hand applies as a capital investment in even silver coins or bars, and on the other hand it is a metal used in industry. Nowadays, it is interesting because on the one hand, deteriorating outlook for the global economy should drive demand for safe assets, which takes place in the form of bonds or gold, and on the other hand it can cause the sale of industrial metals, such as copper.

Bulls on the defensive

Investors on the silver market therefore had to choose which factor is the dominant one for determining the price of the metal. Looking at the price and, for example, the relation to gold, whose quotes have recently been fired, it is quite clear that, however, fears of a drop in demand due to possible stronger braking in the economy have contributed to lower prices than attempts to conquer the value of metal due to return to security . Although the fundamental situation on the silver market is not bad, the price fell to the levels most recently observed in December of the year 2018.

Silver quotes on the daily chart. Source: Conotoxia platform

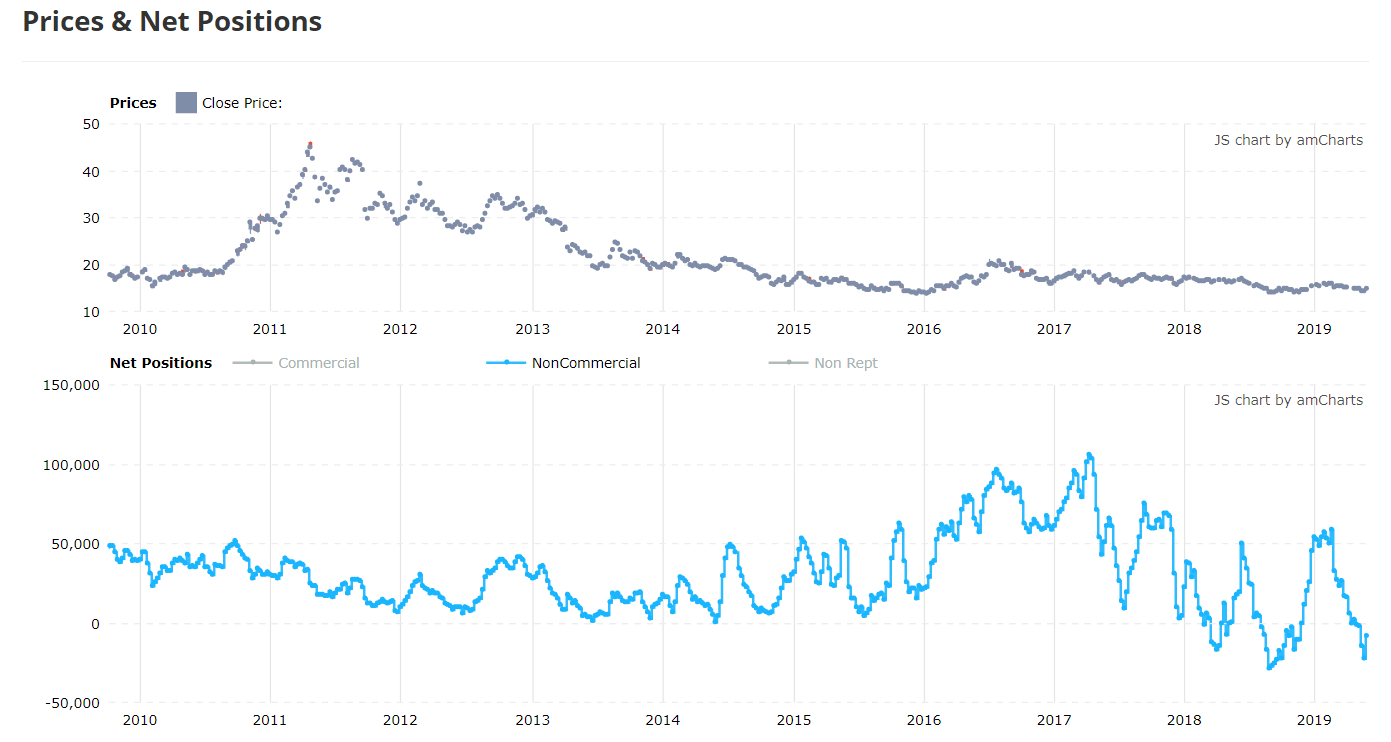

From the point of view of the last history of the chart, only at the turn of the 2015 / 2016 year silver prices were even lower. The last discount could also be a consequence of the increasing involvement of speculative capital, which increased short positions.

Looking at the CTR report published by the CFTC committee, we see that net long positions among non-commercial investors have reached the lowest levels since September 2018 of the year. At that time, the biggest sell-off in the history of this market probably took place.

Long net positions and quotations of a contract for silver. Source: tradingster

Theoretically, therefore, the space for a further drop in the price of metal seems to be limited, and a greater weakening of the dollar or an increase in the chances of a trade agreement between the US and China could be a factor leading to the so-called short squeezu, or quick closing of very numerous short positions on silver.

It is worth paying attention to this heavily discounted metal, because recently there have been the first attempts to draw a larger growth movement that could have disturbed market bears.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response