Spread - fixed, floating or market?

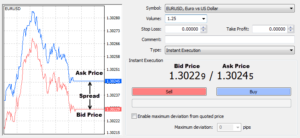

Spread - this is one of the most common words in the slang of currency traders. The definition of the concept is simple. Spread is a term for the spread resulting from the difference between the buying (Ask) and selling (Bid) rates. But we distinguish several types of it. What do they result from, and above all - which one is the best for us? The answers are not so obvious.

What the spread depends on

To put it simply - the market liquidity of a given financial instrument. This means that the more traded a given currency pair, the lower the spread we can expect. Hence, e.g. on the most popular EUR / USD pair, it is the most advantageous. Then other instruments from the Majors (main) group come into play, i.e. USD / JPY, GBP / USD, AUD / USD, NZD / USD, USD / CAD, etc. In the case of exotic pairs, you can expect even a dozen or so times wider spreads. This is perfectly normal.

Spread - the difference between the Ask and Bid price. Meta Trader 4 platform.

Any, even short-term distraction or disruption of liquidity, will be reflected in the spread. We are talking here about such situations as publications of macroeconomic data, hours in which large, key stock exchanges in the world, or holiday periods do not work.

But the very liquidity of the instrument allows us to determine whether the spread will be relatively large or small. We do not read specific values from it.

Types of spreads

All three types have already been mentioned in the title, so now we will only briefly describe them:

- Permanent spread - this is a value set upfront by the broker *, which should not change, regardless of market conditions. The risk of a liquidity failure is on his side.

- Floating spread - the spread assumes the market value, increased by the broker's margin of X. Nobody will tell us directly how much and on which pairs they add themselves, therefore we are not able to directly estimate the final cost of the transaction. It happens that the broker determines the range of min. and max. values within which the spread may move.

- Market spread - the most transparent. The value of the spread results from the liquidity of the instrument that the broker offers us access to, and is usually much lower than the fixed and floating spread. Nothing adds to it, nor does it specify the price range in which it can move. His remuneration is the commission added separately.

* Brokers sometimes define daily and night tariffs or introduce conditions in which they can extend these values.

The broker's model matters

The spread policy will be mainly influenced by the model in which the broker operates. In the Market Maker model, we will mainly meet a fixed or variable spread. When trading u STP broker it will be a floating or market spread. In ECN 99% of the time, we will only have the market spread. Each of these models has its main advantages and disadvantages, but you can read about it in a separate article.

READ NECESSARY: Types of Forex brokers - ECN, STP, MM

Staying on the topic of spreads. Where does this distinction come from? The matter is simple.

Market Maker creates its internal market, where we decide to enter into transactions. It is in its own interest to set such spread values that will allow it to effectively secure its business on the external market and at the same time earn on transactions made by its clients (the difference between its spread and the market spread). In this case, he decides to spread or change. It must be set at such a level that it does not lose the sudden spread of the market spread.

Market Maker creates its internal market, where we decide to enter into transactions. It is in its own interest to set such spread values that will allow it to effectively secure its business on the external market and at the same time earn on transactions made by its clients (the difference between its spread and the market spread). In this case, he decides to spread or change. It must be set at such a level that it does not lose the sudden spread of the market spread.

In the STP model, it happens that brokers offer us a variable or market spread. The first solution is less popular. It is based on adding to the market spread its margin, which will eventually increase it. The STP broker certainly will not give us a min./max range. spread. The second solution assumes offering a market value and adding a separate commission.

There is only one type of spread in the ECN model - the market spread. The broker never interferes with its value and always adds a separate commission for its execution to the order.

Calculation vs simplicity

It cannot be stated explicitly and with certainty that some type of spread is the most favorable regardless of the conditions. However, some assumptions can be made. Theoretically, and in most cases also practically, the fixed spread will be the least favorable. Its advantage is the fact that we know its value in advance. We are not interested in temporary liquidity problems (as long as our broker has not reserved such exceptions - but then it misses the idea of a fixed spread), additional commissions or other elements that additionally absorb our mind.

It cannot be stated explicitly and with certainty that some type of spread is the most favorable regardless of the conditions. However, some assumptions can be made. Theoretically, and in most cases also practically, the fixed spread will be the least favorable. Its advantage is the fact that we know its value in advance. We are not interested in temporary liquidity problems (as long as our broker has not reserved such exceptions - but then it misses the idea of a fixed spread), additional commissions or other elements that additionally absorb our mind.

The second most important is the floating spread - usually lower than the fixed spread. But there is a risk that, due to its temporary jumps, it may be higher (eg at the time of macro data publication). The calculation is just as simple, although a fraction of a second can determine our transaction cost.

Market spread - 99% of the time much lower than the rest. However, it is strictly dependent on market liquidity. Its all disturbances may cause spikes in the spread. The more extreme the situation, the greater the widening of the price range. But that's only a smaller part of our total transaction cost.

READ ALSO: ECN broker commission. How to calculate it?

Analyzing different spreads in terms of simplicity of calculation, one can conclude that the most transparent conditions are with fixed spreads. We know in advance how much we will pay for the transaction. And it is useful at the beginning of our adventure with investing. However, it should be remembered that this is usually the most expensive choice. A floating spread may surprise us with a temporary expansion, but for the vast majority of time it will be better. The most skillful is to operate on your account with a market spread. What is the difference in prices can be seen with the naked eye. But the essence of the cost will be a commission, which is often not so easy to calculate and requires some practice or the use of additional tools in the form of a broker calculator, or an additional indicator.

Ultimately, the transaction costs will be determined by the choice of the broker, that is to what liquidity it offers us access to and what commission rates will be offered to us.

Summation

The table presents a small summary of the most important information from the article.

| Type of spread | Constant | Variable | marketplace |

| Broker model | MM | MM, STP | STP, ECN, MTF * |

| Commission | - | - | YES |

| Value spreads | - | YES** | NEVER |

| Prone to changes in liquidity | NEVER | YES | YES |

| Dedicated to | beginners | wszystkich | more advanced |

* You can read about the MTF model HERE.

** Only for selected Market Maker brokers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)