We check the indicators from Trading Central - Week # 4

We've reached the end of the test five indicators from Trading Central. Our test ran for four weeks and during this period we tried to discover the potential of the new tools as much as possible. A lot of completed transactions are behind us. What result did we get and what conclusions did this lead us to? About all of this below.

Be sure to read: Trading Central - Independent market analyzes [Review]

Trading Central Tools - Week # 4

Each of the indicators has its own significant advantages and disadvantages. The most important thing was to know under what specific conditions they work best and when not to use them, so as not to expose your capital to unnecessary losses. Below we present our observations and comments after the test.

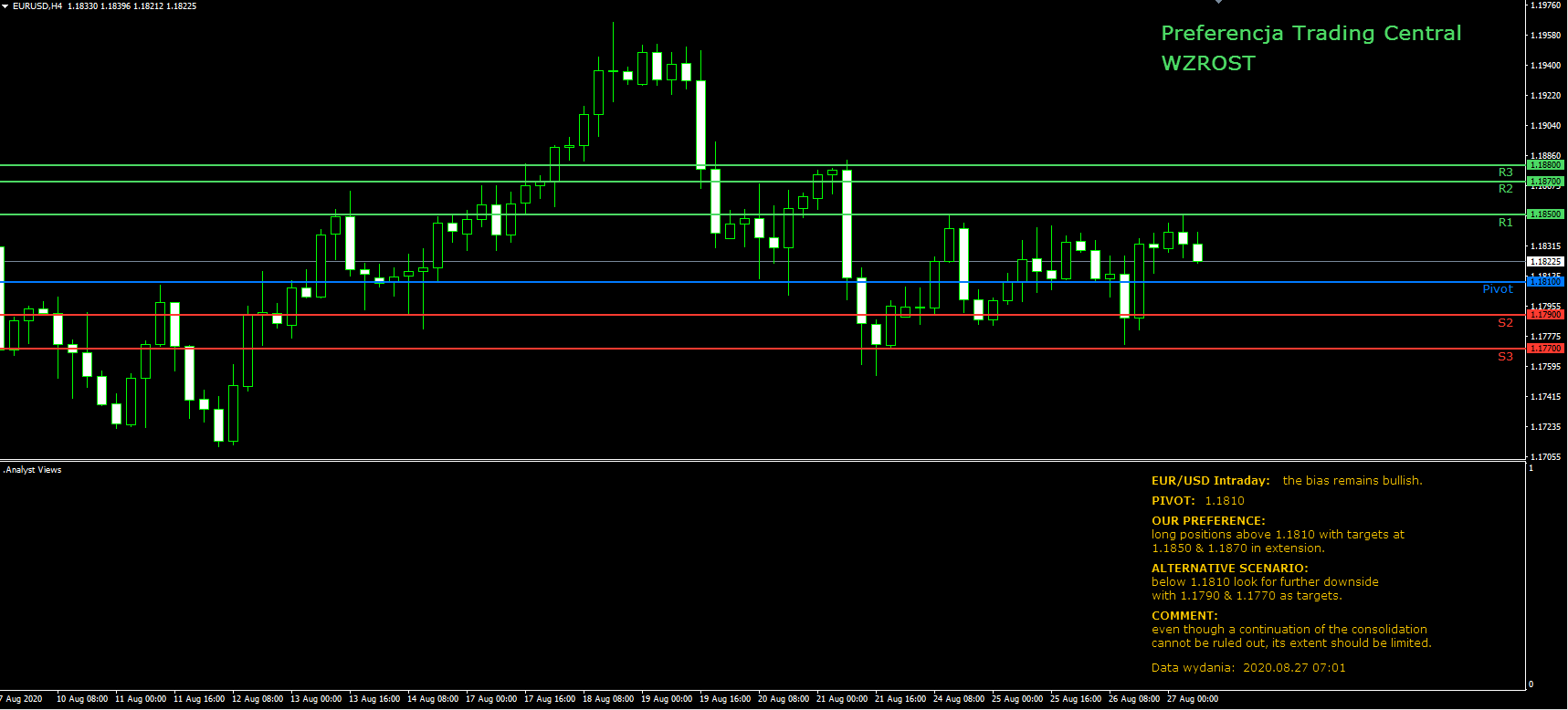

ANALYST VIEWS

The indicator shows the key levels, support and resistance that have been left compiled by analysts. In addition, we also see the comment and scenario for a given item.

ADVANTAGES:

- Well marked support and resistance levels,

- All information is constantly updated,

- He efficiently defines the prevailing trend.

DISADVANTAGES:

- Preferred higher time intervals (from H4 to W1).

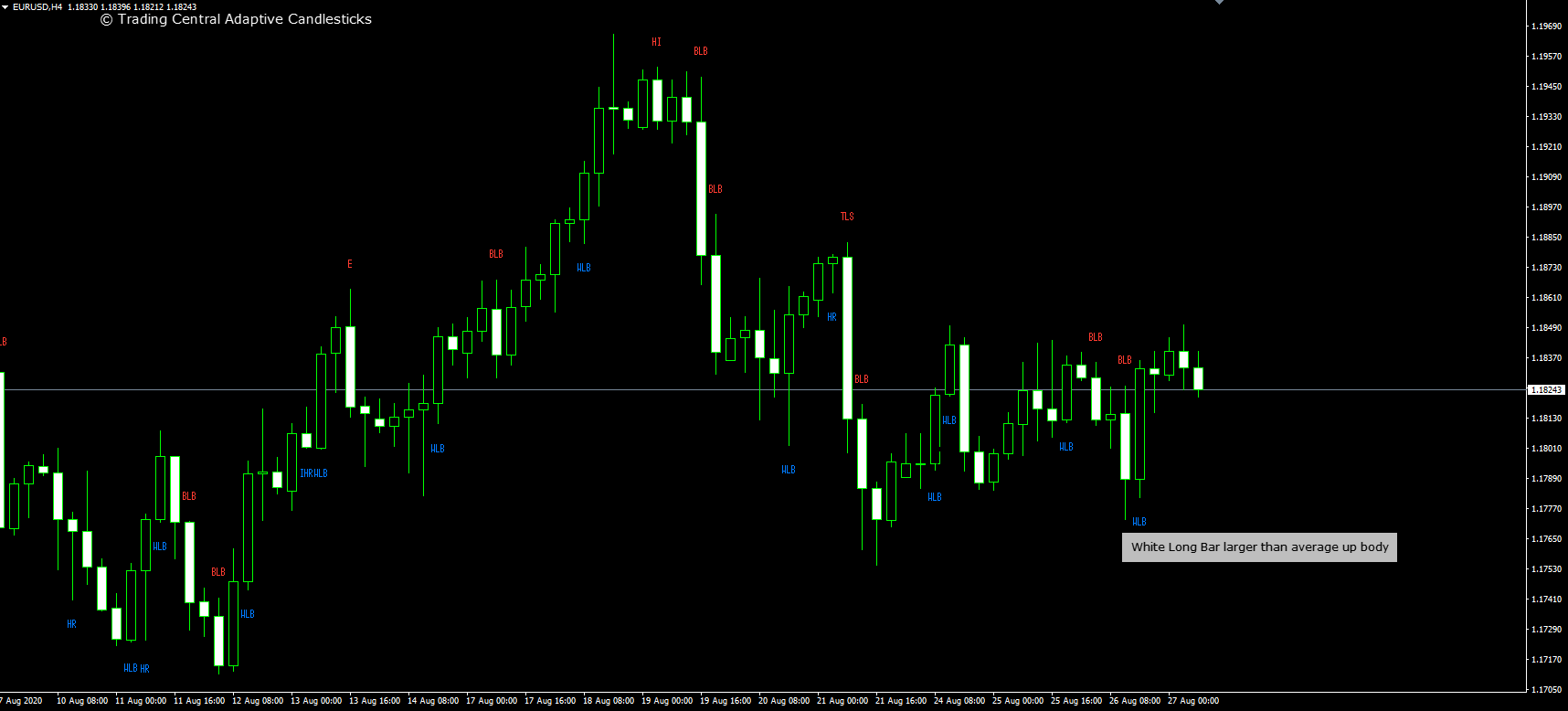

ADAPTIVE CANDLESTICKS

The indicator looks for candlestick patterns among the 16 most popular. Some names are hard to remember, but here it is not needed to take advantage of the value of the Japanese candle formation.

ADVANTAGES:

- Ready and legible signal on the chart,

- It shows the direction well after breaking a certain level,

- It works well as confirmation of future traffic from a higher time frame.

DISADVANTAGES:

- A large number of indicated patterns at low time intervals, especially with low dynamics of price changes.

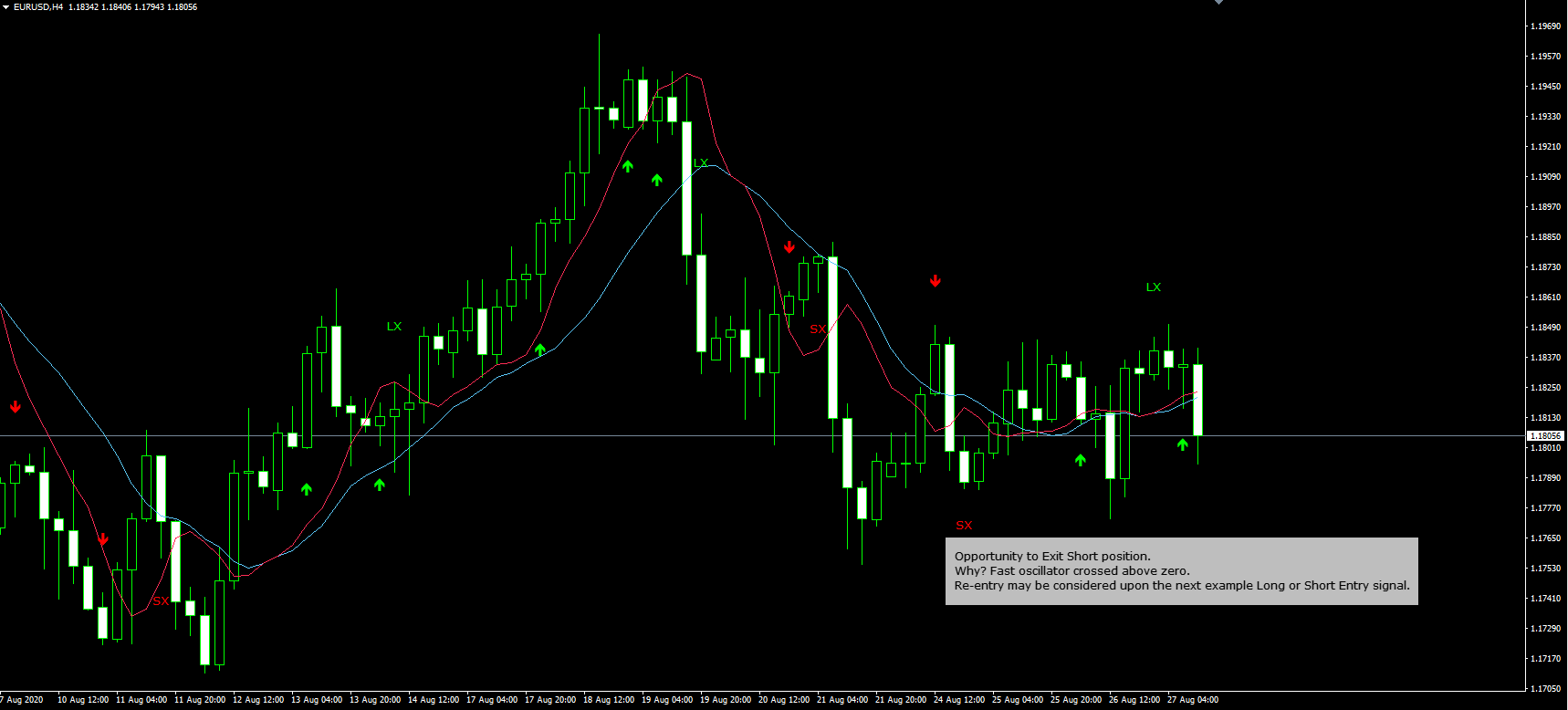

ADAPTIVE DIVERGENCE CONVERGENCE (ADC) CHARTPRICEMARKS

Combines parameters with all ADC components including price lines and two oscillators.

ADVANTAGES:

- It combines several indications into one whole,

- It heralds greater price movement from the higher time frame.

DISADVANTAGES:

- It rarely shows consistent information with other indicators,

- It happens that the pattern does not even appear in obvious situations.

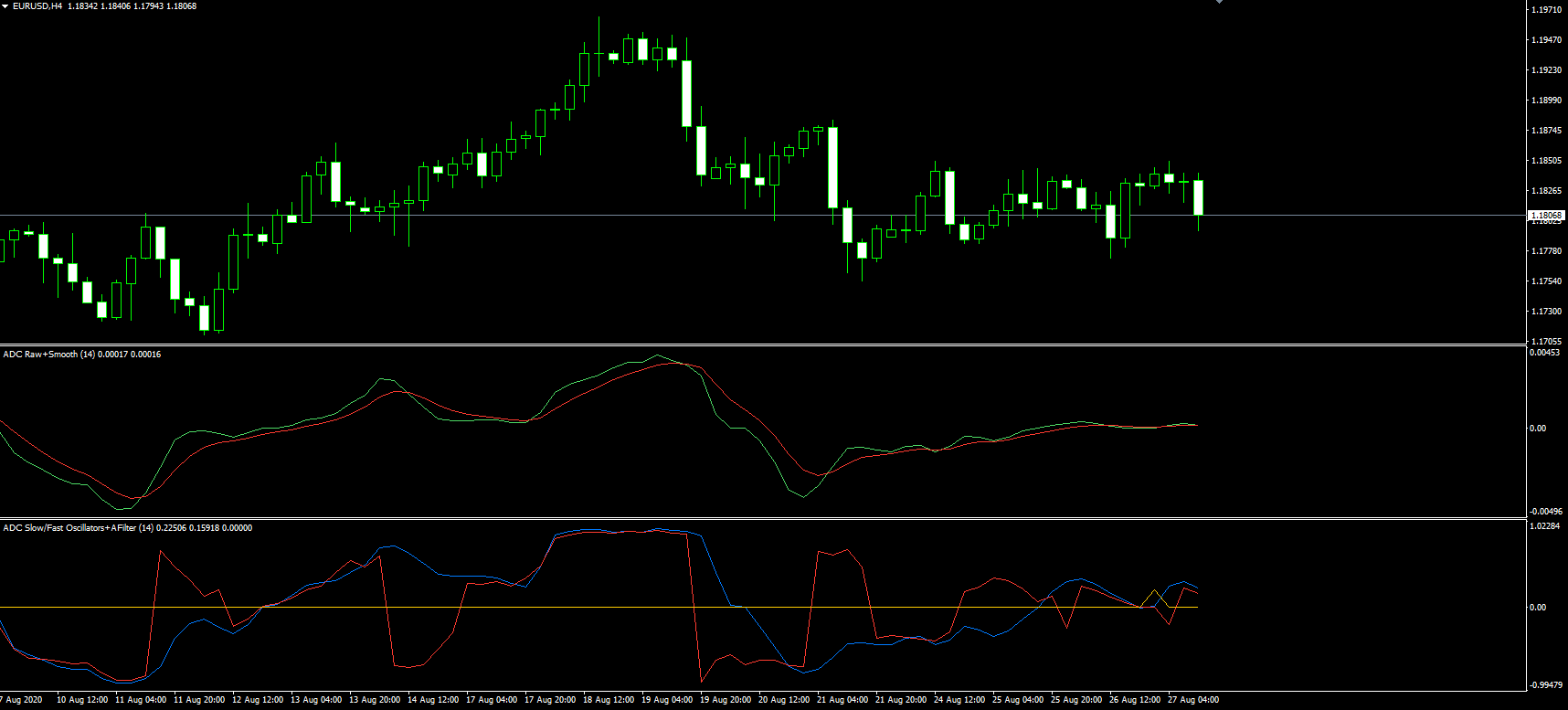

ADC Raw + Smooth and ADC Slow / Fast Oscillators + AFilter

ADVANTAGES:

- They indicate the moment of overbought or sale in a long time frame or after extremely high traffic.

DISADVANTAGES:

- They react very slowly

- Often at lower time intervals (M15, M30 or even H1) they do not generate any specific clues,

- Small amount of signals consistent with other indicators.

Statistics and final score

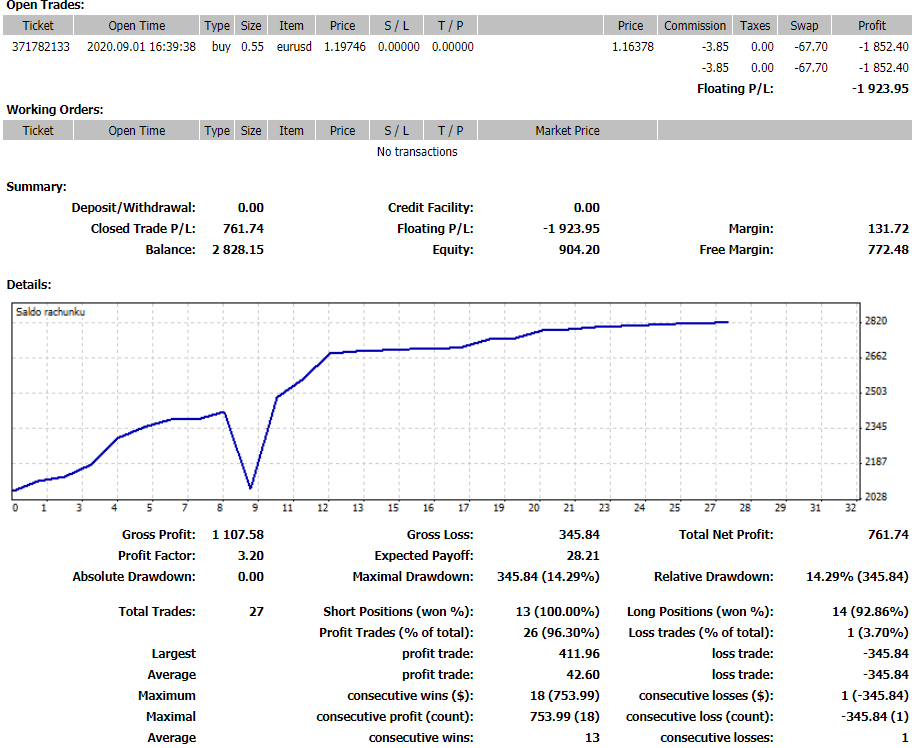

Balance after week 4:

- 27 realized items, including 26 profitable and 1 lossy,

- Stocks: XAU / USD, XAG / USD, EUR / USD,

- Profit + 761,74 USD,

- There is 1 active position left on the total loss -1923,95 USD.

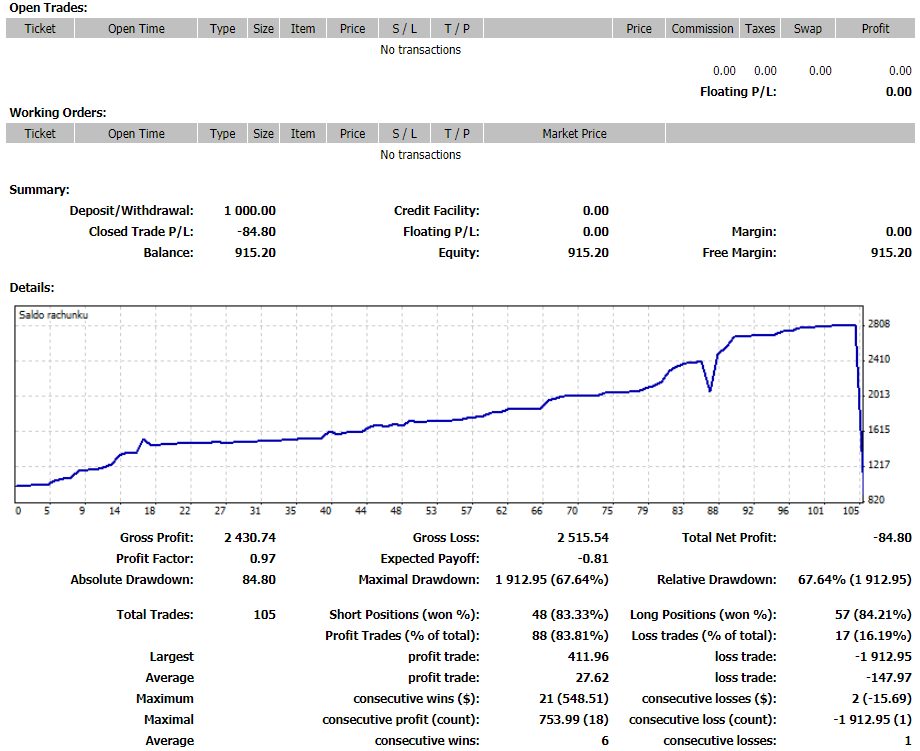

Account balance since test start and final balance:

- 105 items were realized, including 88 profitable and 17 lossy,

- Qualities: EUR / USD, XAU / USD, USD / CAD, XAG / USD,

- Total profit before closing all "outstanding" positions was +1 USD,

- The loss was -84,80 USD after closing all positions and completing the test, which gives a return rate of -8,4%.

Summation

The final verdict is as follows. Both oscillators turned out to be the least useful indicators ADC Raw + Smooth and ADC SLOW / FAST OSCILLATORS + AFILTER. Compared to all the tested tools, these two have the most disadvantages. It is right behind them Adaptive Divergence Convergence (ADC) Chart Price Marks.

The indicators worked best Views Analyst and Adaptive Candlesticks and they can be really useful. It should be remembered that they are not without flaws. Combined with additional elements of technical analysis, they can provide a solid foundation for a new investment strategy. They can also become an auxiliary element in an already developed trading method.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)

Leave a Response