Growth companies that bring losses - where's the point?

Due to the low interest rate policy and non-standard monetary policy of central banks, many companies have no problems with financing their business models. Companies losing millions and even billions of dollars can issue debt with a very low cost of financing. Convertible bonds are particularly popular. In this case, the company issues several-year bonds with a coupon of up to 0,25% or 0,5%. At the same time, the bond buyer has the right to convert the bonds into shares. As a rule, the share price being traded is 30-50% above the market price of the share.

An example is the issue of convertible bonds by Snap. In August 2019, the company issued $ 1,1 billion in 7-year bonds with a coupon of 0,75% annually. The $ 1000 bond can be converted into 43,8481 Snap shares. In effect, the exchange price is $ 22,806. Which was 40% above the August 2019 market price.

In addition to convertible bonds, growth companies also finance themselves by issuing shares, which allow to finance expenses for increasing the scale of operations.

Why do investors want to finance new growth companies instead of investing in stable companies with an established position? In some industries, the winner takes it all is believed. As a result, the faster a company conquers the market, the greater the chance that it will gain a critical mass that will allow it to be a winner on the market. Such sectors include the e-commerce market, technology companies selling software as a service (SaaS), social networks and video streaming. As a result, investors believe that even if they overpay "now", they will achieve a high rate of return in the next 5-10 years. This approach is influenced by the successes of companies such as Amazon, Salesforce or Shopify. Of course, the market forgets about the losers such as Groupon or Yelp.

Wrong approach to profit analysis

Net profit is one of the key factors in shaping the company's long-term value. Net profit should translate into Free Cash Flow (FCF). FCF, in turn, will be used to finance acquisitions, share buyouts and dividends.

Due to the fact that the net profit is an accounting measure of profitability of the enterprise very popular is the price to profit ratio (P / E or P / E). Many traders approach the indicator from the wrong side. He believes that the lower the P / E ratio, the more "cheap" the company is. For this reason, companies with losses or very little profits are "rejected" from the machine. Such companies are considered "overvalued" and "risky".

However, this is the wrong approach. It does not work in many cases. Problems are posed by cyclical companies that in the period of prosperity (e.g. high prices corn, oil) have high profits. Losses appear in periods of decline in raw material prices. Another example is companies losing market share. In this case, an attractive price (low P / E ratio) is a classic value trap. Then, along with the shrinking scale of business, the company's valuation drops, which translates into a low P / E ratio. Keep in mind that the market is pricing in future earnings, not the past.

An interesting example illustrating that a low rate is not everything is the comparison between Amazon (AMZN) and AT&T in 2016-2019. AMZN offered the possibility of selling and buying over the Internet (marketplace). The second main business branch was cloud services (AWS brand). Amazon was considered an "expensive" company as it was valued at $ 2015 billion at the end of 315. In 2015, Amazon generated a net profit of $ 596 million. This gave a P / E of over 520. However, the person who considered the valuation as expensive omitted huge expenses for the development of the offer for customers (including large expenditure on logistics) and the potential of the markets in which the company operated (e-commerce, cloud). This provided fuel for future scaling up of operations. In 2019, Amazon has already generated $ 21,331 billion in net profit and is a leader in the US e-commerce and global cloud market. The company's current capitalization exceeds $ 1 billion.

At the opposite end of the spectrum is AT&T, which has a stable business, including on the provision of internet services to a mobile and landline operator. In early 2016, the company was valued at approximately $ 194 billion. In 2015, AT&T generated $ 13,3 billion in net profit. This resulted in a P / E ratio of 14,6. This was a rate much lower than Amazon's. However, the market in which AT&T operates has a low growth rate, which limits the potential for business scaling. In 2019, the company's net profit was $ 13,9 billion. The company's capitalization is currently around $ 210 billion.

The above-mentioned examples show that what is important is the market in which a specific company operates and its potential to increase the scale of operations. In recent years, technological growth companies have been very popular.

Growth companies

Another problem with valuing a company using the P / E ratio is that it also does not work for fast-growing technology companies. Technology companies that distribute their products digitally do not need a large investment in development. They do not have to build factories or a stationary distribution network. However, such companies need large outlays to acquire customers. Acquiring a user requires building a sales team as well as spending on marketing and customer service. Very often the cost of subscriber acquisition is high in the initial stage of cooperation. In the long term, the cost of customer care is declining and the gross margin on sales for SaaS companies is high. As a result, it is worth asking yourself what is the relationship between the long-term customer value (LTV Life-time Value) and the cost of user acquisition (CAC). These considerations may seem abstract. Therefore, it is worth using the simplified examples of ABC and XYZ companies.

ABC company

The company sells its software in the form of SaaS. Every year, an average of 10% of customers give up its services. The company provides its software with an annual subscription for $ 1. Thanks to cross-selling, it is possible to increase the annual revenue per customer by 000% per year. The gross margin on sales is estimated at 15%. The cost of subscriber maintenance is estimated at 85% of revenues per year, while the remaining costs are 25% of revenues of a given cohort. As a result, the company earns $ 30 per customer in its first year. If the one-time cost of acquiring a subscriber is $ 250, the picture of the company's profitability based on net profit is distorted.

|

Cohort I. |

year 1 |

year 2 |

year 3 |

year 4 |

year 5 |

|

subscription price $ |

1 000 |

1 150 |

1 323 |

1 521 |

1 749 |

|

l. customers |

1 000 |

900 |

810 |

729 |

656 |

|

revenues |

1 000 000 |

1 035 000 |

1 071 225 |

1 108 718 |

1 147 523 |

|

big profit |

850 000 |

879 750 |

910 541 |

942 410 |

975 395 |

|

retention cost |

250 000 |

258 750 |

267 806 |

277 179 |

286 881 |

|

other costs |

350 000 |

362 250 |

374 929 |

388 051 |

401 633 |

|

Profit |

250 000 |

258 750 |

267 806 |

277 179 |

286 881 |

|

customer acquisition |

800 000 |

0 |

0 |

0 |

0 |

|

net profit |

-550 000 |

258 750 |

267 806 |

277 179 |

286 881 |

Source: own study

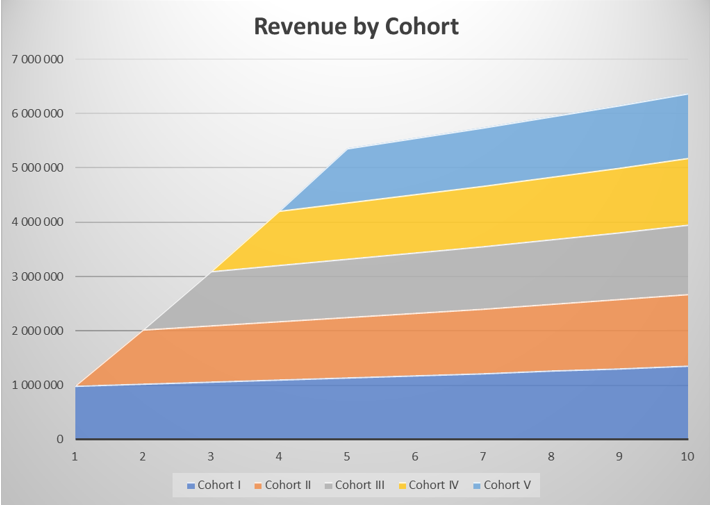

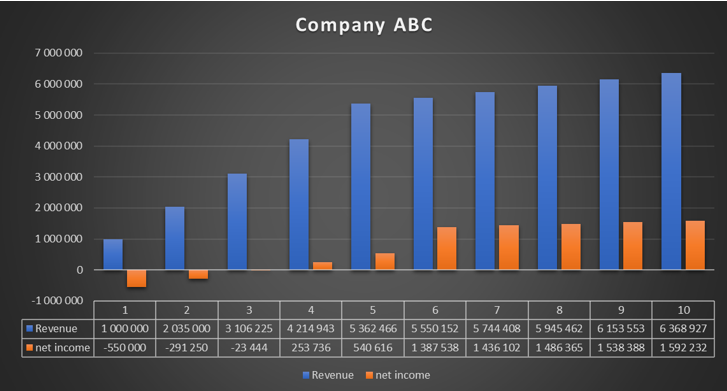

If the company acquires 5 customers for 1000 consecutive years, then during these years the net profit is significantly diminished by business development. Acquiring 1000 customers costs the company $ 800 (it is assumed that the costs will be recognized immediately). With the cessation of the acquisition of new clients, the company suddenly improves its profitability drastically.

In 1-3 years, the company is initially treated as a "cash burner", while in 4-5 years there is an opinion that the company "overvalues". It was only in the years 6-10 that the company showed its true profitability. However, this is at the expense of the decline in revenue dynamics.

XYZ Company

The company sells its software in the form of SaaS. Every year, an average of 15% of customers give up its services. The company provides its software through an annual subscription for $ 1. Unfortunately, XYZ is unable to raise prices. The other variables remained unchanged.

|

Cohort I. |

year 1 |

year 2 |

year 3 |

year 4 |

year 5 |

|

subscription price $ |

1 000 |

1 000 |

1 000 |

1 000 |

1 000 |

|

l. customers |

1 000 |

850 |

723 |

614 |

522 |

|

revenues |

1 000 000 |

850 000 |

722 500 |

614 125 |

522 006 |

|

big profit |

850 000 |

722 500 |

614 125 |

522 006 |

443 705 |

|

retention cost |

250 000 |

212 500 |

180 625 |

153 531 |

130 502 |

|

other costs |

350 000 |

297 500 |

252 875 |

214 944 |

182 702 |

|

profit |

250 000 |

212 500 |

180 625 |

153 531 |

130 502 |

|

customer acquisition |

800 000 |

0 |

0 |

0 |

0 |

|

net profit |

-550 000 |

212 500 |

180 625 |

153 531 |

130 502 |

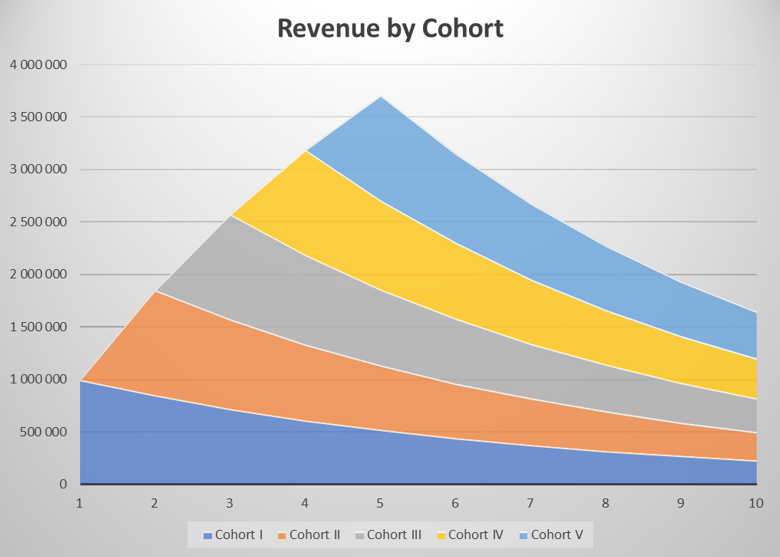

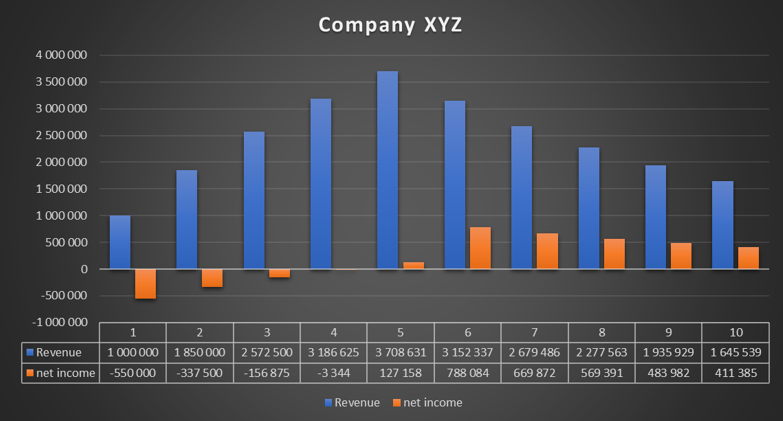

The revenues of the cohort decrease in each subsequent year, because the company is unable to raise prices and loses 15% of customers each year. Even though the net profitability of the "mature" cohort is 25%, the revenues decrease, and so do the profits. During the first 5 years, the company acquires 1000 customers each year, which allows to "hide" a large customer retention. XYZ has stopped attracting customers since the 6th year. As a result, revenues begin to decline.

In 1-5 years, the company can be considered similar to ABC. However, the lack of ability to raise prices and lower retention resulted in a drop in revenues from year 6. Nevertheless, in Year 6, the company's net profit increased significantly, which rapidly improves the P / E ratio. In the following years, the business shrinks despite showing profits.

Wall Street likes growth companies

In recent years, growth has been in fashion. Investors are not bothered by the losses generated by growth companies. Technology companies are especially fond of them. A perfect example is the behavior of the Goldman Sachs Non-Proftable Technology Index, which increased by less than 2020% from the low in March 400. This is due to the structure of the index. It included many companies that benefited from the pandemic and the greater digitization of the economy.

Examples include internet sales companies such as Sea Ltd., Pinduoduo, Wayfair, Jumia Technologies and Farfetch. The closure of economies and the decline in human mobility have resulted in a significant growth in the e-commerce market. It is worth mentioning that in Poland the beneficiaries were such companies as Allegro or Inpostwhich benefited from the increase in revenues by debuting on the Warsaw (Allegro) and Amsterdam (InPost) stock exchanges.

Another example is the Teladoc company, which benefited from the reduction of stationary contacts with doctors. As a result, patients were looking for a way to contact a doctor without contact. The increase in demand for online services made the company teladoc acquired a very large number of new customers. As a result, in the second quarter of 2020, revenues amounted to $ 241 million. A year earlier (Q2019 130), the company generated $ 2020 million. In Q288,8 XNUMX, the company's sales amounted to $ XNUMX million. Therefore, it is not surprising that the company's share price increased significantly. Investors assume that after customers are convinced by online solutions, a significant part of them will remain Teladoc customers. As a result, it will be possible to "monetize" them in the coming years.

Not every growth company grows in the "sky is the limit" style

Not every growth company is doomed to success. The clearest example is Groupon. At the time of its debut in 2011, the company was considered a promising growth company. After the IPO, the company was valued at $ 12,7 billion, which was the largest IPO of a technology company since its debut Google in 2004. Groupon's business model was to give very large discounts to participants. Large discounts on services attracted new customers. This resulted in an increase in the scale of the company's operations. At the same time, in the long term, Grupon users expected stability in large price reductions. The business model did not take hold for long. As a result, fewer and fewer companies appeared in Groupon's offer, while the number of active users decreased. The company's revenue between 2014 and 2019 fell from $ 3,04 billion to $ 2,2 billion. As a result, the current capitalization of the company is approximately $ 1 billion.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)