Sokyu (Munehisa) Homma - the trader of all time

Candlesticks - the name probably sounds very strange to a layman, but to a trader it means a lot of market information. Candlestick charts have a dose of mysticism, mystery or at least secret tactics. Candlestick charts came to us from distant Japan, where for over 250 years they have marked the path of success for many Japanese traders.

The most famous Japanese trader was and still is Sokyu (Munehisa) Homma (1716-1803). He was born as Kosaku Kato and was adopted by the Homma family. The difference in translations is due to the difference in Japanese dialects. In the following I will use Munehis Homm, just like Steve Nison uses.

Homma is known for earning the equivalent of around $ 10 billion today. No wonder he was called the God of the market - Dewa no Tengu. Mystical God over gods. They even wrote a song about him:

"When the sun shines in Sakata (city of Homma), the sky is overcast in Dojima (rice market in Osaka), and it is raining in Kuramae (market in Edo), and no one can be like Homma ...".

What did that mean? When the rice harvest is large in Sakata, the price decreases at the Dojima stock exchange and there is a price crash in Edo.

Homma was well known for his profits with over 100 more positions. Will you be able to repeat this record?

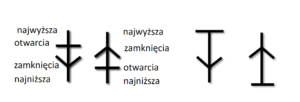

Candlestick charts were created at the beginning of the 18th century. So Homma couldn't use them. Did he not use any charts? How is it possible? The "Eureka" moment came when, reading the literature on Japanese techniques, I came across a note about earlier charts. Well, in the Keoho era (around 1716), the charts preceding the candle charts were created - Anchor Chart. The first charts, where four prices were used: opening, closing, highest and lowest.

I am convinced that Homma used these charts and they contributed to his huge success. Anchor charts are the predecessors of candle charts and the relationships between four prices: highest, opening, closing and lowest are clearly visible graphically.

Hommy's methods and techniques were a great secret. After great success and building a huge fortune, he spent the rest of his life comfortably. He died at 87 years old.

Munehisa Homma - the grave

He left behind secret and secret techniques that allowed him to make a fortune. Many tried to imitate Homma, but to no avail. For many years it was suspected that Homma had written down his secrets and hidden them somewhere deep in the world.

As a result, people began to believe that such descriptions do not exist, and it was slowly forgotten. After many years, handwritten manuscripts were found by Hommy's distant cousin, Kato Kosaku. He combined all the notes and published them as a book with the title "Munehisa Homma Golden Fountain". Later, this book received many other titles: Sanmiden, Sisesanmiden, Soubasanmiden.

Homma wrote his book from 1768 at 51 years and it took him to finish it at the age of 81. The original manuscript was entitled "Homma Munehisa Ishouyakden". Homm's manuscript was passed on as a family secret to future generations. From his records we can learn why this manuscript was hidden from the world for so many years as a family secret.

Portrait of Munehis Homm

"This text should never be shown to anyone, no matter how close that person is to you. Not because I want to be the only rich man. But because this text may be misunderstood by people who will most likely make many mistakes, but the worst part is that the text can cause huge damage and as a result will turn against us. I do not recommend that anyone read this text and it should remain a family secret. In particular, San-Poh (three methods) is a very unique technique and only a few people know it all over the world. If you sell or buy using only this method, you will achieve steady profits, build a fortune, and never make a loss. You should know what value this text has, be careful and determined as to the secret that is contained in this text ... " Munehisa Homma

Amazing words from over 250 years ago are extremely important to us today. Homma explains his secret methods in very clear and simple words in his book. In the form of words that come at moments of dazzling master. When this book saw the light of day, Japan was in great shock that a book of such huge commercial success, which was considered a legend, really exists! It was also a shock and still is how insightful theoretical descriptions, technical analyzes and market psychology are. Homma, discovered not only that there is a close relationship between supply and demand, but also that changes in market prices are greatly influenced by human emotions.

"At the root of high and low levels of the market trend, there are good and bad harvests" Munehisa Homma.

According to Hommy from over 250 years ago, a new rule is clearly being created - supply and demand are the most important in trading.

"After 60 years of day and night work, I gradually gained a deep understanding of the changes taking place in the rice market ..." Munehisa Homma.

The incredible phenomenon is that the truth from over 250 years ago is still valid today! And if we adapt to it, success is at your fingertips.

My goal is for you to discover yourself and look at the market with different eyes, the eyes of Munehis Homm, a successful man and a huge trader. In the rest of this book, I will try to explain how you should look at the market, what the candle chart analysis should look like, how to trade according to the methods on which Munehisa Homma built a huge fortune.

A few words of explanation

Munehis Homm's house. Currently a museum.

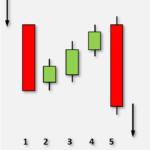

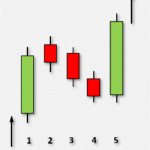

The charts used at that time had solid colors, the sellers 'candles were marked in black, while the buyers' candles were filled in red. One of the conditions for choosing a color was the ink colors available on the market. The most common colors were black and red. At the same time, the use of such contrasting colors also helps to clearly interpret candles, more clearly read charts. In the text you will also find original Japanese names and in brackets - equivalents in English.

But let's return to Homma's methods. They consist of two parts. These are:

- Samni No Den market - a subjective part;

- Sakata's strategies - the objective part.

Market "Sanmi no den" or "Sakata Constitution"

- Leave greed, focus on the time-price ratio by observing previous price changes (emotion control and price analysis with time interval).

- Aim for the ceiling and buying at the bottom (buy and sell points).

- Increase the size of the position after increasing the amount of rice on the market by 100 bags, when the market is at the top or bottom. At that time, the price of rice was stiff, while only the amount of rice on the market changed (decision - size of the item).

- If the market forecast is incorrect, you must find the error as soon as possible. Immediately after finding an error, close your position, abstain from trading for 40 to 50 days (decision about a wrong position).

- Close 70 to 80 percent of the profitable position, liquidate the remaining part after changing the direction, when the price reaches the ceiling or is at the very bottom (directing profitable position).

First rule

The first rule tells us about getting rid of the emotions of greed and what is so important about managing time and price analysis. Isaac Newton said, "I can calculate the movement of heavenly bodies, but not the madness of men." Emotions of fear and greed rule in every market. They dominate the decisions of traders. When we react to market price changes based on our emotions - you can be sure that nothing good will come of it. Any emotions should not affect our analysis. It is not important for us whether we achieve the maximum profit, but whether it is achievable at all. Waiting with an open position in a state of greed or fear, very often ends with either a small profit or a large loss.

The first rule tells us about getting rid of the emotions of greed and what is so important about managing time and price analysis. Isaac Newton said, "I can calculate the movement of heavenly bodies, but not the madness of men." Emotions of fear and greed rule in every market. They dominate the decisions of traders. When we react to market price changes based on our emotions - you can be sure that nothing good will come of it. Any emotions should not affect our analysis. It is not important for us whether we achieve the maximum profit, but whether it is achievable at all. Waiting with an open position in a state of greed or fear, very often ends with either a small profit or a large loss.

The right time to open / close a position and the correct price level are the keys to success.

"You should never hurry to open a position because rush is the same as a bad start. When you buy or sell, wait 3 days from the time you think you can make a profit from a given market situation. " Munehisa Homma

Many traders talk about the importance of timing, we talk about golden opportunities.

When Munehisa Homma advises you to wait three days. He says you should control your mind, your subconscious mind, which creates greed and says, "You'll regret if you miss this chance, this golden chance." Wait a moment, think and calm down, start trading.

Second rule

How to manage the buying and selling position.

Many novices make a huge mistake trying to buy only at the tops and sell at the very bottom. Here comes the basic knowledge of candlestick charts. I would like to warn traders who are starting their adventure with trading on financial markets using only Price Action.

Remember: Candlestick charts can never be used to set a price target.

Misinterpretation of Homm's words can lead to this. This is not about selling at the very top or buying at the very bottom. An important element here is the use of the right time to open a position.

A very common mistake is the "pursuit" of a runaway price. The moment when the price begins to move quickly, emotions prevail over our common sense. We approach such situations emotionally, and then our decisions are not supported by technical analysis, but greed prevails over us. Lack of patience and anxiety pushes us to make such bad decisions. Learn to wait patiently for the right moment. The number of transactions is not important, but their quality. In other words, do not try to get 5 - 10 pips profit, but dozens. In the following you will learn techniques that will help in opening positions during an ongoing trend.

Be sure to read: Trend lines in the LT-4C formation and their application on price abolition

Third rule

How to decide the size of the position you undertake to open. These are comments about managing our investment fund. The size of the position depends on the size of the account. We are talking here about the Forex market with the possibility of using large leverage. But here too, our emotional state is an important element. Opening and monitoring your position is an important element. We should increase the number of open positions at every opportunity. Each subsequent pivot point is a chance for us to open another position in the same direction. Distracting positions allows us to increase profits and offset any losses. Here, the use of fractals and an alligator can be an example. On each fractal above / below the alligator, we add a position on each fractal but only to the fourth fractal. There is a recording of the "New Dimension" system on my site.

Fourth rule

What should our behavior look like when we make a mistake? What should we do when we see that we have made a mistake? First of all, after recognizing the error, immediately close the position. Analyze our approach to trade. Why and where the error occurred and why we made the decision one way and the other. This process is extremely important. If you know where and why you made a mistake, please describe it. Keeping a diary is an important element. Most (90% of traders) do not keep any notes about transactions. Such a note will help you after some time remind you of incorrect behavior and in the future, if this happens, you will know perfectly well how not to repeat the mistake.

Homma says that if you made a mistake, close your position immediately and leave the market for the next 40 to 50 days. This advice is the quintessence of wisdom. It holds a secret and at the same time a secret in itself. Leaving the market for a certain period of time allows us to calm the mind, a different view of the market. Not only will we obtain "cleansing" and calming the mind, but also our subconscious mind will have the opportunity to integrate and achieve the perfection of your strategy, "pure" look. Once again, we hear about patience and greed control. Try to remember it all. This is an extremely important element of proper trading.

The fifth rule

Managing a profitable already open position.

“Close 70% to 80% of all positions as soon as you reach the expected profit. Wait until the move is complete and close the rest of the open positions. "

Monitoring of already open positions, analysis of the trend, direction of opening and closing candles will show us when we should close each of the previously opened positions. Again, this rule tells us to be patient and warns us to keep greed under control. Many traders close positions at very low returns. The consequences are losses or a small profit. We should be patient and brave, let our position develop according to our precise plan, which we should apply from the very beginning.

It is particularly important to consider the risk-to-profit ratio. This principle has a hidden, powerful secret that you now know!

"Consult the market about the market"

The first and second methods require the use of charts and techniques employing real trading methods. The fourth and fifth methods are the basic principles of management as you should permanently use in trading to limit losses and increase profits.

In fact, the above collection of trading tactics primarily tells us about the psychology and emotional side of the approach to everyday trading. The five principles learned are the subjective side of trading. All five principles share the same message - Call for patience and greed control.

It is a championship in itself, where the result is the correct opening and closing of the position at the right time, right time, and at the right price. All five rules are closely related. The first fundamental principle of the market is its fluidity of time and price. It tells us that they should be measured, objectively measured natural market changes, swing oscillations.

When the magnitude of these movements is known, the second rule tells us when and where we should make decisions during them. We must wait for the right moment. There is a Japanese saying, "consult the market about the market." This means that when observing the market, we should pay special attention to price changes on the chart, and not rely on the opinions of market analysts or observe global international situations or economic policy, which may or may not affect the market. The chart is a graphical form representing the market price changes. It is clean and is not contaminated by the opinions of other individual people. By observing the market, anyone can identify the path the price has taken in the past and the path the price may take in the future.

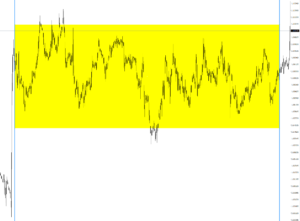

Seiki Shimizu in his book "The Japanese Chart of Charts" reveals the law of natural market price changes that are characterized by "Three Levels of Fluctuation". The market moves in three levels, goes up or down, or stays temporarily in the middle, forming a zig-zag formation. It should be noted here that we are talking about price changes at a given time interval. Because the side trend at one time interval can be a set of changes in the upper and lower prices.

The chart below shows us that the one-hour time interval shows us a completely different situation. We are dealing with changes in the upper and lower trends.

In the same area, GBPUSD has both upward and downward trends.

End of Part One ...

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Win the book "Japanese Candles and Price Chart Analysis" [FB Competition] candles for the Japanese contest](https://forexclub.pl/wp-content/uploads/2018/02/swiecejaponskie-300x200.jpg)