The foreign exchange market has not yet discounted the Fed's future rate cut

June brings a change in the balance of power on the EUR / USD chart. After many months of staying on the defensive, the demand side went to counterattack. In principle, if you stick to the football nomenclature, it is in a positional attack, struggling hard by resistance and tearing out the supply previously annexed by the EUR / USD chart.

Retreat to eurodolarze

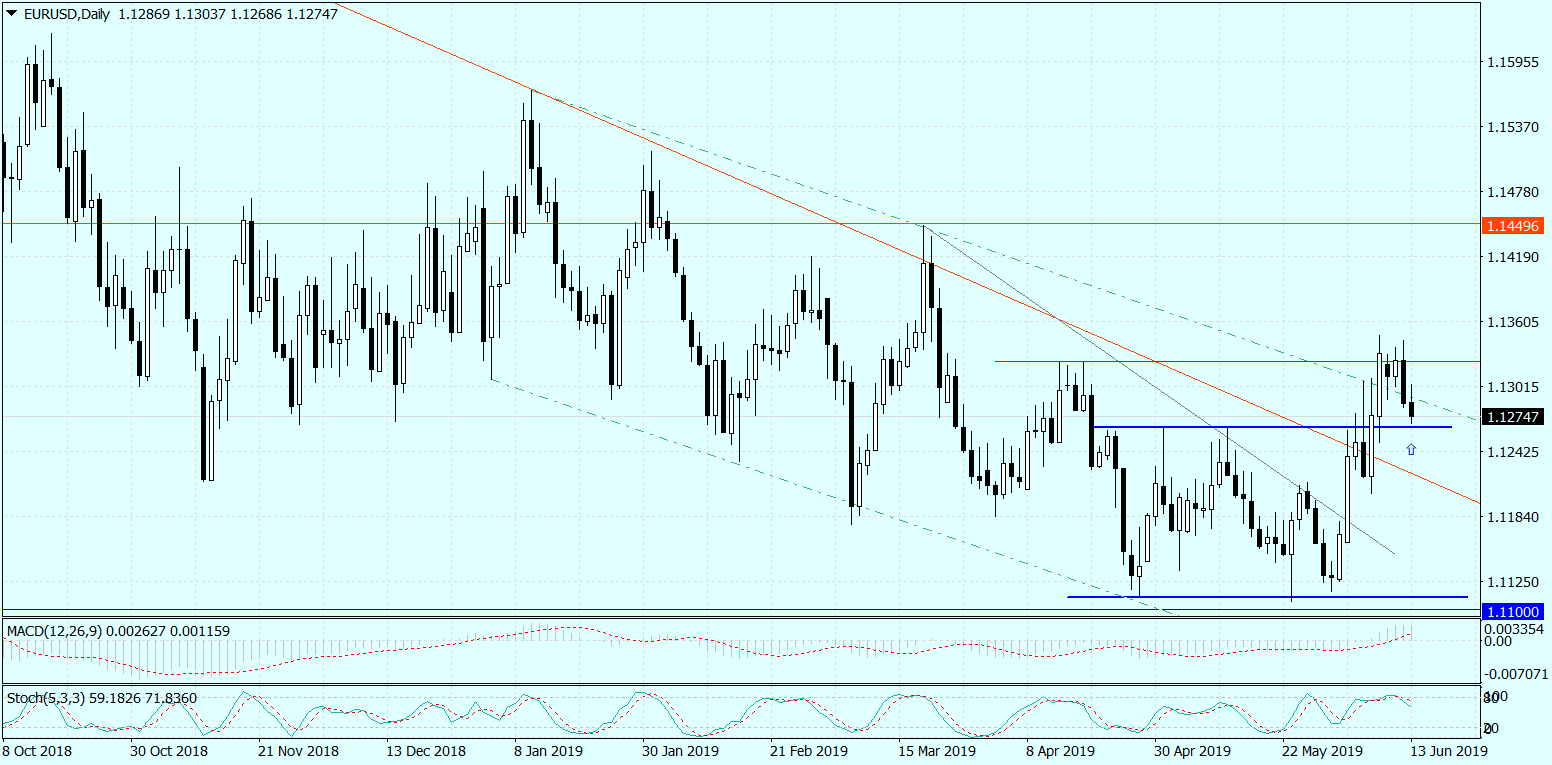

The first signal of change in moods on EUR / USD was another return from the vicinity of 1,11 which took place at the end of May. Later there was a break above the line connecting the peaks of the last two months. Next break out above the analogous, but 8-monthly line. And finally, the breakout above the local summit from the middle of May (1,1263), which led to the creation of a somewhat less bookish, but still a double bottom formation. This break also meant the end of the sequence of lower and lower local peaks, which in itself is a demand signal.

The driving force behind this arduous upward movement was above all the changing expectations regarding future US decisions Federal Reserve. The same one that at the beginning of the year suggested that within the current cycle of interest rate increases, it will make one more move. The market began to speculate that in view of the prolonged trade wars and the risks associated with the global economy, as well as the slowdown of economic growth in the US's major partners, but also a certain downturn in the US alone, the Fed will decide to cut interest rates. These expectations were additionally heated by Fed members themselves. In this even the head of this institution, Jerome Powell. In this way, the futures market started to price the rate even this year. It is true that not at the next June meeting, because in this case the chances are below 20 percent. However, at the next, which will take place on the last Wednesday in July, these chances are around 60 percent. On the other hand, the market as almost surely prices the reduction at the meeting in mid-September.

Cutting in mid-September and the EUR / USD rate still close to 1,13? True, it seems strange. Even if we take into account that the European Central Bank can also mitigate monetary policy. Perhaps the answer to this bothering question is simple. The futures market tends to overshoot the Fed's probability of taking action. Sufficient 1-2 negative reports and his evaluation of cut rates grow strongly. Later on, 2 will receive positive macroeconomic reports and the trend is reversed. Therefore, considering what the Fed will do, maybe it is worth looking at the surveys completed by economists and analysts? And these are not so clear-cut. It is true that more than half see the chances of cutting the cost of money until the end of 2019 of the year, but this advantage is not so significant. Undoubtedly, however, in the context of this survey, the current behavior of EUR / USD is more rational.

Daily chart EUR / USD. Source: MT4 Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)