Forex market - what is it?

Forex Market (Foreign Exchange) - the term most commonly used in connection with the international currency market. Forex is the largest market in the world. According to estimates from the 2017 report of the Bank for International Settlements ( Bank for International Settlements) turnover is close 6,6 trillion US dollars a day and grow dynamically. In 2007, the average daily turnover was only USD 3,5 trillion, and in 2013 USD 5 trillion.

6,6 trillion dollars is the value of turnover, not the funds involved, because this market is very much leveraged. Each transaction may correspond to only 0,5% of the contract value (and in the case of transactions with a low denomination even less), so the cash involved in this case is 200 times smaller. If all transactions were carried out with such a lever, this would give an amount of $ 20 billion in funds, which is less than turnover on stock exchanges where there is no leverage.

Forex is an OTC market. Over The Counter) - a decentralized market, without a trade supervising unit (as is the case with, for example, stock exchanges).

Opening hours

This market, which is atypical, is open 24 hours per day, from 23.00 on Sunday to 23.00 on Friday (according to Central European Time). The biggest advantage is its huge liquidity, causing that the sale or purchase of any amount of currency at any time is not a problem.

Forex market - the main advantages

The biggest advantages of the currency market are:

The biggest advantages of the currency market are:

- very high liquidity,

- high leverage of transactions,

- a wide range of financial instruments,

- the opportunity to earn on increases and decreases of rates,

- attractive fees and commissions,

- active market 24h / day,

- low deposit requirements,

- a powerful amount of tools to help you analyze.

Remember that any investment in capital markets involves the risk of losing some or all of your capital.

Main participants of the currency market

The main participants of the forex market are the largest international banks and large corporations. According to data made by Euromoney in June 2019, nearly 65% of turnover on the Forex market in 2019 was on the top 10 players. Of the ten, banks were the majority.

| Name of the entity | Percentage share in total turnover |

| JP Morgan | 9,81 |

| Deutsche Bank | 8,41 |

| Citi | 7,87 |

| XTX Markets | 7,22 |

| UBS | 6,63 |

| State Street Corporation | 5,50 |

| HSTech | 5,28 |

| HSBC | 4,93 |

| Bank of America, Merrill Lynch | 4,63 |

| Goldman Sachs | 4,50 |

The origins and history of the market

The Forex market as we know it now began to shape in the 70s, after thirty years of government restrictions on international currency trading.

After the end of World War II, a conference took place in Bretton Woods. The purpose of convening the conference was to establish post-war trade and financial relations between conference participants. As a result of the agreement:

- the International Monetary Fund and the World Bank were created,

- the US dollar has become a reserve currency convertible to gold,

- exchange rates were constant,

- gold parity was in force.

In 1971, the United States gave up gold parity breaking the deal with Bretton Woods. Other countries were slowly retreating from fixed exchange rates, so currency prices began to govern the laws of demand and supply. This laid the foundations for the modern Forex market.

Forex market - types of available stocks

Currencies

Initially, the Forex market was created just to exchange large amounts of currencies for other currencies. Therefore, they are the backbone of Forex trading. We divide currencies into three groups - majors, minors i exotics.

majors

To the so-called "Majors" include currency pairs composed of USD (US dollar), EUR (euro), JPY (Japanese yen), GBP (British pound), CAD (Canadian dollar) or CHF (Swiss franc).

The main currency pairs are characterized by the highest liquidity and turnover. Thanks to this, trading on these currencies is the cheapest. The fees charged by brokers are symbolic.

The maximum financial leverage allowed for retail customers in the European Union (ESMA regulations) is 1:30.

Minors

Currencies of economies with a smaller global reach and development than the listed main currencies.

Trading on these currencies is associated with higher transaction fees due to lower liquidity. Instead, these are less speculative currencies with clearer moves and trends.

The maximum financial leverage allowed for retail customers in the European Union (ESMA regulations) is 1:20.

Exotics

Exotic pairs are called dollar currency pairs with currencies of countries with low impact on the global economy, developing and characterized by low liquidity. Examples of countries operating exotic currencies are: Hong Kong, Singapore, South Africa, Thailand, Mexico, Denmark, Sweden, Norway and Poland.

Exotic currency pairs are characterized by low liquidity, high volatility and high fees.

The maximum financial leverage allowed for retail customers in the European Union (ESMA regulations) is 1:20.

Forex market: the price of the currency pair

The price of a currency pair represents the ratio of one currency to another. In other words, the price of a currency pair shows us how much we can buy a "quote" currency for one unit of the "base" currency.

Base and quote currency

The base currency is the reference point for a given currency pair exchange rate. In the EUR / USD currency pair, the base currency is EUR and the quote currency is USD. If the EUR / USD exchange rate is 1,0830, it means that you can buy 1,08 USD for one euro.

Raw materials, indexes and goods

The Forex market also opens up the possibility of trading CFDs on raw materials, agricultural commodities, precious metals, as well as stock indices. That means buying in the Forex market for example oil or gold, we don't become physical owners of oil barrels or gold bars. We only buy a contract for a price difference, i.e. a type of plant that the price of a given raw material will rise or fall.

Raw materials react much more strongly than currencies and are based on fundamental data from the real economy and world events. On raw materials, trends are clearer and last longer. We also observe a similar situation on stock indices such as German DAX.

Cryptocurrencies and the Forex market

Since the last bull market on the cryptocurrency market (2017), the possibility of trading CFDs on cryptocurrency prices has appeared on many broker platforms. The first cryptocurrency that was created in the world was Bitcoin. Currently, it is the most popular digital currency. In the world of cryptocurrencies, it has a status similar to gold or dollar - a reserve cryptocurrency. Other popular cryptocurrencies available from popular Forex brokers include Litecoin, Ethereum or Ripple.

By investing in Forex in cryptocurrencies, we do not buy digital currencies, we only buy CFDs for the difference in the price of cryptocurrencies. Investing in cryptocurrencies in this way is much cheaper when it comes to transaction costs, simpler and safer. Forex brokers are subject to financial supervision as opposed to cryptocurrency exchangesthat are still operating in unregulated territory.

Basic industry concepts

The Forex market is characterized by many specific, industry-specific concepts and sayings that may discourage a novice investor and hinder entry into the meandering of Forex investing. After reviewing the key phrases, this problem disappears quickly. Below are the definitions of the most popular and basic terms.

Long and Short positions

Long and Short positions refer to orders to sell and buy stocks on the market.

Long positions

In other words: long positions, growth positions, buy positions. If we think the price will rise, we open the long position on the given instrument.

Short positions

Otherwise: short positions, declines and sales positions. If we think the price will go down, we open the short position on the given instrument.

Ask price and bid

When we go to an exchange office or a bank to buy a foreign currency, the currency purchase price differs from the currency sale price. The difference between these rates is that a bank or an exchange office makes money. It is similar with a forex broker. The purchase price or opening of long positions (ask price) is higher than the selling price or opening of short positions (bid price). The difference between these prices is called spread and is the cost of opening the transaction. The broker earns on this difference in rates.

Price ask

The opening price of a long position (buy).

Bid price

Opening price of short position (sale).

Pips and flight

As we know from the beginning of the history article, the Forex market was created to facilitate the conversion of huge amounts of currency for large entities - mainly banks. For this reason, when trading in the Forex market, the concept of a lot is used. It is the default package used to determine the size of the transaction. A standard lot is 100,000 units of the base currency.

Currently, with the opening of the Forex market and Forex brokers to small clients and speculators, smaller units have been introduced to facilitate the conversion of the volume of transactions.

Batch

Package 100,000 units of the base currency. By buying 1 lot of EUR / USD we conclude a transaction for 100,000 euros. Given the leverage mechanism, if we use a 1:30 leverage, our margin, which we must physically have on the brokerage account, is 3,333 euros.

Such a large conversion factor makes it easier for banks that make transactions for millions to settle transactions. For the average Forex investor, the amount of 100,000 euros is quite abstract and only makes it difficult to calculate the size of the transaction. For this reason, brokers offer settlement in smaller units.

mini flight

Package 10,000 units of the base currency (1/10 lot). If we use mini-lotos on our broker account (this choice is made when creating an account), the transaction for 1 EUR / USD lot is EUR 10,000 and the required margin at 1:30 leverage is EUR 333. The broker gives us the rest.

Microlight

Package 1000 units of the base currency (1/100 lot).

nanoflight

Package 100 units of the base currency (1/1000 lot).

Lot and CFD on raw materials and cryptocurrencies

In the case of securities that are not currencies, the flight is determined individually by each broker for each asset. The size of the transaction that corresponds to one flight, e.g. of crude oil, should be checked with your broker.

Margin and margin call

The concept and concept of a margin (margin) is closely related to the leverage available on a given broker account. Margin is nothing more than the amount of equity needed to open a position. This is a kind of "own contribution" required to open a given transaction. The remaining part of the money (according to the leverage available on the account) is provided to us by the broker.

If we want to open a position for 1 lot (100,000 euros) on the EUR / USD pair with a leverage of 1:30, we need to engage 3,33% or 3333 euros in this transaction. 3333 euros in this case will be our required margin, or margin.

Margin is expressed as a percentage of the transaction. In accordance with applicable regulations, for a non-professional customer this will be a maximum of 3,33% of the concluded transaction. Because prices are constantly fluctuating, the nominal value of the available margin also changes when you have open positions.

Let's assume that we have transferred 10,000 euros to our broker account. Then we opened a long position (for increases) on the EUR / USD pair on 1 lot (100,000 euros), with a leverage of 1:30. Our margin which we have engaged in the transaction is 3333 euros. The free margin is 6667 euros. These are funds that we can use for subsequent transactions or to secure any losses of an open position.

It turns out that we were wrong and the euro is weakening against the dollar, which means our long position is losing. As long as the loss does not exceed the free funds on our account, the position remains open. However, if our loss reaches 6667 euros, our deposit level will be 100%. This means that the "own deposit", or margin, involved in the transaction is 100% of the funds available in the account. In other words, our free margin is 0. If the market does not reverse and the euro does not start strengthening against the dollar, the position will automatically close at a loss of 6667 euros, because we will no longer have funds to cover losses.

margin call

Margin call, or a call to top up the deposit, takes place before the free balance on the account is zero. It is possible to protect against automatic closing of lossy positions. By paying more funds to our broker account, we increase our free margin, i.e. free funds available to cover losses. If it fails, the next step is Stop Out.

Stop out

This is a security mechanism that is designed to close positions on our account in the event of too much loss. This is to protect both us and the broker from the creation of an overdraft on the investor's account, and thus no need to repay it (and possibly problems with collecting receivables in a short time).

Swaps and the Forex market

Swap is the cost of leaving an open position for the next day. Other names describing this phenomenon are rollover i overnight. Swaps are interest paid for maintaining the credited position for the next day (thanks to the leverage mechanism on the forex market we only use part of the funds in the transaction, the rest are funds borrowed by the broker).

The swap amount depends on the interest rates applicable in the country issuing the currency.

Be sure to read: Swaps without secrets - all about swap points

Stop Loss and Take Profit

By entering into transactions on the forex market, we can and should set stop loss orders and possibly take profit.

Stop Loss

Stop Loss (SL), meaning in free translation, "end loss" is an order securing our position against the loss of a significant amount of funds. If we want to open a long position (for increases) on the EUR / USD we should set the stop loss order below the current exchange rate. We consider this exceeding the level a sign that our concept has failed and the euro is weakening instead of strengthening. After reaching this level, the order will be automatically closed with a loss predetermined by us.

Setting stop loss orders allows you to exclude the weakness of the human psyche from the investment process. As people, we tend to hold on to losses in the hope that the trend will reverse. Of course, the trend will eventually reverse. However, when trading on the Forex market, we are opening leveraged positions.

take Profit

Take Profit (TP) is also a type of security order. In contrast to the stop loss order, by setting the take profit order we secure our profit. This is especially important for speculation based on small price fluctuations or a game against the trend. By setting a take profit we can be sure that the position will automatically close with a profit when the price reaches the level we set.

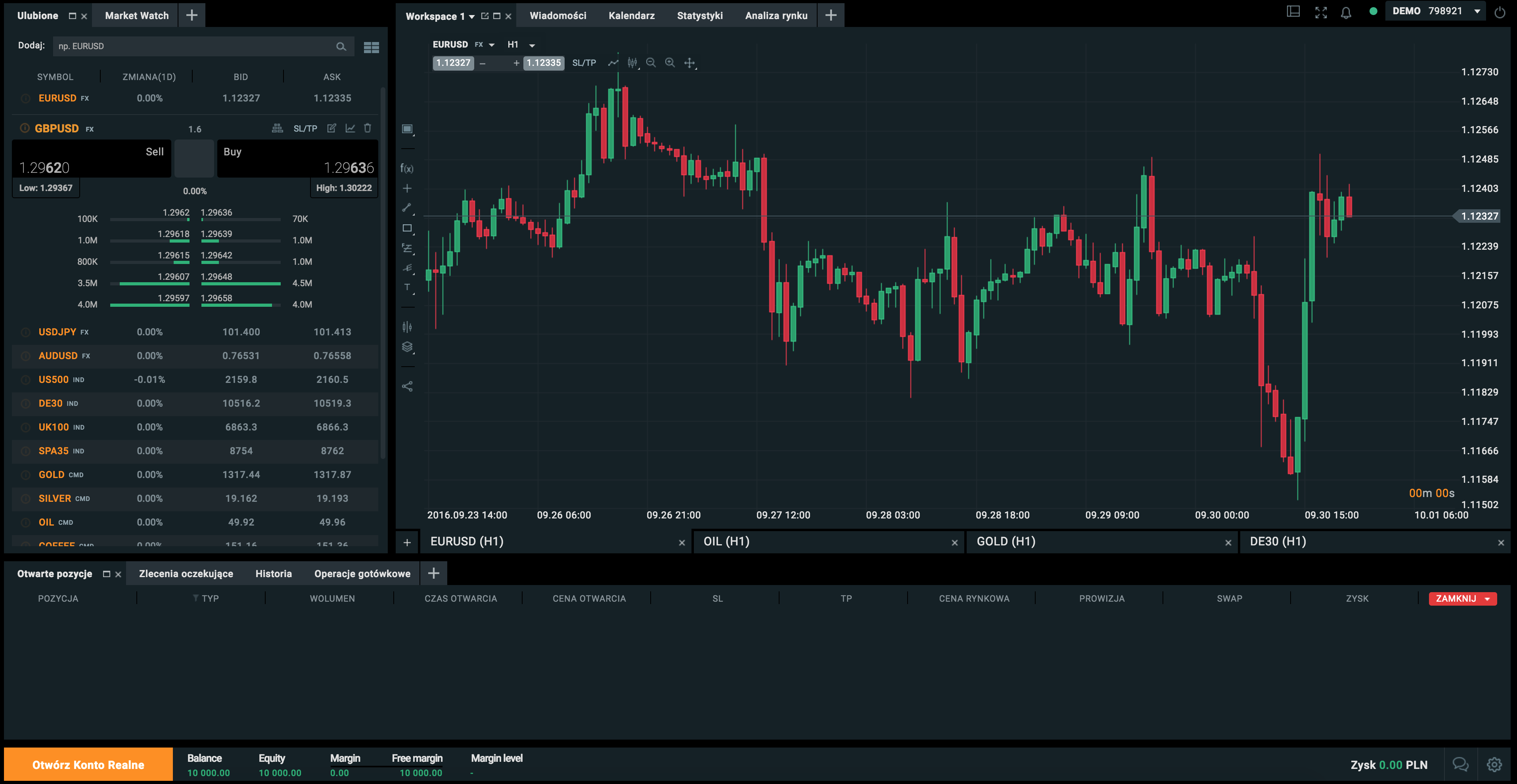

Types of charts and the Forex market

Formerly the price was displayed on the so-called tape. The only thing investors had access to were tables with the price of given items changing over time. It is now widely accepted to use charts to visually represent price changes over time. We can distinguish the three most popular types of charts.

Line graph

The type of chart that most of us associate with everyday life. Suitable for presenting simple figures that change over time. For most traders, line charts are not enough. They are usually based only on the closing price of a given time period. The forex market is changing so much that the closing price itself usually turns out to be too poor information on how to keep the stock at given times.

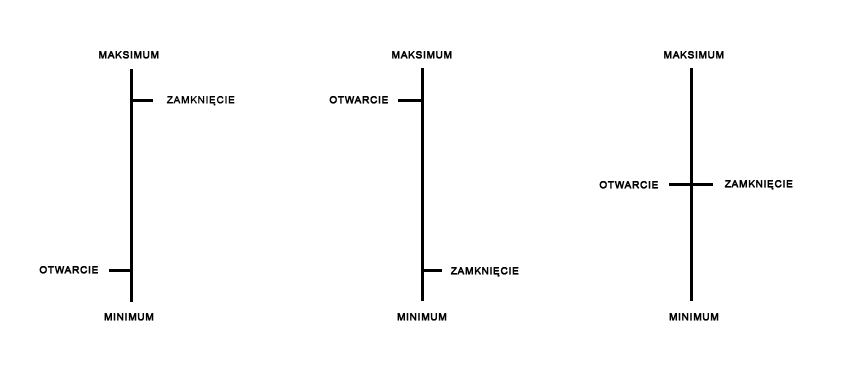

Bar Chart (OHLC)

The bar chart provides much more information about price behavior than a line chart. The OHLC name is short for open, high, low, close. This refers to keeping the price in a given time period. Each bar represents the open price, the highest price range (high), the lowest price range (low) and the close price (close).

The opening price is represented by a horizontal line on the left side of the bar, while the closing price is represented by a horizontal line on the right side of the bar. The top of the bar indicates the maximum price, the lowest level of the bar indicates the minimum price.

Candlestick chart

Currently, the most popular chart used by traders is the candlestick chart. The candlestick chart, like the bar chart, shows the opening price, maximum, minimum and closing price. However, these prices are presented in a more accessible way in the form of rectangles with vertical lines. These rectangles resemble candles with wicks, hence the name of the chart.

The entire department of technical analysis, i.e. predicting future price movements based on price behavior in the past, is based on candle shapes and their formation on the candle chart.

Candlestick charts are most often found in white-black and green-red colors. It is assumed that the white or green world represent situations when the closing price is higher than the opening price (upward candles). Black or red candles represent downward movement, i.e. when the closing price is lower than the opening price (downward candles).

Technical analysis

Technical analysis is a set of techniques that predict future prices based on past price behavior. Technical analysis is not excluded from fundamental analysis. By means of technical analysis, we can determine favorable moments for entering and exiting a position.

It is based on the assumption that all events, financial data and other information are already included in the price and visible on the chart:

"The market discounts everything."

The second assumption behind the technical analysis is that the market and prices are moving in foreseeable cycles. Supporters of technical analysis assume that price behavior is repeatable and schematic, and what happened in the past will happen again.

The third assumption behind technical analysis is the existence of trends in which prices move. The trend can be upward, downward and lateral (horizontal).

There are many methods and techniques belonging to technical analysis. Here are some of them:

- Japanese candles,

- Elliott waves

- price action,

- abolition of Fibonacci,

- classic AT formations.

Fundamental analysis

Fundamental analysis focuses on the condition of a given asset and the economic and political environment that affects the asset. Fundamental analysis primarily answers the question in what to invest your capital and what assets to choose.

Forex brokers

Forex brokers are companies that give clients access to trading on the Forex market. To be able to start using the services of a broker, you must set up a brokerage account with the broker. You then get access to software that allows you to trade in the Forex market in real time, over the internet.

Choosing a Forex Broker

To enter the Forex market as a retailer, we need a broker. When choosing it, it is worth paying special attention to the security of our capital. Our money will be safe with brokers having the appropriate licenses and permits from national institutions supervising the financial markets there.

A practical aspect is to compare the fee tables of various brokers and choose the one offering the most advantageous offer. If we are interested in day trading and plan to conclude many transactions, low spreads (i.e. fees for opening transactions included in the exchange rate difference) will be particularly important for our results.

It is worth paying attention to whether a given broker offers technical support in Polish if we do not speak English freely.

Most brokers offer you the opportunity to test your strength and learn on a demo account before you risk your own hard earned money. Top brokers also provide their knowledge base and training on forex trading, technical and fundamental analysis.

Examples of Forex brokers

| Broker |  |

|

|

| End | Poland | Great Britain | Australia |

| Foundation year | 2004 r. | 2014 r. | 2007 r. |

| Min. Deposit | PLN 0 (recommended minimum PLN 2000) |

PLN 100 | $ 200 |

| Platform | xStation | MetaTrader 4 | MetaTrader 4 / 5 cTrader |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 74% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

The most popular Forex trading platforms

MetaTrader 4 and MetaTrader 5

MetaTrader - one of the oldest and certainly the most popular Forex trading platform. Available in a version for a computer (Windows, MacOS to Mojave version), smartphones, tablets and a browser version.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available in Polish. Around these platforms there is extensive community platforms, creating free and paid add-ons and supporting and solving technical problems on Internet forums.

A refined, stable and predictable platform. Unfortunately, its disadvantage is quite outdated and not very intuitive interface.

Transaction platform MetaTrader 4 FxPro.

Check it out: MetaTrader 4 vs MetaTrader 5 - Features comparison

xStation

The xStation platform is created by a Polish brokerage house X-Trader Brokers. In 2016, it received the award of the best trading platform. It has a built-in calculator for easy calculation of position size, stop losses and take profits. We can manage many smaller positions on the same instrument with one button. It has a lot of built-in tools, but not as much as MetaTrader.

Transaction platform XTB xStation.

cTrader

The platform was created mainly for experienced players. It has the ability to set keyboard shortcuts, especially useful in scalping and insight into the market volume.

Transaction platform cTrader FxPro.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)