The Sahm Rule – does it really predict a recession?

In macroeconomics, there are a number of indicators that are not widely known to individual investors. One of them is sahm rule (Sahm Rule Recession Indicator). According to the author, it can be an indicator informing about the beginning of a recession in the economy. In today's article, we will briefly explain to you what this indicator is. We invite you to read!

What is a recession?

Recession is defined as decrease Gross Domestic Product for two quarters (in a row). Studying the economic downturn by measuring the size of GDP has its drawbacks. This is due to the huge amount of data that needs to be processed. As a result, it happens delay between the calculation of GDP in a given quarter. What's more, very often the level of GDP is revised along with the incoming data. For this reason, it takes economists up to a year to be sure that the economy is in recession.

Such a delay causes fiscal and monetary policy to lag behind the actual needs of the economy (e.g. stimulus). It is wasted time that cannot be recovered. On the other hand, reacting to every natural swing in the economic cycle is meaningless and contrary to common sense. For this reason, many economists are looking for indicators that will predict the impending recession well without generating signals "false positive".

Sahm Rule – indicator history

The indicator is named after an economist Claudia Sahmwho was the first to use this rule in the scientific press. The origins of the Sahm rule can be found in The Booking Institute. It was a report on optimal fiscal policy to stabilize the economy during a recession. In the chapter written by Sahm, the author proposed a fiscal policy that would automatically send support measures to citizens to support consumption and improve the condition of households. According to Claudia Sahm, one should not rely on intuition but develop indicators that are supposed to automatically "trigger" transfers. This indicator was supposed to be based on unemployment data collected by the BLS (Bureau of Labor Statistics).

The Sahm Rule was published in October 2019 by FRED (The St. Louis Reserve Bank's Federal Economic Data). The index values were also calculated backwards to check how well the index predicted the recession. The Sahm Rule itself was defined as an increase in the moving average (3-month) national unemployment rate (so-called U3) by at least 50 basis points (0,5 pp) from the previous 12-month low.

Thus, the rule is based on a "fixed" reference point, which is the annual minimum of inflation. It does not take into account changes in demographics, technology or the "natural" dynamics of unemployment levels. Of course, defenders of the indicator will mention that the above "weak points" do not have a quick impact on unemployment levels.

The great advantage of the indicator is its simplicity. It is based on a single data series, so it is much easier to track than complex indicators based on complex patterns.

For the time being, the indicator has no practical application in fiscal policy, although it was supposed to be used for this purpose. Claudia Sahm argues that the index is a stable measure of a recessionary environment, which means it can be used to "predict" an economic slowdown. Unlike interest rate inversions, Sahm Indicator has much less signals "false positive".

The Sahm Rule and Historical Cases

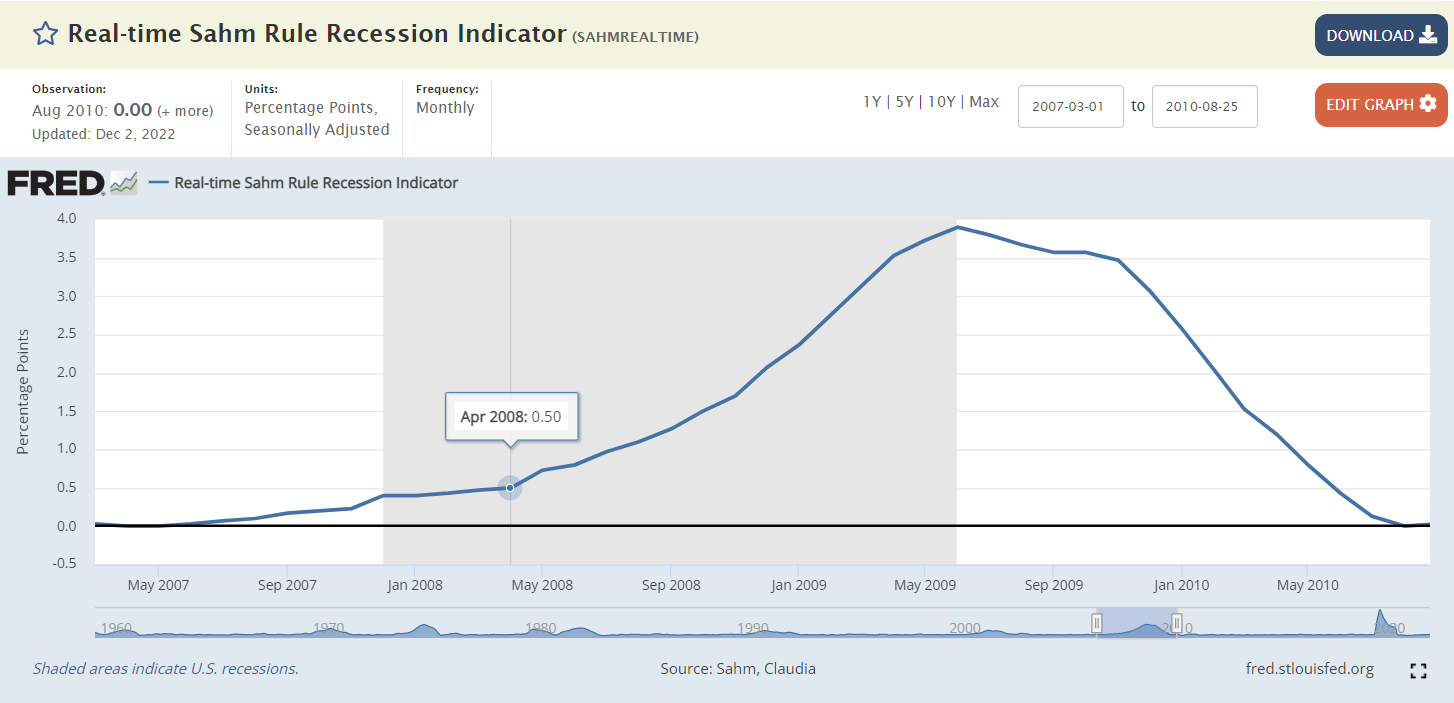

Recession 2007-2009

As you can see, the Sahm rule was unable to "predict" the economic downturn in the United States. The level of 0,5 percentage point above the 12-month low was established only in April 2008. The so-called "Great Recession" began in December 2007 and ended in June 2009. The Sahm rule was “late” by 4 months.” It is worth noting, however, that the alarming level according to the Sahm rule (+0,4 pp) was already in December 2007.

However, it should be noted that the GDP change data lags significantly behind the "Sahm index". The NBER, which tracks changes in Gross Domestic Product, announced in December 2008 that the US economy was in recession. So it was a year after the actual contraction of the US economy began.

It can be seen that the Sahm index is not the best indicator for checking the end of a recession. It wasn't until about six months after the end of the recession that the index fell sharply.

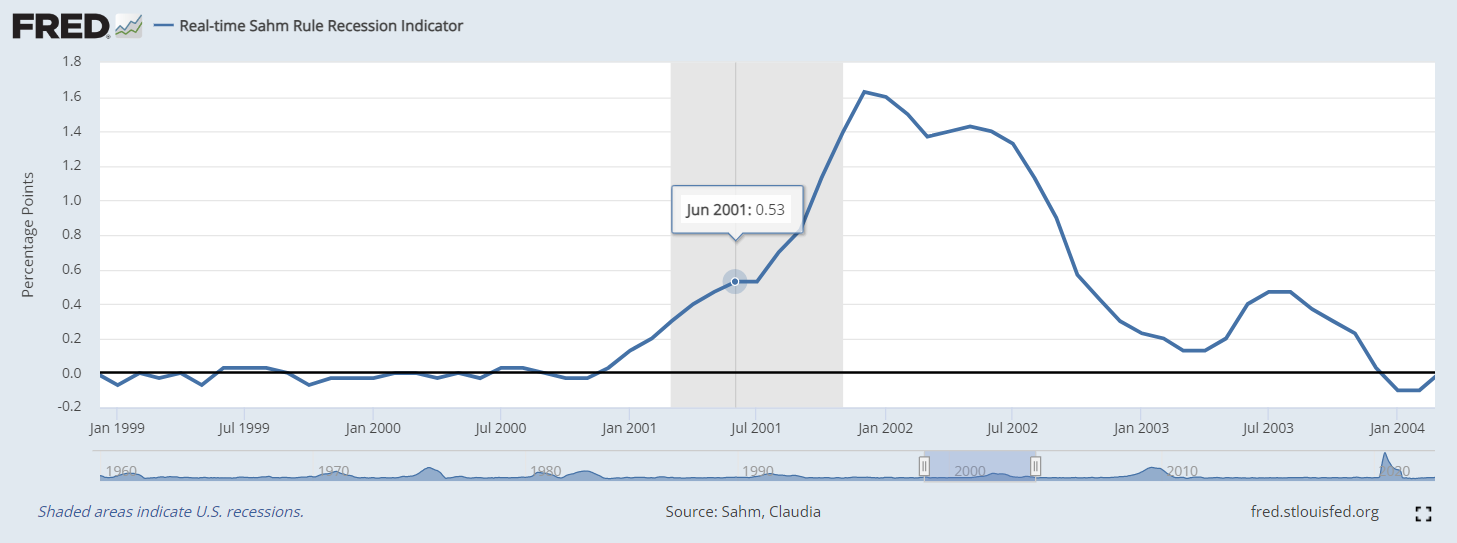

Recession of 2001

The XNUMXs were the longest period of economic expansion in the United States. Credit expansion combined with technological progress (Internet, computerization) resulted in a dynamic growth of the US economy. The development was not hindered by the crisis in Latin American countries or in Asian countries. Economic growth came to a halt with the bursting of the dotcom bubble and the attacks of September 11, 2001.

After the dotcom bubble burst, the US economy was in recession. The rule of Sahm was also slightly delayed in this case. The value exceeding 0,5 pp occurred only in June 2001. It was 3 months after the start of the recession. It is worth noting that the Sahm index continued to grow until December 2001. The recession according to the NBER ended a month earlier.

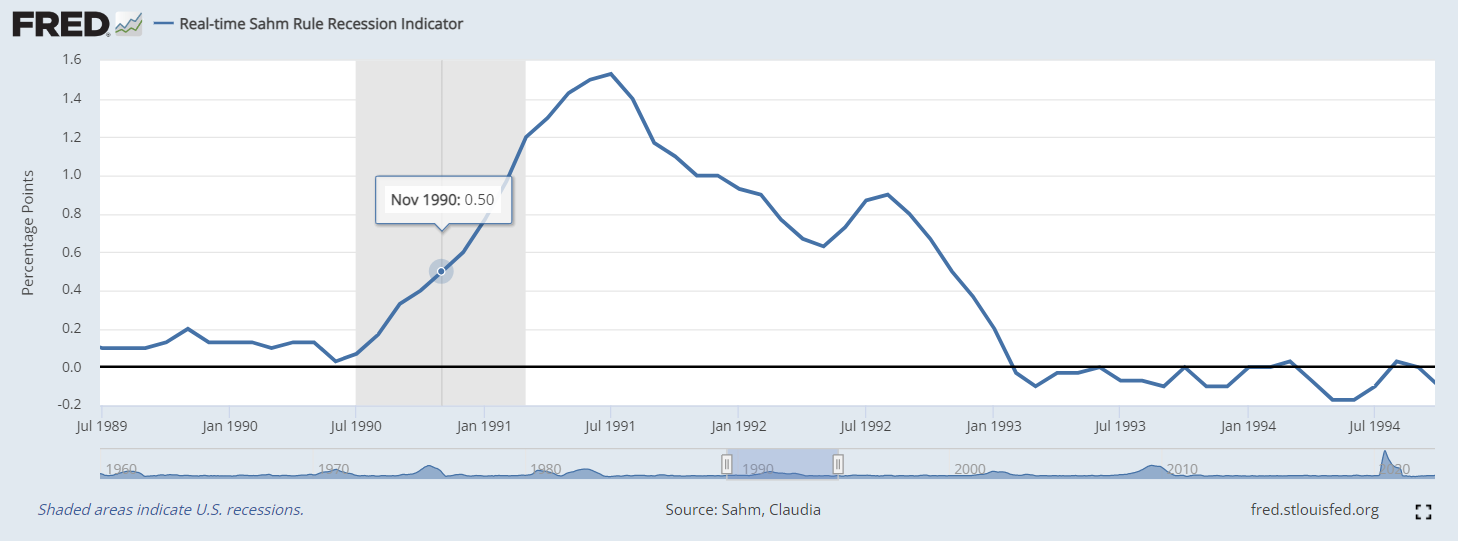

Recession of 1991

The depression of the 1990s had a mild form and ended the economic expansion of the eighties. The economy began to choke due to interest rate increases from 1986 to 1989. The reason for the slowdown was also the accumulation of debt from the previous economic expansion and the oil shock of 1990 (caused by Iraq's aggression against Kuwait).

In this case, the Sahm indicator reported a mid-term recession. What's more, the indicator continued to grow several months after the recession in the American economy actually ended. As you can see, the next recession was indicated with a delay and the signal of improvement in the labor market came several months after the actual end of the recession.

The Sahm Rule: Summary

The Sahm rule is not a very familiar concept among investors. However, it can be a useful and simple tool for investors in predicting a recession in the economy. Of course, the aforementioned indicator works with a considerable lag in relation to the real economy. This is partly due to the fact that the labor market always lags behind the actual changes in the level of production and private consumption. Many companies are delaying layoffs, hoping that the slowdown is temporary. The decision to reduce employment is always a last resort, because the company gets rid of part of its human capital. It is worth noting that the Sahm index indicates a recession faster than in the classical measurement of economic growth (change in GDP).

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)