MENA region - investment opportunities and characteristics [Guide]

There are many acronyms in the world that group specific countries and regions. Because the most famous are BRIC or APAC. The first refers to the countries that were among the most promising developing markets (Brazil, Russia, India, China). APAC, on the other hand, is an abbreviation for Asia-Pacific, which is an increasingly important center for the development of the global economy. Of course, there are also lesser-known acronyms. One of them is EEC i.e. the countries of Central and Eastern Europe. It is one of the "forgotten" regions by investors MENA. In today's article, we will present which countries are part of this region and how you can invest in it. We invite you to read!

What is MEN

MENA is the acronym from Middle East and North Africa. So these are countries that lie in the Middle East and North Africa, in other words belonging to the Persian Gulf or the Muslim countries of Africa. It is worth noting that MENA does not have a hard list of countries. Different organizations define the components of the acronym in different ways. For example world Bank and FAO include Israel in MENA, however International Monetary Fund or UNICEF no longer. Thus, the number of countries that make up this region varies from 19 to 27. However, there is a group of countries that are "hard core" and are counted as MENA by all known organizations.

These countries are:

- Algeria,

- Bahrain,

- Egypt,

- Jordan,

- Kuwait,

- Lebanon,

- Libya,

- Morocco,

- Oman,

- Qatar,

- Saudi Arabia,

- Syria,

- Tunisia,

- United Arab Emirates,

- Yemen.

According to the World Bank, the MENA region accounts for approx 6% of the world's population. It seems that such a small percentage of the population and a relatively low level of development of the entire area should mean that the region is of minimal importance in the global economy. Nothing could be more wrong. Countries belonging to MENA, according to the OPEC cartel, May more than half of the world's reserves oil and about 40% of reserves natural gas. No wonder MENA is "the apple of my eye" both for the United States and for the increasingly important economically and politically China. The MENA region and especially the Persian Gulf country are an important supplier of energy resources.

It is worth remembering, however, that the region has been torn apart by conflicts for many years. In the last 20 years we have witnessed:

- invasion of Iraq,

- war in yemen,

- Arab Spring,

- fall of the Gaddafi regime in Libya,

- conflicts in Lebanon,

- civil war in Syria.

In addition, some countries in the region do not like each other very much. An example is the relationship between Saudi Arabia and Iran. Both countries compete in the Gulf region. An example is e.g. supporting various parties in the conflict in Yemen.

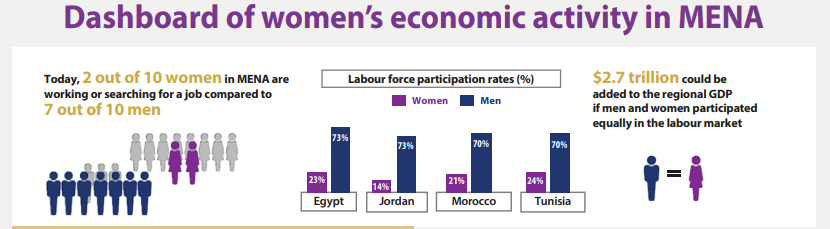

It is also worth remembering that, for cultural and religious reasons, the percentage of working women is very low. According to the data OECD, only 2 out of 10 women in the MENA region are employed. In a country like Jordan, only 14% of women are working or looking for a job. This makes women much more financially dependent on their fathers, brothers or husbands. This hinders the emancipation of women and is one of the barriers to economic growth in the region.

The most important economies of MENA

Despite the large number of countries that make up the region, most of them are small economies with little importance for world trade. However, there are countries in the region that make a significant contribution to the development of the world's GDP.

Islamic Republic of Iran

It is one of MENA's largest economies. No wonder, since this country is inhabited by almost 88 million inhabitants. The GDP is approximately $1 billion in terms of purchasing power parity. For many years, the country was under the burden of sanctions by "Western" countries. Despite this, he was able to find his place on the international arena mainly thanks to the help from China and Russia. The country is not very open to trade. This results, among others, from with strong embargoes. In 500, Iran exported goods worth only $2020 billion. For comparison, Poland, which has a similarly sized economy (calculated in purchasing power parity) in 10, exported goods worth USD 2020 billion. The main recipient of Iranian exports are Chinawhich accounted for 54% of all exports. Exports are dominated by crude oil and products of the refining process.

Kingdom of Saudi Arabia

It is 18th economy in the world in terms of size when expressed in dollars, and 17 in terms of purchasing power parity. In PPP, Saudi Arabia has a GDP of over $2 billion. The country, unlike Iran, has no embargo. This makes it much more open to trade than its rival on the opposite side of the Persian Gulf. In 000, the country exported goods worth over $2020 billion. The main product was crude oil and its derivatives. The largest recipients of export goods were: China (20%), Indie (10%) and Japan (10%). The United States accounted for less than 6% of Saudi Arabia's exports. State budget revenues mainly depend on the price of crude oil and natural gas. It is also the second largest owner of oil reserves (proven reserves). However, moving away from oil means that the country is trying to look for opportunities to remodel the economy. One of the ideas is to increase the emphasis on the development of modern technologies and tourism.

Egypt

It is a country whose economy is in 33rd place in terms of GDP expressed in dollars and is 18th in terms of purchasing power parity. In 2022, the GDP expressed in PPP was $1 billion. Such a high place is also the result of a large population. According to the World Bank, the country is inhabited by 661 million people. The main export commodities are oil and its derivatives and gold. The country also exports a lot of agricultural products, textiles and fertilizers. The largest recipients of goods are countries such as United Arab Emirates (10%), United States (7%), Saudi Arabia (6%), Turkey (6%) and Włochy (6%).

United Arab Emirates

It is a small country with a population of around 9,4 million. However, it is also one of MENA's largest economies. The reason is very rich oil deposits and good geographical location. As a result, the UAE is a beneficiary of the dynamic development of Asian economies. Asia accounted for $2020 billion of $161 billion in total exports in 216. The most important recipients of export products were Indie (10%), China (9%) and Saudi Arabia (8%). The main export commodities are crude oil and its derivatives and gold, jewelry and diamonds.

How to invest in MENA?

The MENA region is mainly focused on the extraction and export of crude oil and natural gas. This is especially true of the countries on the Persian Gulf. As a result, the largest companies operating in the countries are usually entities related to the petrochemical and energy sectors. It is also worth noting that financial institutions also have a very large share in the region's stock exchanges. Of course, the countries of the region are trying to reorient their economies. An example is the United Arab Emirates, which is trying to develop in the technology sector, or Qatar, which focuses on the development of financial services.

It is worth mentioning that none of the exchanges "hard core" MENA is not developed and liquid enough for an investor from Europe to invest on it without any obstacles. Theoretically, it could be one of them Tel Aviv Stock Exchange but the problem is that this country is not always included in MENA (mainly for reasons of cultural distinctiveness). So the easiest way is to use one of them ETFs exposure to this market. One of the biggest problems is that there is no ETF that gives exposure to the entire region. For this reason, substitutes must be sought. One of them are ETFs giving exposure to the largest economies in the region. Among the most important of them are:

iShares MSCI Saudi Arabia ETF

It is the largest ETF giving exposure to one of the EMEA countries. Its benchmark is the MSCI Saudi Arabia IMI 25/50 Index. The fund has approximately $900 million in assets under management. The ETF management fee is very high for this type of instrument. It is 0,74% per year. Since the establishment of the ETF (2015), the average annual rate of return has been slightly above 8%. The largest ETF components include:

- Al Rajhi Bank,

- The Saudi National Bank,

- Saudi Basic Industries,

- Saudi Arabian Oil,

- Saudi Telecom.

VanEck Egypt Index ETF

The task of the ETF is to map the rate of return MVIS® Egypt Indiax. The fund currently manages approximately $17 million. So it is really a small ETF. It should be noted that this is a very expensive fund as its annual management fee is 1,02%. Since its establishment in 2010, the ETF has achieved an average annual rate of return of -8,6%. To say it's a poor result is an understatement. The largest ETF components include:

- Commercial International Bank Egypt,

- Eastern Co.,

- Abou Kir Fertilizers & Chemical,

- Centamin Plc,

- E-Finance For Digital & Financial.

iShares MSCI UAE ETF

It is an ETF that gives exposure to UAE companies. Assets under the fund's management are not large and amount to $ 36 million. So it's really a microscopic ETF. The management fee is 0,58% per annum. So it is not a cheap ETF. Since its establishment (2014), the fund has generated an average annual rate of return of -1,98%. The largest ETF components include:

- Emirates Telecom,

- First Abu Dhabi Bank,

- Abu Dhabi Islamic Bank,

- Emirates NBD,

- Abu Dhabi National Oil Company.

iShares MSCI Israel ETF

It is an investment in the Israeli stock market. It is a benchmark for ETFs MSCI Israel Capped Investable Market Index. It's not a very popular fund. Assets under management amount to just over $140 million. Like the rest of the ETFs listed above, this one is also not the cheapest. The annual management fee is 0,58% per annum. The achieved rate of return for shareholders is also not impressive. Since the foundation of the fund (2008), the average annual ETF rate has been 2,7%. The largest ETF components include:

- Nice Ltd,

- checkpoint software,

- Leumi Bank,

- teva,

- Bank of Hapoalim.

ETF brokers

How to invest in MENA countries? As we mentioned, this is not an easy task and the only relatively easy way is through the listed ETFs. However, an increasing number of forex brokers have quite a rich offer of ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 76% of retail investor accounts record monetary losses as a result of trading CFDs with this CFD provider. Consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Investing in the MENA region is not easy. The reason is that the capital market of many Arab countries is developing and is not a very popular investment destination. This can be seen in the ETFs, in which the largest has accumulated about $ 900 million of assets under management. The region is strongly linked to Asian economies. The problem is that most of it exports raw materials, agricultural goods and low-processed products. In turn, it mainly imports goods with a higher added value. ETFs from the region are dominated by companies from the financial, raw materials and telecommunications industries. The exception is Israel, but this country is often omitted from MENA due to its differences (social, economic, historical) with other countries in the region.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![MENA region - investment opportunities and characteristics [Guide] From our side, the offer remains the same, i.e.: Promotional activities: - sending a newsletter to the subscriber base (currently approx. 17 people) - the first sending announcing the whole cycle + one additional before each webinar (5 in total) - landing page with the event - article about the webinar on the home page of ForexClub.pl - promotion through social media channels (twitter, facebook, advertising on wykop.pl) - sticky banner on the home page announcing the event 1-2 days before each webinar - publication of the recording of each webinar in the form of article on our website (Video section) - bonus: sending one newsletter to our partner's database (approx. 20 items) Price offer: USD 2800](https://forexclub.pl/wp-content/uploads/2023/03/inwestowanie-w-mena.jpg?v=1677753234)

![MENA region - investment opportunities and characteristics [Guide] money laundering](https://forexclub.pl/wp-content/uploads/2023/03/pranie-pieniedzy-102x65.jpg?v=1677828432)

![MENA region - investment opportunities and characteristics [Guide] invest cuffs contest 2023](https://forexclub.pl/wp-content/uploads/2023/03/invest-cuffs-konkurs-2023-102x65.jpg?v=1678084789)