Lever for Polish traders limited to 1: 25? The idea of the government is very real

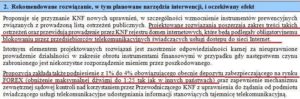

Yes, it's not a joke. A draft amendment to the Act has appeared, which assumes a reduction of the maximum financial leverage to 1: 25 for people investing in the Forex market on the so-called internet platforms. This means that we would be able to get 4 more capital into the same transactions. The project does not imply any exceptions or exceptions. But that's not the end of ideas.

Forex on dating from 2 for years

For nearly two years now the Forex market has been experiencing a gradual phenomenon of the so-called tightening the adjustment screw. The first key changes took place in July 2015, when it was limitation introduced to 1: 100 for Polish residents. Back then, there were many more doubts - it was not known whether the changes would only apply to Polish brokerage houses or to all brokers. It quickly became clear that the changes will apply to all brokers in the EU.

Another key change was introduction of a number of guidelines for industry institutions, which entered into force on September 30, 2016. The changes included both the trading and marketing spheres. They were also intended to increase brokers' transparency. This time the changes are to be even more restrictive.

Lever firmly down

Escape abroad? Nothing of that.

Forex like gambling?

From 1 on July, 2017, the amendment to the Gambling Act came into force. This means that banks have received new responsibilities regarding actions to prevent illegal gambling. The use of payment cards or transfers to institutions associated with illegal gambling is not allowed. At this stage, there are no plans to implement similar solutions for the Forex industry. But did two years ago anyone suspect the possibility of limiting the leverage to 1: 25?

From 1 on July, 2017, the amendment to the Gambling Act came into force. This means that banks have received new responsibilities regarding actions to prevent illegal gambling. The use of payment cards or transfers to institutions associated with illegal gambling is not allowed. At this stage, there are no plans to implement similar solutions for the Forex industry. But did two years ago anyone suspect the possibility of limiting the leverage to 1: 25?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)