JForex 3 Dukascopy - Proprietary broker platforms are relatively rare. Not everyone can and wants to afford it. The creation of the entire concept department and IT facilities that would develop the application often exceeds the cost of purchasing an external software license. Nevertheless, your own platform is a whole lot of possibilities and no limitations. This allows you to create a tailor-made product for the services offered, distinguish the offer and thus may trigger a revolution on the market. This is what I think was with JForex - the platform Dukascopy, the first edition of which was created 9 years ago. The letter "J" in the name means Java, the environment on which the application is based. At the beginning of December 2016, the third version of the platform, marked v.3, debuted on real accounts. For now, it is offered in parallel with the previous version, which will be withdrawn over time. Therefore, we have a great opportunity to review for you the latest work of a Swiss bank.

Admission word

JForex is not one of the most popular and recognizable platforms, but the reasons for this state of affairs cannot be found in its disadvantages (because there are not too many of them) and more in the fact that it can only be found in the offer of one broker (if we count Dukascopy as one) . The application has been on the market for almost a decade and from the very beginning it was distinguished by its transparency and functionality in relation to other popular platforms. One-click trading? Standard for a long time, while MT4 "struggled" with it for several years. Tick charts? They are from the beginning and MT4 will probably never have them. Charts at Ask price? One click and it's ready. One could count for a long time. Of course, there are also disadvantages and it is undoubtedly a platform different from the popular "eM-Te -four", which not everyone will like, but there is a chance that we will fall in love with it after the first launch.

Installation and logging in to JForex 3

JForex 3 is available in two versions:

- desktop version,

- On-line version.

In both cases, we are dealing with the same platform and the difference is only that in the case of the desktop version, the software is installed on the hard drive of our computer and thus there is no need to have Java. Installation files are available for all types of popular OS - Mac, Windows and Linux. JForex in the 0n-line version itself will need to install Oracle Java software. Until recently, the platform required the user to have the latest version of Java. Currently, there is no such requirement and it should work with any version above 1.8 (currently v.8 is available) so it can be said that it was decided to completely simplify the installation process. This solution is useful for people who cannot afford to install external software on a given computer (except Java).

Login. The login process itself is quite unusual for a Forex platform. Let's start with the login itself - it is not a number in the form of an account number. It is a name with uppercase and lowercase letters and numbers. It is a phrase resembling a word or being it, which is generated by the broker's system, but thanks to this solution, no one can "guess" our login on their own (there are no ordinal digits increasing by one unit, which is usually the case with MT4 brokers).

Password - we set our own during the registration process, but it must consist of upper and lower case letters and numbers - nothing extraordinary, but also a bit different than in MT4. And finally, the PIN - it is he who makes the Dukascopy security system not only innovative, but above all very difficult to break. And while there is an option to remember the login and password, the PIN must be entered each time you log in. We can change the PIN code to our own, but interestingly, this is not the number that we enter when logging in. Each time JForex starts, a window with numbers in the form of pictures is displayed, and we have to enter the numbers that appeared in the fields corresponding to our PIN. This means that even if someone monitors the characters we type on the keyboard, they will not learn our code. For example, from a picture and a PIN 1 2 3 4 should be entered 8 0 43 5.

JForex Dukascopy appearance and interface

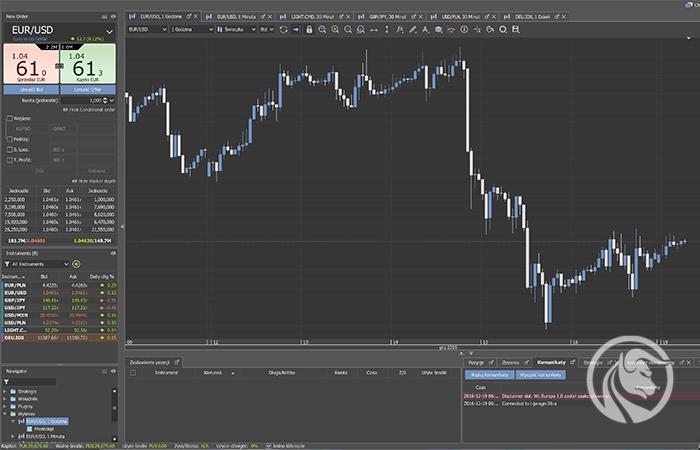

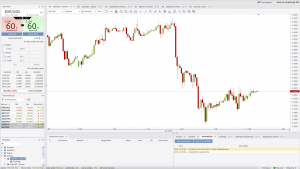

Compared to the previous version, JForex with the 3 designation did not undergo any revolutionary changes - and that's good. Assessing the overall interface, it can be said that it is clear and legible. Even if someone has been based only on MT4 so far, after a few minutes he should have no problem finding individual functions. However, in order to discover the full potential of JForex, a longer time is needed, which is undoubtedly worth spending. The platform is available in two color versions - light and dark (new). The latter is less tiring for the eyesight, but the bright version does not offend enough not to use it, as is the case with trade.

All the important functions of the chart are right above it - the icons may not be very understandable at first, but after a few uses this will not be a problem. The names of the functions are displayed after hovering the cursor over the icons.

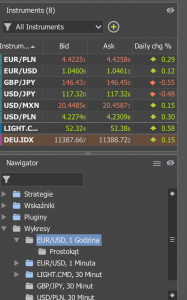

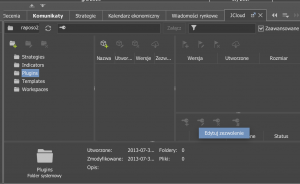

On the left, the standard displays a module for concluding orders, market depth (as befits the ECN platform), a list of instruments and a Navigator - something similar to the one we know from MT4. The entire side window can be hidden with one click, which is very convenient and quick. You can only stick to a too small window with instruments, so you have to scroll through the list often if someone uses many symbols - you can improve the situation a bit by connecting them to the Navigator window but it could be better all the time. You can also see some shortcomings in the translation of the Polish version, but it is nothing very glaring and will probably be corrected in the next updates.

In the lower part you will find a list of open positions and pending orders. Each tab can be detached from the platform and led, for example, to the screen of a second monitor - convenient and helpful. Additionally, you can arrange all tabs next to each other in the selected order or, for example, enlarge only one on the left side, and leave the rest on the right in the classic form. There are a lot of configuration options and this deserves a big plus. The small downside is the font size of the account balance information, which is quite small and placed on the edge of the bottom left side of the platform, but it's not something that you can't get used to quickly.

Functions and possibilities

Transactions. At the very beginning of this section, it is worth addressing the issue of the transaction volume, because here we are dealing with more than just lots known to everyone from MT4. Dukascopy in the JForex 3 version gives you the option to choose the volume for currencies between units, lots, thousands and millions. And here is a short diagram:

- 1.0 lot = 100 000 units

- 1.0 lot = 100 thousands

- 1.0 lot = 0.1 million

The trader can choose the volume unit according to his preferences. For other instruments, the choice is smaller, where for precious metals we can choose between ounces and thousands, and with CFDs there is no choice - only contracts are available. It is also worth adding that Dukascopy accepts an unequal volume, i.e. 1234 units for currency pairs, which is the equivalent of 0.01234 lots (!). Nevertheless, the minimum is still 0.01 and you cannot go below it.

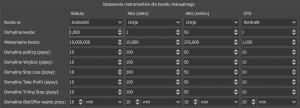

An excellent solution is the ability to define the automatic addition of parameters to a newly opened position such as Stop Loss, Take Profit, Trailing Stop, and even the maximum default slip, distance setting of the order awaiting the current market price and order validity time. If that was not enough, all the values can be personalized for different groups of instruments (currency, gold, silver and CFD per share). This is a great convenience for traders operating on many different markets at the same time.

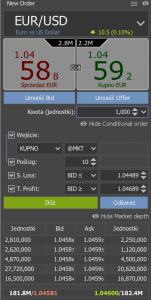

After such a pre-sale, we can proceed to enter into transactions. As a standard, you can open transactions in three ways:

- module on the left side of the platform,

- from the level of the graph (under the right button),

- through the Market Review.

The first way is, in my opinion, the most convenient and the fastest. In addition to the standard Buy / Sell buttons and volume selection, you can immediately add other parameters of the order. In addition to popular types of orders, "Place Bid" / "Place Offer" and MIT are also available. All types of pending orders, including SL and TP, can be defined in relation to the Ask or Bid price (optional). This is a big plus. The pending orders themselves can be modified from the chart level by moving them up or down after double-clicking, even before the moment of its conclusion (just select SL on the left in the window, and then move the level on the chart). It's a standard nowadays, but let's imagine that these 4-5 years ago platforms generally didn't offer such features - apart from JForex :-).

The second option is to trade from the chart. Less intuitive but it can be just as fast, especially when it comes to adding pending orders. All available options are available by right-clicking on the graph.

Market Review, option no. 3. Least popular because a bit hidden. The option is available in the View -> Market Overview tab and thus opens a new window, where we can define a list of instruments with the option of quick buy / sell. It is especially useful for people who work on more than one monitor or desktop and trade more than one instrument at the same time.

There is a "One click" option, which does not require additional transaction confirmation and can be very quickly activated / deactivated at the very bottom of the platform, right next to the account balance. Under the left module we have access to the so-called DOM, i.e. the depth of the market showing the current "pool" of volume in given price ranges, as well as the total value. Most retail traders will not be interested in this information, therefore there is an option to hide the DOM, and thus gain more free space in the left column of the platform (e.g. for the list of instruments). All position parameters can be edited in the Positions tab at the bottom of the platform by clicking on the individual instruments.

Trailing stop. This mechanism deserves a separate paragraph. Trailing Stop, or TS in short, works on JForex in a different way than, for example, on MT4, which is often a determinant of "how something should look / work" among traders. Dukascopy offers us an extraordinary solution. Well, Trailing Stop, once set, is active immediately. This means that it immediately sets the Stop Loss at the distance indicated in TS and thus works not in relation to the point set in TS (the place where our position begins to earn as many pips as we set as a parameter - this is in MT4) but from the market price when Trailing Stop is added to the item. It sounds complicated, so I will use an example.

Example

The market price of the instrument is 1.1060. We opened a long position at 1.1050, so at the moment our profit is 10 pips. The Stop Loss is set to 1.0040, so if you hit it, we will lose -10 pips. If we now set the Trailing Stop at 20 pips, nothing will happen - the Stop Loss will stay in the same place and start moving up immediately when the rate jumps to 1.0061, 1.0062, etc. However, if we set the Trailing Stop to 10, it will automatically our The stop loss will move to 1.0050, which is 10 pips from the current market price, and will start to move upwards with each pip.

Is it good or bad? It depends on your taste and needs. I will let you evaluate it individually.

Chart support. Managing charts on JForex is a pleasure. Of course, assuming that we will know all the possibilities and we will easily find the functions we are interested in (which will take us a while). And there are quite a lot of these. We have at our disposal automatic positioning of charts next to each other in the same size or by horizontal and vertical. You can clone the graph with its entire content (indicators, objects, colors), detach from the platform, and unlock it, and thus move across the entire scale without "up / down, left / right" restrictions. You can quickly clear the graph from an object or close it all. The colors of the charts can be modified in every aspect according to any chosen, or even personally configured, color. Of course, the templates can be saved and stored in JCloud.

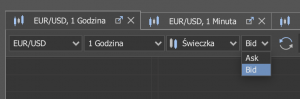

There are three standard types of charts such as line, candlestick, and bar charts, and two less common ones - area and table. It is worth noting that JForex allows you to display charts at both the Ask and Bid prices, while most platforms draw them at Bid and that's it.

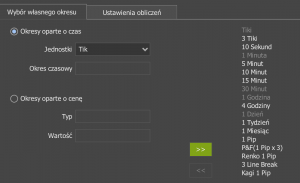

A huge advantage is the wide range of available time intervals, and above all, the ability to ... Create them yourself! Yes, JForex offers the possibility of your own intervals without major restrictions. And this is based not only on time but also on price. This means we can create any Renko, TF 6-tick or 9-day charts. Nothing limits us here. Each of the created intervals immediately goes to quick access on the platform. A powerful plus for Dukascopy.

The platform's settings include a whole series of additional platform configuration options. This also includes the option of flat flats filtering when the price does not change (eg breaks in the quoting of instruments), changes in the priority in displaying elements in charts or time zone selection (still no such option in MT4).

Indicators and tools. The number of technical analysis indicators available as standard definitely breaks down the shoulders of competitors. JForex offers almost 200 of them, while maintaining transparency. The indicators are divided into groups or alphabetically (selectable), and there is also a search engine and a preview window so that you do not have to add another tool each time, if, for example, we do not know what we are looking for. And if what we are looking for is not available as standard, you can support the platform with additional indicators, the set of which is available on JSTOR - the collection is really big. As for the tools used for analysis, their number is correct and in this respect JForex does not stand out with anything special.

Additional tools

Volume. On the JForex platform, the volume indicator, compared to MT4, where we deal with tick counting, has any sense and is reflected in reality. But it could not be otherwise - after all, we are dealing with the ECN platform. The volume shows us the value of transactions concluded within the SWFX Marketplace, i.e. not only by Dukascopy's clients but also by its partners to whose liquidity we also have access. Admittedly, it is still not the total volume of the Forex market, but to some extent it reflects the decisions of traders.

Pattern analysis tool (NAW). This is a fairly innovative module that Dukascopy has been developing for many years. NAW is to facilitate the trader's work and capture the drawn formations on the graph. The configuration of the tool is very simple and its effectiveness? Well, the code itself works correctly and in fact most of the formations, in my opinion, are delineated appropriately, but ultimately effectiveness is a matter of the level of validity of the formation of classical technical analysis in a given market. NAW is a form of hints, not recommendations for concluding a transaction. It can also be used to teach beginners by showing how to, for example, catch classic AT formations on the chart.

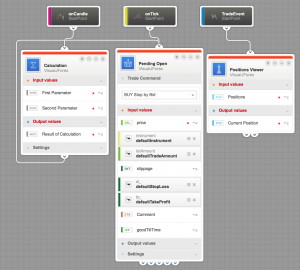

Visual JForex. It is true that this tool is already off the platform, but it is worth mentioning. It is a module that was supposed to make a person unfamiliar with Java or even programming able to create their own tools and strategies. The tool, which in theory was supposed to be trivial, but in practice turned out to be more intended for people who know a bit about programming. It certainly has great potential. However, to use it, you first need to delve deep into the topic. In my opinion, the educational base in this respect is insufficient and, unfortunately, only in English.

JCloud. Otherwise, the JForex Dukascopy cloud - convenient and helpful. It allows us to store platform settings on the broker's server, such as chart templates, workspaces, indicators or plugins, and above all, it allows you to run an automatic strategy without leaving the platform active and the computer turned on. This not only allows us to save several dozen USD per month on VPS but also eliminates problems with its possible restart and minimizes ping to a minimum.

MQL4 converter -> Java. As the name suggests. This tool allows you to automatically translate the programming language from MT4 and MT5 to Java, which is supported by JForex. Thanks to this (in theory) we can easily and quickly convert our favorite indicators into the Dukascopy platform. Unfortunately, it would be too good if it did not involve any inconveniences :-). Like the vast majority of converters, it works, but to some extent. With simple tools, it should not be a problem, but with a more complex one there is a good chance that errors will appear. Thus, in the end, we can be condemned to the need to edit the code ourselves or to have the programmer rewrite the pointer.

Additional JForex modules

Transaction history. One of the big shortcomings of JForex. Dukascopy offers as many as ... 4 different reports, 2 statements and 5 activity logs. For the average trader, all this is completely uninteresting and the only thing he would like to know is how his transactions turned out historically. Here he ends up in a labyrinth of numbers and combinations that is hard to deal with. Even when we find the right report, it takes a long time to decode it, and ultimately something as basic as the chart of the changing capital curve is missing. For more advanced traders, all reports will be an advantage and will allow you to check all transaction settlements in detail, but for the future it would be worth considering first of all those beginners :-).

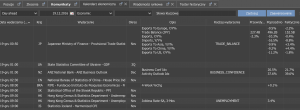

News and calendar. Dukascopy offers a whole range of additional widgets in the form of market news, macro calendar, interest rates and holidays. The problem is just that a lot of them are outside the platform. On JForex itself, we find only links that will open the browser and page with the indicated tool, and this is an impractical extra load for the computer. The exception is the calendar with macro data and messages from the market, however, once they are very illegible, two are displayed as a separate tab in the lower platform window (where open positions are visible). The window is usually relatively small and the willingness to use these tools requires its enlargement or opening the page in the browser. On the plus side, however, you can count the amount of information flowing from many markets and advanced filtering options.

Notifications. Another option "hidden" outside the platform but worth mentioning. Dukascopy offers a number of bill notifications, not only by e-mail but also by SMS (20 messages a month are free). We can configure notifications regarding the execution of pending orders, including SL and TP, account balance, Margin Call exceeded, support / resistance exceeded, or a given account balance or price on a given instrument has been reached. The option is available in the Reports -> My account -> Notifications tab.

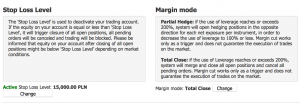

Stop Loss Level. Like the previously mentioned notification option, SLL is tucked away in Reports -> My Account -> My Account. What is SLL? This is the so-called Stop Loss on capital. It causes that after exceeding the margin level indicated by us, it will close all transactions, even pending ones, and additionally block the trade option (we can unlock it in the same place). Thanks to this, even if we use a machine or a position grid, we can prevent unforeseen situations that will cause us unplanned losses. Additionally, it is possible to choose an action in case of reaching the Margin Call: we can decide, for example, to close all positions or the so-called opening a hedging position that will balance the balance sheet.

Speed of action. It happens that JForex can be capricious or rather demanding in relation to our computer and internet connection. Traders using old equipment, in which the add-on is often installed with Windows overloaded with data (with a disordered registry) may experience a slowdown in the computer's work, and also complain about the slow operation of the platform. This is due to Java and a lot of RAM consumption (up to 2 GB). Insufficient memory reserve may affect the slow operation of the platform, and a low-quality link (and speed) - long loading of graphs. If we take care of these two things, we should not have any problems with the efficient use of JForex. The version marked with 3 has been significantly improved in terms of stability and speed of operation. And this is great news, because its earlier versions had various "moods" :-).

Summation

JForex is in my opinion a great creation, but unfortunately it cannot be said that it is perfect. It has a number of brilliant solutions that make the platform shine in comparison to the competition, but to appreciate it, you first need to get to know the platform well. Unfortunately, it also has flaws that will disqualify this platform for some. However, for those who like it, it will make them quickly forget about the popular Russian ... Exactly, what was this platform called? 🙂

| Pros | Cons |

|

|

The JForex platform can be tested by setting up a demo account at Dukascopy.

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)