Spotware is a Cypriot IT company and the author of the very dynamically developing cTrader trading platform, which made its debut on the market in 2011. It was a time when a transformation took place - investors, as a result of increasing awareness and growing problems with their brokers, began to look for companies offering trading in model other than Market Maker. They were fed up with the conflict of interest between the trader and the broker and became interested in the neutral model they were supposed to be STP and ECN. The problem was that the good old MT4 at the time required a lot of combinations to meet these needs, and access to the ECN market started with deposits of $ 10-20. For some time there was a feeling that the STP / ECN model on the MT000 platform is simply impossible.

Forex brokerswho decided to introduce STP / ECN in MT4 had to rebuild the entire order handling infrastructure, creating various types of intermediary bridges, while MetaQuotes dealt with creating MetaTrader in version 5 (which, as it turned out later, didn't really catch on). This created a certain gap in the market that Spotware wanted to exploit by launching a completely new platform - cTrader.

After a few years from the premiere, you can confidently say - cTrader is the biggest competitor of MetaTrader 4, which has already surpassed it on many levels. We invite you to read our review.

Admission word

cTrader is a response to the dynamically growing needs of both traders and brokers (which were forced by traders). This platform was created from the very beginning with the sole idea of providing brokerage services in trading on spot and instruments CFD based on the STP / ECN model. The first broker to introduce cTrader to its offer (December 2011) was FxPro. There was no breakthrough at that moment. The platform had only basic functions, and many things were simply missing (eg Trailing Stop). But Spotware was not idle and quickly got to work. Almost every month there were dozens of modifications. Although, by the way, it was not difficult since the whole mass of necessary things was not added at the very beginning. Anyway, the speed of the upgrades introduced resulted in two things: a lack of transparency but also being ahead of the competition. Until now, nothing has changed :-).

Installation and logging in to cTrader

cTrader comes in several versions:

- stationary version - desktop,

- Web version,

- mobile versions - Web, iOS and Android.

cTrader Web for iOS

Stationary version - we will focus on it first of all, because the others are only an addition. Installation is quick and standard - each time the platform is launched, it checks if there are any new updates for download, and since they are made quite often, you have to take into account that once every 1-2 weeks, launching the platform will take a bit more time.

cTrader in the browser version does not require installation, except for the browser itself, of course. And it may sound not very objective, but it is by far the best version of the Web platform I have encountered. Admittedly, not entirely in the context of the add-ons and innovative possibilities that it offers, but more in the mapping (transfer) of options from the desktop version to the browser version. In addition, the functionality of the platform or the speed of its operation did not suffer in any way.

Mobile applications it's already a standard, so here they could not be missing. Standard: iOS for Apple and Android devices. But it doesn't stop there. There is also a Web Mobile version, i.e. cTrader, which can be run on a smartphone from the browser level without installing mobile versions. The platform automatically scales to the size of our smartphone, thanks to which we lose the fun with zoom, as shown in the picture attached.

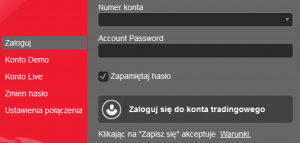

Login. We log in with the same data for each type of platform. When logging in, the platform asks us for a cTrader ID. It is a cloud-connected account that we can register in the marketplace itself. This gives us the ability to store the settings from the platform on the broker's server. Before you say "but it was already", I would like to add that thanks to this our settings are stored for the platform itself, i.e. if we use cTrader of broker A and cTrader of broker B, we can also synchronize settings here. Cool isn't it? 🙂

Login. We log in with the same data for each type of platform. When logging in, the platform asks us for a cTrader ID. It is a cloud-connected account that we can register in the marketplace itself. This gives us the ability to store the settings from the platform on the broker's server. Before you say "but it was already", I would like to add that thanks to this our settings are stored for the platform itself, i.e. if we use cTrader of broker A and cTrader of broker B, we can also synchronize settings here. Cool isn't it? 🙂

The appearance and interface of cTrader

The platform offers two color versions as standard - white and black / gray. Unfortunately, the white version is far too bright and badly toned down, so eye-catching that it's hard to use in the long run. However, the dark is just too gloomy, especially with the standard black chart template. You can deal with it just by changing the garment of the candles themselves and the background. On the plus side, the font size can be adjusted, which is present on the entire platform. It is in vain to look for such a facility in MT4, JForex or web applications. The sizes of each button are appropriate, as is their location.

One of the most serious defects of cTrader is, in my opinion, the left part of the platform, i.e. the window for placing orders. The entire panel is extremely unreadable. The amount of colors (and their shades) on a dark background combined with a lot of information, abbreviations and pop-ups makes it look aesthetically unpleasant and the trader finds it hard to find, especially at the beginning. For sure it will take some time before we really start moving around this window and take advantage of its full potential.

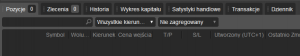

We have the option to run cTrader in the full-screen version, ie without borders and "system" stripes. Additionally, four standard layouts of the platform's windows have been created: default, chart trading, chart only (chart only), market analysis. Actually, no more is needed, because these settings exhaust a reasonable amount of configuration. Additionally, each tab from the bottom transaction window can be "pulled" outside the platform - a useful option when using several monitors.

We have the option to run cTrader in the full-screen version, ie without borders and "system" stripes. Additionally, four standard layouts of the platform's windows have been created: default, chart trading, chart only (chart only), market analysis. Actually, no more is needed, because these settings exhaust a reasonable amount of configuration. Additionally, each tab from the bottom transaction window can be "pulled" outside the platform - a useful option when using several monitors.

CTrader functions and capabilities

Transactions. Platforms generally offer several different trading options so that the trader can choose the most convenient method for them. It could not be otherwise in the carmaker.

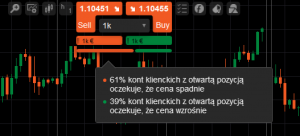

- One-click trading is available from the chart (upper part). We can quickly open a position and define the volume - in the form of a small bar under the transaction, the sentiment among the broker's clients is also visible. Interesting "goodies" but generally unhelpful.

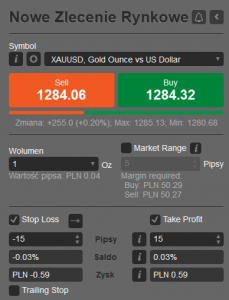

2. The second method of entering into positions is to open a trading window. Here we can independently define SL / TP parameters before making the transaction. Useful information is the loss amount expressed in percentage and currency depending on the settings. It definitely makes risk management easier. This is the slowest way to open positions, but certainly the least vulnerable to possible mistakes on our part.

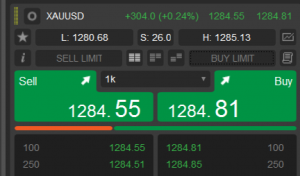

3. The third way is to use the transaction panel on the left side. In my opinion, it is very "gifted", and thus it has lost not only transparency but also functionality. In addition to the classic Buy / Sell buttons, it has been equipped with DoM (Depth of Market), i.e. market depth, where we can see how the liquidity is distributed at individual price levels. DoM is available in three variants: VWAP, Standard, Price. It is difficult to say if these modes are useful for any trader, considering how volatile and dispersed the Forex market can be. However, if someone uses pending orders set close to the current market price, he will definitely discover the great potential of cTrader here.

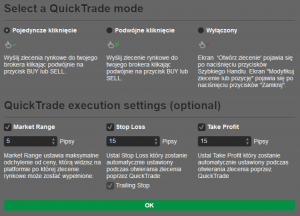

A useful option is to define the settings for one-click trading. You can make them double or turn them off completely (you must go to the transaction window). In the same window, we can configure the default acceptable price slippage and automatically add SL, TS and TP with the specified parameters to each open position. In MT4, until now you have to organize it yourself through non-standard tools.

Chart support. In addition to the standard three types of charts, ie candlestick, bar and line charts, there is also the Dots Chart, or "dot" chart. A very niche feature, although some use it. The number of time intervals is astonishing. Well, there are as many as ... 26, plus 13 tick intervals. The choice is really big - there are even niche TFs such as 4 minutes, 45 minutes, 6 hours or 3 days. The creators probably preferred to give the user many ready-made intervals than to create a module for their own creation. You can save the appearance of the charts as a template. You can easily and quickly define a default template for newly-opened charts, and make changes for all of them at the same time without the need to tediously click on each chart separately. Each graph can be detached from the platform and transferred, for example, to a second monitor.

The option of automatic chart placement would also be useful - unfortunately this was missing. The charts are arranged according to the order, ie "I can see" the platform, where the first chart is considered the main one and its sizes change at the very end as the number of new charts increases (with the option of one chart for the entire platform turned off). In addition, there are workspaces that are saved in the cTrader Cloud after registration.

On the plus side, the option to turn on the display of places of concluded transactions (this is still missing in MT4) - you can turn on this function in the chart view options. Not only that, you can quickly view individual transactions by clicking on them in the account history. To delete the displayed information, just click on the graph once - you don't have to delete any objects separately. A clear and convenient solution. The remaining functions are almost identical to those available on MT4, along with the modification of the colors of the charts.

On the plus side, the option to turn on the display of places of concluded transactions (this is still missing in MT4) - you can turn on this function in the chart view options. Not only that, you can quickly view individual transactions by clicking on them in the account history. To delete the displayed information, just click on the graph once - you don't have to delete any objects separately. A clear and convenient solution. The remaining functions are almost identical to those available on MT4, along with the modification of the colors of the charts.

One of the very useful functions, which somehow is still missing from such a combine that MT4 is considered to be, is the ability to change the time zone on the platform. This option is especially useful for Poles because on FX platforms we always have the default broker's server time. In the case of Cyprus brokers, the time shift is one hour ahead, and in the case of British brokers one hour back. Of course, you can easily get used to the fact that on the platform we have a different time than where we are, but this is another thing to remember, while many traders have already forgotten about it when analyzing the chart, waiting for the publication of macroeconomic data or for market opening. cTrader solves this problem and provides the possibility of changing the time to any time spanning the whole world.

Indicators and tools. The number of analytical tools and indicators available as standard is satisfactory. The objects themselves superimposed on the graph can be easily copied, hooked on key places, as well as configure and personalize their settings. There are about 60 indicators, but if this turns out to be insufficient for us, we can move to the official cTrader website with a whole set of non-standard tools with two clicks - Indicators. This collection is created by both software authors and traders who share their ideas. All posted indicators are available for free. By default, the toolbar is located on the right side of the platform, next to the chart. However, it can be freely moved to each side of the platform, incl. to the top, similar to the default layout from MT4.

Additional tools. cTrader is not the only Spotware product. The company has created a series of additional applications and modules that enrich the platform's capabilities and make it even more universal. From the additional items available, we have: MT-cT Trade Copier, 2cAlgo Converter and cBots. CAlgo and cMirror are available as additional applications. Description with explanations below.

Additional modules:

- MT-cT Trade Copier - in other words, a copier, i.e. a tool for duplicating orders between cTrader and MT4 platforms. It is a module that works as an automatic strategy that allows us to trade on MT4 and copy the same trades on the market. Thanks to this, even if we use robots on the MT4 platform, we do not have to convert them specifically for cTrader - just connect the MT-cT TC. The tool can be downloaded from the website. The setup is very simple and fast - DETAILS. The copier is free and works very well, which we also checked on the real account in FxPro.

- 2cAlgo Converter - it is a website tool that meets the needs of traders using MT4. It is a converter that enables to "translate" the indicator code from MQL into C # on which cTrader is based. It is possible to convert both indicators and automatic strategies. From my experience, there may be occasional errors after such conversion, which will require the programmer's intervention anyway, depending on the complexity of the code. Therefore, we recommend that you carefully check the correctness of the reworked algorithm on the demo account. Go to 2cAlgo Converter.

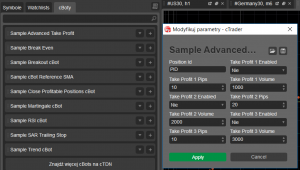

- cBots - this is an option available from the cTrader itself. cBots is the equivalent of Expert Advisors from MT4, i.e. the function responsible for the use of automated strategies. 10 simple (albeit useful) robots are available as standard. The possibilities are limited to the basic configuration of the algorithm and its activation on selected instruments. The cTDN website offers a large collection of free slot machines to download. We advise you to be vigilant as their quality is not verified in any way, at least in the initial phase. Go to cTDN.

Additional applications:

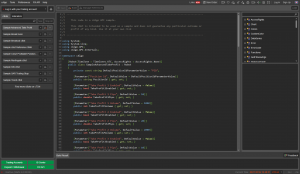

- cAlgo - it is the equivalent of MetaEditor with Backtester functions, i.e. a platform intended for programmers and people who want to use non-standard solutions. It allows you to edit and convert the source codes of all indicators and machines, as well as to conduct tests on historical data and optimize your strategies.

- CMIRROR - is an additional application similar to MultiTerminal, i.e. a platform for managing multiple accounts at the same time. It is equipped with extensive statistics regarding the account and options for managing the risk on the account. It will be especially useful for PAMM account managers and people trading on many accounts at the same time.

News and calendar. The news feed is available on trader. Unfortunately, you can have some reservations about it. These are news only in English from the Dow Jones Newswire stream, which are not particularly interesting for Polish traders. It is true that they can be sorted by category, and even individual currencies to which the news relates, but their transparency is at best mediocre. The messages themselves, at least during my tests, also load suspiciously long. Unfortunately, there is also no built-in macroeconomic calendar. And that's room for improvement for Spotware.

Keyboard shortcuts. Spotware also made it easier to navigate. After all, we do not always have a mouse at our disposal, and touch-pads are the bane of many laptop users. cTrader has a fairly wide range of shortcuts to handle charts, instrument lists, and workspaces. The options are very similar to those known to us from MT4 with one small exception - here we can modify the keyboard shortcuts (in MT4 they are assigned permanently). Everything is great but as if something is missing ... And yes, I already know. There is no shortcut to deal with. We cannot perform quick opening or closing of an item with the keyboard. It's a pity.

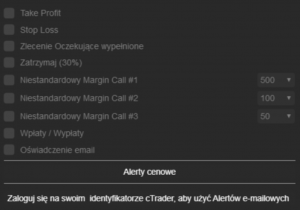

Notifications. Of course, price alarms could not be missing. They can be added by a quick click on the chart or via the icon from the toolbar and selecting the desired place on the chart. Interestingly, price alerts can also be stored in the cTrader cloud. However, what is much more interesting is the e-mail notification option. These notifications do not apply to the rates themselves, but to the code in the invoice. We can be notified, for example, about the realized SL / TP or about the departure of our capital below the set level.

Notifications. Of course, price alarms could not be missing. They can be added by a quick click on the chart or via the icon from the toolbar and selecting the desired place on the chart. Interestingly, price alerts can also be stored in the cTrader cloud. However, what is much more interesting is the e-mail notification option. These notifications do not apply to the rates themselves, but to the code in the invoice. We can be notified, for example, about the realized SL / TP or about the departure of our capital below the set level.

Speed of action. If I were to rate the overall speed, I would have to give 5 in the school grading system. There is nothing to complain about. Support for many charts, logging in, operating tools, closing positions with one click, changing time intervals even to tick intervals and so on ... - with no action I was able to "freeze" the platform for more than two seconds, and usually everything lasted indefinitely " moment".

Feedback. From the very beginning, Spotware focused on the development of the platform based on user feedback. From the first version, the module was available with the option of sending comments to the authors of the software. Currently, the same module functions as two columns. We can both praise cTrader and write what we don't like. From the platform itself, there is also a chat linking with customer service and the entire database of instructional videos. In addition, an on-line manual, a forum on Spotware products and even a voting module for new products to be introduced have been created - Vote Spotware. Admittedly, users have reservations about the speed of response from Spotware. However, don't expect too much if you want them to focus on programming :-).

Summation

cTrader is undoubtedly a successful product that, despite its clear disadvantages, initiated a small revolution on the FX platform market. It is by far the most dynamically developing software (for retail brokers / traders), focusing on the increasingly popular trading model (STP-ECN) from the very beginning. Will cTrader overshadow the fame of the good old MetaTrader 4? Time will tell, but the chances for it are growing every year ...

| Pros | Cons |

|

|

The cTrader platform can be tested on a demo account, among others at the broker FxPro or IC Markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)