Ray Dalio - an investor and one of the richest people in the world

Ray Dalio can certainly be called a celebrity billionaire. He gained wealth thanks to his successful investments, and fame, among others, thanks to a writing career. According to Bloomberg, it is 79th richest person in the world (2020) with assets exceeding $ 18,6 billion. He popularized many terms that are still used today in the financial world. These include risk parity, currency overlay, portable alpha and global inflation-indexed bond management.

Who is Ray Dalio

Raymond Thomas Dalio was born on August 8, 1949 in New York City. He was the son of the jazz musician Marino Dailio and Ann. Ray has been hardworking since his youth. As a child, he took up many odd jobs, such as mowing the grass, clearing snow or delivering newspapers. At the age of 12 he started working as a midfielder at The Links Golf Clubb (caddied). As a result, he had contact with many Wall Street professionals: investors, analysts and managers. One such person was George Leib. Young Dalio quickly became friends with a Wall Street veteran. Thanks to this, he was invited to Leib's family home for dinners or family holidays. George Leib gave young Raymond Dalio a summer job with his trading firm. This, in turn, attracted Ray's interest in the financial market and prompted him to start an investment career. As a teenager, he bought Northeast Airlines stock for $ 300, which soon tripled in value following a merger with Delta Air Lines.

Raymond Thomas Dalio was born on August 8, 1949 in New York City. He was the son of the jazz musician Marino Dailio and Ann. Ray has been hardworking since his youth. As a child, he took up many odd jobs, such as mowing the grass, clearing snow or delivering newspapers. At the age of 12 he started working as a midfielder at The Links Golf Clubb (caddied). As a result, he had contact with many Wall Street professionals: investors, analysts and managers. One such person was George Leib. Young Dalio quickly became friends with a Wall Street veteran. Thanks to this, he was invited to Leib's family home for dinners or family holidays. George Leib gave young Raymond Dalio a summer job with his trading firm. This, in turn, attracted Ray's interest in the financial market and prompted him to start an investment career. As a teenager, he bought Northeast Airlines stock for $ 300, which soon tripled in value following a merger with Delta Air Lines.

He reinvested the money he earned and added new funds from his savings in the following months. Before entering high school, he had made a "small fortune", which was an investment portfolio worth several thousand dollars.

Despite his fascination with the world of investments, Dalio did not stop educating himself. In college, however, he was bored with monotony. He believed that he was learning impractical things that would not be of use to him in the future. Nevertheless, he continued his education. He graduated in finance from Long Island University and earned an MBA from Harvard Business School in 1973.

Many Americans came to the minds of his books: Principles: Life & Work and educational films: How the Economic Machine works.

Investment career

At college, Dalio mainly traded stocks, but as he continued to expand his financial knowledge, he discovered a new type of instrument. They were commodity futures. Ray quickly discovered the potential of leverage in this instrument. After graduating from college, Dalio began working in a low-level office position at the New York Stock Exchange. Back then, he was an eyewitness to the effects of Nixon's decision to "suspend" the convertibility of the dollar into gold. As a result, share prices and foreign currencies rose sharply. This was a prelude to the "lost decade", when many economies struggled with high inflation and low economic growth (known as stagflation).

The following year, together with his friend, he founded a company that dealt with investing in the commodity market. Reality happened very quickly. The first investment project ended in failure. Ray Dalio was not discouraged by this. He still believed that he could get rich by investing on his own. But he needed more experience.

Some time after graduating from Harvard, Dalio started working as a commodity futures trader. The place of work was the "trading floor" on the New York Stock Exchange. Then he worked as Director of Raw Materials Market at Dominick & Dominick LLC. Very quickly, in 1974, he moved to Shearson Hayden Stone, where he worked as a trader and consultant. He dealt with, among others, advising cattle breeders or grain producers on how to manage risk using fututres contracts. Ray quickly began to tire himself in his new job. He was disturbed by a hierarchical structure in which he did not feel comfortable. However, it was not for this reason that he left Shearson Hayden Stone. The reason was much more unusual. While playing on New Years Eve 1974, a drunk Ray Dalio punched his supervisor. The reason was the difference of views.

Founding Bridgewater Associates

Despite Dalio's scandal, the customers did not turn their backs on him. Many of Shearson Hayden Stone's clients still wanted him to manage their capital. In 1975 he founded Bridgewater Associates, whose seat was in ... Dalio's apartment. At the beginning, the company acted as an advisor to companies in the field of capital management and investment risk control. The main area of the company's operations was the currency and interest rate markets. This was a very lucrative area as the deviation from the gold standard made exchange rates more volatile.

Dalio began preparing paid reports for the Daily Observations. which drew conclusions from trends in global markets. However, not everything was going according to Ray. In 1982, he had expected a stock market to collapse due to the emerging market sovereign debt crisis. Earlier successes made him arrogant and took too much of a risk. The wrong decision meant that the fund lost a significant part of its capital, clients and was forced to drastically cut employment.

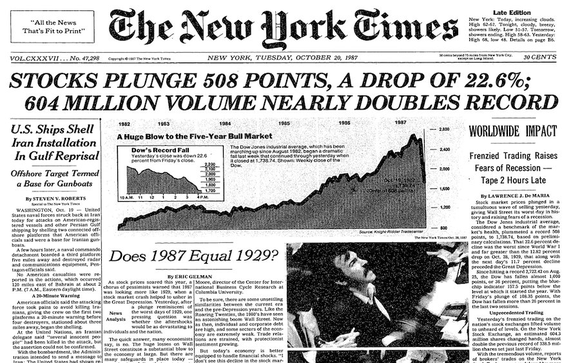

Once again, Ray Dalio did not give up after the defeat. Within a few years, he rebuilt his reputation and rose to fame as one of the people who made money from the 1987 crash.

This made it easier for him to acquire customers. The company's reputation was so good that Bridgewater acquired clients such as McDonald's and pension funds World Bank (in 1985) and Kodak (1989).

Pure Alpha

In 1991, the flagship fund "Pure Alpha" was launched, the investment philosophy of which was based on the so-called portable alpha. Simply put, it is a strategy that involves investing in stocks or other assets that are not correlated with the market. The real success of the strategy was in the years of the bear market in 2000-2003, when the rate of return significantly exceeded the leading indices. It is worth adding that in 2006 the fund returned some of the money to clients due to the fund's assets being too large. There was therefore a risk that the fund would not be able to effectively reinvest funds from its clients. Bridgewater proposed participation in alternative strategies such as All Weather or Pure Alpha Major Markets.

all weather

The fund was established in 1996 and was the first to apply risk parity in managing an investment portfolio. Risk parity was a concept considered in the theories of investing in the 50s and 60s. However, several decades had to pass before a professional fund was created using this concept. The strategy was that the portfolio manager mainly focuses on allocating risk (defined as volatility). The method of capital allocation is the only factor that matters in second place. In theory, this way of investing is to increase the so-called Sharp ratio. The investment portfolio should in theory perform better than the market in a bear market.

At the end of the 1991th century and the beginning of the 2005st century, Bridgewater Associations was a market star. In 4–2002, they achieved only three times negative return on investment, with the largest loss being XNUMX%. For comparison, in XNUMX S&P 500 index lost as much as 22%. The success of the Bridgewater funds resulted in an exponential growth in assets under management. Even in the mid-nineties, the fund managed approximately $ 5 billion. In 2003, AUM (assets under management) already amounted to $ 33 billion, and in 2007 they exceeded $ 50 billion.

The One Who Knew - the crisis of 2007-2009

Few in 2007 were aware of the problems that may await the world economy. The fast pace of economic growth and the warm real estate market seemed to confirm the "bright future". Few of the skeptics have been silenced by the slogan "This time is different." However, not everyone lost their vigilance. One of them was Ray Dalio. In the spring of 2007, an article appeared in Barron's arguing that "no one is better prepared for the coming financial crisis than Bridgewater's customers and Daily Observations subscribers." In the following months, Dalio made a similar statement in the media. Bridgewater analysts in one of their forecasts estimated the hypothetical losses related to the loss of bad loans at $ 839 billion. With his report ready, Ray Dalio traveled to the Treasury Department in December 2007. Unfortunately Ray was ignored. In January 2008, he informed his clients that "if the economy collapses, it won't be a typical recession." Due to the proper preparation of the portfolio, the Pure Alpha fund achieved a return in 2008 of 9,5%. The following year was weaker, as the fund earned only a few percent, compared to the DJIA index grew by 19%. The reason for the fund's poor performance was that Dailo believed that economic growth in 2009 would be weak. Therefore, he did not expect a significant increase in indices in the post-crisis year.

Next years

The increase in recognition and good results resulted in a further inflow of capital to the funds. In 2019, Bridgewater funds managed over $ 132 billion. The funds have been invested by, among others, the International Monetary Fund and the Singapore state fund GIC. The growing number of assets and customers resulted in a significant increase in employment. Between 2003 and 2017, the number of Bridgewater Associates employees increased from 100 to 1500 employees. However, in 2017, Ray Dalio ceased to be managing Bridgewater Associates.

Ray Dalio's investment philosophy

Ray Dalio focuses mainly on investing based on the "global macro". This means that investment decisions are made based on, among others, inflation rates, interest rates, GDP growth, etc. It can therefore be said that this is the type of investor who "looks from a bird's eye view" at the financial market. Ray Dalio prefers risk allocation over capital allocation. He is a supporter of the use of risk parity and portable alpha in building an investment portfolio. As a rule, Dalio does not select companies individually. So he is a different type of investor than Peter Lynch or Warren Buffett. He is closer to investors using quantitative strategies (eg Jim Simons).

Philanthropy

Like Bill Gates and Warren Buffett joined the Giving Pledge. As a result, he undertook to donate more than half of his property to charity. Ray Dalio also founded Dalio Fundationwhose assets at the end of 2013 exceeded $ 800 million. In the years that followed, the Dalio family donated more and more funds. By 2020, $ 5 billion had been transferred to this organization. The Foundation was involved in many health projects, including subsidized the mitigation of the effects of the COVID-19 pandemic. Dalio co-financed the project OceanXthat supports and organizes initiatives to protect the oceans.

Journalism

In 2011, Ray published the first book he made available online. Its title is "Principles". The book contains the author's thoughts on the importance of principles in life. The book has been downloaded several million times. However, another book brought the author a real success: "Principles: Life & Work", which was the best-selling business book on Amazon in 2017.

In 2011, Ray published the first book he made available online. Its title is "Principles". The book contains the author's thoughts on the importance of principles in life. The book has been downloaded several million times. However, another book brought the author a real success: "Principles: Life & Work", which was the best-selling business book on Amazon in 2017.

The following year, Dalio's third book was published in which he addresses issues related to debt crises. The title of the book is "Principles for Navigating Big Debt Crises". In November 2021, another book was released: The Changing World Order: Why Nations Succeed and Fail.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)