The future of the automotive industry - How to invest in electric cars? [Guide]

Flocken Elektrowagen, source: wikipedia.org

Electric cars are by no means a new solution. Even in the XNUMXth century, people experimented with this electric drive in vehicles. In 1881, Gustave Trouve presented an electric means of transport at the International Electricity Congress in Paris. In 1888 a German - Andreas Flocken - created the Flocken Elektrowagen - according to many it was the first "real" electric car.

Electric cars enjoyed their peak in the first decade of the XNUMXth century. In those days, there were three primary power sources for vehicles: for, Electricity i internal combustion cars. Back then, electric cars were much easier to use than those powered by a steam or combustion engine. Due to the fact that the road infrastructure was still in its infancy at that time, the small range of electric cars posed no problems. The electrics were typically "city" cars.

However, the breakthrough came in 1908 with the launch of the production of the famous Ford T. Four years later Charles Kettering invented the starter, which meant that internal combustion cars did not have to have a crank (used to start an internal combustion engine). Prior to World War I, Hery Ford collaborated with Edison on a low-cost electric car model. However, the plans were not implemented. As a result, due to the lower range and poor infrastructure outside the cities, electric cars began to lose to vehicles powered by combustion engines. The era of cars running on petrol, diesel and LPG has arrived. Only in the last dozen or so years has the share of electric cars started to grow.

The move away from fossil fuels is a global trend and is currently affecting more and more industries. The most "tangible" evidence of the departure from the hydrocarbon world is seen in the automotive industry. More and more cars sold are currently powered by electric or hybrid drive. The trend is also supported by numerous governments. In the United Kingdom, the sale of petrol and diesel cars will be banned from 2030. In the first half of 2022, MEPs supported the proposal of the Committee on the Environment, Public Health and Food Safety of the European Parliament, banning the sale of cars with internal combustion engines from 2035. Such activities mean that the beneficiaries of changes in the market will be producers of electric cars and components necessary for the production of this type of cars (e.g. batteries, batteries, etc.).

Modern electric cars

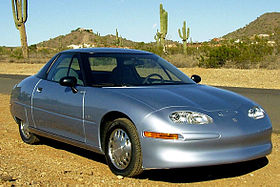

EV1 model, source: wikipedia.org

In the 90s, many automotive concerns returned to the development of electric cars. In 1990, General Motors introduced the concept of a two-seater "electric" under the name "Impact". In turn, between 1996 and 1998, GM produced more than 1100 EV1 cars. It was the first mass-produced electric car of the "new era". The car had a maximum range of 127 km. The maximum speed of the car was 129 km / h. In the following years, many automotive companies experimented with electric cars. Honde, Nissan, Toyota, Citroen and Ford can be mentioned here. However, the projects were not warmly welcomed by customers.

The real revolution on the electric car market was introduced only by a little-known American company Tesla. The origins of the company date back to 2003, when a project was created to create a technology company producing electric vehicles. The company gained momentum with the investment in the project of the former PayPal shareholder - Elon Musk. With the assumption of power in the company by Elon, Tesla began to dynamically raise capital. The first prototype was presented in 2006 under the name Roadster. The production of this car started two years later. In 2010, Tesla started production "Model S". This car model went on sale two years later. The commercial success of the car made automotive concerns look more and more closely at the unattractive market until recently. Companies that offered their own electric vehicles began to spring up like mushrooms after the rain.

Technological advances in batteries have helped in the development of new electric cars. The maximum range of such vehicles and their maximum speed have increased. At the same time, government pressure to reduce carbon dioxide is causing subsidies for cars powered by electricity. At the same time, increasing the energy efficiency of electric motors resulted in their significantly better efficiency than internal combustion engines (conversion of energy into motion).

Currently, the electric car market is worth around $ 185 billion in 2021. According to Facts and Factors analyzes, global demand for electric vehicles will grow by an average of 24,5% in the next few years. As a result, this market may be worth around $ 2028 billion in 980. In 2020 alone, over 3,2 million electric cars were sold, 41% more than in the previous year. Of course, the sale of electricians is still a market niche. In 2020, a total of almost 64 million cars were sold. Thus, the share of electricians in total sales is around 5%. According to BNEF forecasts from 2020, over 2030 million electric cars will be sold in 26. As a result, the share of electricians in global sales will exceed 28%.

But without a doubt, we are in for a dynamic growth in this industry, also in terms of the emergence of new manufacturers, even those who were not previously present in the automotive industry. An example would be Sony, which announced that in cooperation with Honda it will develop an EV car in the coming years.

In today's text you can find out:

- how to invest in electric cars

- which companies related to this industry are listed on the world's stock exchanges

- who can be the beneficiary of the trend

How to invest in electric cars?

To invest in the electric car industry you don't need your own electrician factory. Thanks to the stock exchange, an investor with less than millions (or even billions) of dollars can also gain exposure to this sector. The most popular solutions include:

- acquisition of shares in selected producers of electric cars

- investing in the "basket" of manufacturers of this type of vehicle

In the case of investing in individual producers, the investor can use selection by analyzing the stock market trend or look at the company from the fundamental point of view. Exposure to individual companies is much more dangerous than if you invest in a broad market. If the trader is right and chooses correctly, his result will be much better than the broad market. However, a mistake can cost you a lot. By investing in single shares, the investor has a chance to take advantage of leveraged instruments (futures, options).

You can invest in the entire market with the help of specialized actively managed investment funds, or by buying an ETF giving exposure to the market of electric vehicle manufacturers.

Electric car producers' shares

Below we will briefly describe the companies that focus on production only electric cars. For this reason, we will omit manufacturers such as Toyota, General Motors or Volkswagen, whose electricians offer only a small percentage of the total. Companies for which the development of autonomous cars is currently a side activity were also omitted. For this reason, companies such as Alphabet (Waymo's project) or Apple have not been described.

Tesla

Tesla is one of the most famous electric car manufacturers. It focuses on selling higher-priced cars. In 2021, it delivered over 936 to consumers. vehicles. The company's operations are divided into two main segments: "Automotive" and "Energy Generation and Storage". In the automotive segment, the company produces electric cars. In addition, the company creates a network of the so-called Tesla Supercharger. There are over 30 fast charging stations located all over the world. Thanks to them, the Tesla user can charge the car in 000 minutes (up to 15 km range). Tesla has route planning in its system, thanks to which it will guide the car so that it is able to recharge at fast charging stations. The “Energy Generation and Storage” segment is responsible for the production of solar panels and energy storage. The product is sold to both households and companies.

| $ million | 2018 | 2019 | 2020 | 2021 |

| revenues | 21 461 | 24 257 | 31 536 | 53 823 |

| operational profit | -252,8 | 80 | 1 994 | 6 496 |

| operating margin | -1,17% | + 0,33 % | + 6,32 % | + 12,07 % |

| net profit | -976 | -862 | 690 | 5 519 |

Tesla stock chart, interval W1. Source: xNUMX XTB.

BYD

It is a Chinese company that was founded in 1995 in Shenzhen. BYD operates mainly in the Chinese market, but has started to expand geographically in recent years. The main subsidiaries are BYD Automobile and BYD Electronic. BYD stands for "Build Your Dreams". At the very beginning, the company focused on the production of rechargeable batteries. In a short time, the company has become a leading player in the market of mobile phone batteries. In 2002, the company decided to enter the car market. Currently, it is one of the four largest producers of electric cars in the world. In addition, it is also the 4th largest producer of EVB (Electric Vehicle Batteries). In addition to cars, BYD Automobile also produces buses, trucks and electric bicycles. BYD Electronics produces components for mobile phones. Interestingly, in 2020, it began producing surgical masks.

| CNY million | 2018 | 2019 | 2020 | 2021 |

| revenues | 130 054 | 127 738 | 156 597 | 216 142 |

| operational profit | 8 032 | 6 861 | 13 045 | 7 597 |

| operating margin | + 6,18 % | + 5,37 % | + 8,33 % | + 3,51 % |

| net profit | 2 780 | 1 614 | 4 234 | 3 045 |

NIO

The company was founded in 2014 and its headquarters is in Shanghai. The company focuses on the production of electric cars (mainly SUVs and sedans). For most of its history, the company operated only on the Chinese market. However, in 2021, NIO Inc. announced entering the European market. The first market was Norway. NIO offers its customers a Power Swap service where the batteries are quickly replaced. Thanks to this, the user does not have to waste time while "refueling" the car. The company also plans to open its own factory in Europe. This is to shorten the delivery time of cars to the European market. In addition, NIO is also developing an offer of home products (including home vehicle charging stations).

| CNY million | 2018 | 2019 | 2020 | 2021 |

| revenues | 4 951 | 7 825 | 16 258 | 36 136 |

| operational profit | 9,7 | -210,2 | -259,1 | 247,2 |

| operating margin | + 0,19 % | -2,69% | -1,59% | + 0,68 % |

| net profit | -23 327 | -11 413 | -5 610 | -10 572 |

NIO stock chart, interval W1. Source: xNUMX XTB.

ETFs for electric cars

Global X Autonomous & Electric Vehicles

This ETF focuses on investing in the market of autonomous cars and electric vehicles. In addition, the ETF also includes companies that supply components for this type of car. As of June 17, the assets under this ETF's management totaled $ 907 million. Currently, the fund consists of 73 companies. About 58% of assets are held in US stocks. Japanese stocks (10%) are in second place. The rest of the countries have less than 5% of the ETF's assets. About 25% of Global X Autonomous & Electric Vehicles assets are held in car manufacturers. It is in second place semiconductor industry (13%), and on the next auto parts suppliers (9%). The largest components of the ETF include: Apple, Toyota, Alphabet, Tesla and Intel. Each of these companies has a slightly over 3% stake in the ETF. It is the benchmark for the fund Solactive Autonomous & Electric Vehicles Index. The ETF is quite expensive with the Annual Management Fee (TER) of 0,68%.

KarneShares Electric Vehicles & Future Mobility Index

The said ETF deals with investing in companies that either produce electric vehiclesor provide the necessary components to such producers. In addition, the portfolio also includes companies whose activities may change the future transport industry. Thus, the portfolio also includes companies dealing with the sharing economy (sharing economy), producers of systems for autonomous cars or suppliers of key infrastructure for electric cars. As of June 17, 2022, the ETF had assets under management of $ 246 million. The ETF consists of 77 companies. The largest components of the fund include: Nio Inc, BYD Co, Contemporary, Tesla and APTIV Plc. It is a benchmark for the fund Bloomberg Electric Vehicles Index. The ETF is quite expensive with the Annual Management Fee (TER) of 0,70%.

iShares Self-Driving EV and Tech ETF

It is an ETF that was established in April 2019. To date, it has accumulated over $ 450 million in assets under management. The ETF focuses on investing in electric cars, autonomous. In addition, there are in the wallet suppliers of components for electric vehicles (e.g. batteries) and creators of technologies developing autonomous and electric cars. The ETF consists of 118 companies, more than half of which are listed in the US. The other two main markets are Japanese (11%) and German (10%). The biggest components of the ETF are: A, Tesla, Toyota, Apple Lossless Audio CODEC (ALAC), and Samsung. It is a benchmark for the fund NYSE FactSet Global Autonomous Driving and Electric Vehicle Index. The ETF is much cheaper than the previous two. The Annual Management Fee (TER) is 0,47%.

Global X Lithium & Battery Tech ETF

If someone thinks it is better to sell shovels to miners during the gold rush, this ETF can meet those expectations. This fund focuses on investing in lithium battery producers and investing in lithium mine owners. The ETF was established in July 2010 and managed to amass over $ 4,5 billion in assets under management (AUM). The fund has 40 companies in its portfolio. The American has the largest share Albertmarle (10,3%). In the following places are: EVE Energy (6,3%), BYD (5,8%) and Yunnan Energy (5,7%). It is a benchmark for the fund Solactive Global Lithium Index. The Annual Management Fee (TER) is 0,75%.

Forex brokers offering stocks and ETFs

Where to invest in electric cars? Of course, the simplest option is to buy only shares, but for people who want to well diversify and balance their portfolio, investing in dividend companies through entire ETFs will be a better choice. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The future of the automotive industry - How to invest in electric cars? [Guide] how to invest in electric cars](https://forexclub.pl/wp-content/uploads/2022/06/jak-inwestowac-w-samochody-elektryczne.jpg?v=1655894348)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![The future of the automotive industry - How to invest in electric cars? [Guide] oil is falling](https://forexclub.pl/wp-content/uploads/2020/03/ropa-naftowa-opec-102x65.jpg?v=1583737705)

![The future of the automotive industry - How to invest in electric cars? [Guide] gasoline is more expensive](https://forexclub.pl/wp-content/uploads/2022/06/cena-benzyny-102x65.jpg?v=1655894888)