Before the US elections, commodities outperform equities

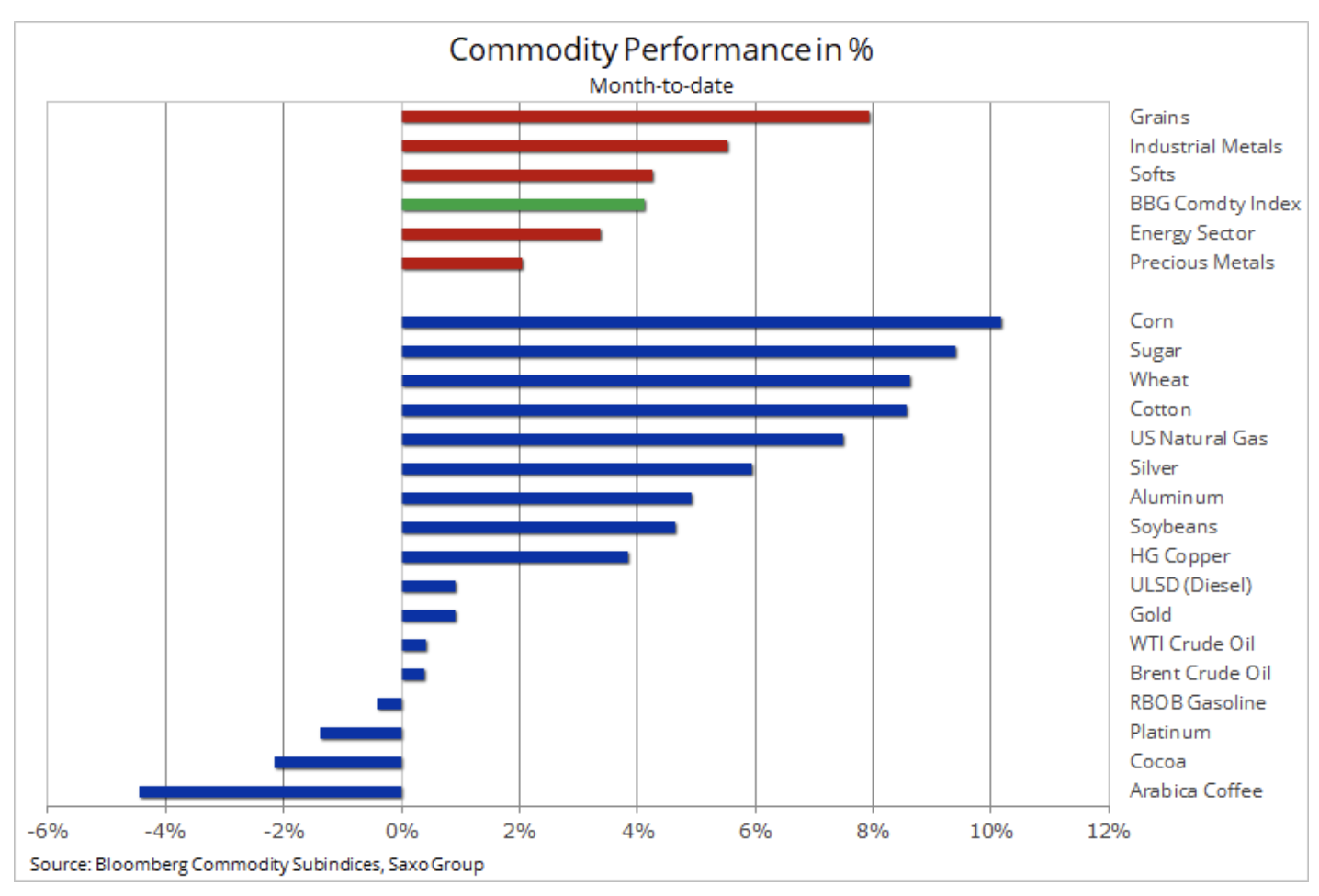

October has been broadly favorable to commodities markets so far: the Bloomberg commodity index gained 4%, outperforming equities in the S&P 500 indexwhich gained about 1%. The two main reasons for this growth are grains, benefiting from worries about the weather and strong demand, and industrial metals such as copperwhich recorded a two-year high after the yuan strengthening and the supply disruptions in Chile.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

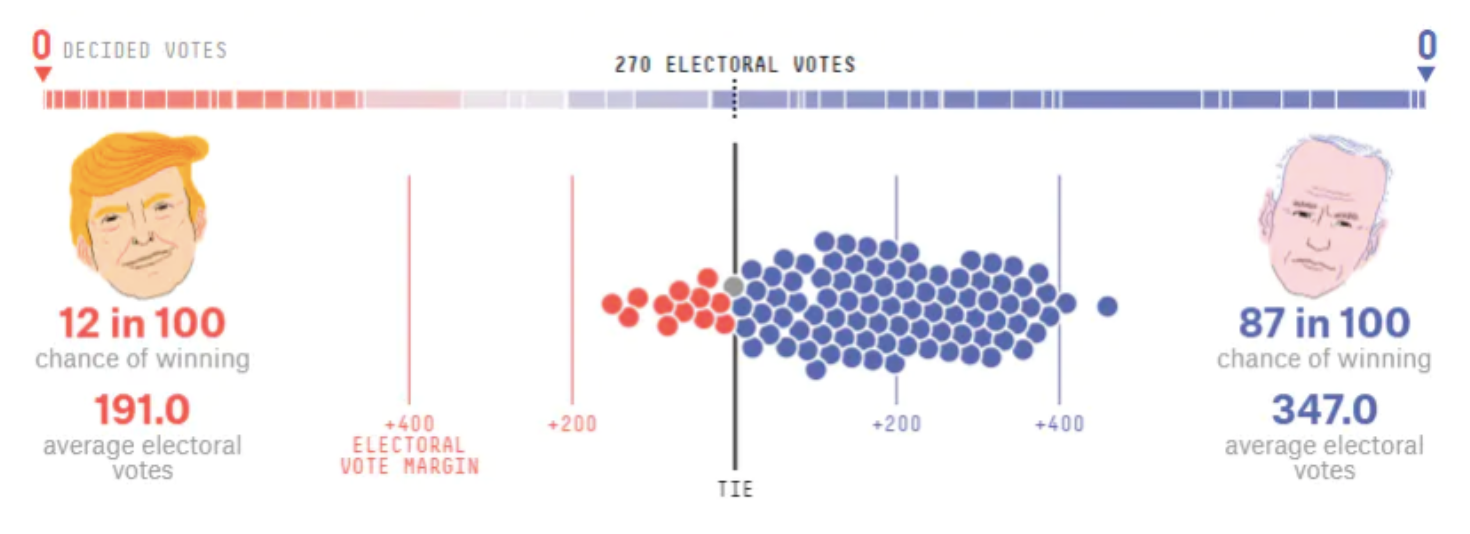

From a macroeconomic perspective this month, it seems that Joe Biden will be victorious in the US presidential election on November 3. As a result, the market adopted a more reflective approach: bond yields at the long end of the curve rose, while the dollar weakened. Both of these developments have provided commodities an additional boost despite the new rise in coronavirus infections, threatening the weak economic recovery and thus the outlook for short-term demand.

We see potential for an increase in commodity prices in 2021, regardless of who will sit in the White House after November 3. Supply constraints on key commodities, from metals and energy to major crops, coupled with macroeconomic impulses from a weaker dollar and reflation can fuel buy orders in this sector, both commercial and speculative.

On this basis, we maintain a positive outlook for crude oil, copper and key agricultural products. Similarly with precious metals, silver can be further strengthened by using this metal for industrial purposes. This is especially true for solar panels, for which a strong and possibly accelerated price increase can be expected in the coming years as the green electrification program becomes more popular, especially if blue prevails on November 3 on the US map.

Petroleum

The collapse of prices and demand for oil during the epidemic, coupled with the increasing shift away from financing shale drilling by capital markets - as interest in the "old economy" wanes - has contributed and will further contribute to the sharp decline in investment spending that will drive production down in non-OPEC countries. Based on this, we predict that oil and fuel prices will rise in 2021 as rapid market rebalancing and higher prices may not lead to higher production in non-OPEC countries, as was the case in earlier cycles.

The key moment of the oil price boom will be the release of the vaccine, which should restore global travel and commuting. With regard to the energy market, it is widely predicted that Biden's victory will lead the United States to join other countries in reducing emissions by investing in greener energy solutions, while reducing shale oil production as a result of tighter regulation.

The rise in oil prices - due to lower supply growth - would have been more influenced by Biden's win than Trump's second term. However, in the short term, crude oil and fuel products face an oversupply problem against the backdrop of rising coronavirus infections worldwide, raising concerns about the trajectory of global fuel demand.

OPEC + will meet on December 1 to decide to implement or postpone the previously agreed 1,9 million barrels / day increase from January next year. Given that we are still months away from worldwide access to the vaccine, the current slow recovery in fuel demand, coupled with increased production in Libya, makes this decision extremely difficult.

The US election result, the OPEC + meeting and the impact of Covid-19 on demand are the main drivers of the Brent crude oil price at the end of the year in the $ 38-48 / b range we mentioned in the recently published forecast for the fourth quarter of 2020 For now, both Brent and WTI crude oil remain in the lower range of $ 40, with a limited possibility of a breakout until November 3.

Precious metals

Gold he waits at around $ 1 / oz. The metal's recent problems with gaining a new impetus saw funds reduced their net long position in futures and options to 900 million ounces in the week ending October 13, the lowest level since June 12, the time preceding the start of the gold boom, by 2019% to the current level.

Meanwhile, long-term investors, who express their optimism mainly with listed products, have recently reduced their overall volume by just 330 ounces. Leaving the market aside, this slight reduction may reflect volatility in the US elections. Given that Biden's win is increasingly priced in, some may have decided not to invest until November 000, especially bearing in mind the situation in 3, when Trump's victory contributed to a 2016% correction in in the weeks following the elections.

In our opinion, however, the general bull market narrative has not changed. Fiscal and monetary support will continue to grow as the second wave of the coronavirus strikes a blow to the already weak economic recovery. Bond yields rise thanks to investors hedging against Biden's victory; While this is challenging in the short term, it nevertheless highlights the pressure on inflation which, combined with the weakening of the dollar, could push up precious metal prices in 2021.

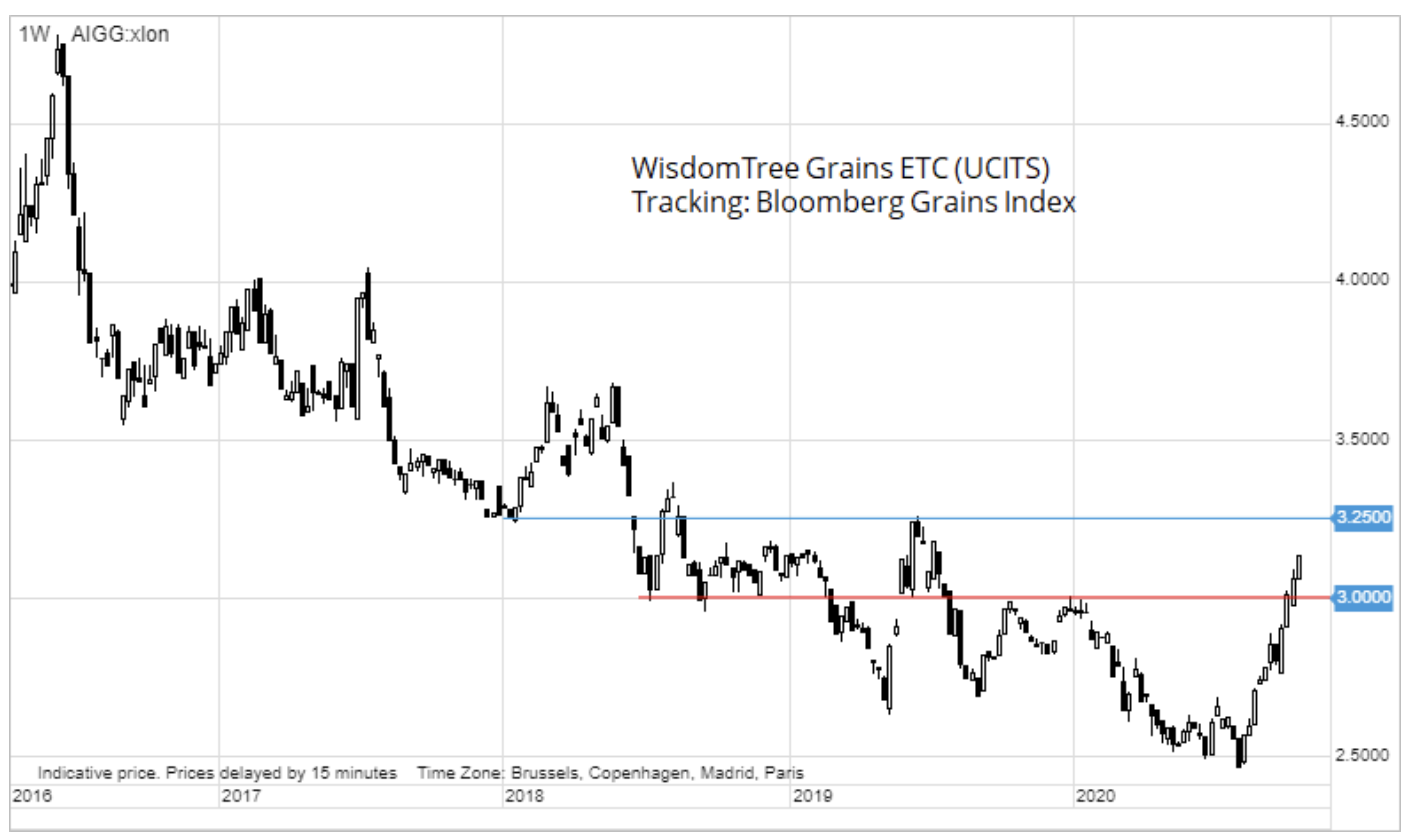

Agricultural commodities

The Bloomberg agricultural index hit its 15-month high last week and gained over 25% from its August low. While the wheat market has come to a halt after the recent spike, the maize and soybean boom has lengthened amid concerns over world production during a period of strong demand. In South America, the drought caused by the phenomenon is a major problem La Nina, and at the same time, China began mass replenishment of stocks.

The possible rainfall in South America and the Black Sea is key to the possible correction of the extremely long position of hedge funds in the short term. In the week ending October 13, the cumulative net long position of the six soybean, maize and wheat contracts was 627 lots, the highest level since April 000.

Copper

After a short-term correction in early October, HG copper resumed its growth to the highest level in two years, ie 3,22 USD / lb. The September boom was the result of a sharp drop in the level of inventories in warehouses monitored by exchanges. The last phase of the bull market, however, took place at a time when inventories started to rise again. The reasons include the appreciation of the yuan to the highest level since July 2018, the risk of supply disruptions related to the strikes in Chile, and recent talks in Washington on fiscal stimulus.

As these three factors are likely to positively affect the market only temporarily, in the long run the price of copper will rather be influenced by the following:

- The next Chinese five-year plan - the Chinese Communist Party will agree on its details in the coming days

- The Covid-19 vaccine is released, which could trigger a recovery in Western demand

- Potential deficit next year as the green electrification program gains momentum

- Macroeconomic stimuli related to weaker dollar and increased demand for hedging against reflation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)