Anti-inflation wallet - how to protect your savings against inflation

A period of high inflation is a very dangerous time for savers. During this time, the purchasing value of money drops noticeably. So a reasonable person will try to protect his wealth in some way. Most often, when there is a rapid increase in prices in the economy, deposits pay interest well below the rate of inflation. This results in a savings holder "forced" to look for an alternative. In today's text, we will introduce what it is anti-inflation portfolio and how you can protect your savings against the loss of value caused by the increase in prices in the economy.

The devastating impact of inflation

Few people realize how devastating inflation is to long-term savings. XNUMX% inflation is not scary in the eyes of the investor. This is an error. It is worth calculating exactly what the value of PLN 100 will be after 30 years of 3% inflation.

After 30 years, the real value of such money will be PLN 40,1. If the average inflation in this period was 5%, then the purchasing power of such a banknote would be equal to PLN 21,36.

As can be seen, for a person who wants to save money for her retirement must find a way to overcome inflation. Only this will allow the sacrifices made today to bear fruit in a few decades. However, it's not that simple. It is much easier to save than to invest in assets that give a satisfactory rate of return at the assumed risk. The saver, whether he wants to or not, must somehow invest the money so that the rate of return is higher than inflation. Keeping them in a low-interest savings account is a bad idea.

What can such a person invest in? The following variants are possible:

- inflation-linked bonds;

- Stocks of companies with pricing power/high switching cost;

- raw material companies;

- Raw Materials;

- Commodity country currencies;

- real estate;

- REITs;

- Broad stock market;

Thus, the components of an anti-inflation portfolio may look like this. Of course, the composition of such a portfolio depends on the level of risk that the investor is able to take.

Anti-inflation portfolio aoinflation-indexed bonds

An anti-inflation portfolio based on inflation-indexed bonds is the simplest and safest way to invest in times of rising prices. The bond buyer receives coupons (i.e. interest), the amount of which is calculated according to the following formula: inflation rate + margin.

If the inflation for the accounting period is 5% and the margin is 1%, the investor will receive interest equal to 6%. Of course, an inflation-linked bond is a good idea in times of moderate inflation because during hyperinflation, which takes an exponential form, the inflation-linked bond is always "lagging" in relation to the current price change.

The great advantage of such an instrument is its little risk. The issuer of such bonds is a government that, at least theoretically (in the case of macroeconomically stable countries), issues debt with little risk of bankruptcy or insolvency. Another advantage is simplicity of investment. It is enough to buy a bond via the Internet or stationary to enjoy receiving interest (quarterly, semi-annually or annually). The downside is that the real rate of return is small.

It is also worth noting that it is also important reinvestment of interestthat will allow you to maintain the purchasing power of your savings. There is a risk that the investor will have trouble reinvesting interest at a similar rate of return (i.e. inflation rate + margin).

Shares of companies with pricing power/high switching cost

Companies that have the so-called pricing power may be an interesting investment idea in a period of higher inflation. It should be remembered that the period of price increase in the economy is very dangerous for companies that compete on price or whose customers are poor people.

Very often, an increase in production costs forces a company to raise prices for its products or services. However, the increase in the price of the final product is not always as large as the increase in costs. When the cost of production rises faster than the price of the product, it occurs margin erosionand even the appearance of an operating loss. Many companies have to accept this, because otherwise they may lose their customers. This is especially likely if the recipients have a negotiating advantage because they are the main customer and at the same time have the ability to easily find substitutes on the market. Such a company does not have the so-called pricing power, i.e. an easy ability to transfer costs to customers.

Another example, of course, is when the company's customers are mainly poor people. Keep in mind that a period of high inflation primarily hits the poorest households. The increase in the cost of living, little or no savings, combined with little chance of finding a better paying job, mean that such people are unable to maintain the standard of living before the period of higher inflation. For this reason, companies focusing on such customers generate much weaker sales growth. Moreover, it may be difficult to fully pass on rising costs to customers, as price increases may force customers to reduce the value of their purchases. As a result, despite the defense of the gross margin on sales, the company will generate lower operating profitability because slower revenue growth than inflation or even a decrease in sales will result in a higher operating cost to revenue ratio than in the pre-inflation period.

These two types of companies may perform worse than the average market. So what type of companies would be a good investment idea? It is worth taking a closer look at companies that have strong pricing power. This term means that the company is able to pass on its costs to customers. This allows you to maintain profitability (and even improve it) when the company is struggling with increasing costs. This is especially important during inflation, when companies without strong pricing power are not able to transfer all costs to their customers.

Who has a strong ability to raise prices without losing customers? There are many companies that have such power. Among the most widespread types of activities that allow you to raise prices. The following types of enterprises can be listed:

- Owner of a strong consumer brand;

- A key component in manufacturing activities with no significant substitute;

- Company with dominant market shares (allows to dictate market prices);

- A monopolist who doesn't operate in a price-regulated industry.

In addition, companies that have customers who have customers have a big advantage high switching cost. Switching cost is a situation when the customer is very inconvenient to stop using the current product. This may be due to the long time required to change the product to another. The second reason is force of habit. If the customer has been using a given product for many years, it may not be easy for him to change for psychological reasons. An example of a company that has a high switching cost is Bloomberg, Adobe or Apple Lossless Audio CODEC (ALAC),. Bloomberg is the provider of terminals used by the world's largest investment firms. In turn, Adobe offers a wide range of services for photographers and graphic designers. Both companies offer some of the best products on the market and have won huge market shares. Customers of these companies know that switching to a cheaper product will require many weeks of study, which discourages them from looking for a cheaper alternative.

Apple products, on the other hand, tie customers with iOS software and good marketing that encourages customers to continue using Apple products. Apple has additionally created a closed ecosystem for its client, which means that many clients do not want to leave the company thanks to the rich offer of additional services. Moreover, the company has managed to position its products as premium, which also psychologically binds customers to the brand.

These types of companies have it easier to pass on rising costs to customers. Of course, this does not mean that they can set prices freely. However, a reasonable price increase for such products is often accepted by customers. For this reason, these types of enterprises will be able to protect their margins in times of high inflation.

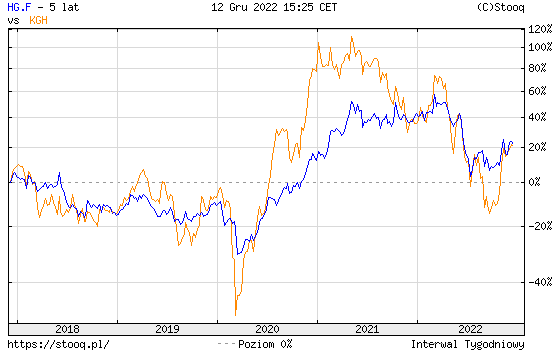

Resource companies

This is another possible way to protect your wealth during high inflation. These types of companies have high operating leverage. For this reason, the increase in the prices of raw materials causes that such companies begin to generate very high operating margins. This may translate into high net profits, which will allow for the payment of a high dividend or to carry out a share buyback. Such actions may cause the share price of a raw material company to increase significantly, which will translate into profit for the investor. These types of companies follow changes in commodity prices, so they are not a good choice for investors who want to invest in a very long-term perspective.

Raw materials and precious metals

This is an interesting investment idea in a period of inflation. Some commodities increase during inflation, which translates into investor profits. Of course, the investor will not buy raw materials in order to possess them physically. The most common commodity exposure is through futures, options, or CFDs. Another investment idea is ETNs or ETCs. Of course, investors in derivatives should be aware that there are terms such as backwardation i contagionwhich have a significant impact on the price of the derivative.

READ: How to invest in raw materials, metals and agricultural commodities? [Guide]

For some, one of the assets that is supposed to protect against inflation is gold and silver. According to the supporters of these investments, gold retains its value in the long term, which cannot be said about fiat currencies. However, it should be remembered that gold performs much worse in the long term than stocks, bonds or real estate. For this reason, gold should be a small component of an anti-inflation portfolio. A kind of buffer that can then be used to allocate to another asset class.

Currencies of commodity countries

The increase in commodity prices causes the currencies of countries where raw materials are the main export commodity to improve the current account and the trade balance. This translates into the strengthening of commodity currencies. Of course, investing in the currency market can be done by:

- Physical purchase of currencies;

- Trading on platforms that provide the currency market;

- Acquisition of shares on the market whose domestic currency is to strengthen (earnings on the exchange rate and increase in the share price).

Real Estate

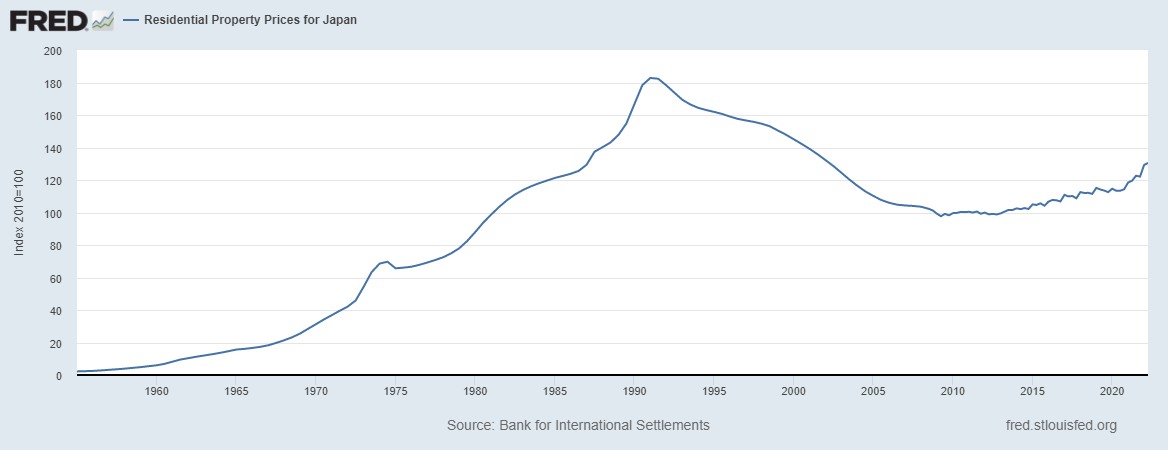

This is another way to protect your property from erosion. Of course, high inflation may cause interest rates to increase, which will weaken the demand on the real estate market and cause a real decline in the value of real estate. However, in the long term, real estate investment can beat inflation. The increase in real estate prices depends on many factors. Among them are: macroeconomic environment (e.g. economic growth, wage growth), location of real estate, demographic structure of the society.

The problem of investing in real estate is the need to have significant capital to ensure the diversification of assets in the investment portfolio. A flat for rent in Warsaw costs a minimum of several hundred thousand zlotys. Considering that the exposure of this class of assets in the investment portfolio should not exceed 20-25%, we are talking about a million investment portfolio. If an investor would like to ensure geographic diversification of the property (different countries), the value of the portfolio could reach over PLN 10 million. It is therefore an unattainable value for most savers.

REITs

It is a way of investing for people who do not have enough funds to purchase a diversified real estate portfolio. Another group of clients are also investors who prefer to take advantage of the increase in the prices of various types of real estate without having to be physically exposed to the market. Investment in REITs they will ensure a dividend and often an increase in the value of the investment portfolio. In addition, they will provide a wide selection of property types. Among them are: office buildings, rental properties, forests, agricultural land, data centers or shopping centers. As you can see, the choice is really wide. Of course, everything is a matter of the price that the investor has to pay for said assets. One of the measures to assess the attractiveness of the investment is dividend rate. This is a percentage value that allows you to determine how much each year the investor will receive dividends in relation to the current capitalization. Another helpful indicator is price to FFO (funds from operations), which, according to many analysts, better reflects the actual profitability of this type of business.

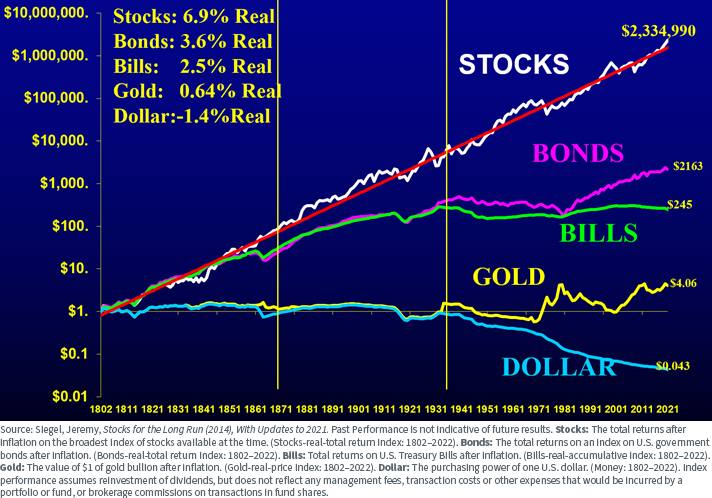

Broad stock market

This is an interesting idea because at what date it may seem that the investor does not multiply his assets. In a period of higher inflation, the broad market may grow slowly in real terms or lose value. But when inflation ends, interest rates fall and a new period of economic boom begins, action will make up for lost time. In the long term, stocks provide a very high real rate of return.

Source: etftrends.com

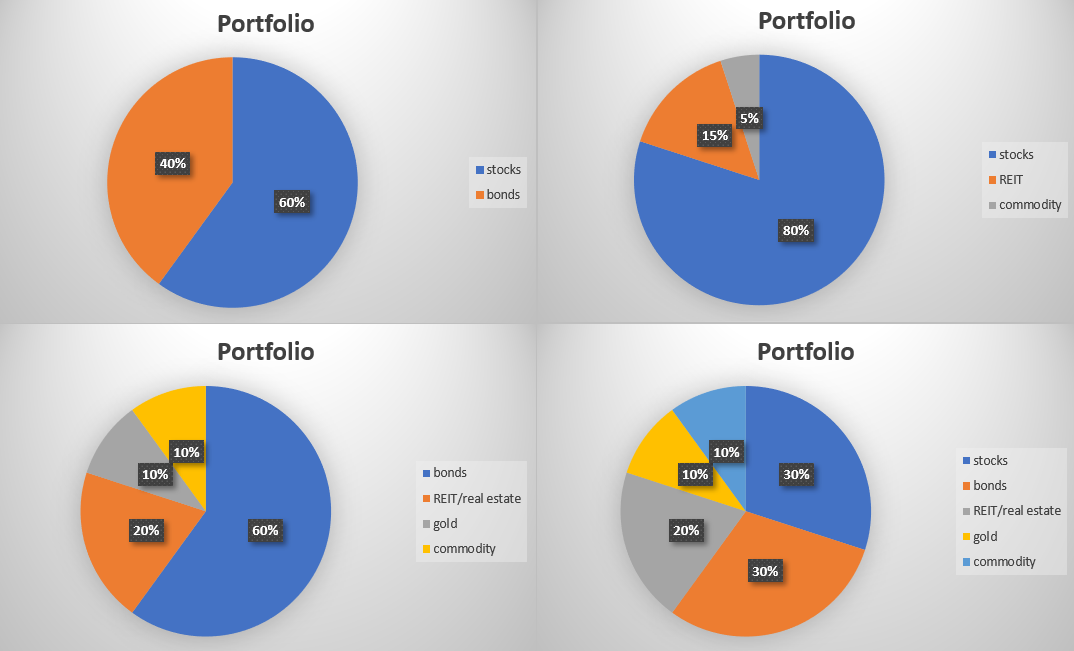

What can an anti-inflation portfolio look like?

First of all, ask yourself what it is investor risk appetite. For some, the stability of the investment portfolio and its small fluctuations are the most important. The second type of investors, on the other hand, is more focused on achieving the highest average annual rate of return, even at the expense of greater portfolio volatility. Below we present some examples of anti-inflation portfolio constructions:

Source: own study

Anti-inflation wallet: Klasyczny

Stocks 60%, Bonds 40%

It is a classic investment portfolio, where we invest 60% in the stock market and 40% in bonds. In this case, it can be slightly modified. Instead of ordinary bonds, it is worth choosing inflation-indexed debt securities. In the case of an equity portfolio, you can focus on shares with strong competitive advantages (moat). This can be seen in the fact that they have a very high pricing power and customers experience a high switching cost in the event of resignation from the company's products. Such a portfolio provides a conservative approach to risk management and ensures high rates of return in the long term. However, it is worth considering the number of companies in the investment portfolio. Regardless of the value of the assets in the portfolio, you should not own more than thirty companies. This is due to the fact that the greater the number of companies, the greater the chance that the results of the equity part will not differ from the broad market.

Having a large part of assets in bonds allows you to take advantage of the possibility of reallocating funds in the portfolio. For example, a fall in stock price will allow an investor to sell bonds to buy discounted stocks. This will allow you to have a lower average purchase, which should translate into generating a higher rate of return in the long term.

Anti-inflation wallet: Aggressive

Stocks 80%, REITs 15%, commodities/precious metals 5%

In the case of this portfolio, the investor gives up holding bonds altogether. Thanks to this, the chance of achieving an above-average rate of return increases. Of course, the disadvantage of such a strategy is susceptibility to high volatility of the value of the investor's assets. The stabilizing part of the portfolio are companies operating as REITs. This gives indirect exposure to the real estate market and offers the opportunity to take advantage of the operational leverage that REITs have. It is worth checking the debt level of such companies. If they have too much debt, the increase in inflation (and interest rates) may cause the debt servicing costs to increase and the company may run into liquidity problems.

Having a 5% share of raw materials will allow you to take advantage of the inflationary environment, which should have a positive impact on the prices of some raw materials. Of course, there is no guarantee that selected commodities will actually rise during inflation. Another idea is to replace raw materials by purchasing precious metals.

What can be found in an equity portfolio? There are a lot of ideas - from companies with a strong moat through raw material companies. The first choice is much safer and allows you to invest in the long term. If companies have sustainable competitive advantages, there is always a good time to invest in such enterprises, even in times of inflation.

On the other hand, commodity companies react much more strongly to commodity prices. When raw material prices start to increase, the market begins to anticipate an improvement in margins. This causes the prices of commodity companies to rise. However, when the price of raw materials stops rising, the market begins to fear that high margins will be difficult to maintain. As a result, there may be downward pressure on the company's valuation.

Anti-inflation wallet: Conservative

Bonds 60%, Real Estate/REITs 20%, Gold 10%, Commodities 10%

It is a very safe portfolio, in which the majority is invested in inflation-indexed bonds. Thanks to this, bond prices do not fall as a result of fears of an increase in interest rates. The disadvantage of investing in this instrument is the small real profit from the transaction. Another part of the portfolio is an investment in "safe" real estate or REITs. Although real estate has less volatility than the stock market in the long term, much depends on the purchase price. There are countries whose real estate indexes have not returned to the top even for several decades. It all depends on previous real estate bubbles, demographics and the macroeconomic environment. A great example is Japan.

One-fifth of the portfolio was invested in precious metals and commodities that may perform better during a period of higher inflation. The disadvantage of such investments is that precious metals and commodities do not generate free cash flow or any added value in the long term. A gold bar buried in a garden will still have the same weight in 100 years. It is different with actions that can pay a dividend, buy shares and/ or reinvest profits in further activity.

The aforementioned portfolio is prepared for very conservative investors who prefer to protect their existing capital rather than multiply it. It is certainly not the best solution for investors looking to increase their assets quickly.

Anti-inflation wallet: Zdiversified

Stocks 30%, Bonds 30%, REITs 20%, Commodities 10%, Precious Metals 10%

The aforementioned portfolio is for investors who want to both profit from equity instruments (stocks, REITs) and have exposure to safe investments that protect value (bonds) and the commodity and precious metals market (20% of the portfolio). Of course, some investors may not like too much exposure to non-performing assets (the aforementioned commodities and precious metals).

Forex brokers offering ETFs and stocks

The market offers a number of solutions for creating a highly diversified anti-inflation portfolio. An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments. You can also easily find a large list of equity instruments, raw materials and metals, as well as foreign bonds. There is also no shortage of alternatives to the "physical" purchase of real estate, e.g. in the form of purchasing shares of selected companies, entire packages in the form of ETFs or REITs.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

An anti-inflation portfolio is an investment strategy that aims to protect capital against the devastating effects of inflation. The structure of assets depends on the risk that the investor is willing to take. The conservative anti-inflation portfolio consists mainly of bonds and instruments giving exposure to the real estate market. On the other hand, an aggressive anti-inflation portfolio consists mainly of stocks that beat inflation in the long term.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)