Poor Man Covered Put (PMCP) – an option strategy for bears

In the previous article, we explained what it is Poor Man Covered Call. In today's text, we'll look at a "bearish" strategy that allows you to gain market exposure with less capital. So this is the topic of today's text Poor Man Covered Put, i.e. a strategy that allows you to earn on the fall in the value of the underlying instrument.

READ NECESSARY: What are options - an introduction

What is Covered Put

Covered put is the opposite strategy covered call. In a covered call, an investor would buy a stock and write a call option "against them". In such a case, the investor received a premium by agreeing to sell the shares at the option strike price.

In the case of the covered put strategy, the investor would sell the shares short and write a put option against them. Thanks to this, he received a premium, but at the same time he limited his profit potential in the event of a large drop in the underlying instrument.

Short selling shares is borrowing shares on the market, selling them at the market price. In such a transaction, the investor hopes to buy back the shares at a lower price than he sold them. The difference between the sale price and the repurchase price of the stock is the profit of the transaction.

Poor Man's Covered Put - building a strategy

The name can be confusing. This is not a strategy for the poor but one of the tools for more efficient capital allocation by the investor. Of course, this strategy will not always be effective. But in many situations, it will allow you to get the same market exposure as Covered Put, but with less investment.

The strategy is created by purchasing a put option with a long execution date (LEAPS i.e. Long-term equity anticipation securities) and delta close to -1. Thanks to this choice, the investor is not exposed to a significant drop in the value of the option as a result of the passage of time (i.e. time decay). On the other hand a high delta ensures that the price of the option will react to a change in the price of the underlying asset. A delta close to -1 means that the option itself has a high intrinsic value. Depending on the strategy, LEAPS can have a delta of around -0,8 and in some cases over -0,9. The lower the delta, the more expensive the long-term option.

After purchasing the put option long execution period, the investor must issue a put option (usually OTM) with a much shorter execution period. This may be due to the assumption that there is a chance for an upward correction in the near future, which will cause a decrease in the value of the put option. Writing a put option will allow you to keep the option premium on the written option.

By purchasing a long-term ITM put option and writing a short-term OTM option, a strategy with parameters similar to the covered put strategy is created. By using options instead of selling shares short, the maximum loss held by the investor is much lower than in the classic strategy.

The saved capital can be invested in other transactions or held as a reserve for better times. The maximum loss (premium paid on the put option) is the "built-in stop loss". The investor cannot lose more than the capital invested in the LEAPS option, less the option premium received.

Sample transaction

On September 16, the investor purchased 1 put option on Amazon shares with a strike price of $200 and expiring on January 19, 2024. The option premium was $76,9, which meant that the investor had to pay $7690. The share price was then $123,8. The investor expected that further declines were inevitable, but assumed that the share price would not fall below $100. For this reason, on September 16, 2022, he issued a put option with an exercise price of $100 and expiring on February 17, 2023. He received $4,90 for it. Effectively, the investor paid for the construction of Poor Man's Covered Put $7200, i.e. (76,9-4,9)*100. This is also the investor's maximum loss.

If an investor were to create Covered Put strategies, they would have to sell 100 shares short Amazon and issue a put option expiring on February 17, 2023. It would also receive $4,9 per share. Thus, after the transaction, the investor would have $490 and would have shorted 100 Amazon shares at $123,8.

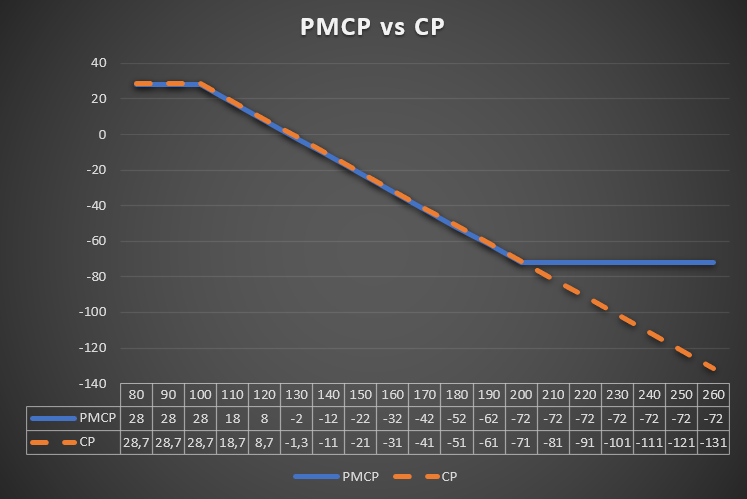

Below is a graphical representation of the payout profile for the Poor Man's Covered Put strategy and the classic Covered Put strategy.

Source: own study

As you can see, PMCP (Poor Man's Covered Put) and CP (Covered Put) strategies have very similar rates of return. Only after the increase of the Amazon rate above $ 200, the PMCP strategy performs better than the PC. This is because the option buyer is only financially liable up to the premium paid. For the short-selling trader, the theoretical loss is infinite (In theory, a company's share price can go up to any amount).

On January 20, 2023, Amazon's share price hit $97. The market valued LEAPS expiring in January 2024 at $102,8. The price of the February put option was $6,55.

| 16.09.2022 | 20.01.2023 | Score | |

| Put Jan 24' $200 | 76,9 | 102,8 | +25,9 |

| Put Feb 23' $100 | 4,9 | 6,55 | +1,65 |

| Amazon | 123,8$ | 97$ | -26,8 |

Source: own study

The long-term put option gained $25,9. So the profit from her ownership was $2590. This meant that the option value increased by 33,68%. The value of the February put option increased by 33,68%. Amazon's share price fell 21,65%.

The PMCP strategy ended with a profit of $24,25, i.e. $2425. In turn, the profit from CP (Covered Put) amounted to $ 25,15, i.e. $ 2515. Thus, the Poor Man's Covered Put strategy made a profit of 3,58% lower, but the investor is protected from the scenario of a sharp increase in Amazon's share price.

Profitable position management

When the underlying asset starts to fall, the investor makes profits from the strategy. The problem is the issued put option, which generates losses in the event of a further decline in the underlying instrument. The closer the strike price of the put option is, the less potential for further profit is. In such a situation, the investor can:

- Close the placed put option,

- Close all PMCP,

- Buy a short-term put option

- Don't change anything.

Closing out a put option that has been written is a good idea if the investor expects the price of the underlying asset to fall further. As a result, the written put option will "eat up" the profits from the purchased long-term put option. However, if the price of the underlying asset starts to rise, closing the short position on the put option causes the investor to accept the loss. At the same time, the price of a long-term put option decreases.

To close the entire PMCP means that the investor is taking profits. If the underlying asset falls further, the investor loses the opportunity to make more profits. The advantage of closing the PMCP is that there is no risk "evaporation of paper profits" and a chance to reinvest the earned cash.

Buying a short-term put option is an idea that allows you to offset a "loss-taking" put option written. Such a strategy makes sense if the investor is very sure of further declines in the near future. If the share price increases, the investor will generate more losses than if he maintained the usual PMCP strategy.

The simplest strategy that tells the investor to wait to let the profits run. This is possible when the price of the underlying instrument is far from the strike price of the put option issued. This allows you to increase the profit from the transaction. This approach to position management does not make sense if the price of the underlying asset has long been below the strike price of the put option sold. Then the position profit will not be higher.

Managing a losing position

When the underlying asset starts to rise, the trader suffers losses on the Poor Man's Covered Put strategy. The problem is the depreciating put option with a high delta. The issued put option is not able to make up for the losses. The investor must decide what to do in this situation:

- buy a call option,

- Close all PMCP,

- Write a short-term put option,

- Don't change anything.

The purchase of a call option allows you to hedge against further growth of the underlying instrument. The disadvantage of this solution is that if the market starts a downward impulse, the investor will lose some or all of the amount for which he purchased the call option.

Closing the entire PMCP means that the investor has accepted the loss. In the case of a fall in the price of the underlying instrument, the investor loses the chance to make up for losses. The advantage of closing the PMCP is "cutting losses", which will enable capital to be allocated to more prospective investments.

Short-term exposure put option may be an idea to "stop" losses and leave the door for profits from LEAPS. This temporarily stops the losses resulting from the growth of the underlying instrument. Of course, the scale of the shield depends on whether the option issued is ITM or OTM.

No change in position leaves the trader exposed to the same risks as before. This means that if the share price or index increases, the value of the purchased put option decreases. If the underlying falls, there is an increase in the value of the put option purchased.

Benefits of Poor Man's Covered Put

The greatest advantage of the PMCP strategy is the protection of the investor's capital against a sharp increase in the underlying instrument of the option. In the classic strategy, the worst situation is when the scenario of a sharp increase in stocks comes to fruition. An increase in the value of a share or index by 70-80% means that a few percent profit on the issued put option is little consolation for the investor. An interesting example is Netflix, which has increased by 13% since the October 73 low.

Another advantage is the chance to build a leveraged position as an investor can build much greater market exposure. This is due to the fact that when purchasing a put option with a large delta, the investor pays 30-60% of the nominal value of the contract.

Cons Poor Man's Covered Put

As with the Poor Man's Covered Call strategy, the disadvantage of PMCP is its lack of flexibility. The investor can use options to be exposed to "bundles" of 100 or 1000 shares.

Another problem with the use of the LEAPS option is "worse" delta than in the case of a classic purchase of company shares. One stock sold short has a delta of -1, while ITM options with high intrinsic value have a delta of -0,80 to -0,95. Thus, the value of the portfolio changes slightly less than in the case of a regular Covered Put strategy.

Summation

PMCP is a synthetic short position with limited loss. The investor may lose funds equal to the value of the put option paid. The big advantage of such a strategy is less capital that is needed to create the strategy.

An investor should think about making a Poor Man's Covered Put when stock prices are "expensive" and volatility is low. This makes it cheaper to buy a LEAPS put option than during a period of high volatility. It is worth remembering that a short put option can be issued under more favorable conditions. Such conditions are, for example, high implied volatility and when the underlying has already fallen and there is a chance for an upward correction.

With PMCP, there is no need to use long-term put options. However, you should buy put options with an expiration period of more than 90 days. In such a situation, the passage of time will not have a large negative impact on the strategy.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response