Pyramid in FX trading

The first stepped pyramids appeared 2650 BC. and were most often used as tombs. Half-heartedly, half-seriously, you can see some analogy to pyramiding in the Forex market, which we are about to discuss - 1) they were used in trading a long time ago, 2) they can become a grave for our account :-) Of course, it all depends on which pyramids we are talking about and how we will create them. But from the beginning ...

Forex pyramiding

What exactly are pyramids and what are their types? Looking at the first sentence of the article, the pyramids generally appear in a stepped form and hence the analogy to Forex market, where the "steps" are the movement of the price of the financial instrument and the moment of concluding the transaction.

The types of pyramids can be classified according to two main criteria - due to:

- direction,

- volume.

Direction

The use of pyramids only makes sense in the trend, regardless of whether we predict it well, because that is what our concept already defines. Therefore, due to the direction the division consists of:

- in line with the trend,

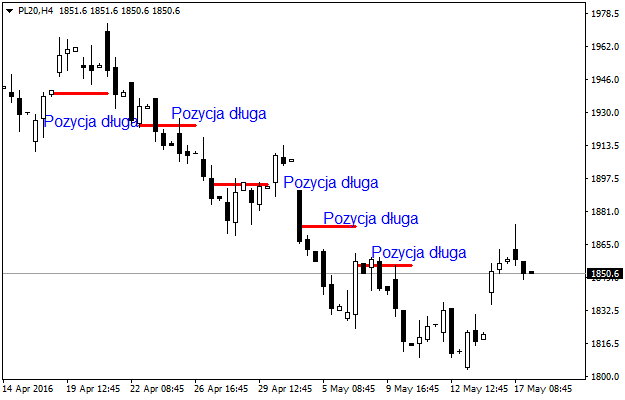

- against the trend.

Of course, it is about the situation in which we start building the next steps - we can add more positions when the rate changes in the direction in line with our expectations or not. Trading in line with the trend is much more rational because we aim to optimize the profit from a given move by increasing the total profit.

However, when we decide to add further items in a situation where the rate moves backwards, it is risk it increases inversely to the potential profit. It can even be said that we optimize the possibility of a loss in order to quickly recover from the correction.

Volume

In the second criterion, three types of pyramids can be specified due to the transaction volume. They are pyramids:

- decreasing,

- constantly,

- growing.

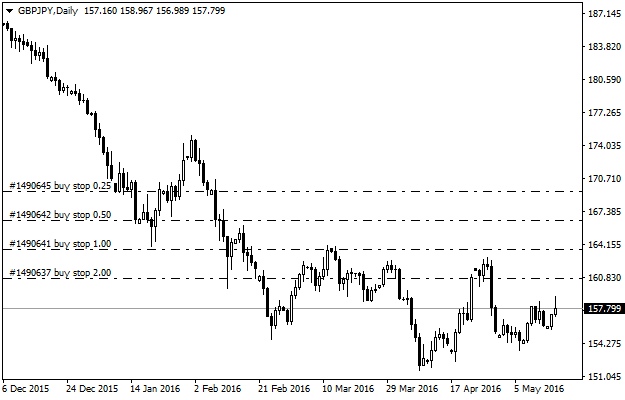

The descending pyramid assumes that with each subsequent item the volume is reduced by the assumed level or percentage, eg by 25% or 50% in relation to the previous transaction. For example, assuming 50% if the first open position was 2.00 flights, the second has the 1.00 lot value, the third 0.50 lot, the fourth 0.25 flight, and so on.

READ NECESSARY: What is the Forex market volume?

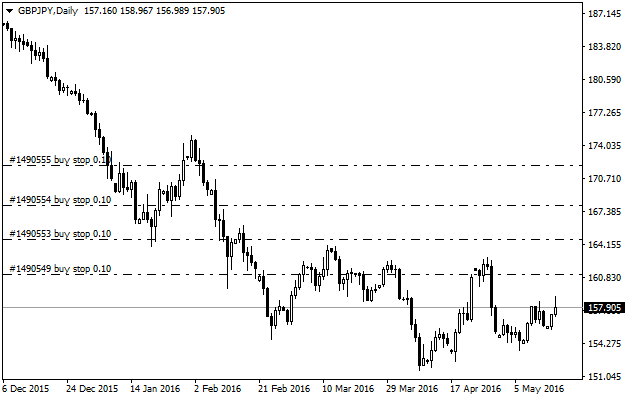

In fixed pyramidation the volume is not differentiated. If we are starting to trade eg 1.00 with a flight, each subsequent item has the same volume.

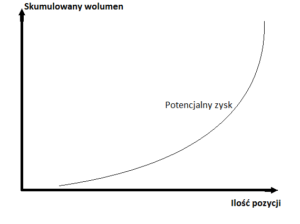

The rising pyramidation is the inverse of the decreasing variety. This means that with each subsequent transaction, the volume is increased by a given value. Assuming 50% if the first position has the 0.50 lot value, the second is for 0.75 lot, the third for 1.50 lot, the fourth for 3.00 flights.

The rising pyramidation is the inverse of the decreasing variety. This means that with each subsequent transaction, the volume is increased by a given value. Assuming 50% if the first position has the 0.50 lot value, the second is for 0.75 lot, the third for 1.50 lot, the fourth for 3.00 flights.

Looking at the pyramids through the prism of risk, the third type is definitely the most dangerous for our account. The premium for the risk is of course disproportionately greater profit in the event of success. This is because it is not enough that we increase our involvement on the market, this is also done on a geometric scale.

Volume and strategy

If we accepted strategy opening positions in line with the trend, we must be aware that this trend will finally reverse or there will be even a small correction in the form of profit taking. It may turn out that even if the first three positions bring us a big profit, the opening of the fourth one, which has a volume, e.g. 6 times greater than the first, in the case of a dynamic correction, will eliminate our entire profit and simply destroy the pyramid that will bury our account.

Pyramid with volume decreased by 50%

Fixed volume pyramiding is relatively easy to calculate because we don't differentiate the value of a single pip relative to a single item, making it easy to estimate the break-even point (break even point). Unfortunately, apart from this advantage, the risk is still relatively high.

The most conservative version with volume limitation for each subsequent transaction provides the best results in my opinion, because it allows to use the trend to a large extent by adding next positions, while the change of direction is likely to ensure, after all, closing the entire position grid at a profit.

How the pyramids are created

In fact, how many traders, so many variations of pyramids, that's why I will present only the most popular assumptions. We can create so-called transaction grid:

1) already at the start, eg before or after opening the first position after the occurrence of the transaction signal

be too

2) to respond to what is happening and add new items depending on the situation.

The first variant is the implementation of preconceived assumptions, where immediately at the beginning with the fulfillment of certain criteria of our transaction system, we set pending orders at a given distance and wait for the trend. The upside is the lack of the need to track the market but the downside is the delay in changing the assumptions if the signal at some point is negated.

The first variant is the implementation of preconceived assumptions, where immediately at the beginning with the fulfillment of certain criteria of our transaction system, we set pending orders at a given distance and wait for the trend. The upside is the lack of the need to track the market but the downside is the delay in changing the assumptions if the signal at some point is negated.

In the second case, constant monitoring of exchange rate fluctuations is required, but also (and perhaps most importantly) a resilient psyche to objectively analyze the situation, even with a large number of positions with a total, relatively large volume.

How much you can earn on it

To demonstrate the power of forex pyramiding, a small demonstration with calculations and comparisons to the results of the classic trading concept has been prepared. The example is hypothetical and intended only to illustrate the scale of the difference in results.

READ ALSO: How to distinguish a trend market from consolidation [Tips]

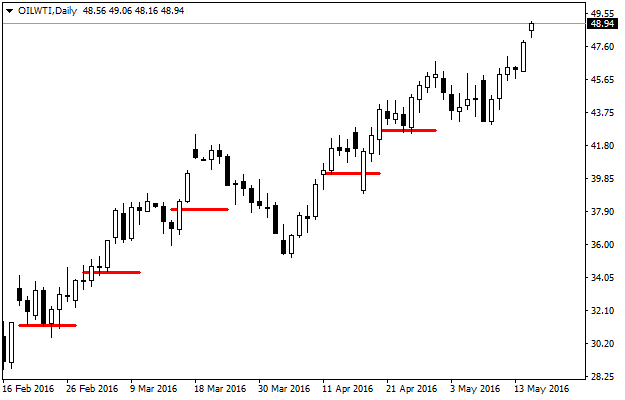

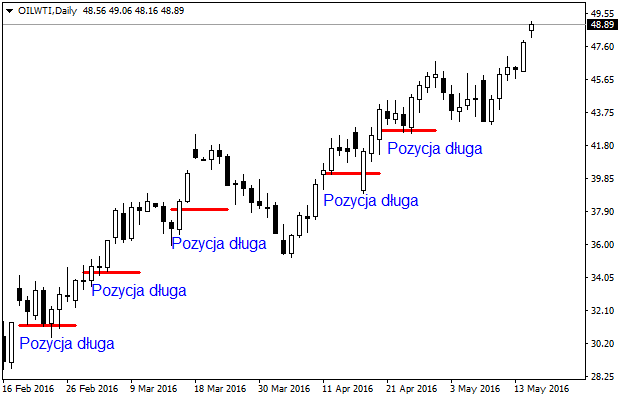

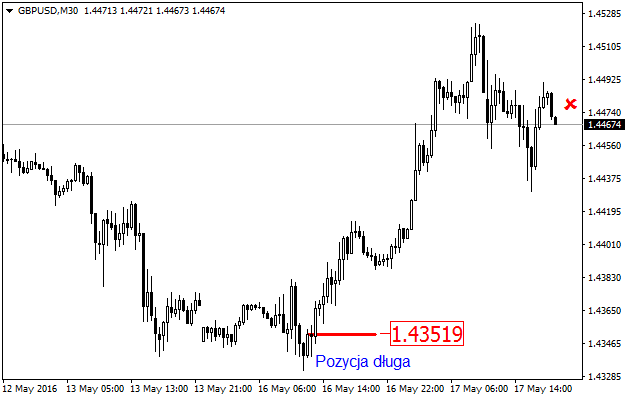

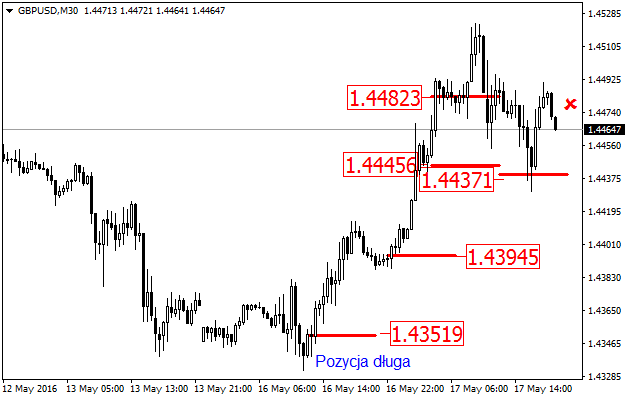

We assume trade in accordance with the trend, the correct direction and positions with a constant volume of 1.0 lot in the pyramid, where subsequent transactions were made on corrections. We do not take into account when the position is closed but only the current, indicative profit in open positions.

1. Classic trade with one item

The result: approx. + 115.0 pips, 1150 USD

2. Pyramiding the position along with the ongoing trend

The result: approx. 221.0 pips, 2210 USD

Although one item would already bring a loss, the result would be almost twice as good. This shows how large opportunities in the optimization of profit are offered by pyramid, but one must not forget about the growing risk of unforeseen, severe loss in the event of a sudden, sudden reversal of direction (eg after the publication of macroeconomic data).

Pyramid and gambling

It can be assumed that the very concept of pyramiding reached the strategy of trading on the casino stock exchange, where it is relatively popular to increase the rate with each failure in order to quickly "break", for example in a game of roulette. And frankly speaking, if we use the pyramids in a not very thoughtful way, additionally using the inverse pyramids (game in line with the trend but adding positions when the rate does not go our way), we can safely say that we stopped investing and started to gamble.

You can find many free and paid strategies on the Internet, the capital curve of which, during back testing, moves very steadily (as drawn from the ruler) up. Very often in the longer term, also from the ruler, finally the capital curve flies very dynamically south. Then we should not have doubts - we are dealing with Grids.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)