Paul Tudor Jones - How to Make Money from the Crash

Paul Tudor Jones is one of the most outstanding investors in history. He is the founder of one of the largest hedge funds in the world - Tudor Investment Corporation. As a consequence, perfect capital management, he became one of the few investors who became billionaires. For many years in his career, he has acted as a counterarian who opens short positions when most buyers and looks for a position to take long during the market panic. It is one of the "old guard" among investors. He is one of the heroes of the book Market Wizards.

Be sure to read: Ed Seykota - A pioneer of automatic trading

Education

Paul Tudor Jones II was born on September 28, 1954 in Memphis, Tennessee. The beginnings of education began in a Presbyterian school. Then he enrolled at Memphis University School. After graduating, he enrolled at the University of Virginia, where he won the University Welterweight Boxing Championship. To pay his tuition, he wrote to the family newspaper (The Daily News) under the pseudonym Paul Eagle. In 1976 he obtained a bachelor's degree in economics. It is noteworthy that Jones entered Harvard Business School (HBS) in the XNUMXs. Tudor believed that the business school would not teach him practicalities, only theory itself. As a result, he did not attend HBS meetings.

Career

After graduating in 1976, Tudor Jones asked his uncle William Dunavant Jr. For introduction to the world of trading. At that time, his cousin was the CEO of Dunavant Enterprises, who was one of the world's biggest players cotton market. William recommended Jones join Eli Tullis, who operated in the New Orleans cotton market. Tullis hired Paul Tudor Jones and taught him to trade in the cotton market on the New York Cotton Exchange. He worked as a flor clerk under Tullis's side, but his analytical work was within the scope of his duties. Thanks to this work, he learned to make decisions and execute orders on the trading floor.

After leaving his job, Paul found employment as a commodity broker at EF Hutton & Co. After working for four years with this company, Tudor made a decision "Go on your own". In 1980, Paul founded Tudor Investment Corporation, which operated as an asset management company. Its headquarters were established in Stamford, Connecticut. Paul's first customers were Uncle Dunavant and Tullis. He started working as a trader on the New York Cotton Exchange. Between 1980 and 1984, Tudor only suffered a one-month loss. This allowed him to acquire new clients, which increased the scale of Tudor Investments operations. Work-related stress as well as general fatigue and boredom with work caused him to move away from a typical trader job to professional asset management. Tudor Investment achieved a phenomenal average annual rate of return of around 19%. However, Tudor's greatest fame came not from the average annual rate of return, but from the great deal of 1987.

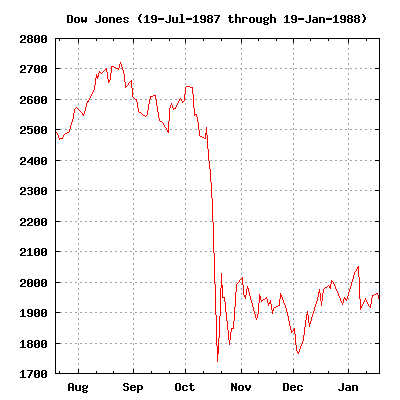

October 19, 1987 is known as "Black Monday". The name stems from the global stock market crash that caused the Dow Jones Industrial Average to drop by approx 20%. It was the largest one-day decline in the index value in the XNUMXth century. However, the loss did not apply to Tudor Investment. Paul Tudor Jones, along with his strategist Peter Borish, "predicted" the crash. As a result, he tripled his assets from short positions. The year 1987 ended with a profit of over 125% of all capital. Thanks to his accurate predictions, Paul gained notoriety. He also became one of the heroes of a famous documentary "Trader". The aforementioned film became a kind of "white crow" because Jones began demanding its withdrawal from public circulation. However, it can still be seen on the Internet on various sites.

1987 was no accident. Tudor Investment earned around 90% in short positions on Japanese stock market. Due to its excellent timing, the fund managed to take advantage of one of the biggest stock market crashes in history. It is worth remembering that in 1991 Jones closed one of the Tudor Select Funds that dealt in futures trading. The capital was returned to investors.

Paul Tudor Jones, shot from the movie "Trader".

Tudor Jones traded as "Global Macro Investor"which focused on making decisions based on macroeconomic premises that relate to the global market as well as specific economic situations in specific countries. Futures contracts were one of the trader's favorite instruments. You can learn from the Trader video that one of the tools that was used by Paul Tudor was Elliot Waves.

Tudor Jones managed capital well, as evidenced by the fund's phenomenal returns. This was because this outstanding investor knew when to risk more (good risk / reward ratio) and when to behave more conservatively.

Property and philanthropy

In November 2019, the magazine Forbes estimated the net worth of this one of the most prominent investors in the world at around $ 5,3 billion. As a result, he was among the top 400 richest people in the world and in the top ten hedge fund managers. Jones donates part of his fortune to charity. In 2019, he and his wife joined Giving Pldege. It is a campaign that aims to convince the richest people to donate most of their wealth to charity. The Giving Pledge campaign was launched in 2010 by Bill Gates and Warren Buffett.

Tudor Jones is also the founder Robin hood foundationwhich was established in 1988. Its aim is to alleviate the problems caused by poverty in New York. The organization also administers a disaster relief fund (e.g. natural disasters) in the New York City area. The organization was founded together with his friends: Peter Borish and Glenn Dubin. The foundation is supported by many well-known investors, including George Soros, who in 2009 donated $ 50 million to the foundation.

Paul Tudor Jones: Investment Philosophy

Paul Tudor Jones shared the pages of the book Market Wizards and in the document Trader your trading style, which can be characterized as follows:

- He likes to play against the market - this does not mean that he is always looking for a low or a downhill, but he realizes that at certain market moments (buying madness or selling panic) it is worth having a different point of view than most market participants.

- Does not average losses - if he is wrong about the direction of the market, he accepts losses. No pyramids lossy position because it is very detrimental to your rate of return. Always has "Mental stop"which is activated when the price of a given instrument exceeds a given level.

- Actively manages the size of the position - in the case of a loss period, it reduces the size of the position so as not to look too much for opportunities to "break". This allows you to avoid playing under the influence of emotions, which can have a significant impact on long-term results.

- Flexibility - does not stick to established patterns. A great example was the recent news of a desire to own 5% of his private wealth in Bitcoinie. Despite being over 60 years old, Paul follows the market trends and does not try to be an "orthodox investor".

- Risk management - During his career, Paul has constantly managed the risk in the fund because he did not want to be held hostage by the market. The awareness of how much he could lose in the case of a negative scenario, gave him investment comfort in both good and bad periods.

- Questioning your positions - this investor believes that one should not be a hero in the market. You should protect your money in the stock market, not your ego. Therefore, it should be accepted that there are series of losses in the market. When taking any position, you should look at its potential advantages and disadvantages.

- The price is the most important - believes that price discounts all or almost everything, therefore it is always "ahead of fundamental changes".

Paul Tudor Jones - a living legend

Tudor Jones is an example of an investor who can achieve long-term double-digit returns. It resulted from his professional approach to investments and meticulous risk control. Being careful about risk did not make him a "conservative" investor. He just knew when to take more risks and when to "let go". Paul continues to follow market developments as evidenced by his recent positive statement regarding Bitcoin.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)