Taxation of Forex Income - Part 3

Forex investors using the services of foreign brokers often forget that the income obtained in this way comes from the country in which the company whose headquarters is located is located. Therefore, it is income that Poland can claim taxation (due to the fact that the person obtaining such income is resident in Poland) and the country where the broker is based. In most agreements on the avoidance of double taxation concluded by Poland, income from the FOREX market is taxable only in the country where the taxpayer is domiciled (i.e. in Poland).

Foreign income: Annex PIT / ZG

Some agreements, however, contain some reservations or exceptions, eg a contract with the US provides for the possibility of taxing this income in the US if a taxpayer spent more than 183 days in the United States in a given year, an agreement with the United Kingdom gives the possibility of taxing these profits in the UK if the taxpayer currently residing in Poland, during the last 6 years he had a place of residence in Great Britain. If the contract provides for taxation of this income only in Poland, we will not have a problem with avoiding double taxation.

However, it may happen that the income will be obtained from a country with which Poland has not signed an agreement to avoid double taxation (eg from Malta, Bahamas, countries that are so-called "tax havens"). If the tax regulations of such a country (or territory) provide for taxation of such income then we will face double taxation (because Polish tax regulations also provide for taxation of this income). In this case, double taxation, in accordance with art. 30a paragraph 9 and 10 updof are avoided in such a way that the tax paid abroad is deducted from the tax due (19%) - as a result, the difference between the Polish tax and the tax paid abroad will remain to be paid in Poland.

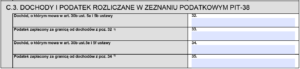

Regardless of whether a tax was paid abroad or not, a taxpayer who obtained income through a foreign broker for the PIT-38 testimony should attach the PIT / ZG attachment - intended for persons earning income from abroad. The income from the Forex market is shown in the C3 part of this annex.

In item 32 PIT / ZG shows the income from the Forex market obtained abroad. In item 33 PIT / ZG we show the tax paid abroad on this account (if it was paid, of course).

The amount of income from item 32 PIT / ZG is the difference between revenues and costs, which should be shown in item 23 and 24 PIT-38 tax returns - other income, similar to PIT 8c.

In item 33 PIT-38 we show you tax deducted abroad.

If the taxpayer earned money both through Polish and foreign brokers, revenues and costs will be added up. In this case, however, the deduction of tax paid abroad can not exceed that part of the tax calculated before the deduction, which is proportional to the income obtained abroad. In this case, the tax amount calculated according to the 19% rate on the total income obtained in Poland and abroad (shown in item 32 PIT-38) should be multiplied by the amount of income obtained abroad (shown in item 33 of the Annex PIT / ZG), and then divide by the amount of total income earned abroad and in Poland (shown in item 27 PIT-38).

And what about the loss?

Despite the best intentions, it may happen that during the year we will lose on the FOREX market. In such a case, should I file a PIT-38 statement?

Pursuant to the provisions of art. 45 sec. 1a point 1 of the Act on personal income tax, taxpayers who generate income from cash capitals are obliged to submit, by April 30, the year following the tax year, a statement on the amount of income (loss incurred) achieved in the tax year. Thus, regardless of whether investing in the FOREX market brought income or loss, the testimony should be submitted.

It should be noted, however, that according to Art. 9 sec. 3 of the Personal Income Tax Act - by the amount of the loss from the source of income incurred in the tax year, it is possible to reduce the income obtained from this source in the next five consecutive tax years, however the amount of the reduction in any of these years cannot be exceed 50% of the amount of that loss.

As a consequence, the taxpayer is entitled to reduce the income from the source of income incurred in the tax year by reducing the income obtained from that source in the next five consecutive tax years, however, the amount of reduction in any of these years may not exceed 50% amount of this loss.

The provision of para. 3 is applicable to losses from the paid disposal of shares in companies with legal personality, securities, including the sale of borrowed securities for a fee (short sale) and paid disposal of derivative financial instruments and the exercise of rights arising therefrom, and from taking up shares ( shares) in companies with legal personality or contributions in cooperatives in exchange for a non-cash contribution in a form other than the enterprise or its organized part, which results from the provision of art. 9 sec. 6 above Act.

Example

The taxpayer in 2018 incurred a loss on the forex market in the amount of PLN 15.000. In the year 2019 also suffered a loss, however, in the amount of 7.000 PLN. The year 2020 brought him a profit of 10.000 PLN. This income can be reduced by losses incurred in previous years, however, in a given year you can not deduct more than 50% loss from a given year. As a result, in 2020, the taxpayer has the right to deduct a maximum of 11.000 PLN (50% from 15.000 PLN and 50% from 7.000 PLN). As the income obtained in 2020 was PLN 10.000, only the taxpayer would deduct this amount (ie 50% loss from 2018 and 35,71% loss from 2019).

If subsequent years also bring profit to the taxpayer, the unused amount of loss (PLN 12.000) will be able to be deducted in those years (with the proviso that the deduction can not exceed 50% and that the loss from a given year can be deducted only for 5 years).

Consultation: Mariusz Makowski, tax advisor

The deadline for submitting the tax return for 2022 is May 1, 2023. (Declarations can be submitted from February 15). We would like to remind you that information about profits or losses achieved with foreign Forex brokers it will not included in the automatically prepared prints in the service Your e-PIT. In this case, if we do not cancel or amend the return, after May 2, 2023, you will need to submit a correction.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)