Earning on currency exchange rate differences on the FOREX market has become very popular in our country. This is evidenced by the number of platforms (Polish and foreign) offering account maintenance, many FOREX websites, guides, internet forums and many investors who try their hand at the currency market.

Along with income earned from investing in the currency (specifically in currency pairs) a question arises about taxes. Unfortunately, the Polish tax office expects us to share profits with FOREX. It turns out, however, that the issue of paying tax on forex profits is not so simple. On many internet forums you can find a lot of threads on the topic, the information appearing on them in many cases is simply untrue, also tax experts and tax officials have doubts.

In this article I will try to explain how to determine the due tax on income earned in transactions on the FOREX market (so-called Forex tax).

What is it earning?

Without going into the details of forex investing and earning it should be noted that we are dealing here with a rather specific type of currency purchase and sale transactions. The specifics of this transaction is that we do not physically buy a currency, we only make speculations on its exchange rate. As a result, the emerging income is also a specific type of income - this is the income from capital.

In March 2005, the Polish Securities and Exchange Commission (KPWiG) interpreted the provisions amending the Law on Public Trading in Securities and considered transactions made by Forex investors for derivative transactions and therefore subject to tax as capital. This is also confirmed by tax regulations. The Act on personal income tax in the catalog of sources of income listed in art. 10 sec. 1 lists the capital and property rights at 7, including the sale of property rights for consideration other than those listed in point 8 (a) a) -c).

Based on Article. 17 sec. 1 point 10 of the Act in question, revenues from cash and cash equivalents are revenues from the payable disposal of derivative financial instruments and the exercise of rights arising therefrom.

Derivative financial instruments as defined in art. 5a, item 13 of this Act, means financial instruments referred to in art. 2 sec. 1 point 2 of the Act of 29 July 2005 on trading in financial instruments (Journal of Laws No. 183, item 1538, as amended).

Pursuant to the provision of Art. 2 clause 1 point 2 of the Act on Trading in Financial Instruments, derivative financial instruments include those financial instruments that are not securities, such as, inter alia: financial futures and other equivalent financial instruments settled in cash, forward interest rate agreements, equity swaps, swaps on interest rates, swaps currency.

The method of taxing these revenues is regulated by Art. 30b paragraph 1 Personal Income Tax Act, pursuant to which income tax, including but not limited to the sale of securities or derivative financial instruments, and the exercise of rights arising therefrom, the income tax is 19% of income earned.

In connection with the above, the income from transactions on the FOREX market should be considered as revenue from the source of revenues specified in the above-mentioned provision of art. 10 sec. 1 point 7 of the Act on personal income tax, i.e. from cash capital.

The above legal justification boils down to the statement that the income from forex transactions is income from cash capital. This is a separate source of revenue, which means that we do not combine these revenues with revenues, for example from work or business activity, and we tax them separately - by applying a linear 19% tax rate to income. Settlement of due tax is made for annual periods on the PIT-38 form submitted to 30 on April. The due tax for the previous year should also be paid within this period.

PIT 38 and the Forex Tax

The correct completion of the testimony and the payment of the tax due is simple in the case of conducting transactions by a Polish broker. He is obliged to draw up a PIT-8C form for the taxpayer (ie investor), in which he shows revenues and costs for a given tax year. Income and expenses from PIT-8C are entered into the appropriate headings in the PIT-38 statement (item 19 and 20) - the positive difference is the income from which we count the tax of 19%.

Example - Forex Tax I

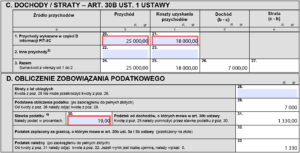

In 2020, the investor used the services of a Polish broker. After the end of the year, he received information from him PIT-8C, in which, in part D, in line 3 (paid sale of derivative financial instruments and exercise of rights arising therefrom) it was shown:

in item 27 - income: 25000 PLN

in item 28 - costs: 18.000 PLN

The investor, based on PIT-8C information, completes the PIT-38 testimony:

in item 20 enters 25.000 PLN

in item 21 enters 18.000 PLN

In item 26 calculates the income of 25.000 - 18.000 = 7.000 PLN

He counts tax on this amount (19% from 7000 PLN gives 1330 PLN) and puts it in item 33. The testimony must be submitted to the 30 office on April 2021. A tax of PLN XNUM must also be paid by that date.

If the taxpayer has used the services of several Polish brokers, then the amounts of income and expenses resulting from the information received from them, PIT-8C sums up and shows in the statement of PIT-38.

The obligation to prepare the PIT-8C information by the broker results directly from art. 39 sec. 3 Act on personal income tax, according to which, natural persons conducting business activity, legal persons and their organizational units and organizational units without legal personality are obliged, by the end of February of the year following the tax year, to send the taxpayer and the tax office which is directed by the head of the tax office competent according to the place of residence of the taxpayer, and in the case of a taxpayer referred to in art. 3 sec. 2, to the tax office, which is directed by the head of the tax office competent in cases of taxation of foreign persons - personal information about the amount of income referred to in art. 30b paragraph 2, prepared according to the established formula (PIT - 8C).

However, the matter becomes more complicated when we invest through a foreign broker (using foreign forex websites). Of course, a foreign broker is not required to prepare tax information in accordance with Polish regulations. So how to settle the Forex tax if we use the services of such a broker?

Investors using foreign brokers must therefore independently determine the amount of revenue and costs. In addition, double tax treaties should be taken into account.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)