Options: Butterfly Spread - earning on non-volatility

Butterfly spread is one of the most popular strategies used to invest in the expected market consolidation. In contrast to inverted rack strategy, the butterfly's strategy, in addition to the maximum profit, also has a maximum loss level. As a result, this is a "safer" strategy than the inverted rack. However, since the investor has to trade 4 options, the strategy generates lower potential profit and higher transaction costs.

Technically speaking, the butterfly strategy is a combination of two spreads: bull and bear. A butterfly strategy can be built from both four puts and four puts. In either case, the trader buys two options and writes two options. The butterfly can be used by traders who assume that the price of the underlying will not change much until the option expires. For this reason, rather short-term butterflies (less than 3 months until option expiration) are preferred. It should be mentioned that all options are to have the same expiry period.

Be sure to read: Options - how to invest with them?

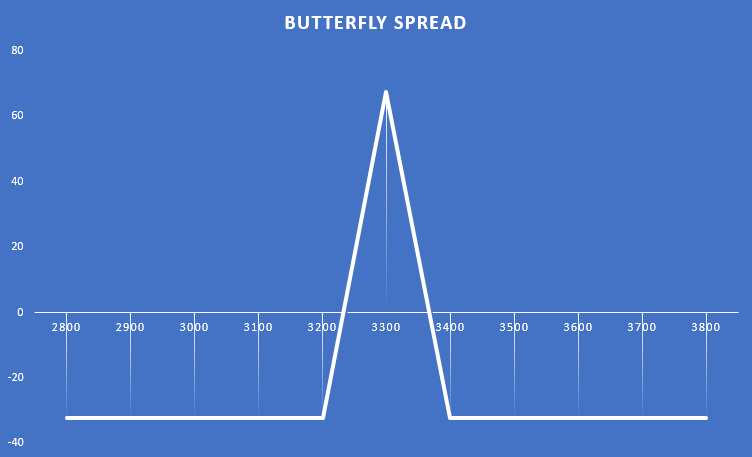

Butterfly spread with call option

In the case of building a butterfly spread using the call option, the investor issues two call options (which are ATM) and buys ITM and OTM options. The premium paid is the maximum loss that the investor can make. In turn, the maximum profit is the difference between the exercise price of the ATM and ITM options and the premium paid. Below is an example strategy using the butterfly strategy.

On August 23, 2021 the course Amazon it fluctuated between $ 3210 and $ 3280 per share. The investor assumed that the AMZN price would not change much until the end of September 2021. As a result, he issued two strike options with a strike of $ 3300 that expired on September 24. For these options, he received a total of $ 10600 ($ 53 in bonuses multiplied by 200 shares). At the same time, he bought call options with an exercise price of $ 107,4, which meant paying a premium of $ 10. At the same time, the investor acquired a call option with an exercise price of $ 740, which cost $ 3400 ($ 3100 per share). Below you can see the payout profile of the created strategy.

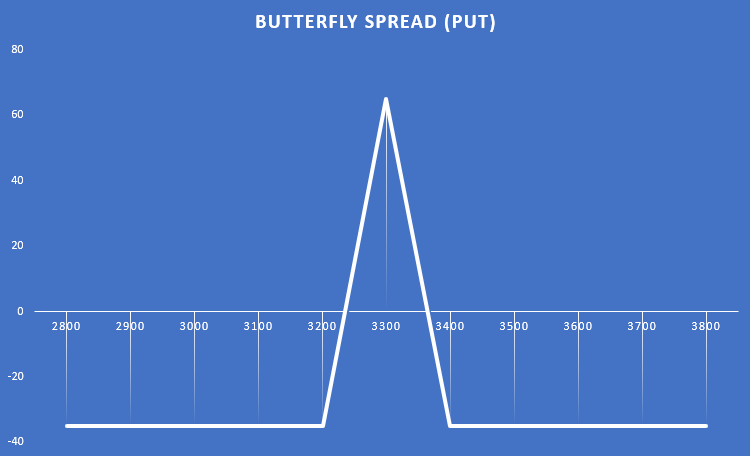

Spread the butterfly with put options

In the case of building a butterfly spread using the put option, the investor issues two put options (ATM) and buys ITM and OTM options. The premium paid is the maximum loss that the investor can make. In turn, the maximum profit is the difference between the exercise price of the ATM and ITM options and the premium paid. Below is an example strategy using the butterfly strategy.

On August 24, 2021, Amazon was trading between $ 3275 and $ 3315 per share. The investor assumed that the AMZN price would not change much until the end of September 2021. As a result, he issued two put options with a strike price of $ 3300 and expiring on September 24, 2021. For these options, he received a total of $ 15120 ($ 75,6 in bonus multiplied by 200 shares). At the same time, he bought put options with an exercise price of $ 3200 with a bonus of $ 50, which meant paying a bonus of $ 5000. At the same time, the investor acquired a put option with an exercise price of $ 3400, costing $ 13610 ($ 136,1 per share). Below you can see the payout profile of the created strategy.

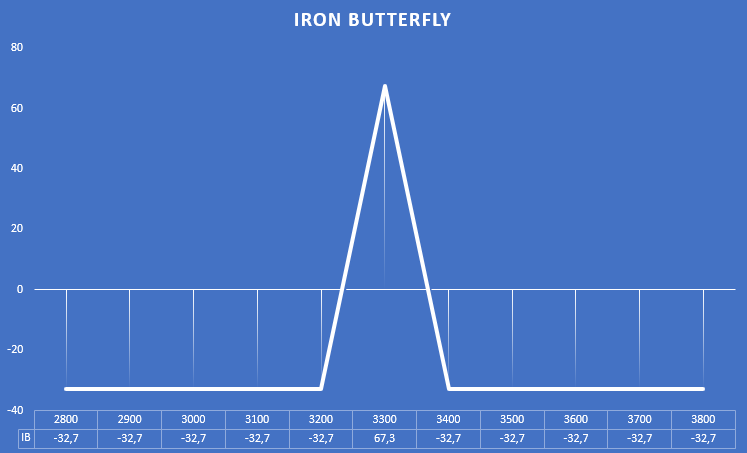

iron butterfly

It is a strategy which consists in buying one put option being OTM, buying one call option being OTM and issuing two ATM options (one call and the other put).

We will use the example again in the Amazon stock. The investor has created a trade using the following options (all expire on September 24, 2021):

- Long position on call option with strike price of $ 3400 (OTM),

- A short position on a call option with an exercise price of $ 3300 (ATM),

- A short put position with an exercise price of $ 3300 (ATM),

- A long put position with an exercise price of $ 3200 (OTM).

The investor made the transaction on August 24. He received $ 7560 ($ 75,6 per share) from his put option. In the case of the written option, the investor obtained $ 8310 ($ 83,1). The obtained funds were used to purchase the call option being OTM. The bonus was $ 4140 ($ 41,4). For the put option, the premium was $ 5000 ($ 50 per share).

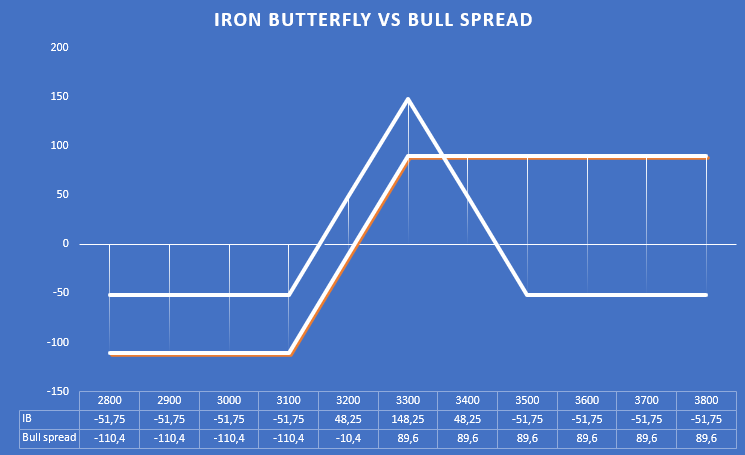

Creating the iron butterfly strategy as a defense strategy

Sometimes the formation of a butterfly strategy stems from a profit-hedging strategy from a previous trade. An interesting example is the bull spread created from the put option. Such a strategy consists in writing an ATM put option and buying an OTM put option. In the event that the market rises, the investor may expect a further price increase is unlikely. In such a case, it may somehow improve the payout profile when the price of the underlying falls.

An example is the situation on August 19, when Amazon's price was around $ 3200 per share. On August 19, an investor issued a put option with an exercise price of $ 3300, for which he received $ 14, and purchased a put option with an exercise price of $ 000, which cost $ 3100 ($ 5040 per share). This resulted in a bull spread with a maximum profit of $ 89,6 per share ($ 8960).

On August 25, Amazon's price rose to around $ 3300. The investor decided to give room for further increases and at the same time reduce the potential loss in the event of a decline AMZN course. To this end, he has made:

- Selling a call option with an exercise price of $ 3300,

- He bought a call option with an exercise price of $ 3500.

The investor received $ 7715 ($ 77,15) from the sale of the call option, while the purchase of the call option cost the investor $ 1850 ($ 18,5 per share). Thanks to this transaction, if the share price fell below $ 3300, the investor would keep $ 5865 from the hedging transaction. As a result, the profit space is in the range of $ 3151,75 and $ 3448,25. Before the trade, the profit area was above the $ 3210,4 level. However, the disadvantage of such a solution is that there will be a loss if the market grows too much. The following is the result of the hedging strategy:

Summation

The butterfly spread should be created by an investor who expects a tight consolidation in the market. A convenient time to use this strategy is when volatility is declining. As a result, the movements of the underlying instrument are not abrupt, which increases the likelihood of the trade ending at a profit. Creating a "book" butterfly spread requires the investor to issue two ATM options (strike price close to market price) and buy one OTM and one ITM option. In the "book" version of this strategy, all options must expire at the same time and be of one type (put or call). However, there is a so-called Iron Butterfly, which is created as a result of issuing put and call options being ATMs and two OTM options (call and put). Sometimes a butterfly strategy may arise as a result of creating a hedging strategy to hedge an earlier bull or bear spread.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![VSTOXX - the European equivalent of the American VIX [Guide] Vstoxx index](https://forexclub.pl/wp-content/uploads/2022/10/Index-vstoxx-300x200.jpg?v=1666609979)

![VIX Index [Fear Index] - in search of market volatility [Video] vix fear index](https://forexclub.pl/wp-content/uploads/2021/12/vix-index-strachu-300x200.jpg?v=1638525622)