Options - how to invest with them? [Introduction]

Options have the reputation of being a complicated and "dishonest" derivative. The reason is the intricate patterns as well "Option scandal" from 2008-2010 and specific vocabulary used by financial professionals. However, contrary to appearances, options are very simple and useful instruments in "Investment palette". Thanks to this instrument, strategies that are difficult to create with other financial instruments can be applied.

In Poland, it is a derivative that is neglected by domestic investors. On the Polish stock exchange, there are only options for the WIG 20 index. This is woefully little compared to the US market (stock options, indices, ETFs, currencies, commodity futures, bonds, etc.). Even local capital markets (e.g. Swedish) have more instruments available with satisfactory liquidity (for a retail investor).

Due to their design (including payout profile), options offer a wide range of investment opportunities. You can get paid for both declines, increasesAnd consolidation a financial instrument within a specified fluctuation band. At the same time, this derivative has many investment options available (exercise level, expiry date). As a result, it is an interesting instrument for both short-term speculators and long-term investors. Possibility is a particularly big advantage of this option combining them into strategies with a specific payout profile. There are so many strategies that both risk-averse investors and traders will find something for themselves "The gambler's vein."

Issue and purchase of options

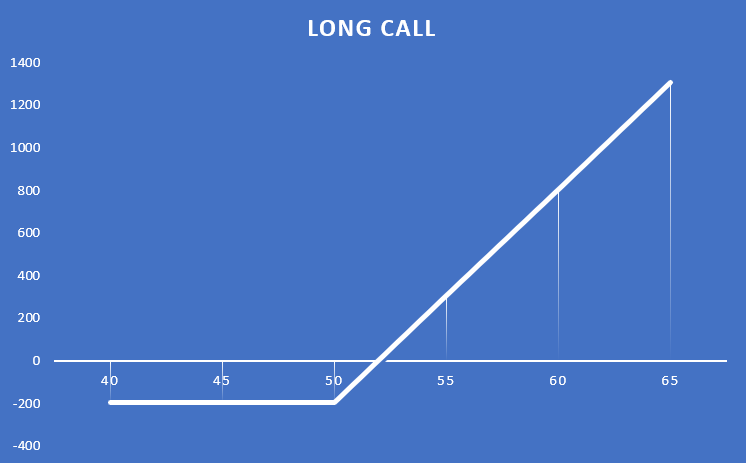

An options trader can make four different trades that have a different risk-reward ratio.

Can distinguish:

- Buying a call option,

- Issue of a call option,

- Buying a put option,

- Issue of a put option.

Buyer of the call option

Acquires the right (not the obligation) to buy the underlying instrument (shares, ETF). In return, he pays an "option premium". As an example, Coca-Cola stock options expire on June 18, 2021. The option strike price is $ 50 and the option premium is $ 1,94. Because one option suits 100 shares of the company, the face value of the contract is $ 5000. In return, the investor will pay $ 194. If the share price is $ 55 on the exercise date, then the investor acquiring the option has the right to buy the shares at $ 50 apiece. As a result, the return on the trade is $ 306 ($ 55-$ -50 = $ 1,94 on each share). If the price drops to $ 3,06 on the day of exercise, the option buyer loses only the premium paid ($ 45 per share), which is $ 1,94. Thus, one can consider the purchase of a call option to "buy" the policy on the company's shares. The maximum profit is theoretically unlimited (but only theoretically), while the potential loss is predetermined (premium paid).

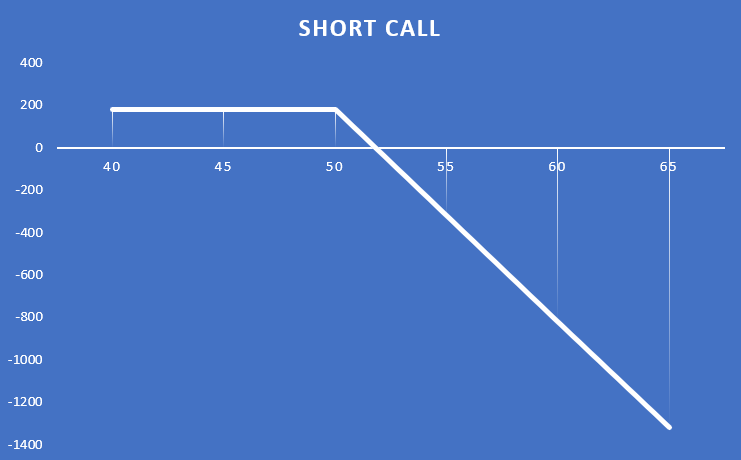

Call option issuer

This is the option seller. The issuer undertakes to sell the underlying instrument (share, ETF) unconditionally at a predetermined price. In return, he receives an option premium. If an investor calls a call option with an exercise price of $ 50 and expires on June 18, 2021, he will receive $ 1,8 on each share ($ 180). If the stock price drops to $ 45 the option will expire worthless. As a result, the option writer will win the $ 180 bonus. If the rate goes up to $ 55, your transaction loss will be $ 320 (50-55 + 1,8). The maximum profit is $ 180 (option premium) and the potential loss (theoretically) is unlimited.

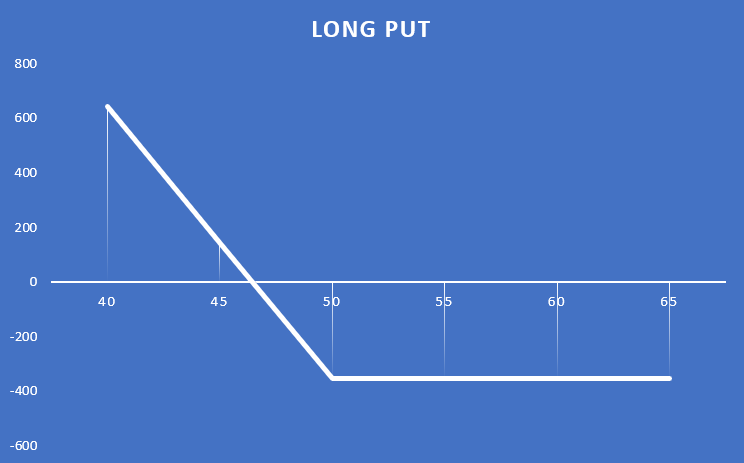

The buyer of the put option

Receives the right (not the obligation) to sell the underlying instrument (share, ETF) at a specified price. In return for this right, the option buyer must pay a premium. For a put option on Coca-Cola stocks expiring in June 2021, the premium is $ 3,55. The exercise price was $ 50. If the share price drops to $ 45, the investor has the right to sell the shares for $ 50. As a result, the profit on the transaction was $ 1,45 per share ($ 50-$ 45-$ 3,55), giving a profit per transaction of $ 145. If the price goes up to $ 55, the trade loss is the premium paid ($ 355). The maximum profit is the strike price minus the premium (the share price cannot fall below 0) and the maximum loss is the premium paid ($ 355).

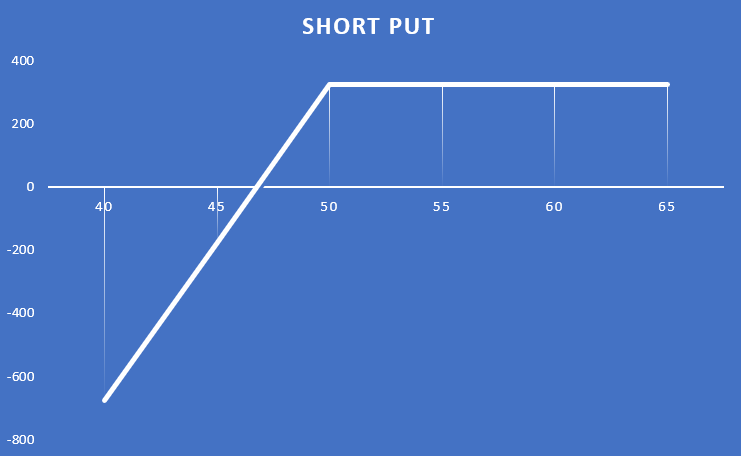

Issuer of the put option

It imposes an obligation to unconditionally buy the underlying instrument (shares, ETF) at a predetermined price. In return for the obligation, the writer (seller) of the option receives an option premium. If an investor writes a put option with an exercise price of $ 50 and expires on June 18, 2021, he or she receives $ 3,25 on each share ($ 325). If the stock price drops to $ 45, the net loss on the trade will be $ 175 ($ 1,75 per share). If the share price rises to $ 55, the option expires without value, which means a profit for the option writer of $ 325. The maximum profit is $ 325 (option premium) and the potential loss is the option strike price (the share price cannot fall below 0) minus the premium received.

Thanks to the use of the option, the investor can with surgical precision determine his maximum loss or potential profit. This is a big advantage compared to instruments such as stocks or futures.

Options are an instrument that can be used, among others down:

- Buying and selling stocks or ETFs,

- Use of leverage,

- Securing positions,

- An additional source of income from owning shares,

- Playing for declines with a predetermined level of loss,

- Earning on the lack of volatility,

- Earning on volatility.

Buying and selling stocks or ETFs

By investing with options, you can buy shares in a given company. This can be done both:

- by buying a call option or,

- by issuing a put option.

It all depends on what strategy the investor has and what he expects from the payout. Although the solutions mentioned may seem counterintuitive. For this reason, it is worth using the example of investing in 100 shares of Coca-Cola. Coca-Cola's share price was $ 49 at the end of Friday's session. An investor wishing to acquire 100 shares of the company may make a transaction by:

- Standard share acquisition,

- Issue of a put option,

- Purchase of a short-term call option,

- Acquisition of LEAPS.

An investor buying "standard" stocks must pay $ 100 for 4900 shares. However, there are alternatives.

You can use the put option expiring on March 12, 2021. The investor then receives $ 0,91 for each share, committing to unconditionally buy $ 49. As a result, the investor can buy the shares for $ 48,09. If the stock rises above $ 49, the investor will keep the premium.

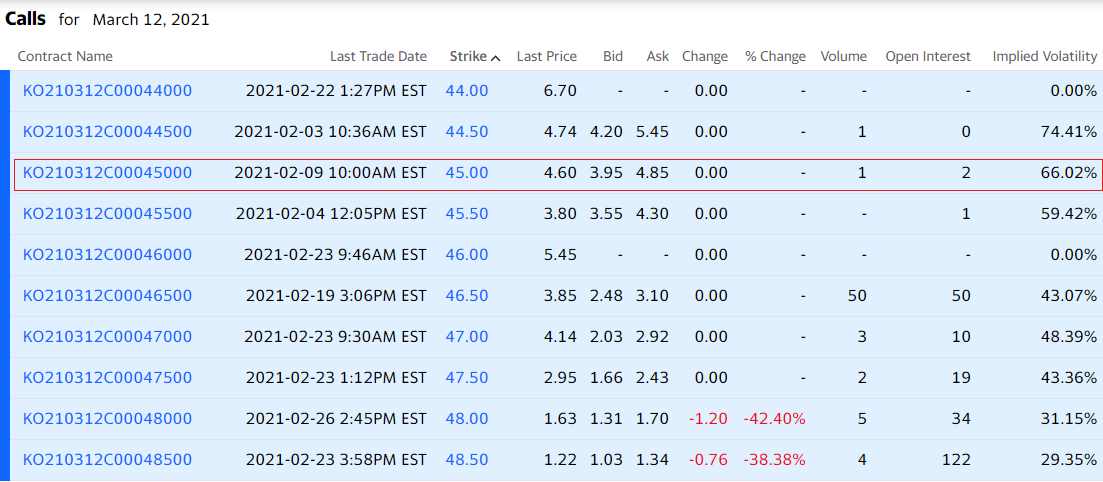

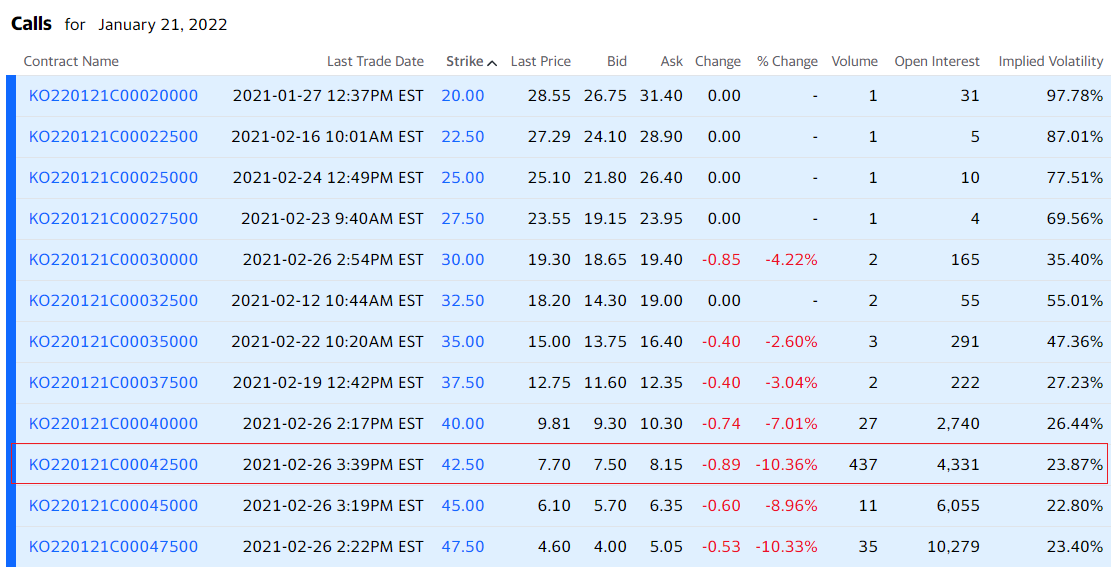

Source: yahoofinance

Another option is to buy a call option on Coca-Cola stocks. The option expires on March 12, 2021. The option exercise price is $ 45. The option premium was $ 4,85. The effective purchase price for the Coca-Cola stock was $ 49,85 (85 cents above market price). The advantage of this solution is the reduction of the potential loss in the event of a sharp sell-off of shares.

Source: yahoofinance

You can also use long-term options (LEAPS - Long-Term Equity Anticipation Securities) on Coca-Cola shares. An example is the purchase of an option that expires in January 2021. The strike price is $ 42,5 and the bonus value is $ 8,15. The effective purchase price for such stocks is $ 50,65. The upside of such a strategy is "Maximum loss guarantee"which is $ 8,15.

Source: yahoofinance

Using the lever

By buying options, you can use the financial leverage in a relatively safe way. As a result, the investor knows in advance how much he can lose. At the same time, the investor can sell the option before it expires. As a result, an investor may open a position well in excess of the available capital. An example is the purchase of a call option on an SPDR S&P 500 ETF. Its face value is $ 40. However, the weekly option is worth $ 000. If the ETF price rises to $ 300 during the week, the profit from the transaction will be $ 600 (300% of the transaction).

Securing your position

Options can be an interesting alternative to creating hedging transactions. It is a tool of particular interest to long-term investors. Instead "Sell winners" in the event of a defense strategy being implemented, a put (sell) option may be purchased. And secure it for any period (day, month, quarter, year). In such a situation, the put option will cover the losses resulting from the drop in the exchange rate. The earned funds can either be used to increase your position on temporarily depreciated stocks, or you can use the generated cash for other assets.

Options can also be a hedging strategy for holders of short positions. This allows you to limit the "potentially unlimited" loss from a short position. It is a kind of insurance against "Short squeeze". Recently, the acquisition of a call option on GameStop actions could protect many short holders from soaring stocks.

An additional source of income from the action

This option application may seem "Weird" an idea to use this derivative on the stock market or ETFs. However, it is very popular "application" options by professional investors. We are talking about strategy covered callwhich is an easy way to generate extra profit from a long-term position in downtrends, sideways and slight increases. Using this strategy on a regular basis can help you generate an additional source of cash from your stocks or ETF ("Option Dividend"). Of course, there are no free lunches, so by writing a call option you agree to "give up" profits above the strike price of the call option.

Playing "safe" for relegation

This is the variance for hedging a short sale position. Instead of taking a short position and hedging the trade with a call option, you can purchase a put option. In this case, the maximum loss is the premium paid for the option. However, the potential profit is the value of the option strike price, less the commission. When you buy a put option, you have a "maximum loss guarantee" that helps you manage your portfolio risk.

Earning on non-volatility

This is another advantage of investing in options that futures or stocks cannot offer. By creating a short rack strategy (issuing a call option and a put option at the same time), the investor makes a profit in the event of a slight change in the price of the underlying instrument.

Earning on volatility

A trader can also build a strategy that earns on high volatility. The creator of a strategy that earns on the increase in volatility is not sure which direction the market will go. However, he is sure that the market will make a dynamic move up or down. For this purpose, it is necessary to purchase a long frame (buy a put option and a call option). In such a situation, the maximum loss is "bonus"paid by the developer of the strategy. In the case of a dynamic price movement, the investor will most often earn a multiple of the amount invested.

Who offers options

Options are not very common in the offers of Forex brokers. However, there are proven companies that offer both vanilla options on currencies and stock options on other asset classes. This group includes, for example, Saxo Bank.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 74% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

The options provide a very interesting one, however "forgotten" financial instrument. This is due to his "Complicated" character and the patch of "toxic instrument". This is sad because with a little bit of time the investor or trader gets a wide range of possibilities with little effort. Thanks to that "Optionalary" will be able to create strategies tailored to their own needs.

Of course, nothing is as simple or as complicated as it initially seems. This article omits the "Greek" options, the impact of volatility or the impact of spreads on the profitability of transactions. We will tell you about it in the next parts of the cycle soon!

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Options - how to invest with them? [Introduction] OPTIONS how to invest](https://forexclub.pl/wp-content/uploads/2021/02/OPCJE-jak-inwestowac.jpg?v=1614538681)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Options - how to invest with them? [Introduction] commodities and bonds](https://forexclub.pl/wp-content/uploads/2021/03/surowce-a-obligacje-102x65.jpg?v=1614597455)

![Options - how to invest with them? [Introduction] crypto-retirement February 2021](https://forexclub.pl/wp-content/uploads/2021/03/kryptoemerytura-luty-2021-102x65.jpg?v=1614628967)