Forex trading in July - mixed data. Volatility remains low.

July was full of many macroeconomic data published for leading global economies. Additionally, at the end of last month interest rates in the US were reduced, which triggered significant market reactions. At first glance, the slow June currency pairs began to recover in July. We could catch some major moves, and volatility eventually attracted investors and forex speculators. Looking through the volume reports of the leading companies in the industry, the results they presented in the publications are really different. On the one hand, one might think that July will be the beginning to overcome the bad luck in the context of volatility, on the other hand the data presented are not reflected in this claim, although there are exceptions.

Be sure to read: Sleeping Markets - June volume in currencies fell by 25%

14,08 trillion euro in management

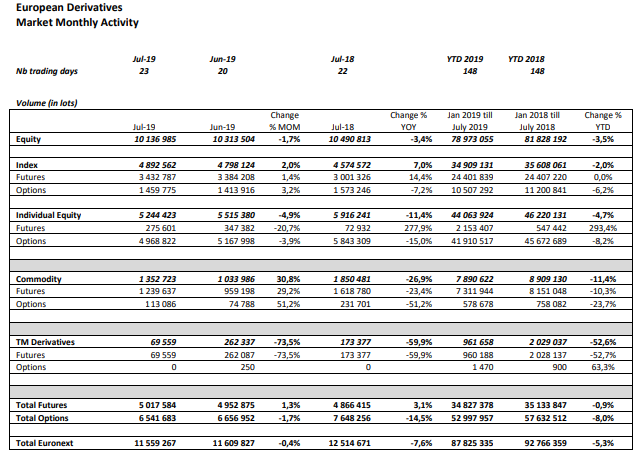

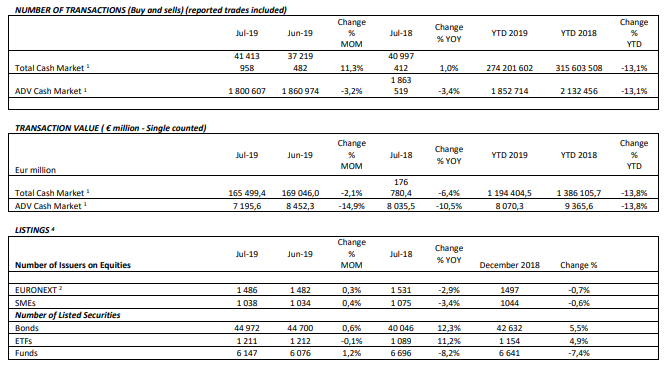

The first report that came out basically recently is the company report Euronext. At first glance, the results are not surprising and do not differ from the industry. Interesting, however, are publications on assets collected by customers. 19.08 trillion euros is under management (as declared by the company at 14,08). This result is 2% better than the one from July 2018 year.

Interestingly, although the company does not record significant increases on a monthly basis, compared to last year, most of the segments (key for the enterprise) recorded increases.

One of the most interesting results that the company presented relates to the ClearStream Investment Fund. According to the data presented, the fund processed 2,6 million transactions. This translates into 31% increase on an annual basis.

There is a high probability that good results are partly due to the expansion of the fund offer, especially on the Australian market. They have been enriched with additional opportunities to invest in currencies.

25% less than a year ago

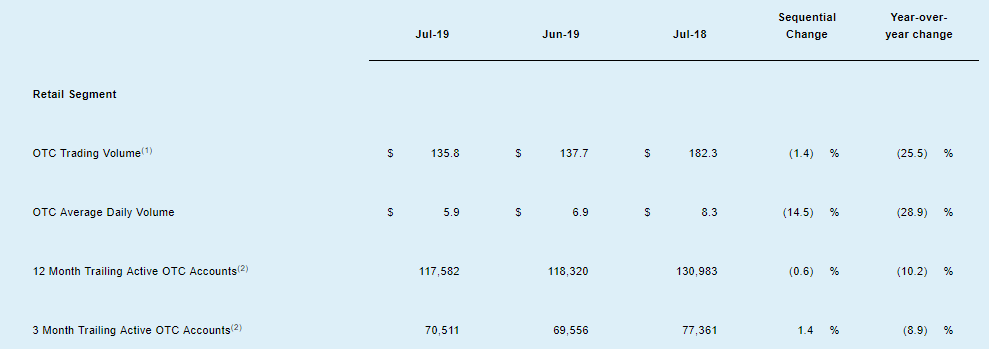

Another report that we've taken a look at is a publication GAIN Capital. Looking at the turnover generated by retail customers, you can see a lot of regression in recent years. They made transactions for the amount of 135,8 billion USD in July 2019.

The group's average daily volumes (ADV) amounted to $ 5,9 billion in July 2019. It represents a decrease of 14,5 percent on a monthly basis. The decrease occurred from the amount 6,9 billion USD per day. Given 2018 year, there was a regression of 29%.

They present interesting data about active and new accounts. Despite the poor data in the context of volume, the number of active accounts has increased. By translating words into numbers, we are talking specifically about 117 582 accounts. This is an increase of about 4 500 accounts. Looking a bit broader at the presented results, they are more than 10% worse than in 2018 year.

July breakdown

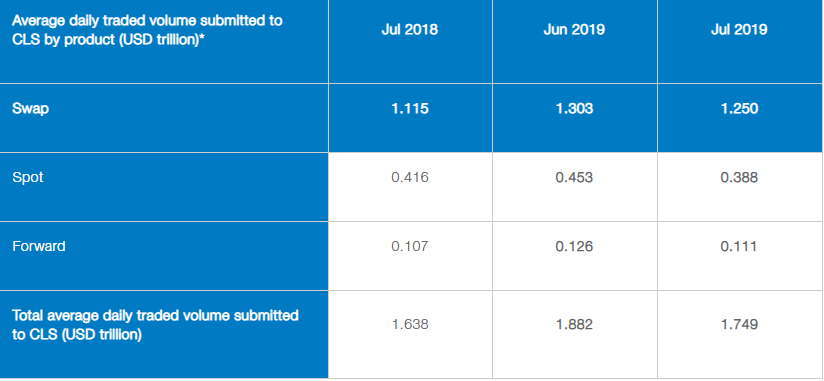

CLS belonged to a group of companies that could boast of growth in June. Looking at the July reports, we can talk about the breakdown of this run. The average daily turnover was at the level of 1,75 trillion dollars. The CLS Group is a leading provider of risk mitigation and settlement services for currency dealers. It recorded a decline in all three segments of its activity.

Comparing the data presented to last month, the average daily trading volume shrank by 7,1%. Considering the annual approach, the result is 6,8% better. Finally, let's look at three company segments: swap, spot and forward contracts. Of these three sections, swap enjoyed the greatest interest, and thus turnover.

Will August surprise us?

Given the July data, sentiment improvement may be expected in some segments. Let's not forget that in August we had some important data from the United States and the eurozone. What's more, some new news has arrived on the market regarding the imposition of customs duties on China and their possible postponement. The escalation of conflict on the one hand conquers the aversion to risky assets and on the other hand tempts to risky moves counting on strong moves on currency pairs.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response