Being embraced - what is it and how to use it in trading

Navigating the currency market with the intention of achieving regular and regular profits is undoubtedly quite a challenge. It is very important to use and skilfully read all the tips given by the market. The category of tips can include technical formations that are created in the chart as a result of price changes. One of such formations, which is relatively rare, but can bring interesting results, is formation bullshitbut also known as taking up the bull market.

In this article, we will take a closer look at this type of formation, we will present a few tips that will facilitate its use in everyday trade, while allowing you to maximize profit and reduce unnecessary risk.

Check it out: The most important candle formations

Description of the formation

When entering a bull market, the context or location is important. The textbook ideal is when it occurs after a long inheritance movement. Then it can signal some kind of exhaustion. Formation arises when the sellers post their profits from the position, and the buyers begin to "enter" the market. This causes the price to be pushed up.

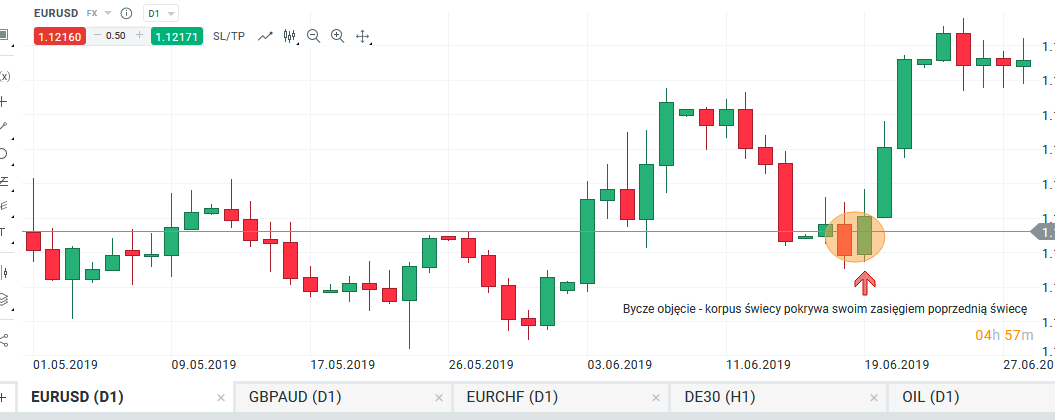

As the name suggests, "embrace" - a covering candle should cover its entire previous candle. It is worth noting that also formation, where the body does not cover the entire previous candle is correct and should not be omitted as a guide. Generally, formation works better at higher time intervals, but it can also be used in typical day-trading. In our article, we will not present "ideal" formations and we will focus on the examples played on the real market.

An example of the formation of a bullish embrace. EURUSD, D1 interval. Source: xNUMX XTB xStation

Be sure to read: MACD instead of moving averages

The use of formation in everyday commerce

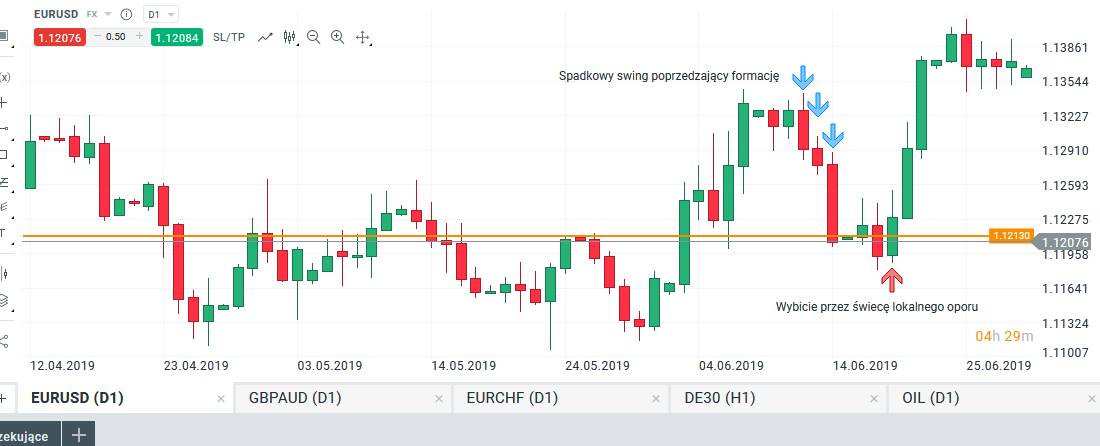

There are many different techniques for playing the bullish formation. A lot also depends on risk aversion and the preferred investment style. The most important aspects that prove the strength of this setup is Preceding the formation with a downward swing and the candle breaking the local level of resistance. Why is overcoming resistance so important? It's about the beliefs that build on the market. The strength of this formation are mainly buyers. If the covering candle covers its downward range and additionally breaks the resistance zone, this is a very strong additional confirmation.

Factors strengthening formation. EURUSD, D1 interval. Source: xNUMX XTB xStation

The next step in the formation of the formation is the principle of changing poles. Defeated resistance now works as support. It is also worth defining further resistance zones, thus defining the potential ranges for the formation and the place where you can set target orders take Profit.

Playing the formation

The last step is to play the formation, in other words, determine where the entry takes place. As I wrote earlier, this aspect depends a lot on risk aversion and the way of trading. The basic methods are as follows:

- If the candle has penetrated the resistance level slightly, you can enter directly at the closure. This is related to the larger setting Stop Loss.

- Another technique to play is to re-test the resistance that is now supported. We are waiting for the price to be withdrawn and we are entering either hand or pending order.

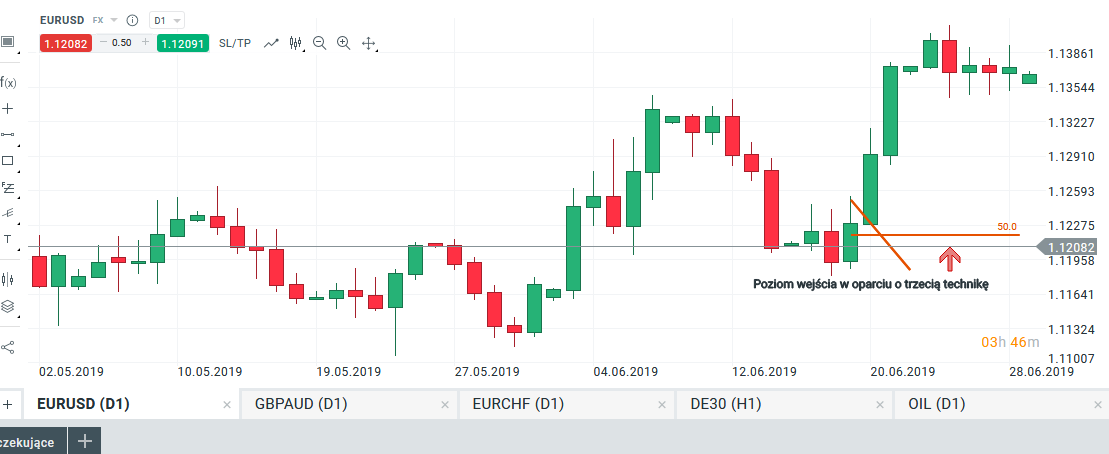

- The third technique is to use the Fibonacci 50% elevation. We extend the net on the candle covering, determine the abolition of 50% and place our buy order there.

Designation of the entry site based on the Fibonacci 50% removal. EURUSD, D1 interval. Source: xNUMX XTB xStation

Summation

Formation of a bullish cover can be a very good way to identify turning points on the market. When playing and using this type of setup, remember:

- well when the candle covering its range completely covers the previous candle,

- the formation can be successfully used as a feedback point to determine the potential bottom in a given market,

- the formations at higher time intervals have higher probability of success,

- the formation should be preceded by a strong downward swing,

- a very strong confirmation is a puncture by a candle covering the local level resistance.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)