Nikkei, Hang-Seng, Kospi - how to invest in Asian indices? [Guide]

The rapid economic growth of Asian countries means that more and more investors want to have exposure to countries in this region. While investing in the Vietnamese, Indonesian or Malaysian market is difficult for the investor, there are many brokers that give access to the most important stock exchanges in the region, which are located in Hong Kong, Japan and South Korea. In the article, we briefly describe the main indices of these markets: Hang-Seng, Kospi and Nikkei. Many of the companies listed on these exchanges are benefiting from the unprecedented enrichment of Asian societies.

Brief characteristics of the countries

People's Republic of China, Japan and South Korea are key economies in Asia. These three countries have a difficult history, but currently they are quite strongly related economically. Below is a brief summary of the countries mentioned:

| China | Japan | South Korea | |

| GDP (PPP) | $ 23 billion | $ 5 billion | $ 2 billion |

| Nominal GDP | $ 14 billion | $ 5 billion | $ 1 billion |

| GDP per capita (PPP) | 17,8 thous. $ | 43,6 thous. $ | 44,1 thous. $ |

Asian stock market schedule

An interesting fact that we will not observe on European or American stock exchanges is the fact that during Asian sessions there is a break in trading, and the sessions themselves last relatively short. In terms of capitalization and the number of listed companies, the Tokyo Stock Exchange is the largest market.

| Comparison of exchanges | Tokyo Stock Exchange | Korean Stock Exchange | HK Stock Exchange |

| Time zone | GMT + 9 | GMT + 9 | GMT + 8 |

| Trading hours | 9:00 - 15:00 | 9:00 - 15:30 | 9:30 - 16:00 |

| Break in quotes | 11:30 - 12:30 | None | 12:00 - 13:00 |

| Capitalization (31.12.20/XNUMX/XNUMX) | $ 6,5 trillion | $ 2,1 trillion | $ 6,1 trillion |

| L. companies (19/02/2021) | 3 755 | 2 421 * | 2 548 ** |

- * KOSPI + KOSDAQ + KONEX

- ** Main Board + GEM

Hang-Seng index

An interesting fact is the access to the Chinese market, which is divided into three categories of companies: A, B and H. Shares of type A are listed in mainland China and quoted in the renminbi. Access to these shares is difficult for foreign investors. Institutions qualified as Qualified Foreign Institutional Investor (QFII) are eligible. On the other hand, companies that decide to issue B shares are quoted in dollars and are much more accessible to foreign investors. The shares of companies A and B are listed on the stock exchanges in Shanghai and Shenzhen.

H-companies listed on the Hong Kong Stock Exchange are a separate category. They are marketed by anyone and priced in Hong Kong Dollar (HKD). For this reason, the first exposure to Chinese companies that are not listed in the US starts with Hong Kong. The key index listed on the Hong-Kong Stock Exchange is the Hang-Seng Index (HSI).

It is the most important index of the Hong Kong Stock Exchange. The index began quoting in 1969. Due to the fact that it quotes the largest and most liquid companies listed on the Hong Kong stock exchange, it is considered a barometer of the condition of the local economy, which has strong economic ties with mainland China.

Hang Seng index weights are, like most major indices in the world, it is based on free-float. A company's capitalization is multiplied by the free float ratio. At the same time, none of the companies may have a larger share in the index than 10%.

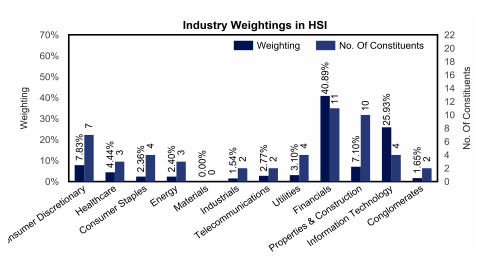

The HSI index consists of 52 components. It is also poorly diversified by sector. Over 66% of the index are companies from two sectors: financial (40,9%) and technological (25,9%).

Source: hsi.com.hk for January 2021

How to Invest in the Hang Seng Index

For an investor who does not want to invest in individual companies, it is possible to take advantage of the offer ETFs. One of them is iShares Core Hang Seng Index ETFwhich the issuer is BlackRock. The annual cost of managing an ETF is 0,09%. Bechmark for the ETF is the HSI Net Total Return Index. Assets under management amount to Hong Kong $ 285 million.

Tencent - Interesting Company in the Index

Tecent Holdings is one of the most famous technology companies in the People's Republic of China. The company operates in many markets (including games, mobile payments, music streaming, social networks). The "pearl in the crown" of the company is WeChat, which is one of the most popular messengers in the world (1,2 billion users). WeChat is a super-application, from its level you can pay (WeChat Pay) and order food, as well as make purchases. In addition, Tencent is the largest game publisher and distributor in China. He is also the owner of the Riot Games studio (incl. League of Legends). Tencent is also a "mini fund" that invests in many companies operating in the Chinese market (JD.com) as well as foreign markets (Activision Blizzard, Epic Games, Mail.ru).

| Tencent | 2017 | 2018 | 2019 |

| revenues | CNY 237,8 billion | CNY 312,7 billion | CNY 377,3 billion |

| Operational profit | CNY 70,4 billion | CNY 78,0 billion | CNY 96,6 billion |

| Operating margin | 29,6% | 24,9% | 25,6% |

| Net profit | CNY 71,5 billion | CNY 78,7 billion | CNY 92,6 billion |

KOSPI 200 index

KOSPI is short for Korean Composite Stock Price Indexeswhich was established in 1983. The base value of the index was set at 100 points (January 4, 1980). It is an index that groups all companies listed on the Korean Stock Exchange.

However, the flagship index of the Korean market is KOSPI 200, which groups 200 of the largest and most liquid companies in the Korean market. The index was established in mid-1994, while the base value was established at the January 3, 1994 session. KOSPI 200 is considered a barometer of the health of the Korean market. It can be said that it is the Korean equivalent the S&P 500 index. KOSPI 200 is a capitalization weighted index. The index may include companies with capitalization in excess of KRW 20 billion or equity capital of KRW 10 billion.

The KOSPI 200 index is the underlying instrument for futures and options. The futures contract was introduced in May 1996. On a futures contract, one index point has a value of KRW 250 (Korean Wongs). As at February 000, 19, the contract's nominal value was KRW 2021 (approximately PLN 105). Futures and options can also be traded on the German stock exchange. Both basic contracts and mini versions are available (one fifth of the value of the KOSPI 235 contract). In the case of an option contract, its value is equal to one futures contract.

The index is very concentrated, the largest company in the index is Samsung. In 2020, a rule was introduced limiting the maximum weight of one company in the index to 30%. The well-known smartphone manufacturer accounts for around 30% of the index. Other significant companies are SK Hynix (over 5%) and Naver (around 4%).

How to invest in the Kospi 200 Index

A very popular ETF with exposure to the Korean market is the iShares MSCI South Korea ETF. Admittedly, this is not a perfect representation of the KOSPI 200 index, as the ETF consists of just over 100 companies. On the other hand, it is a much better diversified investment as Samsung's share is over 22%. The annual management fee is 0,59%. And assets under management total $ 7,8 billion.

Samsung Electronics - an interesting company in the index

It is the largest subsidiary of the Samsung Group. Samsung Electronics is the largest component of the KOSPI 200 index. electronic equipment (smartphones, monitors, household appliances, electronics, etc.). Samsung is one of the largest manufacturers of lithium-ion batteries.

| Samsung Electronics | 2018 | 2019 | 2020 |

| revenues | KRW 243,8 trillion | KRW 230,4 trillion | KRW 236,8 billion |

| Operational profit | KRW 58,9 trillion | KRW 27,8 trillion | KRW 36,0 trillion |

| Operating margin | 24,2% | 12,1% | 15,2% |

| Net profit | KRW 38,6 trillion | KRW 18,9 trillion | KRW 22,9 trillion |

Nikkei 225

Nikkei 225 is the most famous Japanese index. It is a price-weighted index, which is the equivalent of the US Dow Jones Industrial Average (DJIA 30). Nikkei 225 is a blue-chip index, i.e. shares of the largest and most liquid Japanese companies. The index has been computed by the Nihon Keizai Shimbun since 1950. Nikkei 225 may include companies, REITs listed on the Tokyo Stock Exchange.

You can invest in the Japanese index through derivatives. The Nikkei 225 futures contract was established in 1988. The contract multiplier is 1000 Japanese yen. As a result, the nominal value of the futures contract is 30 million yen (over PLN 1 million). A mini-contract is also available, which is 1/10 of the normal contract (approx. PLN 100). As with the Hang-Seng and KOSPI 000 indices, investors can invest in options on a futures contract.

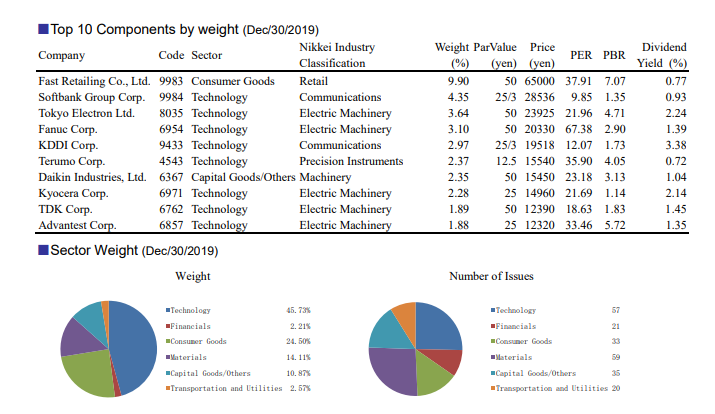

The largest company in the Nikkei 225 index is Fast Retailing, which weighed around 9,9% at the end of December. The next company in terms of weight is Softbank (over 4%). The index is dominated by companies included in the technology sector (a highly developed electromechanical industry).

Source: indexes.nikkei.co.jp

How to invest in the Nikkei Index

One of the ETFs, with exposure to the flagship Japanese index, is iShares Core Nikkei 225 ETF. Assets under management at the end of January 2021 amounted to 863 billion yen (approximately PLN 28,8 billion). The annual management fee is 0,1%.

Another idea is to invest in an ETF with exposure to the Japanese market. An example is iShares MSCI Japan. The annual management fee is 0,51%. The assets under management collected by this ETF exceed $ 14 billion.

Rakuten - an interesting company in the index

It is a company offering many Internet services, one could say that it is an "Internet conglomerate". The company's main products include e-commerce platform (Rakuten Ichiba), online travel and hotel booking services (Rakuten Travel). The company is also the largest online bank in Japan (9,1 million customers). Rakuten also has its own brokerage house (Rakuten Securities) and offers online insurance. The company is also present on the payments market (Rakuten Pay or Rakuten Card).

| Rakuten | 2017 | 2018 | 2019 |

| revenues | 944,5 billion JPY | 1 billion JPY | 1 billion JPY |

| Operational profit | 152,0 billion JPY | 170,4 billion JPY | 72,7 billion JPY |

| Operating margin | 16,1% | 15,5% | 5,8% |

| Net profit | 110,6 billion JPY | 142,3 billion JPY | -31,9 billion JPY |

Popular brokers offering Asian indices

Below is a list of the most popular ones Forex brokers offering the best conditions for CFDs on Asian indices.

| Broker |  |

|

|

| End | Poland | Cyprus / Australia / Mauritius | Great Britain, Cyprus |

| Nikkei 225 | JAP225 | JP225 | JP225 |

| Min. Lot value | Price * $ 10 | Price * 1 JPY | Price * 1 JPY |

| Hang-Seng symbol | HKComp | HK50 | HK50 |

| Min. Lot value | Price * $ 5 | Price * 1 HKD | Price * 1 HKD |

| copy 200 | KOSP200 | - | - |

| Min. Lot value |

Price * $ 500 | - | - |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | PLN 100 |

| Commission | - | - | - |

| Platform | xStation | MT4 / MT5 / cTrader | MT4, MT5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

The XNUMXst century is called the century of Asia. For this reason, it is worth having Asian indices on your radar. The most important of them are the Japanese, Hong Kong and South Korean markets. These markets include companies that belong to the largest corporations in the world (Tencent, Alibaba, Rakuten, Sony, Hyundai, Samsung).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Nikkei, Hang-Seng, Kospi - how to invest in Asian indices? [Guide] Asian indices nikkei kospi hang-seng](https://forexclub.pl/wp-content/uploads/2021/02/indeksy-azjatyckie-nikkei-kospi-hang-seng.jpg?v=1613983334)

![Nikkei, Hang-Seng, Kospi - how to invest in Asian indices? [Guide] Will gold protect against inflation?](https://forexclub.pl/wp-content/uploads/2021/02/Czy-zloto-zabezpieczy-przed-inflacja-102x65.jpg?v=1613983565)

![Nikkei, Hang-Seng, Kospi - how to invest in Asian indices? [Guide] band protocol cryptocurrency](https://forexclub.pl/wp-content/uploads/2021/02/kryptowaluta-band-protocol-102x65.jpg?v=1613993894)

Leave a Response