Nickel - How to Invest in Nickel? [Guide]

Nickel is one raw material mainly used in the steel industry for the production of stainless steel. Nickel is also used to form galvanic coatings to protect against corrosion. For this reason, nickel is used in various industries, such as aviation and petrochemicals. However, recently there has been a lot of hype about nickel because of its use in the production of batteries used by electric cars. An appeal made in mid-2020 by Elon Musk (Tesla's CEO) to increase nickel mining broke through to the headlines. The increase in supply would reduce the cost of producing lithium-ion batteries. The key importance of this raw material is proven by the fact that rumors have been circulating for several months about plans to launch the factory Tesla in Indonesia. The reason is, among others, rich nickel deposits in this country.

Graph - nickel

Nickel plot, MN interval. Source: xNUMX XTB.

The largest producers and the largest reserves of nickel

According to data presented by the United States Geological Survey (USGS), the extraction of nickel in 2020 was estimated at 2 tonnes. The largest nickel producers are:

- Indonesia - 760 tonnes

- Philippines - 320 tons

- Russia - 280 tons

- New Caledonia (overseas territory of France) - 200 tons

- Australia - 170 tons

- Canada - 150 tons

The case of New Caledonia, which is an island in the Pacific, is particularly interesting. The area of New Caledonia (including offshore islands) is over 19 thousand. square kilometers (for comparison, Poland 312,7 thousand). This overseas territory of France produces more nickel than Brazil and China. Together, these two countries extract 193 tonnes of nickel per year.

According to USGS data published in the Mineral Commodity Summaries, the world's total proven nickel reserves amount to 94 million tonnes. At the same time, estimates taking into account potential deposits give the number of 300 million tons. Below is a list of countries with the largest reserves according to the USGS:

- Indonesia - 21 million tons

- Australia - 20 million tons

- Brazil - 16 million tons

- Russia - 6,9 million tons

- Cuba - 5,5 million tons

Nickel grades

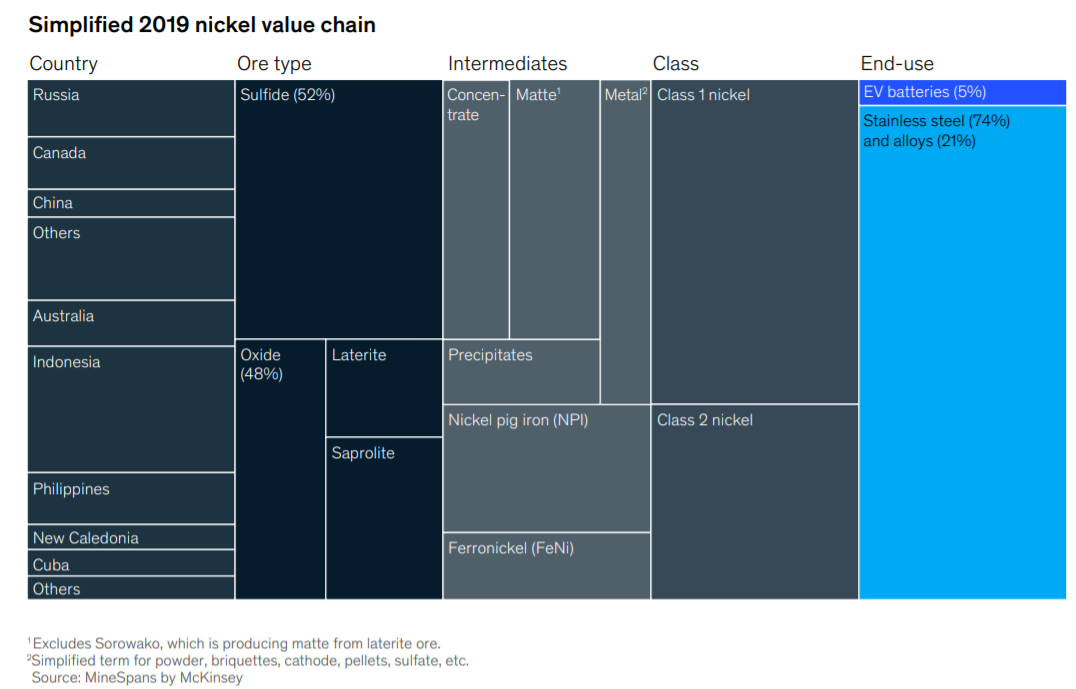

Nickel can be divided into two classes: the first and the second. Different countries have different classes of deposits. At the same time, the individual nickel grades differ in their application. It is worth mentioning that today, first-class nickel is used for the production of lithium batteries. In turn, in the case of steel production, both first and second class nickel can be used. For this reason, the investor "playing" to increase the demand resulting from greater production of batteries should focus on ETFs and companies that provide exposure to class 1 nickel. However, it should be remembered that according to McKinsey's estimates, lithium-ion batteries account for 5-8% of demand for class 1 nickel. It applies to both NCA and NCM batteries. However, it is worth remembering that technologies are currently being developed to create a battery for electric cars that will not need nickel and cobalt. This was mentioned by the Chinese company Contemporary Amperex Technology (CATL).

What affects the price of nickel?

Economic situation

One of the main factors influencing the nickel price is the steel market situation. This is because almost three quarters of the consumption comes from the steel sector (stainless steel). The demand for steel is stimulated by e.g. by construction and infrastructure investments. For this reason, the economic situation in the world economy has the greatest impact on the price of nickel. China is the key country. In 2019, the Middle Kingdom was the largest nickel importer in the world. Import value amounted to $ 5,5 billion. Another important importer was the United States ($ 2,9 billion), Japan ($ 2,8 billion) and Germany ($ 1,9 billion).

electromobility

Another big trend predicted by many analysts is the increasing demand for grade 1 nickel due to the increased production of electric cars. Increased production of electric cars increases the demand for lithium-ion batteries. Their production requires cobalt and nickel.

Raw material supply

The global supply of nickel also has an impact on nickel prices. The increase in nickel prices may induce mining companies to increase production (e.g. through further investments). At the same time, many projects that have been put on a shelf due to high mining costs suddenly become profitable, which may increase global production.

How to Invest in Nickel

There are many ways to invest in nickel. Investments in shares of nickel mining companies are the most popular. Another idea is to take advantage of investing with futures. For investors who do not like to choose individual companies and avoid trading in derivatives, it is an interesting idea to invest through ETFs, ETNs and ETCs.

Projects

Norilsk Nickel PJSC (MNOD)

It is a Russian company established in 1993. Norilsk Nickel is a company that mainly extracts nickel and palladium. Other raw materials sold by the company are gold, silver, platinum and cobalt. Norilsk Nickel is one of the largest nickel producers in the world. In 2019, the extraction of this raw material amounted to over 166 thousand tons.

| Norilsk Nickel | 2017 | 2018 | 2019 |

| revenues | RUB 9 146 million | RUB 11 670 million | RUB 13 563 million |

| Operational profit | RUB 3 350 million | RUB 5 466 million | RUB 7 012 million |

| Operating margin | 36,6% | 46,8% | 51,7% |

| Net profit | RUB 2 129 million | RUB 3 085 million | RUB 5 782 million |

Norilsk Nickel stock chart, interval D1. Source: xNUMX XTB.

OK

The full name of the company is Companhia Vale do Rio Doce. It is a Brazilian mining company, diversified in terms of raw materials and geographically. It is the world's largest nickel producer. In 2019, the production of this raw material amounted to approximately 208 thousand tons. The company has nickel mines in overseas countries and territories such as Brazil, Canada, Indonesia and New Caledonia. The company also has a joint venture in China, South Korea, Japan and the United Kingdom. In addition to nickel, Vale also mines iron, copper, cobalt and kaolinite.

| OK | 2017 | 2018 | 2019 |

| revenues | $ 33 million | $ 36 million | $ 37 million |

| Operational profit | $ 11 million | $ 12 million | $ 13 million |

| Operating margin | 33,1% | 35,1% | 36,8% |

| Net profit | $ 5 million | $ 6 million | $ -1 million |

Vale stock chart, D1 interval. Source: xNUMX XTB.

Futures contracts

Nickel futures are traded on, inter alia, the LME (London Mercantile Exchange).

The contract size is 6 tons and is quoted in US dollars.

First class nickel (99,8% purity) is traded on the LME. The contract is settled physically. The current price is $ 18 per ton. This means that the notional value of the contract is over $ 600.

Nickel CFD

Contracts for exchange differences are a more affordable alternative to futures because they have lower margin requirements. Unfortunately, the choice of brokers offering Nickel CFDs is very limited. Among the recognized brokers in Poland, it is only offered by Dom Maklerski X-Trade Brokers.

| Broker |  |

| End | Poland |

| Nickel symbol | NICKEL |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

| Min. Lot value | price * 10 USD |

| Commission | - |

| Platform | xStation |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETFs, ETNs, ETCs

One of the more popular mutual investment associated with the nickel market is WisdomTree Nickelwhich is Exchange Traded Commodity (ETC). Over £ 547,5 million is raised under this fund. The management fee is 0,49% per annum and an additional annual fee for servicing the swap (0,45% or 0,001233% per day). The ETC benchmark is the Bloomberg Nickel Subindex Total Return. The ETC uses imitation through a swap contract that is hedged.

Another instrument is the Nickel Market ETN, which was issued in 2018 by Barclays Capital. This instrument is the iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN). Assets under management (AUM) amount to less than $ 19 million. The annual management fee is 0,45% per annum. The benchmark for ETN is the S&P GSCI Nickel Index. The index tracked by JJN is Bloomberg Nickel Subindex Total Return.

Where to invest in ETFs and stocks

More and more forex brokers have a wide range of ETFs in their offer.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Investing in nickel can be an interesting idea to diversify your portfolio into the raw materials market. However, it should be remembered that the price of raw materials depends on a number of factors (demand, supply, dollar strength, technological changes). Today, many investors believe that the demand for new lithium-ion batteries will increase the demand for class 1 nickel. However, be aware that another technology may be introduced in the future that will not require as much nickel (which will reduce demand). Another problem for long-term investors is contango effectwhich may adversely affect the investor's rate of return.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Nickel - How to Invest in Nickel? [Guide] how to invest in nickel](https://forexclub.pl/wp-content/uploads/2021/02/jak-inwestowac-w-nikiel.jpg?v=1613726337)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Nickel - How to Invest in Nickel? [Guide] ren cryptocurrency](https://forexclub.pl/wp-content/uploads/2021/02/ren-kryptowaluta-102x65.jpg?v=1613720445)

![Nickel - How to Invest in Nickel? [Guide] lockdown industry](https://forexclub.pl/wp-content/uploads/2021/02/przemysl-lockdown-102x65.jpg?v=1613731474)