Bad licks Forex brokers are already surrounded by quite a legend. The fight on the trader <-> broker line, resulting from the emerging conflict of interest, in which the trader's profit is the broker's loss, leads to abuses. It is obvious that the broker did not set up a business in order to lose on it, and the protection of its own interests will always have a priority. The bigger problem is greed and the lack of transparency, that is "help" on the part of the broker to make his client lose, preferably as soon as possible. For this purpose, various "plug-ins" have been created, which help him not only segregate clients into groups but also offer them various transaction conditions, i.e. execution of orders, slippages, quotes, as well as a whole lot of other goodies.

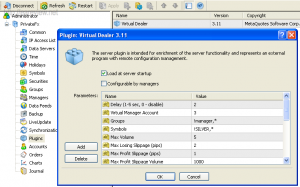

The most popular plug-in for manipulating customer accounts. "Delay" parameter responsible for the delay in the execution of orders.

As traders, we are stuck with brokers and therefore they are stuck with us and our different strategies. We do not expect any broker to admit to using unethical plays. Even though after reading this article you will get the impression that we are taking part in an unequal fight in which we are doomed to fail in advance, know that this is not the case.

Proven Forex Brokers - Summary

Not every broker is our enemy and is playing dirty - and many companies have successfully eliminated conflict situations and thus have become an ally of traders. But in the meantime ...

We present to you our subjective ranking TOP 5 with the description of the most popular bad practices used by dishonest brokers.

Place # 5

Manipulation course

The low rank of this "trick" in the ranking is the result of the following changes in the world of FX brokers. Currently, it is much more likely that a powerful institution (or a group of them) will raise the rate on the market with its orders by cutting our orders Stop Loss (fat fish know where to put them) rather than that the broker himself manipulates the course on his platform. However, this is only an estimate of probability, because we know that sporadically such practices still take place. In short: what is it about? The broker, seeing all their clients' orders, including SL values, can, from the level of their platform / server / application to manage these tools, freely modify the rates of instruments visible on our platform. Not only that, you can do it yourself! You do not believe? Please, here's the proof :-).

The difference is that you can make such a change but only on your platform, while the broker is able to do it globally for all clients or just a selected group.

FX companies are departing from this practice due to the fact that the awareness of traders has increased significantly, and they themselves have several real accounts with different brokers, which makes verifying the "correctness" of the rates extremely simple and fast. I wrote "correct" in quotation marks not by accident. Forex is a decentralized market where there is no single, right price that is a benchmark for the whole world.

Rates on FX platforms have always slightly varied depending on the broker - due to spreads, the degree of data filtering (number of ticks) and the source of their origin. Therefore, before we challenge our broker, it is worth keeping a cool head and sober mind by answering the question "what is the chance that the broker has just cut my order?". I will say from my own experience - currently such numbers happen only in the biggest greedy companies, i.e. companies with a really poor reputation, focused only on profit. If you have chosen such a company as your trading partner, you have, in a way, exposed yourself to additional risk.

HOW TO DIAGNOSE:

Verify whether a similar rate occurred on at least two additional platforms of other brokers (only real accounts!), Taking into account: the type of broker (ECN / STP / MM), the difference in spreads and the degree of data filtering, i.e. compare the number of ticks on nearby candles (read it: What is the volume on the Forex market). Large discrepancies and repeated similar situations may suggest that your suspicions are justified.

Place # 4

Transaction corrections

The problem became particularly well known after the events of January 15, 2015, following the famous SNB intervention. Without going into too much detail: some brokers have adjusted the prices of closed positions not only reducing profits. In some cases, corrections generated huge debits - the broker's argumentation was limited to the claim that transactions were concluded at non-market prices. The situation was extreme, as was the course adjustments, but is similar practice only in these circumstances? Unfortunately not. "Non-market prices" at which we open / close a position may occur theoretically wherever we can speak of the well-known bad ticks (read it: What are badists and where they come from), periods of increased volatility or publication of macroeconomic data. On a calm market, the risk of possible correction falls drastically but does not disappear.

The broker protects himself against any complaints with the provisions in the regulations on the right to be able to adjust prices. The problem is that it does not give the client absolutely no the possibility of verifying the "correctness" of the rate, both before and after the conclusion of the transaction and at the time of the correction. And yet, paradoxically, we enter into orders at prices that are the broker offers us on his own platform (!). As a result, it may turn out that our considerable profit, as a result of corrections, transforms into a small profit, or even a loss (which is certainly good for the broker), while we have to take our broker 's word for it that we' re unlucky ' non-market price ".

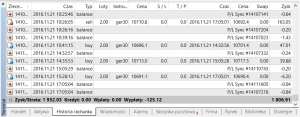

Transaction adjustment performed "on the fly" - P / L Sync items appearing in the summary as "Withdrawal". Loss of profit by PLN 125 (6,5%).

In extreme cases, such corrections occur en masse, not immediately after the position is executed, but only when funds are withdrawn, when the broker refuses to pay out some or even all of the profit.

HOW TO DIAGNOSE:

The diagnosis is actually unnecessary. Unfortunately, we will only find out about the position adjustments after the fact and complaints will be rejected. In this case, the broker will always hide behind the accepted regulations.

Place # 3

Changes to Swap points

We dedicate the 3 number to long-term traders. With strategies such as carry trading, arbitrage, hedging or standard long-term trading, the value of swaps (read it: Swaps without secrets) plays a key role (and even strictly based on them) and often determines the steps taken by the investor and, consequently, its financial results. There is a literally free American among some brokers in determining the value of swap points.

Do an experiment: choose one instrument and five brokers, then compare the swap rates - I bet they won't be the same anywhere. Sometimes it may even happen that where broker A has a positive value for a long position, then broker B will have a negative value. This can be explained to some extent by the different margins charged by the broker on the swap points. But not always. How to explain the phenomenon where, two weeks after using the system based on swaps (carry trading) bringing regular profit, suddenly all the instruments on which I have open positions change to an unfavorable value? It is worth noting that during this time there were no changes in the market, eg in the level of interest rates, that would explain the change of policy. It must be said straightforward - the broker can change the swap points at any time if it deems it to be losing out.

HOW TO DIAGNOSE:

Brokers do not inform about swap changes - when offering several hundred instruments, each change would involve sending relevant information, and be honest - how many of you are interested in swap on SGD / JPY? 🙂 If you are investing long term, monitor the value of your swap points by checking the value on the platform (not on the broker's site!) E.g. via the indicator (Spread and Swap Monitor - DOWNLOAD). If you want to avoid surprises, choose a transparent broker that offers "market" swap rates and publishes a formula based on which these values are calculated.

Place # 2

Artificial slides

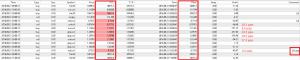

Over the past few years, brokers have managed to get used to the phenomenon of price slippage. slippage). This is the result of the popularization of the ECN and STP model and the market execution of orders. In theory, the ECN / STP model assumes the complete elimination of the conflict of interest, where it becomes only an intermediary of the transaction. And with the proper preparation of the infrastructure by the ECN / STP broker, such a theory may coincide with practice and with this state of affairs we can only talk about natural slippages in the execution of orders (read it: What the price slippage results from). It can therefore be concluded that this is a market phenomenon on which the broker has no influence. But really zawsze this is? Well, NO. Sometimes brokers manipulate price slips. However, the problematic issue is how to distinguish between natural and artificial slip. The procedure itself consists in adding "unnatural" slippage to the orders, so that in addition to the commission or spread, you can earn an "additional" profit by slipping. Recurring slippage in the execution of orders (usually on Stop Loss orders) may result from insufficient number of liquidity providers (ECN), problems with quotations (STP, MM) or greedy (mainly MM). When closing positions from the "hand", in extreme cases, it is impossible to close profitable positions.

Orders executed with a slip on Stop Loss (differences in execution are visible in the selected columns). Market Maker broker.

Another problem is the unfair execution policy. Since we notice a slippage on Stop Loss orders, logically thinking about Take Profit it should look the same. Are you sure? A high-profile case was that the FXCM broker was fined $ 2 million by the American NFA regulator (the American equivalent of the Polish KNF) for not taking into account the positive price slippage (read: NFA message) and the FXCM UK broker for an amount of 4 million USD by the UK supervisory authority FCA (read: Message from FCA) for manipulating slips in the execution of orders. Unfair practice consists in the fair implementation of Stop Loss orders with market slippage, while Take Profit orders are always carried out perfectly to the point.

HOW TO DIAGNOSE:

Check how your broker carries out orders. If, even in a calm market, you are constantly slipping on Stop Loss orders, while on Take Profit this is practically not the case, it's time to get the right suspicions. Remember to keep an open mind, because slippage is primarily a market phenomenon and its occurrence is not necessarily the broker. When analyzing the results, check what happened with the rate further (preferably on the lowest possible interval), what was the dynamics of traffic, whether there were any price gaps and base on the percentage *.

Some brokers keep statistics of their clients' orders regarding the execution of orders over which the regulator watches over. One example is FxPro (check: Data regarding the execution of orders for the second quarter of 2016.). There are also companies that provide tick data (e.g. Dukascopy - historical database) where you can clearly see how the rate changed and whether the slippage was caused by market conditions. The greater the transparency, the less chance of abuse.

Place # 1

Delaying orders

The dirty licks of Forex brokers have a lot to calculate. But this is definitely the number one on our list. The practice has been used for years, which is constantly harvesting. Real terror of scalpers, day-traders, news traders and people using automated strategies. We can safely say that it is a tool that will finish off any uncomfortable trader (for a broker). If you started earning money and suddenly noticed from a certain point that your transactions are carried out much, much slower, know that you came to the Dealing Desk (DD). What does it consist of? It is very easy.

The broker, seeing that you are trading extremely well, loses out as a consequence, because:

- does not secure your transactions on the market,

- it does only partially or

- secures them in an ineffective way ...

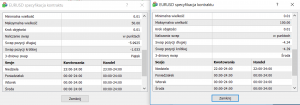

... At the same time, sees no prospect that you will eventually lose all your capital quickly, decides to extend the lead time. The magic button in his system sets the minimum value of time in which your order will be processed by its system (or rather it will be waiting for execution). For this indefinite moment, you can do nothing but wait, the rate changes, and ultimately the transaction is concluded at a different price than you planned. The broker may create a separate group for this purpose (the so-called blacklist) to which he will throw inconvenient customers or assign them individual conditions (not to be confused with preferential conditions 🙂). In the case of dynamically trading machines, a delay of 300-500 ms can do the trick and cause EA to start losing, simply because its reaction will take too long. In the case of scalpers trading manually (so-called "hand") this time is often enough to extend "only" usually from 1-2 seconds up. With such a dynamic market as Forex, it should be enough.

But it's not like the broker sets your DD and forgets about you - now his friend is focused on you. If you are still coping, it can easily extend this time. My record is 57 seconds. Almost a minute that I had to wait every time I wanted to not only open or close a trade, but also modify parameters such as Stop Loss or Take Profit. Of course, I gave an extreme case here where the broker clearly wanted to make me understand that we have to say goodbye. Typically a DD of 2 to 5 seconds does the trick.

In the classic Market Maker model (without the so-called NDD - Non Dealing Desk), the result of delayed implementation is the so-called re-quoting, i.e. re-asking about the willingness to conclude a transaction at the current price that has already changed. Interestingly, the re-quoting appears only when the rate changes in the "good" side for us - in the other direction we will only notice a "slip". It is also worth adding that the practice of delaying orders covers not only transactions concluded "out of hand" but also pending orders (Stop Loss, Take Profit, Trailing Stop action) and their modification.

HOW TO DIAGNOSE:

The way to catch these abuses is trivial. The first step is to compare the current execution time with that from a few days / weeks ago. You need to use the transaction log or saved logs for this. If the times of executions clearly differ, it's time to get suspicious. But let's refrain from judging. The culprit may be, surprisingly, our internet provider, which, as a result of a failure or introduced changes, indirectly increased our ping to the broker's server (there were such cases). Even a new anti-virus installed that slows down data transfer or just a temporary overload of the broker's server (as a result of, for example, several clients who started using machines sending a lot of inquiries - I experienced this too) may be to blame. Usually, this is a temporary state of affairs, but traders have a problem with patience… 🙂

So if you still have doubts, the next step is to check the execution from another computer connected to another internet source. Opening an order, several modifications, checking the time and the matter almost is explained. To be certain, the last experiment can be carried out. For this we need a friend who has an account with the same broker. It's best if you sit next to us and make a deal identical transaction - if the execution times will differ and you notice a constant tendency, you should be 100% sure what happened.

The help of another person is crucial to prove the practice because the broker may impose a delay not only on your account number 12345 but on you in general, i.e. on every account you have open with him, so transferring funds to the sub-account may be of little use.

PS Brokers also monitor IP addresses so it may turn out that you just "kicked" your friend :-).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)