Nick Sleep - a forgotten, outstanding long-term trader [Great Traders]

Achieving above-average returns is not a guarantee of becoming "Investment celebrity". Many prominent investors, such as Nick Sleep, are known only to a small group of people interested in the capital market. Nobody makes Hollywood movies about these people, because their history is not as colorful as, for example, "The Wolf of Wall Street". However, many of the "forgotten wizards of the markets" can provide valuable advice for those interested in investing in the capital market. Over the course of several years, Nick Sleep has achieved an average annual rate of return on investment exceeding 18% per annum. As a result, people who entrusted their funds to Nick achieved a rate of return several times higher than an investment in an ordinary index that mimics the global stock markets.

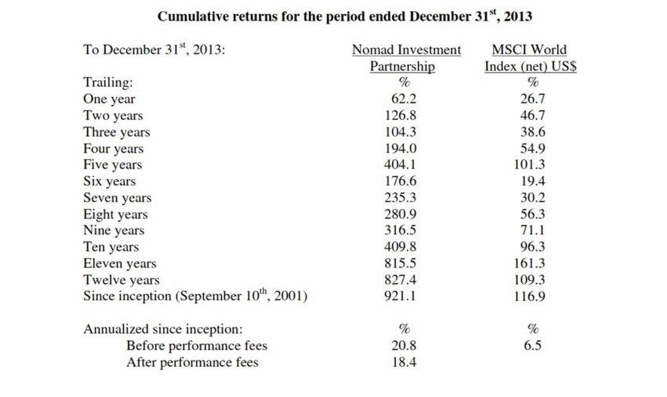

According to the last letter to investors, the Nomad fund generated 10% profit (after fees) from September 2001, 2013 to December 921,1. At the same time, the MSCI World Index returned 116,9%.

Source: Letter to investors for 2013.

In today's article, we will introduce Nick Sleep's investment policy. We invite you to read!

Discovery of SES companies

Nick Sleep's story is related to the Nomad fund, which he co-managed with Qaus Zakaria (UAC). The Nomad Investment Partnership was founded in early September 2001 and began investing on September 10 of the same year. It was not the happiest time to start buying stocks. A day later it followed attack on the WTCand a slump in tech stocks began not long before that followed the bursting of the bubble on the "dotcom" companies.

Initially, the fund invested in "typical" value companies. They were not perhaps the best companies in the world, but they were valued well below their intrinsic value. So it was a slightly modified classic investment in cigarette butts, the creator of which was a legendary investor Benjamin Graham.

However, over time, however, Nick Sleep realized that the current diversified "cigarette butts" portfolio must evolve into a more concentrated long-term portfolio.. This meant that Nick and his associates had to search for "compounders", companies where "compound interest" plays the main role. This type of company they increase the intrinsic value thanks to the increase in the scale of operations and improvement of operational activity. The choice fell on the companies managed by the founders, which operated according to the "scale-economic shared" model (the so-called SES businesses). It is a type of enterprise where the "flywheel" operates from the supply-side. A flywheel in such a business is very difficult to get started, but if it does, it then becomes a self-propelling mechanism that allows you to quickly build a scale without the need to drastically increase investment costs. As a result, companies operating in the SES model gain a great advantage over the competition. A company that takes advantage of the economies of scale is able to offer cheaper services and products than the competition. Greater economies of scale attract more customers. To focus on these companies was to take famous advice Charlie Munger:

"Pick a simple idea and take it seriously."

After some time, Nick and Zak selected three companies:

- Amazon,

- costco.

- Berkshire Hathaway.

These were companies operating in or investing in SES-type enterprises. Moreover, the main shareholders of the selected companies were their founders. According to Sleep and his colleague Zak, the founders focus more on the long-term vision of the company than hired CEOs. This portfolio structure allowed the managers to focus on analyzing the best businesses in their opinion and to focus on their investments.

Golden investment advice

In the further part of the article, we will focus on the presentation of the main investment principles that guided the managers of the Nomad fund. Interestingly, Nick Sleep did not have any original thoughts. But he did something that most investors find unattainable:

- developed a perfect system for himself,

- was patient

- he used common sense.

NickSleep: Think long term

Nick always made decisions thinking about the long term. Thanks to this, he had "Speed bump"that kept him from making emotional investment decisions. Sleep understood that the worst investment mistake was to get rid of the long-term compounder from the portfolio. Time is a friend to such a company, so don't worry when the stock is in a consolidation or temporary correction. Nick thought that you should focus on the best companies that will deliver above-average returns in the long term, rather than trying "To catch the top and the dimple" on average companies. At the same time, Nomad fund managers ignored the information noise, which they included:

- Economy data (inflation, unemployment),

- Quarterly financial results.

- Sell-side analyst recommendations,

- Daily "news" (ie Daily market action).

By ignoring the buzz of the market, Nick did not give up his willingness to sell the company due to a "weaker quarter" or "recession risk". This, in turn, limited the risk of selling a great company under the influence of emotions (fear, greed).

Focus on the purpose of the enterprise

Understanding the company's goal allowed Nick to ask better questions on how the company operates (acquires customers, generates income). Additionally, if Sleep knew what the company's goal was, it could learn the company's DNA (what employees it is looking for, how it will allocate capital). Some of the questions Nick asked himself while analyzing any business are:

- What will the company look like in 10-20 years?

- What does management have to do now to achieve the set goals?

- What circumstances may prevent the company from achieving its goals?

As you can see, the questions relate to the goals and measures that a company must take to achieve its long-term goals. Such action, combined with "avoiding information noise", made it possible to calmly follow the company's activities.

Compound interest machines

Nick Sleep regretted that he initially invested in cheap companies that can be characterized as "butts", i.e. cigar butts. As he mentioned, if only he could turn back time, he would turn his fascination with average and cheap companies into focusing on the analysis of the DNA of companies. It is worth emphasizing Nick's quote in one of his letters to investors:

"(...) one of the things I have learned in the last few years of investing is that the most profitable thoughts come from getting to know the company's business in depth rather than being more contrarian than other investors."

This is an interesting quote as it suggests that a good investor does not have to be original. Sometimes this "obvious" deal is potentially more profitable than a "forgotten" company. There are no points for difficulty in investing.

According to Nick, investing in companies that are compound interest machines is the "holy grail" of investing. For example, Costco has generated a fantastic shareholder return through its economy of scale. Another example is Berkshire Hathaway, which is thanks to its investment genius Warren Buffett and Charlie Munger acquired great companies at ordinary prices. As a result, Berkshire achieved a medium-term rate of return of over 20%.

Nick took Munger's words about the return on capital very deeply. According to Charlie Munger, investing in companies that generate a 6% return on equity provides a similar return for the investor in the very long term. So if the investor finds a company that will earn 20% on the invested capital, then the price paid for such a company is not the key to achieving a double-digit rate of return in the next 30 years.

Focus on founders and management

Nick paid special attention to how the company's founders and top managers treat their work for the company. The ideal founder does not focus on the compensation, bonuses or options he receives from the company. Instead, it makes sure that the company provides an increase in intrinsic value. Then the stocks held by founders and managers will be worth a fortune in the long run. This is how Jeff Bezos and Warren Buffett made their billions. Instead of focusing on quickly becoming multi-millionaires, they chose the path of painstakingly building billions of dollars.

The founder of the company is usually more focused on the development of the company because they have more to lose than a typical manager (skin in the game). In turn, mercenary management focuses more on short-term goals that will quickly translate into an increase in the value of shares. That's why, that "Hired" CEOs receive most of the remuneration in options and shares, their "care" for the company usually does not last longer than a few years. This phenomenon has earned its name in the investment community as "short-termism". Among the companies that benefited from having founders focused on the long-term development of the company, the following can be mentioned:

- Amazon,

- Apple Lossless Audio CODEC (ALAC),,

- Berkshire Hathaway,

- Constellation Software,

- costco.

Each of the founders of these companies created a great corporate culture that allowed the company to adapt to changing market conditions. As a result, each of these companies ensured an above-average rate of return for investors in the shares of these companies.

Invest in good SES (Scale Economics Shared) companies

The economies of scale make it possible to create some of the best investment opportunities, regardless of the market conditions. In one of his letters, Nick Sleep explained the concept using the example of the Walmart chain of stores. The larger the Walmart chain of stores, the cheaper the prices for many products became. This was due to the fact that Walmart, when buying larger quantities of a given product, received price discounts from suppliers. As a result, the unit price of the product decreased, which allowed the chain of stores to offer lower prices than the competition. It attracted customers. Walmart's success was due to the fact that as scale grew, the company passed some of the economies of scale to its customers rather than focusing on short-term profits. A similar mechanism is visible in both Costco and Amazon.

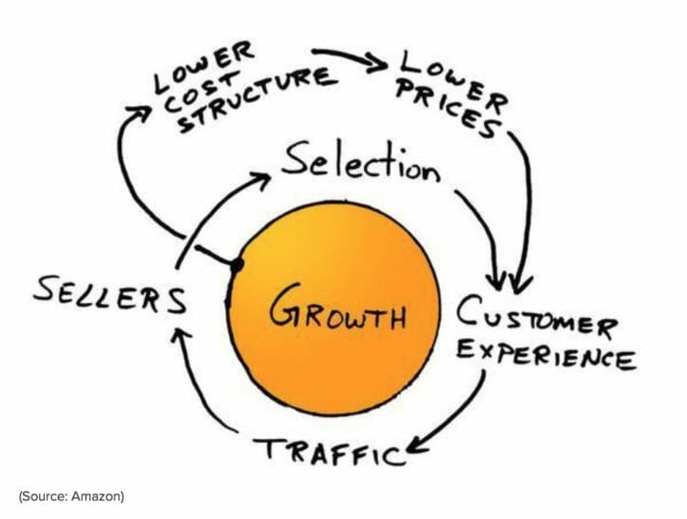

The chart above perfectly illustrates the economy of scale. The concept was very well introduced to his company by none other than Jeff Bezos. It is thanks to low prices that Amazon has gained a large number of satisfied customers. The increased traffic on the site encouraged an increasing number of sellers to list their products on the Amazon website. Along with the increase in competitiveness, the size of the product offer increased and the prices decreased. This, in turn, attracted more and more new customers.

According to Nick Sleep even if the market knows about the business advantages of companies such as Amazon, it may value them below the company's intrinsic value. This is due to the fact that most investors pay too much attention to market noise, which affects the company only in the short term. Examples of such noise are:

- Worse than expected sale,

- Operating margin decrease,

- Economic slowdown.

Due to the fact that many investors are focused only on the short-term horizon, it allows value investors to take advantage of the market sell-off and buy a great company below its intrinsic value.

Companies that offer discounts can gain loyal customers

According to Nick, a wisely implemented policy of offering customers discounts is one of the more interesting ways to create a group of loyal consumers. Thanks to loyal customers, the company has a chance to monetize them for a long time. If the business model is well structured, the larger the base of such customers, the greater the potential for long-term growth of the company's value.

Thanks to the use of discounts, consumers receive from a few to a dozen or so percent savings, which encourages them to make more frequent and larger purchases. At the same time, a loyal customer will build a habit of buying in a specific place. Thanks to this, you will not have to encourage him to buy through marketing campaigns. Price reductions can be seen not as a drop in revenues, but an investment that is often more effective than the costs of research and development, sales or marketing..

Thousands of small steps are worth more than one "milestone"

Nick believes that many of the small nuances have a greater impact on a company's long-term success than one big difference. In his opinion, a company that increases its competitiveness with thousands of small things has a much better competitive position than being distinguished by just one thing, such as a great location, brand or patents. If a company increases its operational efficiency with numerous small changes, it is much more difficult to "copy" its activities. This includes that's why it's so hard to build "New Amazon" or "Next Google". Thousands of small changes include corporate culture of the company or methods of crisis or capital management.

Doing nothing has its tangible benefits

Paradoxically, refraining from executing a trade in the market is also tantamount to taking a position. It is also very difficult to accept by professional investors. Human nature "encourages" anyone to do anything just to "protect" themselves from inaction. However, when it comes to investing, sometimes not trading is a better idea than just catching "Highs and lows". An investor who is too active on his account can only sell a great company for fear of a "market correction" or because it is "too expensive". A long-term investor should only change the portfolio composition when the new company is of better quality than the current position. Simply put, an investor should be very picky when choosing a company. For this reason, it shouldn't have 30 "good" companies, but only a few "best" ones. Each subsequent company reduces the potential to generate above-average rates of return, gaining only "lower risk".

Be on an informative diet

There is a rule called GIGO (Garbage in, Garbage Out), in the literal translation it "Garbage at the entrance - garbage at the exit". In an IT environment, this acronym means that even a correct data processing procedure will not produce added value if the initial data (on which the analysis is based) is incorrect. Always the result of processing erroneous data will give an erroneous result. For this reason, the investor should not focus on collecting all available data on the market, but focus on understanding what factors are responsible for creating the best companies in the world. According to Sleep you should only invest your time on relevant information that will not get old quickly. It is worth remembering that most of the information in the world has a specific use-by date. Therefore, the investor should focus on understanding the operation of the enterprise rather than trying to know everything about all listed companies.

Volatility - your friend, not your foe

For many investors, market volatility is considered the greatest threat to the investment portfolio. Downward corrections can be really deep. For an investor who does not know what he is buying (does not know the fundamentals of the company), such declines can encourage the sale of a good company at a very low price. A conscious investor should use periods of market panic to accumulate stocks, as a good company will always defend itself in the long term. Regardless of whether the interest rates are 5% or 1% each. Nick Sleep is a great example of such an investor as he has been a shareholder of Costco for several years.

Summation

As you can see, you don't need to be original in order to achieve above-average rates of return. Nick Sleep's thoughts are simply a continuation of the thoughts of such outstanding investors as Warren Buffett or Charlie Munger. Sleep is a supporter of understanding the operating activities of the analyzed company from scratch and a very restrictive strategy of selecting companies. He is a supporter of investment portfolio concentration which resembles Charlie Munger's strategy as well Mohnish Pabrai. In addition, Nick encourages investors to take a long-term view of the market and rates of return, and advises against worrying about information hype. In his opinion, most of the market information has a very short "shelf life", so it is a pity to waste time analyzing it.

Nick Sleep did not make above-average profits because of complicated financial models, insider information, or white intelligence. Instead, he focused on good synthesis of the information obtained and focusing on the very long term. He also liked to ask questions and question generally accepted views of society. In addition, he was patient, he did not care about a worse quarter or six months. In addition, he did not want to prove to himself or others that he knows everything. Due to the fact that there are no difficulty points, he focused on his own circle of competence.

Finally, it is worth quoting from Nick Sleep, who perfectly shows the investment philosophy of the fund:

"There are three advantages to investing: informational (I know an important fact before others), analytical (I can draw better conclusions from publicly available information) and psychological (let's call it behavioral) ... [in my opinion] the long-term advantage can be mostly psychological."

"Philosophically, an error is only a mistake if it is so named. Otherwise, it is a learning opportunity. This is the view that seems correct to us (...) in other words, every error has a positive net worth [in the form of conclusions drawn]. "

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Nick Sleep - a forgotten, outstanding long-term trader [Great Traders] NICK SLEEP TRADER](https://forexclub.pl/wp-content/uploads/2022/09/NICK-SLEEP-TRADER.jpg?v=1663573827)

![Nick Sleep - a forgotten, outstanding long-term trader [Great Traders] CapitalWaysTrade tickmill scam](https://forexclub.pl/wp-content/uploads/2022/09/CapitalWaysTrade-scam-tickmill-102x65.jpg?v=1663414654)

![Nick Sleep - a forgotten, outstanding long-term trader [Great Traders] fed interest rates](https://forexclub.pl/wp-content/uploads/2022/09/fed-stopy-procentowe-102x65.jpg?v=1663576737)