Next Eleven (N-11) – Top players, i.e. Mexico, Turkey and South Korea [Part. AND]

We return to our cycle, which explains the acronyms that group specific economies. One of them is Next 11 which is also known as N11. As we know from BRICS history, acronyms for groups of countries are often created by investment banks. It was no different with Next Eleven (N-11)who created Goldman Sachs. Interestingly, the American investment bank had already created a famous group of countries - BRIC.

Source: wikipedia.org

Next Eleven is an attempt to search for more countries that were to become a good place to invest money. The study was created on December 12, 2005. The group of countries included: Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey and Vietnam. What did these countries have in common? Seemingly not much. After all, some of the countries were already highly developed (South Korea, Turkey), while others were just getting richer (Bangladesh). They were located on different continents and had different trading partners. However, looking more closely, all countries had very high potential. With the exception of South Korea, the countries had a very good geographic pyramid and were growing rapidly.

The beginnings of the formation of N-11

In 2003, Goldman Sachs gained additional notoriety with the creation of the BRIC, which was also called the "Big Four". This acronym is a combination of the first letters of countries such as Brazil, Russia, India and China. These four countries were a symbol of the coming change. From now on, over the years, the advantage of developed countries over developing countries will decrease. This will increase the economic, political and military importance of developing countries. BRIC accounts for 25% of the land area and about 40% of the world's population. It is easy to imagine how much potential this group of countries had. Especially when it comes to India and China.

With the “discovery” of the BRIC countries, the race to find more prospective countries and group them into acronyms began. In 2005, Goldman Sachs proposed The Next Eleven (N-11). According to economists and analysts of this investment bank, the group had a chance to become one of the most important economies of the XNUMXst century.

N-11 is not a homogeneous group of countries

Goldman Sachs did not choose these countries by chance. Each country had to meet the following criteria:

- economic stability,

- political situation,

- openness to trade,

- investment policy,

- quality of education.

In addition to these criteria, economic potential was also taken into account. For this reason, the most developed countries have already dropped out of the run-up. The reason was that, despite good scorings awarded by Goldman Sachs, their potential to increase the scale of GDP was much more limited than in the case of developing countries. The exceptions were South Korea, Türkiye and Mexico. Both countries were significantly behind the rest of the countries in terms of economic development.

Each of these countries experienced an increase in population. Of course, Pakistan's demographic pyramid (population growth of 110% between 1980 and 2008) was quite different from South Korea's (+28% over the same period). The younger the population, the more competition there is in the labor market. This results in less wage pressure than in countries with a labor shortage.

It is worth noting that none of the countries was small in terms of population. South Korea, the least populous, had less than 50 million inhabitants. Indonesia was the most populous, with a population of around 230 million. Of course, a large population alone is not enough for a country to have great growth potential. It is also important that the country has favorable factors that will allow it to take advantage of a good starting point, which is the demographic dividend. A young population combined with the convergence of the economy can work wonders. A great example of this is China, which has achieved spectacular economic growth over the last forty years.

The economic potential of the N11 countries is much smaller than that of the BRIC. But we are still talking about countries with a very large population and a chance for convergence. According to the analysis World Bank and Goldman Sachs, these countries could reach ⅔ of the GDP of the G7 countries by 2050. However, it is worth remembering that only South Korea, Mexico and Turkey have a chance to catch up with the standard of living of the G7 countries within a few decades. Of course, in the case of South Korea, this route is much shorter than in the case of Mexico.

Unfortunately, we have bad news for “comfortable” investors – there is no ETF that only gives exposure to Next Eleven countries. The reason for this is that some N-11 countries have very poorly developed capital markets.

Primates and outsiders

The countries selected for this list may now seem like a mistake. After all, Pakistan and Nigeria are not currently among the top economic leaders. However, in 2005 the world looked completely different. Permanent raw material boom, which contributed to the fact that countries such as Nigeria were experiencing a golden age. The inflow of funds from export created an opportunity for a more dynamic development of the country. However, in the case of Pakistan and Nigeria, the good times have not been used to lay the foundations for future growth. In turn, the development of Egypt has certainly slowed down social unrest, as exemplified by the revolution in North African countries in 2011.

The disadvantage of the created acronym was the general mismatch of countries in many aspects. One of the most striking aspects is the unequal levels of development. South Korea, for example, does not fit the whole list. It is too well developed economically. The same was true of Mexico and Turkey. Both countries were less developed than Korea, but they were ahead of countries such as Bangladesh, which was considered one of the poorest countries in the world. The three mentioned (South Korea, Turkey and Mexico) are the N-11 "top players".

In this article, we will focus on the most developed countries. The reason is simple. In the case of the most developed capital markets, the investor has the opportunity to invest directly. This possibility most often applies to the Mexican, Turkish and Korean stock exchanges. In other cases, direct access to the exchange is unlikely. Moreover, these countries are already a popular destination for foreign investors to invest their capital.

South Korea - a wonderful economic transformation

It is a true raisin among the N-11 countries. South Korea is a highly developed country. It is the fifth largest economy in Asia (behind China, India, Japan and Indonesia). It is a country that has undergone an incredible economic modernization. It is often referred to as Miracle on the Han River. The miracle began in 1961 when a military junta seized power in the country and began implementing a series of economic reforms. Over time, the famous chaebols arose and began to transform the economy. Korea has gone from exporting simple products of low quality and price to advanced products. Currently, most people associate Samsung smartphones or Kia cars.

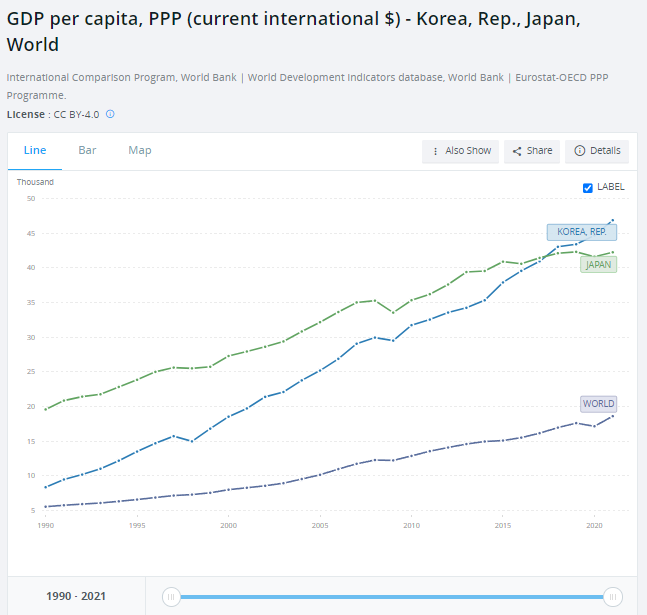

South Korea's GDP per capita since 1990. Source: World Bank

The rapid economic development resulted in the country being included in the G-20 and joining OECD. The strength of the country is an efficient education system and emphasis on education on the part of children's parents. The “educational race” is criticized on the one hand, but it makes Koreans very well prepared to enter the labor market. The country is also developing thanks to exports. Currently, Korea exports highly processed products that find buyers all over the world. Before COVID, the country was the 8th largest exporter and importer in the world.

Seoul now. Source: wikipedia.org

Korea also has a very developed financial sector. The Korea Stock Exchange is one of the most important securities trading venues in all of Asia.

The country is open to foreign investors and likes to invest in other markets itself. However, one of the biggest disadvantages of South Korea is its northern neighbor, which from time to time makes itself felt with the help of missile tests. Another problem is demographics. Population aging is a challenge. It seems that in the coming years Korea will have to increase the share of immigrants. This is quite a cultural challenge, because Koreans are generally somewhat skeptical about opening the labor market to immigrants.

KOSPI 200 index. Source: TradingView

Investing in the Korean market can be done both through direct purchase of shares and investing in ETFs. Below are two ETFs that allow European investors to invest in this market.

READ: Nikkei, Hang-Seng, Kospi - How to invest in Asian indices? [Guide]

Lyxor MSCI Korea UCITS ETF - Acc.

It is an ETF with exposure to the Korean market. The ETF follows the MSCI Korea 25/30 index. The fund has over €115 million in assets under management. The index is very concentrated. The largest position is Samsung with over 27% share in the portfolio. Another 7% is held by Samsung subsidiaries. The management fee is 0,45%.

iShares MSCI Korea UCITS ETF USD (IKOR)

It is the European equivalent of iShares listed in the USA. The index has over $368 million in assets under management. It is a relatively expensive ETF. The annual management fee (TER) is 0,74%. There are over 100 Korean companies in the ETF. So this is an interesting way to get exposure to the Korean market.

iShares MSCI Korea UCITS ETF USD Chart, MN Timeframe. Source: xStation, XTB

Mexico - still in progress

It is the tenth most populous country in the world. As you can see, this is the only Latin American in N-11. Mexico, unlike other countries, trades mainly with the United States. This is due to the fact that the US and Mexico border each other and have operated under NAFTA for many years. NAFTA consisted of Mexico, the United States and Canada. In 2020, countries signed the USMCA (United States – Mexico – Canada – Agreement), which replaced NAFTA.

READ: The Tequila Hangover, or the 1994 Mexican Crisis

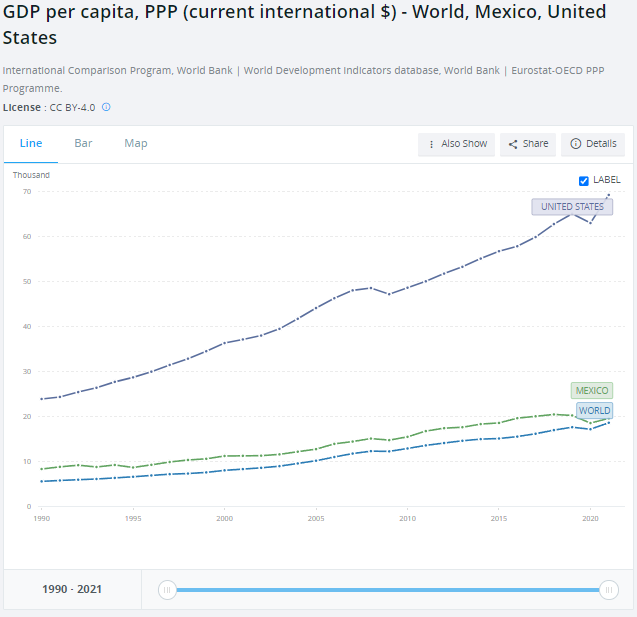

Meksyk is a moderately developed country. However, thanks to its large population, it is one of the most important economic areas in the world. After adjusting for purchasing power, Mexico is the 13th largest economy. In 1994, Mexico experienced a severe currency, banking and economic crisis. After only a few years, the country returned to the path of growth. It is worth mentioning that the country has experienced low inflation in the last two decades. This made doing business in Mexico much easier. Not surprisingly, the country has experienced an increase in foreign investment. Unfortunately, convergence to the United States has not progressed in recent years. According to the chart below, Mexico had a GDP per capita (purchasing power parity) of 2021 in 19,6. $. The United States had 69,3 thousand. $. This means that the relation of the index of these two countries is 28,28%. In 1990, the rate was 34,76%.

Mexico's GDP per capita since 1990. Source: World Bank

Despite dynamic economic growth, the country still struggles with high social inequalities. Another problem is the unequal economic development, i.e. the division into the rich "Midnight" and poorer "South".

It is worth remembering that Mexico has one of the most important capital markets in all of Latin America. A European investor can invest in this market directly or through ETFs and mutual funds with exposure to this region.

iShares MSCI Mexico Capped UCITS ETF (Acc)

The management fee is 0,65% per annum. The ETF mimics the behavior of the MSCI Mexico Capped Index. Assets under management amount to $87 million. The ETF only has 22 companies in its portfolio. Of these, the top 10 positions account for 80% of the entire portfolio. By purchasing this product, you will have in your portfolio, among others: companies such as Walmart de Mexico and Cemex.

US investors can invest in the Mexican market through the iShares MSCI Mexico Index (EWW). The fund's assets under management amount to approximately $1,5 billion. There are 44 companies in the ETF portfolio. The most important company in the portfolio is America Movil. As in the previous ETF, the investor gets exposure to companies such as Cemex or Walmart de Mexico.

iShares MSCI Mexico Index (EWW) ETF chart, MN time frame. Source: xStation, XTB

Türkiye - dynamic development and macroeconomic problems

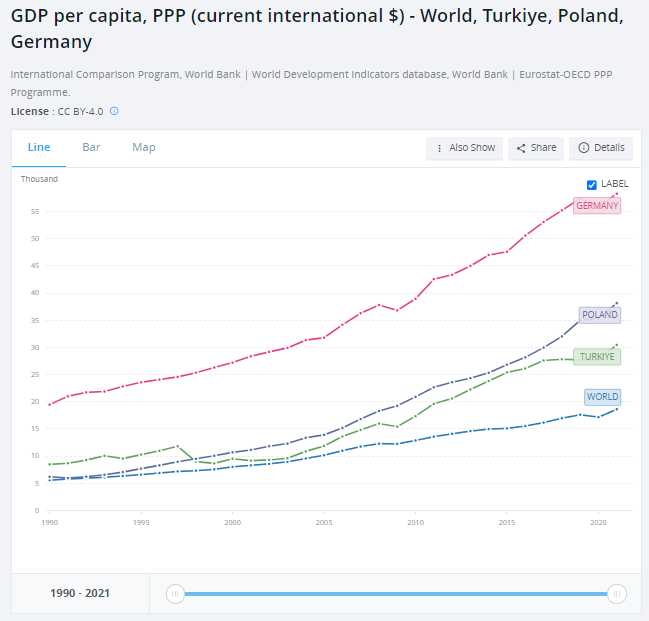

It is one of the most evolved members of the N-11. It is also one of the G20 and OECD members. It is the 11th economy in terms of purchasing power parity. For many years, the country negotiated with the European Union to join this organization. However, after 17 years of negotiations, joining the EU is further than closer. The current political elites have significantly distanced themselves from the EU accession plans. Despite this, the country exports most of its goods to European countries. This is not surprising, considering that Turkey is a bridge between Europe and the Middle East.

READ: High inflation, low interest rates and a weak currency, or how to invest in Turkey? [Guide]

Turkish exports include agricultural goods, clothes, engines, car parts, household appliances, electronics and building materials. In recent quarters, Turkish military equipment has become very popular (e.g. drones Bayraktar). The country is also developing its own fighter aircraft concept, which is to eventually replace the F-16.

The dynamic development of the economy was interrupted by the currency crisis of 2018-2022. The Turkish lira has crashed. Monetary policy certainly did not help in the fight against inflation. Keeping interest rates low was one of the reasons for the weakening of the Turkish lira. The country is struggling with a problem in the banking sector. The high share of NPL loans (delays in repayment) causes banks' assets to be of low quality. This means that banks have to look at new borrowers much more carefully. This, in turn, slows down economic development. The crisis in Turkey has significantly slowed down the country's convergence to the most developed economies.

Turkey's GDP per capita since 1990. Source: World Bank

Türkiye has acquired several brands that are recognizable on the European market. One of them is Bekowhich has a strong position on the household appliances market. In addition, it is a Turkish company Vestel. The company produces televisions for brands such as Toshiba or Hitachi. The company is listed on the Istanbul Stock Exchange.

Türkiye is also a local power in the export of clothes to Europe. Part of the production is commissioned by global, foreign brands. However, the country has also acquired its own brands. They include e.g. vakko or Mavi Jeans.

iShares MSCI Turkey UCITS ETF

It is an ETF whose benchmark is MSCI Turkey. It is a very concentrated ETF. It consists of 17 components. Therefore, it is not investing in the broad Turkish market, but in the largest companies. This has its downsides as the investor will not have exposure to an index of small and medium caps which can have very high potential. ETFs are quite expensive. The annual management fee is 0,74%. It is the European equivalent of the iShares MSCI Turkey Index (TUR).

iShares MSCI Turkey UCITS ETF Chart, MN Timeframe. Source: xStation, XTB

Forex brokers offering ETFs and stocks

How to invest in the markets of Next Eleven (N-11) countries? It is not as simple as we would like, and the selection of ETFs is simply very limited. However, an increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 76% of retail investor accounts record monetary losses as a result of trading CFDs with this CFD provider. Consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

South Korea, Mexico and Turkey are the most developed economies included in Next Eleven. All of the countries have a well-developed capital market. Thanks to this, investors can invest in these countries in a very easy way - whether through direct investments or by investing with ETFs.

South Korea is the best performer. Despite the high standard of living, Korea continues to get richer. As a result, in terms of GDP per capita (in parity), they outperformed Japan. This seemed impossible 40 years ago. Of course, Korea struggles with demographic problems that may slow down economic development.

Türkiye, in turn, is the second richest country belonging to Next Eleven. Until 2018, the country was developing very dynamically. It was one of the favorite emerging markets for investors from developed countries. Unfortunately, the last few years have been a struggle with a currency crisis and high inflation. Nevertheless, the country has a great potential for further development. The favorable geographical location and still young population help.

Mexico, in turn, is close to one of the most powerful economies in the world - the United States. It would seem that Mexico should quickly catch up with the US. After all, as a result of economic integration with the countries of the "Old Union", Poland began to develop very quickly. Mexico is not yet using its full potential. However, the advantage is the young population and favorable geographical location. The problem is corruptionwhich slows down economic growth and increases social inequalities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Next Eleven (N-11) – Top players, i.e. Mexico, Turkey and South Korea [Part. AND] next eleven countries 1](https://forexclub.pl/wp-content/uploads/2023/05/next-eleven-countries-1.jpg?v=1684740403)

![Next Eleven (N-11) – Top players, i.e. Mexico, Turkey and South Korea [Part. AND] inflation ppi in Germany](https://forexclub.pl/wp-content/uploads/2021/08/wybory-w-niemczech-olaf-scholz-102x65.jpg?v=1630408613)

![Next Eleven (N-11) – Top players, i.e. Mexico, Turkey and South Korea [Part. AND] AI heats up market sentiment](https://forexclub.pl/wp-content/uploads/2023/05/AI-podgrzewa-rynkowe-nastroje-102x65.jpg)