Next Eleven (N-11) – Good prospects, or upcoming giants [Part. II]

In the previous In the N-11 text, we mentioned the most developed economies this acronym. In this section, we will mention economies that have very good prospects ahead. All of the countries listed below are located in Asia. No wonder. For now, it seems the next century will belong to Asia. Will this actually be the case? Time will tell, but it is worth finding out what the economic development of these countries looked like and how you can invest in them.

Bangladesh - the former economic pariah shows strength

It is a country that many people would have a hard time showing on a map. However, in terms of population, Bangladesh is the 8th most populous country in the world. Its population is as much as 169 million inhabitants. If we take into account the size of GDP alone, it is clear that this country is on the rise. In purchasing power parity, Bagladesh's GDP will be approximately $2023 billion in 1. For comparison, much less populous Poland is expected to have a GDP (PPP) of $457 billion in the same year.

Bangladesh is a place of cheap production. It is a particularly popular country for investments made by clothing industry. Economic reforms began in the 70s. Thanks to this, the marketization and easier access to investing in Bangladesh by foreign entities and individuals has been made. Currently, over 80% of GDP is generated by the private sectordominated by small and medium-sized enterprises.

CHECK: How to invest in clothing companies? [Guide]

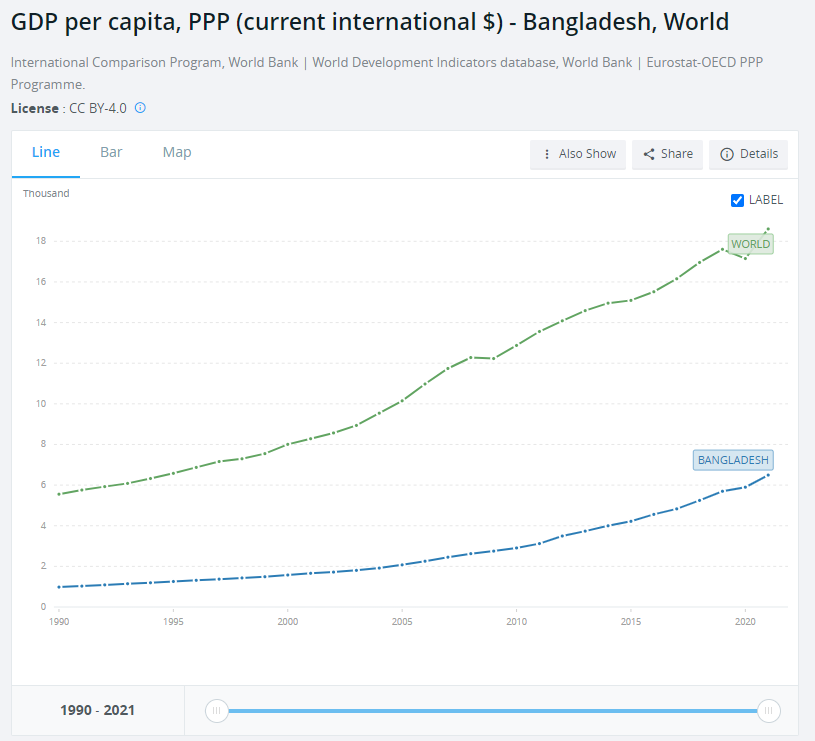

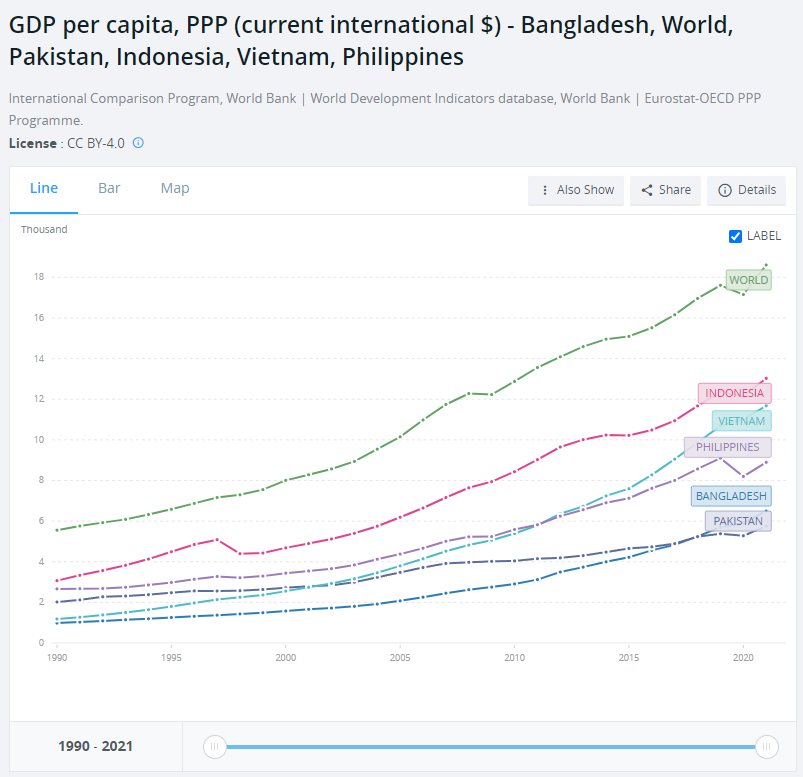

The country is one example of a successful transition. In 1971, Bangladesh was the second poorest country in the world. However, by unlocking the potential, Bangladesh's per capita GDP is already higher than Pakistan and India. Large infrastructural projects also help in development. As an example can be given Padma Bridge, Dhaka Metro or development of the port of Matarbari.

Source: World Bank

The most important stock trading venues is Dhaka Stock Exchange and Chittagong Stock Exchange. However, it is very difficult to access trading on these exchanges. This is due to the fact that it is a very niche market, outside the radar of the largest investment funds.

Despite the large population and great development prospects for the coming years, there is no ETF only with exposure to this country. It can be invested indirectly through a listing in the United States iShares MSCI Frontier and Select EM ETF. Bangladesh's share in the aforementioned ETF is only 5,3%.

Philippines – beneficiary of the Asian economic boom

It is a country classified as a developing market. The Philippines is another example of an Asian country benefiting from the rise of China, India and Indonesia. It is becoming one of the industrial hearts of the region and the world. This is helped by its location and still cheap labor. The Philippines is a country with over 110 million people. It is also the 29th economy in the world, counting GDP after adjusting for purchasing power parity. This places it between the Netherlands and Argentina.

The country has undergone a rapid transformation over the last 30 years. From an agricultural, backward country, the Philippines is slowly becoming a place where many companies locate their production plants or shared service centers. After the 1998 crisis, the Philippines returned to a path of rapid growth. Thanks to this, there is a systematic improvement in the wealth of the society. Extreme poverty is also decreasing. The financial center is the capital of the country - Manila. Despite the large population, the country does not suffer from high unemployment. This is due to the dynamic economic development, which quickly increased the demand for hands for work.

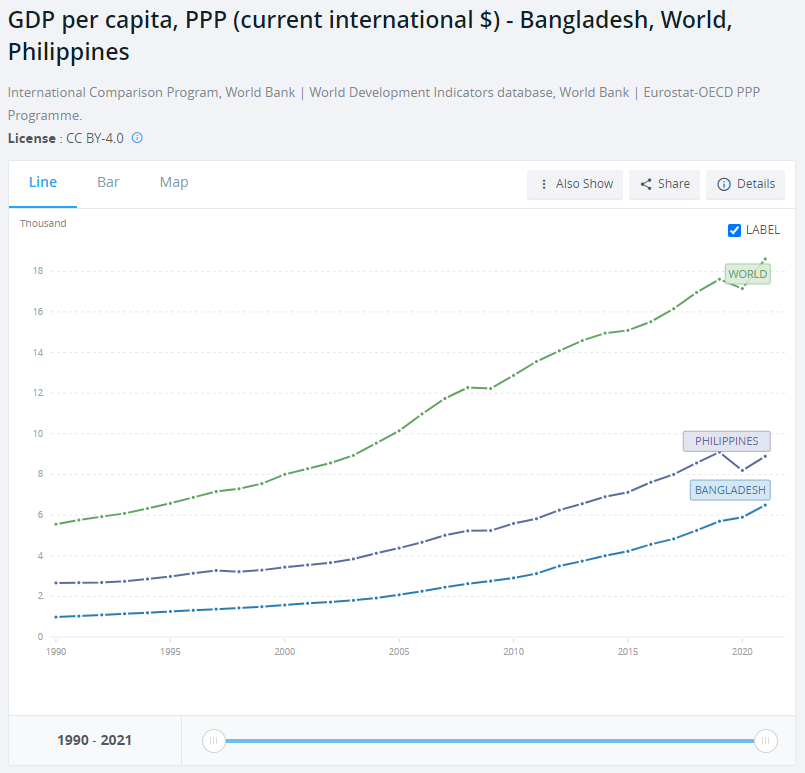

The country is still much less developed than the world average, but despite this, it ranks higher than the previously described Bangladesh.

Source: World Bank

The most important export products are those related to semiconductor industry. In addition, the country exports electronics, vehicles, clothes, chemical products. Of course, the country also exports raw materials (e.g. nickel, copper) and agricultural goods (e.g. fruit). The Philippines is focused on trade cooperation with Japan, China, Singapore and South Korea. No wonder, because these are thriving economies that are "close to" the Philippines. The United States is also an important partner.

CHECK: How to invest in semiconductor companies? [Guide]

The Philippines, due to its dynamic development in recent years, is classified as one of the Tiger Cub Economies. This is a list of the "stars" of Asia, to which it belongs Indonesia, Malaysia, Vietnam and Tajlandia. According to optimistic forecasts, the Philippines has a chance to become one of the 5 largest economies in Asia by the end of 2050.

The country is still struggling. One of them is social stratification and large differences in the level of development between regions of the country. Currently, it is easiest to invest in Philippine companies with the help of an ETF.

Xtrackers MSCI Philippines UCITS ETF

The annual management fee is 0,65%. The ETF tracks the MSCI Philippines index. Assets under management are small. They amount to less than $35 million. The ETF consists of 43 companies. SM Prime Holdings has the largest share with shares exceeding 12%.

Xtrackers MSCI Philippines UCITS ETF daily chart. Source: TradingView

iShares MSCI Philippines Index (EPHE)

The annual management fee is 0,58%. The benchmark for the ETF is the MSCI Philippines index. The ETF itself was established in 2010. The average annual rate of return on the ETF amounted to 1,5%. So these are not impressive results. Currently, the fund comprises 38 companies. The largest of them has SM PRIME HOLDINGS with over 11% share in the ETF.

iShares MSCI Philippines Index (EPHE) chart, weekly. Source: TradingView

Indonesia – a little-known economic giant

Indonesia is associated more with exotic holidays than with a country that will set the tone for the global economy. The country has everything to develop dynamically: young population, low labor costs, raw materials. Indonesia is the largest economy in Southeast Asia. It is also one of the emerging markets with one of the greatest potential for growth. Indonesia is also recognized as NIC (Newly Industrialized Country). Literally translated, it is a newly industrialized country.

It is the fourth most populous country in the world. Not surprisingly, Indonesia ranks 7th in terms of GDP in purchasing power parity (PPP). Despite the fact that it is a free market region, state-owned companies still operate in various sectors. Most often these are “strategic” economic areas.

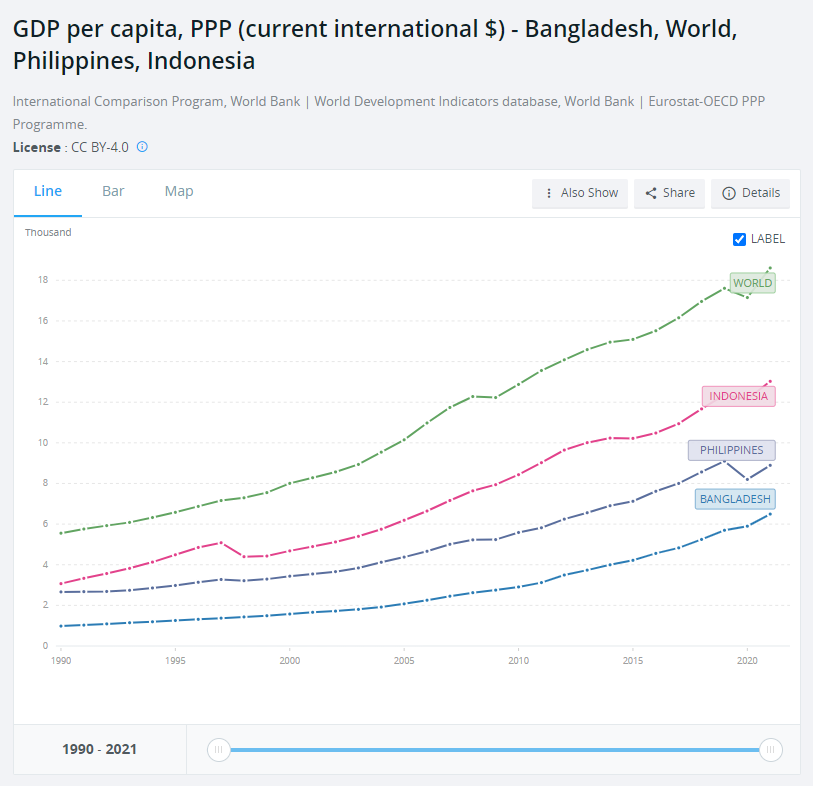

Source: World Bank

In 1997, the country experienced a major economic crisis. It was the so-called Asian Tiger Crisis. It was not until 1999 that the shock of the currency and banking crisis was recovered. Currently, there is no trace of it, and Indonesia is becoming one of the most promising markets in the next few decades. The reason is the growing population and convergence. As a result, already in 2045 Indonesia will be the 4th largest economy in the world.

Indonesia exports palm oil, steel, metal products, industrial and specialized machinery. In addition, Indonesia sells natural gas, petrochemical products or transport vehicles. The main partners are China, ASEAN countries and the United States,

It is worth mentioning that Indonesia is cooperating with some ASEAN members (Malaysia, Vietnam, Philippines, Thailand and Singapore) to integrate stock exchanges. This is to make regional stock exchanges an interesting place to invest capital also for foreign investors.

Indonesia also cooperates economically with Japan. In 2008, an agreement was signed Indonesia-Japan Economic Partnership Agreement (IJEPA). It was a free trade agreement between the two countries.

HSBC MSCI Indonesia UCITS ETF USD

It is an ETF that can be purchased by a European investor. The ETF itself is very concentrated. The 10 largest companies hold about 80% of the portfolio value. This product is dominated by the financial sector (53%) and telecommunications (14%). Assets under management amount to approximately $90 million. This is not an amount that knocks you to your knees. The management fee is 0,5% per annum.

HSBC MSCI Indonesia UCITS ETF USD chart, daily. Source: TradingView

iShares MSCI Indonesia ETF

The annual management fee is 0,58%. The benchmark for ETFs is the MSCI Indonesia index. The ETF itself was established in 2010. Since its establishment, its average annual rate of return has been 1,5%. The ETF consists of 89 companies. The largest component is Bank Central Asia, with over 20% share in ETFs.

iShares MSCI Indonesia ETF chart, weekly time frame. Source: TradingView

Pakistan – disappointed hopes

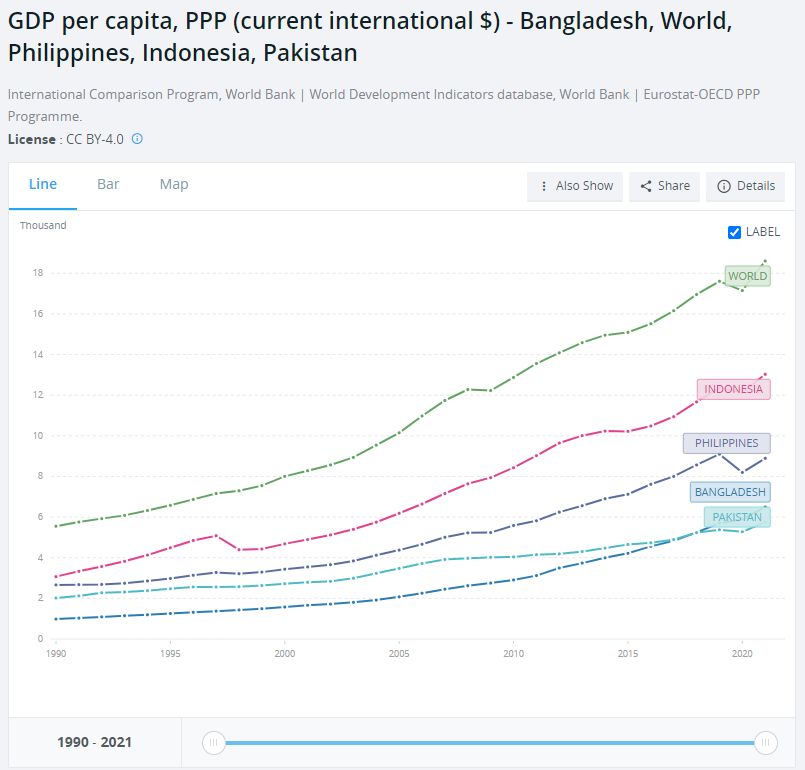

It is one of the most populous countries in the world with a population of over 220 million. Despite its size, it is only the 23rd economy in the world (taking into account purchasing power parity). At the same time, it is one of the poorest countries in the world. Despite this, two decades ago it was considered a good place to invest. What happened?

In the 90s, the process of marketization of the economy began. A more "Islamic" approach to economic development was then abandoned. This allowed for rapid development. Investments came mainly from raw materials sector and textile. The country seemed to have great potential for further development.

Weak state structures hamper opportunities for rapid development. This, coupled with a growing population, creates problems in the labor market. Another challenge is high for the current times illiteracy rate. It doesn't help either high corruptionthat makes it difficult to run a business. Especially for small and medium-sized companies. It is corruption that also discourages foreign companies from investing in Pakistan.

Source: World Bank

The country is not economically developed. The main export commodities are raw materials, agricultural commodities and textiles. Pakistan also exports simple chemical products.

It is a country with a large share of agriculture in GDP. About 19,2% of the Gross Domestic Product was related to agriculture. It's worth mentioning that as much as 37% of the workforce was employed in this sector. This information alone proves that Pakistan is an underdeveloped country. Moreover, it has very inefficient agriculture. Pakistan exports a lot of rice and cereals. However, net exports of agricultural products are currently not very profitable. This is due to the fact that these are products with low added value. Pakistan, on the other hand, imports a large amount of highly processed products.

The textile industry is a very important branch of the economy. This is due to access to raw materials and low labor costs. Mainly simple products with a low market value are exported, which means that exporters compete mainly on price. The sector employs around 40% of the workforce employed in the industry as a whole.

Pakistan is also a field of rivalry between the United States and China. The Middle Kingdom has invested a lot of money in infrastructure development in recent years. China has encouraged infrastructure investment, but it has done so with debt. As of 2021, Pakistan periodically asks China to postpone or partially forgive its debts. In the background, one should remember about cool relations with India (conflict over Kashmir).

The Pakistan Stock Exchange in the early XNUMXs was one of the best markets in the world. This was helped by the boom in developing markets and the increase in commodity prices. However, after 2008, there was an increase in political instability. As a result, the KSE 100 index has ceased to be so popular among foreign investors. In 2016, as a result of the merger of three exchanges, PSX (Pakistan Stock Exchange) was formed. A year later, the Pakistan Stock Exchange was reclassified by MSCI z Frontier Markets do “Emerging Markets”. It became the flagship index PSE-100.

Global X MSCI Pakistan ETF

Investors can invest in the Pakistani market with ETFs. European investors can do this via the Global X MSCI Pakistan ETF, for example. It is quite an expensive ETF. Its annual management costs (TER) are 0,8%. Looking at the chart below, you can see that even economic development is not a guarantee of profits on the capital market.

iShares MSCI Indonesia ETF chart, weekly time frame. Source: TradingView

Vietnam – a forgotten economic miracle

When mentioning the success of economic transformation in Asia, most mention China. However, there is also a country that has undergone spectacular economic growth. However, it does not have a population of billions. For this reason, its economic growth went unnoticed by many people. However, it is worth looking at the achievements of this country.

Vietnam is an interesting country whose economy is a combination of a socialist and free-market approach to the economy. It is a member ASEAN (Association of Southeast Asian Nations) and WTO (World Trade Organisation). It is also one of the fastest growing economies not only in Asia, but also in the whole world. Between 1991 and 2016, it was one of the 5 fastest growing countries in the world. This resulted in a sharp increase in the standard of living. The country lives from trade. It is one of the places with the highest trade turnover to GDP ratio.

He was the author of the economic miracle Đổi Mớiwho transformed Vietnam. From a country that was supposed to be ruled by a communist regime, Vietnam became more free-market. Of course, 5-year plans are still being announced, but private companies have taken economic growth on their shoulders. Small and medium-sized enterprises dominate, which are an important link in development. They provide the largest employment in the Vietnamese economy.

CHECK: FTSE Vietnam 30 – How to invest in Vietnamese stocks? [Guide]

Due to the investment climate, young population and proximity to countries such as China, Japan and India, they make Vietnam an important production center. Just look at a graph of GDP per capita adjusted for purchasing power parity to understand how colossal this growth is. Even in 1990, the standard of living in Vietnam did not differ from that in Bangladesh. Currently, the country has surpassed Pakistan and the Philippines in terms of development. It is also approaching the standard of living in Indonesia

Source: World Bank

Xtrackers FTSE Vietnam Swap UCITS ETF

If we want to invest in the Vietnamese economy with ETFs, the choice is not large. The optimal choice seems to be Xtrackers FTSE Vietnam Swap UCITS ETF. The management fee is 0,85% per annum. The important information is that the ETF replicates its benchmark using swap contracts. This is called synthetic replication. The benchmark is the FTSE Vietnam index.

Xtrackers FTSE Vietnam Swap UCITS ETF Chart, Weekly Timeframe. Source: TradingView

Brokers offering ETFs and stocks

How to invest in country markets Next Eleven (N-11)? It is not as simple as we would like, and the selection of ETFs is simply very limited. However, an increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 76% of retail investor accounts record monetary losses as a result of trading CFDs with this CFD provider. Consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summary: Economic development does not always translate into profits from investments

N-11 is a very heterogeneous group. The countries with the highest level of development were described in the previous section. In the current one, we looked at Asian countries that are still in the making. Of the above-mentioned rate, two countries are the most developed: Indonesia and Vietnam. Both also experienced dynamic economic growth. Pakistan and Bangladesh are at the tail end of the pack. It is worth noting, however, that Bangladesh has been developing dynamically over the last dozen or so years. It has overtaken Pakistan, which has done the worst in the last 3 decades. Pakistan still has huge potential, but it needs to make solid economic reforms and tackle corruption if it wants to make up for lost time. We didn't mention the Philippines. It is a country that has significantly slowed down its development for several years. However, it still has a large potential for growth and a relatively high level of development (as for the group of countries under study).

The five mentioned above have great potential for further development. However, for the investor, the problem will certainly be poorly developed capital markets. In practice, for an investor from Europe, it is practically possible to invest through ETFs. However, their rate of return in the last decade is not impressive. This is another proof that economic growth does not necessarily lead to an increase in the main indices. Investors in WIG 20 companies are well aware of this.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Next Eleven (N-11) – Good prospects, or upcoming giants [Part. II] next eleven 2](https://forexclub.pl/wp-content/uploads/2023/05/next-eleven-2.jpg?v=1685433352)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Next Eleven (N-11) – Good prospects, or upcoming giants [Part. II] Rafał Glinicki Using volume in the forex market webinar](https://forexclub.pl/wp-content/uploads/2023/05/rafal-glinicki-Wykorzystanie-wolumenu-na-rynku-forex-webinar-102x65.jpg?v=1684850257)

![Next Eleven (N-11) – Good prospects, or upcoming giants [Part. II] gold price goes down](https://forexclub.pl/wp-content/uploads/2023/05/kurs-zlota-spada-102x65.jpg?v=1685436728)

Leave a Response