Review: Money Flow Index

Money Flow Index (MFI) is a cash flow index. This technical analysis indicator has gained much less popularity than classics such as MACD, RSI or a stochastic oscillator. However, this does not mean that it is worse than them. Will it be useful for every investor? Certainly not. There is no point in looking for universal solutions. However, it is worth each of you to decide on your own, and our review should help you make the decision.

What is the Money Flow Index

MFI is successfully used on all asset groups - stocks, currencies, commodities, indices and bonds. Its usefulness is also positively assessed by traders regardless of the time perspective.

MFI is an indicator from the group of oscillators, whose task is to measure the flow of cash flows on a given market. Its construction resembles RSI (Relative Strength Index). The main difference is above all the fact that in addition to measuring the price change, it also includes volume in its calculations.

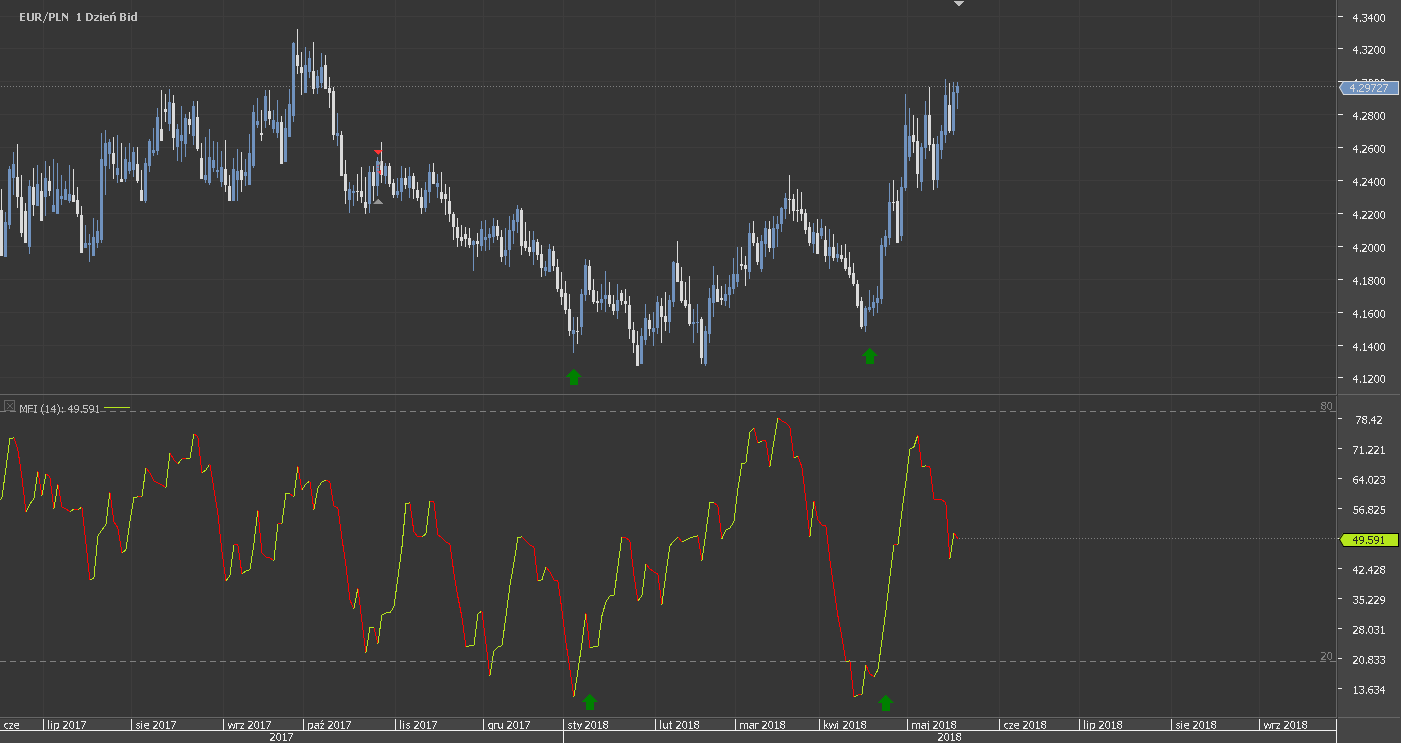

The indicator is drawn in a separate window under the graph. Its readings can range from 0 to 100. As with the RSI, there are two key levels of MFI readings - 20 and 80 points (in the case of RSI it is 30 and 70). Another similarity is the number of periods from which the calculations are made. As in the RSI, the last 14 periods are dominant.

Operation of the Money Flow Index

The idea behind MFI is relatively simple. Along with the decrease in volume during the price increase, it heralds the beginning of the end of the uptrend. Similarly - a decrease in volume during a price discount is a signal of weakening investors' determination on the supply side.

The MFI can be used in two ways. The first, simpler and more popular, is to use oversold and overbought zones. When the values go above the level of 80 points, this means that the market is overbought - this is a potential signal for us to open a short position. Similarly, in the case of MFI indications entering the zone below the level of 20 points, this is information about the oversold (undervaluation) of the instrument by the market. Thus, it is a potential buy signal.

The second method is based on divergences, which are intended to help us locate the place of trend reversal.

The growing price of the instrument combined with declining MFI values, which is also located in the overbought zone, is an important signal suggesting a change in the trend from the upward to the downward trend. The drop in the price combined with the increase in the MFI being in the sales zone is a harbinger of the market's transition from a downward trend to an upward trend.

Summation

The MFI indicator is usually only one of the elements of a wider puzzle in the form of the applied investment strategy. Based on the signal, which only suggests the possibility of reversing the market trend, it is worth being prepared to find additional confirmations.

Certainly, it will not be of use to all traders. Investors with less patience may be frustrated by the relatively small number of signals generated. On the other hand, we get higher quality indications that are devoid of a lot of "market noise".

Its main pain, in the event Forex market, will be obtaining data on the real volume. Even in the case of ECN brokers we will only get a "slice" of the whole. Will this part of the turnover information be sufficient to use the MFI effectively? Judge for yourself.

For some Forex brokers, the tick volume will be used to calculate the MFI indications.

Read: What is the Forex market volume?

Advantages:

- Simple in interpretation,

- Works on every market and interval,

- High "noise" filtering.

Disadvantages:

- A small number of signals,

- Useful more as a complement to the strategy,

- The problem with the real volume on the Forex market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] vs faq](https://forexclub.pl/wp-content/uploads/2023/06/vsa-faq-300x200.jpg?v=1685689430)

![The use of volume on the forex market in practice - Rafał Glinicki [Video] Volume utilization in the forex market](https://forexclub.pl/wp-content/uploads/2023/06/Wykorzystanie-wolumenu-na-rynku-forex-300x200.jpg?v=1685602297)

![The volume on the Forex market - what it informs us about and where to get it [Video] forex trading volume](https://forexclub.pl/wp-content/uploads/2021/07/wolumen-forex-300x200.jpg?v=1625745857)