MTF stock market model from LMAX Exchange

LMAX Exchange offers precise, efficient and consistent implementation FX orders, thanks to solid liquidity from the world's leading banks and proptrading companies.

An efficient and effective FX trading method:

- Precise and consistent execution of transactions with direct access to institutional liquidity.

Total transparency of turnover ("Pre and post-trade transparency"):

- Open order sheet, with liquidity created only by orders with a limit,

- Access to 20 market depth levels via the FIX API,

- Standard access to 5 levels of market depth.

Same commercial terms for all FX market participants:

- The strict "Price / time priority" principle ensures neutral and transparent execution of orders.

The highest quality of FX execution thanks to the implementation of the stock exchange exchange model (MTF).

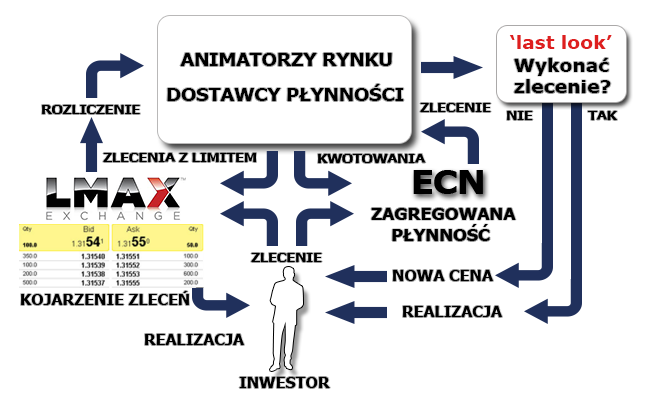

Model MTF vs ECN

LMAX Exchange - precision, consistency, stability

Unrivaled quality of order execution:

- The strict rule: "Price / time priority" without rejections resulting from "Last look".

Huge liquidity coming from leading financial institutions:

- provides a transparent price level search process and precise implementation.

Total anonymity when entering into transactions - no conflict of interest and neutrality:

- LMAX technology adjusts purchase and sale offers while maintaining full anonymity of users.

The fastest available execution of orders:

- the average order execution speed is only 4ms.

A unique vision of the global Forex market

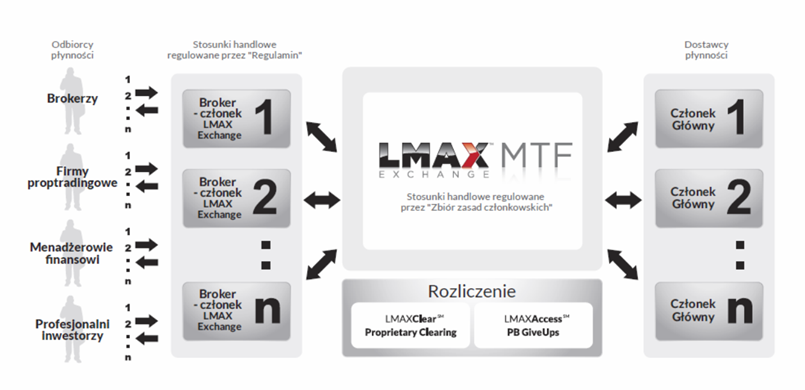

Established to provide the execution quality of the exchange model for both sides of the transaction ('buy-side & sell-side'), the LMAX Exchange is the first MTF for FX trading. This London based company is authorized and regulated by the FCA (Financial Conduct Authority) as MTF (Multilateral Trading Facility) in accordance with the II MiFID Directive.

LMAX Exchange - goes against the changes introduced by MiFID.

The structure of LMAX MTF together with the quality of the stock exchange order fulfillment model ensures the introduction of missing elements in the FX industry, such as:

- Transparency of the actual cost of trading FX on the OTC market (Over the Counter) - The LMAX Exchange order sheet contains only limit orders from the world's leading banks and proptrading companies, giving the user transparency of the rules and the total cost of FX orders execution.

- Precise, consistent and stable execution of FX orders - Matching orders ('order matching') in the LMAX Exchange, using the "Price / time priority" principle without the possibility of rejections resulting from 'last look *', ensuring consistent and stable execution of FX orders.

* 'last look', the ability to reject or requote an order by the liquidity provider within 200 - 400 milliseconds

Key technological elements of the MTF model

- Ultra-fast matching mechanism ("Matching engine"),

- The highest performance of the stock market model ("Exchange"),

- High throughput> 100k messages / sec,

- Constant ability to process 5k orders / sec or 400 millions of orders / day,

- Award-winning technology "Disruptor" - maximizing performance LMAX Exchange uses a range of technologies "Open source",

- Key elements of LMAX Exchange technology including "Disruptor" were created using the model "Open-source".

Speed, capacity and flexibility

- The average speed of order completion is 4 ms,

- The average MTF speed is 0.5ms,

- High bandwidth thanks "Disruptor", a transaction system designed to ensure the highest performance,

- High level of accessibility achieved thanks to the flexibility of all system levels,

- Scalable architecture allowing expansion and support of increasing demand.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)