Price gaps - types and characteristics

One of the popular formations, except for strictly formations Price Action, there are price gaps. More often we can observe it on the stock market, but it also applies to the currency market. Vulnerabilities can provide us with a lot of useful information and give some insight into the basic dynamics of price movement.

The most important defining feature is the difference between the opening and closing levels of the previous day. The gap is forming if the previous day's closing and opening is at different price levels. In markets with high volatility, gaps can also occur within one session. In this article we will look at the basic types of formations, and present their characteristics.

Be sure to read: Price gap systems

Escape gap

This type of formation usually appears in strong trend movements. The escape gap occurs when the price exceeds an important level of support or resistance. This is a strong signal of continuation.

Escape gap. Apple (AAPL), D1 interval. Source: xNUMX XTB xStation

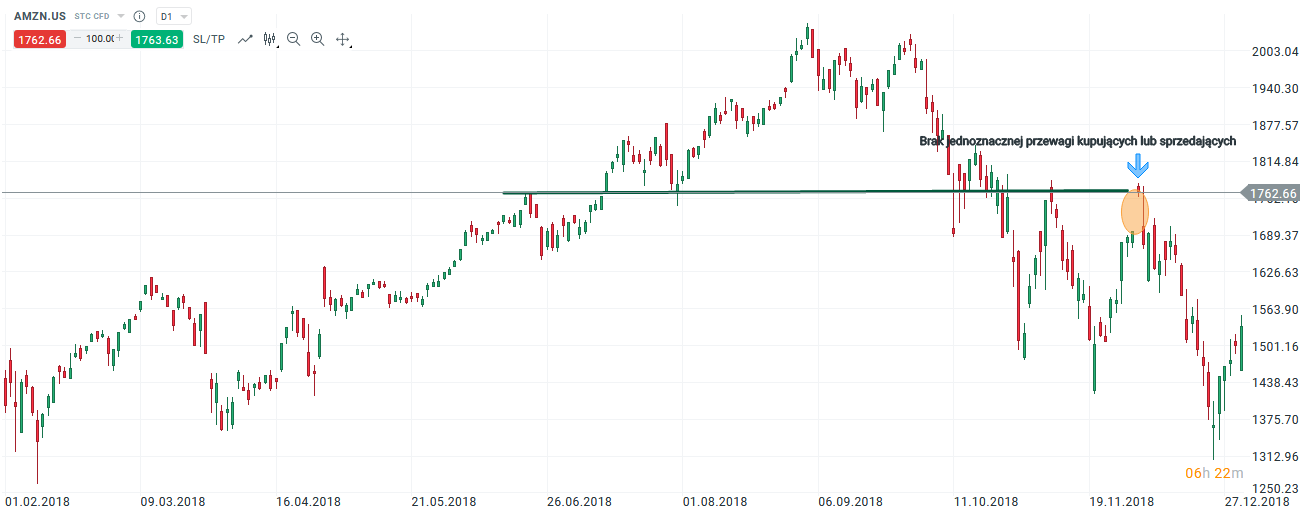

The exhaustion gap

Another very important type we can meet on the market is the exhaustion gap. Like the escape gap, this type of formation also most often appears in strong trends with the difference that it is heralding the reversal / change of tendency. The market opens above or below the last closing depending on the trend, the formation is a kind of last "stop", followed by a turn in the opposite direction. The example shown shows that the market creates a gap within a significant level of resistance. It is also worth noting that the first candle that forms at the formation in question has the shape of a small spool, which is a sign of indecision. The next candles, in turn, have a much greater momentum. With this type of formation, it is also important to properly wait for the candle to close, which will avoid false signals.

The exhaustion gap. Amazon (AMZN), D1 interval. Source: xNUMX XTB xStation

Continuation gap

Another type of gap we can often see in the charts. A characteristic feature of this type of formation is that usually appears in the middle of a given move. If the current trend is upward, then the gap up signals the entry of new buyers who push the price to new higher levels. A similar situation occurs in the downward trend with the assumption that the gap is opening downwards, which indicates additional supply. It is important that the continuation gaps are not too large, because a slightly smaller range of formation means greater stability. Large, extreme ranges can be difficult to play and show a change in dynamics between market participants.

Continuation gap. AMD (AMD), D1 interval. Source: xNUMX XTB xStation

"Normal" gaps

These types of formations can also appear on the price chart. They are called "ordinary" because they usually do not have a significant impact on the further direction of listing. Most often they occur when the price is oscillating between key support levels and resistance. Characteristic features are the small range and the fact that very often the formation is closed in a short period of time. As a rule, in such a market environment it is worth refraining from playing setups, especially if we do not have additional confirmation as to the further direction.

Gaps in the consolidation period. DBB (DBB), D1 interval. Source: xNUMX XTB xStation

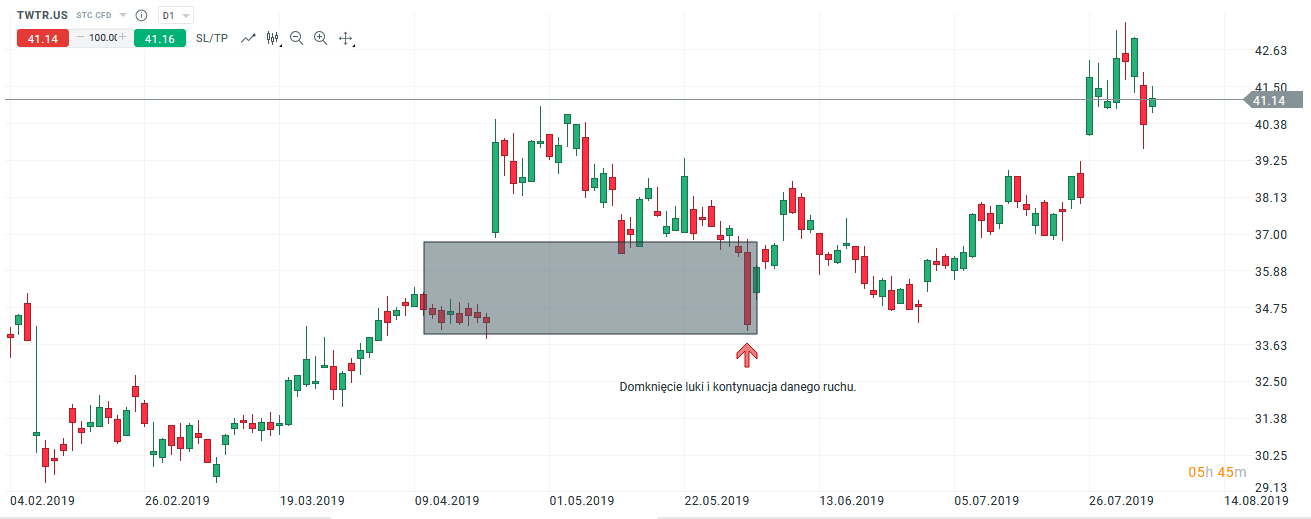

Close the gap

The last aspect worth addressing in relation to price gaps is the phenomenon "Closing". Often, when the price creates a specific gap, we can observe a return to the initial level, which is commonly said closure. Of course, this type of phenomenon is not always the case and it does not necessarily have to occur immediately after the formation of the formation. Playing closures works well if you want to join a given move. When closing it is possible to re-enter the position, because the probability of the price returning to its original direction is high.

Closing the price gap. Twitter (TWTR), D1 interval. Source: xNUMX XTB xStation

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)

Leave a Response