LEAPS - a useful solution for the long term [Options]

Options are very often associated with a derivative that can be used for short-term speculation, creating a spread strategy or securing a position against a decline in the underlying instrument. As a result, the option was labeled as an ideal instrument for short- or medium-term investments. However, in many markets there are ideal options for those who like to invest in the long-term investment horizon. These are Long-Term Equity Anticipation Securities (LEAPS)which are a "long-life" option. Thanks to LEAPS, it is possible to create strategies with a horizon exceeding the next few quarters.

Be sure to read: Options - how to invest with them?

This type of option was introduced in 1990 on Chicago Board of Exchange (CBOE). Initially, this type of option only applied to companies classified as blue chips. In the following years, an increasing number of underlying instruments had this type of option. The "book" definition suggests that LEAPS is any option with an expiry period of 2,5 years and more. However, there are commentators who treat the option as LEAPS if the expiry period is at least one year.

Option pricing and Greek ratios

As with any option, there are a number of factors that affect the size of the premium paid or received. They are:

- Execution price,

- Option "lifetime",

- Variability,

- Interest rate,

- Dividend rate.

Due to the time until expiration, many factors (interest rate and dividend) has a much greater impact on the valuation of options than in the case of short-term options (weekly, monthly).

Keep in mind that each strategy has its advantages and disadvantages. The idea behind the LEAPS acquisition is that the option buyer has plenty of time to implement a positive scenario. At the same time, as in the case of "ordinary" options, there is no obligation to hold the option to be settled. It can sell it after, for example, three quarters. Due to the fact that the passage of time is not linear, the time value of the LEAPS option elapses much slower than the option with a shorter exercise period.

Bonus value

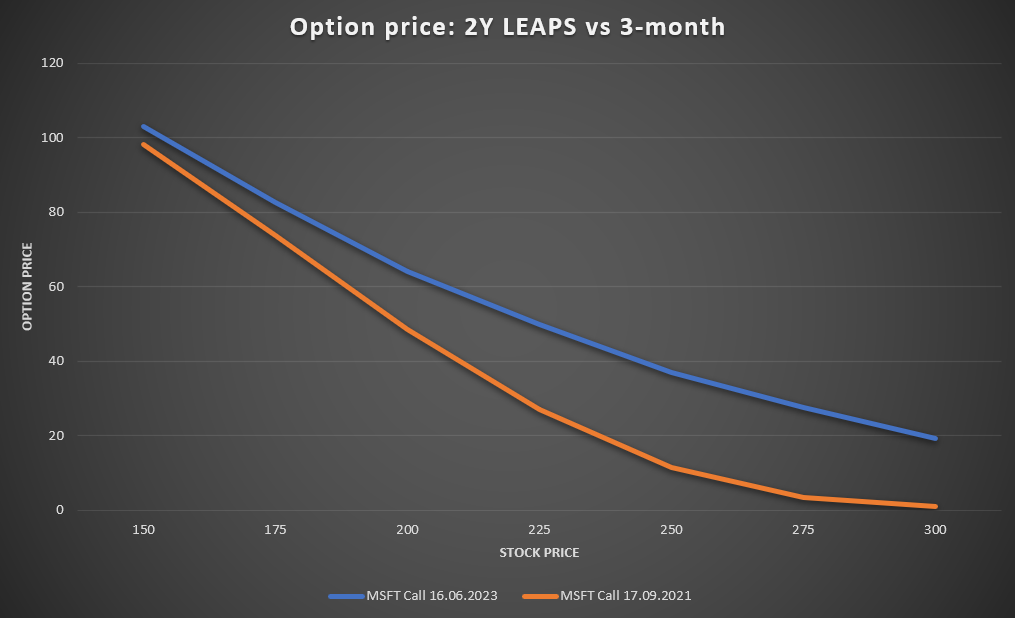

Due to the fact that Long-Term Equity Anticipation Securities options have a longer expiry time, the probability of making a profit in LEAPS is higher than in the case of options with a shorter exercise date. An example of this dependency is the comparison of options for Microsoft (MSFT) expiring in June 2023 and September 2021, on May 21, 2021. The price of one MSFT share was approximately $ 245.

Source: own study

It is clear that the more ITM the option is, the smaller the difference between the expiry price of the short-term (September 21 ') and long-term (June 23') options. For example, a call option with a strike price of $ 150, expiring in June 2023, had an ask price of 103. An option with the same strike price ($ 150), but expiring in September 2021, was valued at 98,2 by the market. As a result, the difference between the valuation of the options was less than 5%.

However, if we compare the valuation of the options with the strike price of $ 250, the difference between the aforementioned options is already huge. The ask price of the Microsoft option exercised in September 2023 was 37. The option expiring on September 21 'was valued at 11,4. The difference in price was around 225%. In simple terms, such a large difference in the time value of the option resulted from the greater probability of earning a profit of the LEAPS option than in the case of the short-term option.

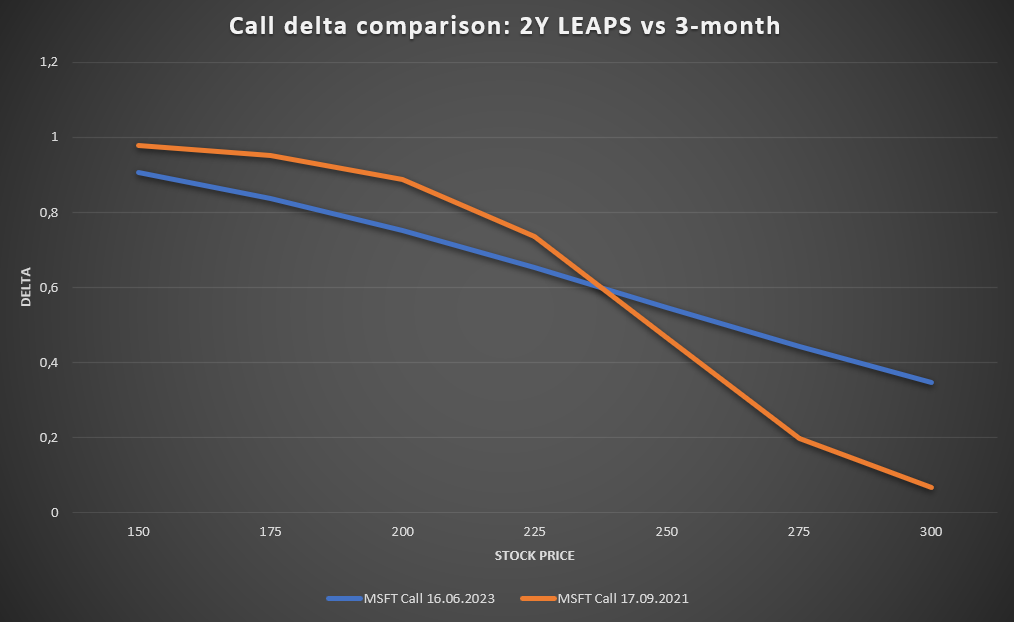

Delta

This is one of the Greek coefficients. Delta has a number of uses, but the best known is to estimate the potential movement of an option price relative to the price of the underlying instrument. In the case of a call option, the higher the delta, the greater the change in the option price. For example, if the Microsoft share price rises by $ 1 (ceteris paribus) and the option delta is 0,75, the call option premium will increase by $ 0,75 (ceteris paribus). Another use of delta is to approximate the probability of an option becoming ITM (in-the-money). If the delta of the call option is 0,75, there is approximately a 75% probability that the option will expire as ITM.

Source: own study

As can be seen in the chart above, the delta of the early exercise option is higher in the ITM-ATM range. However, as the option is more ITM and closer to ATM, the smaller the delta variation becomes.

The situation is different in the case of the OTM option. Short term options are less likely to become ITM OTM than LEAPS. As you can see, the delta for LEAPS drops relatively linearly, while the 3-month option is losing the delta very quickly. A particularly big difference is visible the more the option becomes OTM (eg DOTM). However, the "cost" is the greater premium that is paid by the buyer of the long-term OTM option.

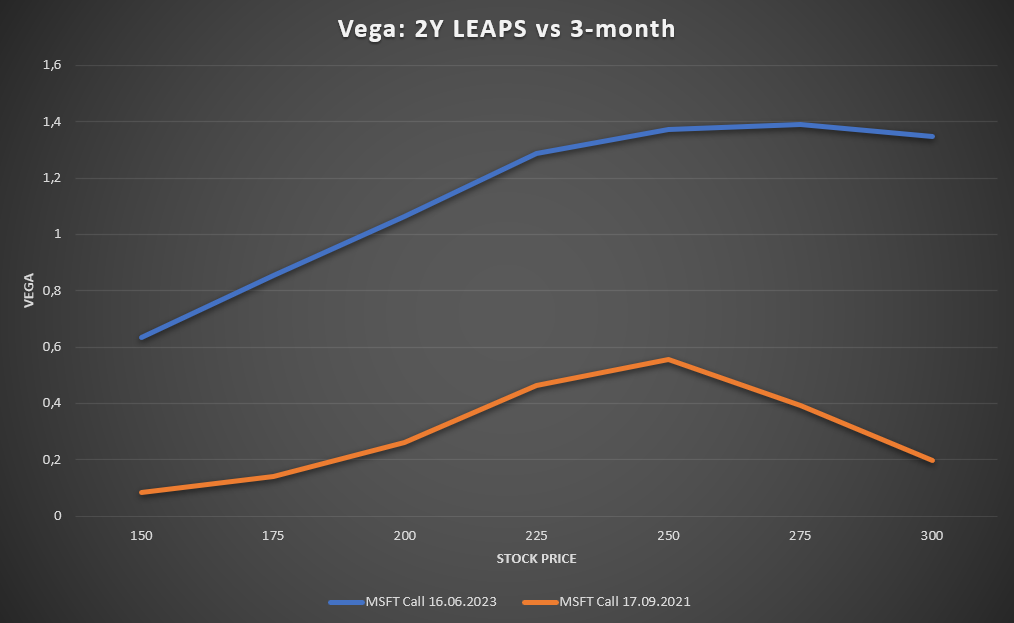

Vega

A very important issue for any option investor is the impact of volatility on the option price. The aforementioned relationship is described by the Greek vega coefficient. It specifies by how much the value of the option will change if the volatility level changes by one percentage point. An increase in volatility increases the value of an option, while a decrease in volatility causes the option price to decrease. It is worth remembering that in the period of increased volatility, the purchased option is more expensive because the external value of the option (the so-called time premium) grows. As the implied volatility returns to "normal levels", option prices will decline as well. In turn, periods of implied volatility decline are the times when "options are cheap", in such periods it is better to buy options than to write them.

Source: own study

The chart above shows the relationship between the size of the vega and the exercise price of the long-term (blue) and short-term (orange) options. As you can see, the price of a long-term option is much more “sensitive” to the level of volatility than it is for a 3-month option. It is also worth remembering that vega drops the more the option is OTM and ITM. The greatest vega value is found around the ATM option.

Strategies with the use of LEAPS

There are a number of applications in which a trader can successfully use the LEAPS option. Due to its nature, this type of option can be used in medium- and long-term trading. The popular strategies using LEAPS include:

- Stock substitute,

- Covered call substitute,

- A substitute for short selling.

Stock substitute

An interesting use of long-term options is to create a "substitute" for a long position in stocks. This application allows the use of financial leverage while controlling the maximum loss. An example would be a comparison of buying Microsoft stocks in the market (100 stocks) or buying a call option deep in the money (DITM).

On March 30, 2020, the investor acquired a call option with an exercise price of $ 150 expiring in June 2023. Paying $ 89,5 per share for it. As a result, the investor must pay $ 8950 to purchase this option. The average purchase price for the shares was $ 239,5. If an investor chose to buy 100 shares, he would buy the shares on the stock exchange at $ 232. However, the investor had to invest $ 22320. The capital invested was 150% higher than in the LEAPS option. The higher average purchase price (for LEAPS options) is due to the time premium.

On April 26, the Microsoft stock price (MSFT) rose to around $ 262,4. At that time, the option price rose to around $ 116,25.

This meant that an investment in common stocks yielded an increase of $ 30,4 per share. As a result, the rate of return on investment brought about 13,1% return on invested capital.

In the case of selling the call option at the price of $ 116,25, this resulted in the profit from the option being $ 26,75 per share. As a result, the rate of return on invested capital was approximately 29,9%.

It is clearly visible that in the case of a dynamic increase in the share price, it is more profitable to use the options that are "deep in the money" (DITM). Such options have a delta close to one and at the same time a limited risk of loss in the event of a sharp sell-off of shares.

Covered call substitute

LEAPS options can also be used as one of the components of covered call strategies. However, instead of buying stocks and writing a call option, you can benefit from buying LEAPS deep in the money and writing a call with a shorter exercise date.

On March 5, the investor acquired the LEAPS option (expires June 2023) with an exercise price of $ 150. He paid $ 92,25 for it. At the same time, he issued an option that expires in June 2021 with an exercise price of $ 275. He received $ 3,25 for it. An alternative would be to buy Microsoft stock at $ 233 and put an option in June for $ 3,25.

At the end of May 21, 2021, one MSFT share was valued at $ 245 and the option price (June 21 ') was valued at $ 0,78. In the event that a written call option was closed, the profit from the transaction was $ 247 ($ 2,47 per share). As a result, the profit on such a transaction was 1,06% ($ 247 / $ 23300).

In the event of closing the written call option (and maintaining the long LEAPS), the return on the written call option would be 2,68% ($ 247 / $ 9225).

Covered call closure

In the case of realized profit on shares held (or LEAPS options), the profit from long-term shares also looks better.

The gain on selling the shares and writing the call option was $ 14,47 per share, as the investor earns $ 1200 to sell the shares at $ 245 and $ 247 to close the option. As a result, the profit was $ 1447, which was a gain of 6,21%.

By reducing the position in both options, the trader made $ 625 on the LEAPS option he bought (selling at $ 98,5) and $ 247 on the issued call option. As a result, the net profit was $ 872, resulting in a return on capital invested of 9,45%.

A substitute for a short position

LEAPS options can be used as a substitute for a short position. Thanks to this, the investor does not have to be afraid of this phenomenon short squeezebecause the maximum loss when using the put option is the premium paid. An example is Microsoft's short sale (MSFT).

On March 5, an investor bought a put option that expires in June 2023 for $ 4330 ($ 43,3 per share). An alternative to such a deal would be a short sale of the stock at $ 232.

On April 26, 2021, Microsoft's share price rose to $ 262,4. As a result, the loss on a short position on MSFT stocks was $ 3040 ($ 30,4 per share). At the peak of the gains, the put option price dropped to around $ 25,75. This meant a loss of $ 1755. This was due to the smaller delta. Taking a short position on MSFT stocks has a delta of -1. In turn, for the LEAPS option, the delta for the put option oscillated around -0,4 to -0,5.

LEAPS - Summary

LEAPS options are an interesting alternative for investors who prefer long-term strategies. This allows the investor to create a substitute for taking a long position in stocks gaining light leverage (for DOTM) and much lower maximum loss than in the case of "ordinary" share acquisitions.

Of course, there are a few "hooks" to which LEAPS may not be beneficial. The investor should remember that long-term options have a much smaller delta than short-term options and LEAPS are much more sensitive to changes in volatility and the interest rate. In the event of high volatility, buying options (call and put) should be avoided, because the price of the option then has a much higher time value. On the other hand, in times of lower volatility, it is worth buying options and avoid writing options. Another downside to using LEAPS is the high bid-ask spreads which make it difficult "Active LEAPS trading". Of course, this article is just an introduction to considering long-term options. Not included, inter alia rolling options, creating horizontal spread strategies or writing long-term options.

| LEAPS | |

| Disadvantages | Advantages |

| Greater sensitivity of option prices to volatility | Less sensitivity to the passage of time |

| Greater sensitivity to changes in interest rates | Possibility of a strategy with a long-term horizon |

| Less sensitive to price changes | |

| High spread | |

More about option strategies

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![LEAPS - a useful solution for the long term [Options] leaps option strategy](https://forexclub.pl/wp-content/uploads/2021/05/leaps-strategia-opcyjna.jpg?v=1622129371)

![LEAPS - a useful solution for the long term [Options] mining cryptocurrencies](https://forexclub.pl/wp-content/uploads/2021/05/wydobywanie-kryptowalut-102x65.jpg?v=1622044397)

![LEAPS - a useful solution for the long term [Options] ed seykota biography](https://forexclub.pl/wp-content/uploads/2021/05/ed-seykota-biografia-102x65.jpg?v=1622183827)