Crises drive innovation - Saxo Bank's forecasts for QXNUMX

Due to the multidimensional complexity of nature and our evolving civilization, society moves from one existential crisis to another, highlighting our weaknesses. Each new crisis is unique and our response to it catapults society onto a new path of development - the current crisis is no different. There is growing evidence that the energy crisis will revive concepts such as self-sufficiency, accelerate the green transition in Europe, and the potential renaissance of Africa. Most importantly, it will accelerate deglobalization as the world economy will split into two competing systems, with India as the greatest unknown.

The world is experiencing the greatest energy shock since the late 70s, and the cost of primary energy relative to GDP has increased by 6,5% this year. This is having a heavy impact on consumers who limit consumption, but also forces factories to cut production and EU politicians to create economic rationing plans, as the coming winter puts even more pressure on the already struggling energy sector. According to the International Energy Agency, the total supply of primary energy to the world economy 81% comes from coal, oil and natural gas, and the main source of growth is non-OECD countries.

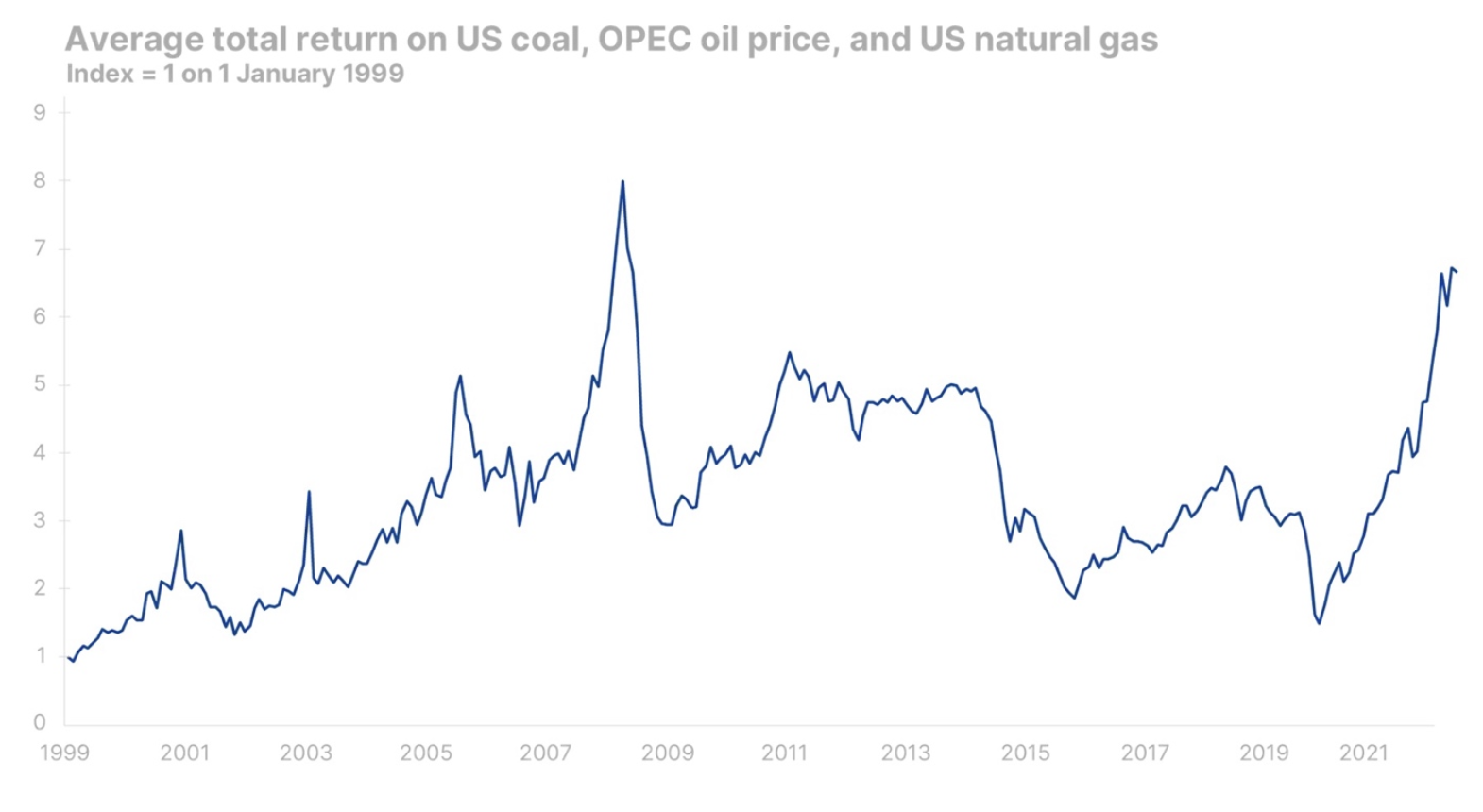

As the world still relies on fossil fuels, it is natural that it has plunged into crisis as the prices of these three energy sources have risen by 2020% since April 350. The price increase is the most intense in the history of the modern economy and, unlike the energy crisis of the 70s, it is total in the sense that it hits transport, heating and electricity. The recently passed US climate and tax law paves the way for the oil, gas and coal industry to continue operating longer than expected two years ago using a carbon capture and valuation system. It could also be one of the reasons why the concern Berkshire Hathaway increased its stake in Occidental Petroleum and was approved for a majority stake. In our forecast for Q10, we wrote that the best return forecasts are related to the global energy sector (9% annually). Due to rising prices in energy companies, the projected annual rate of return has now dropped to XNUMX%, but this does not change the fact that the mining industry is still attractive.

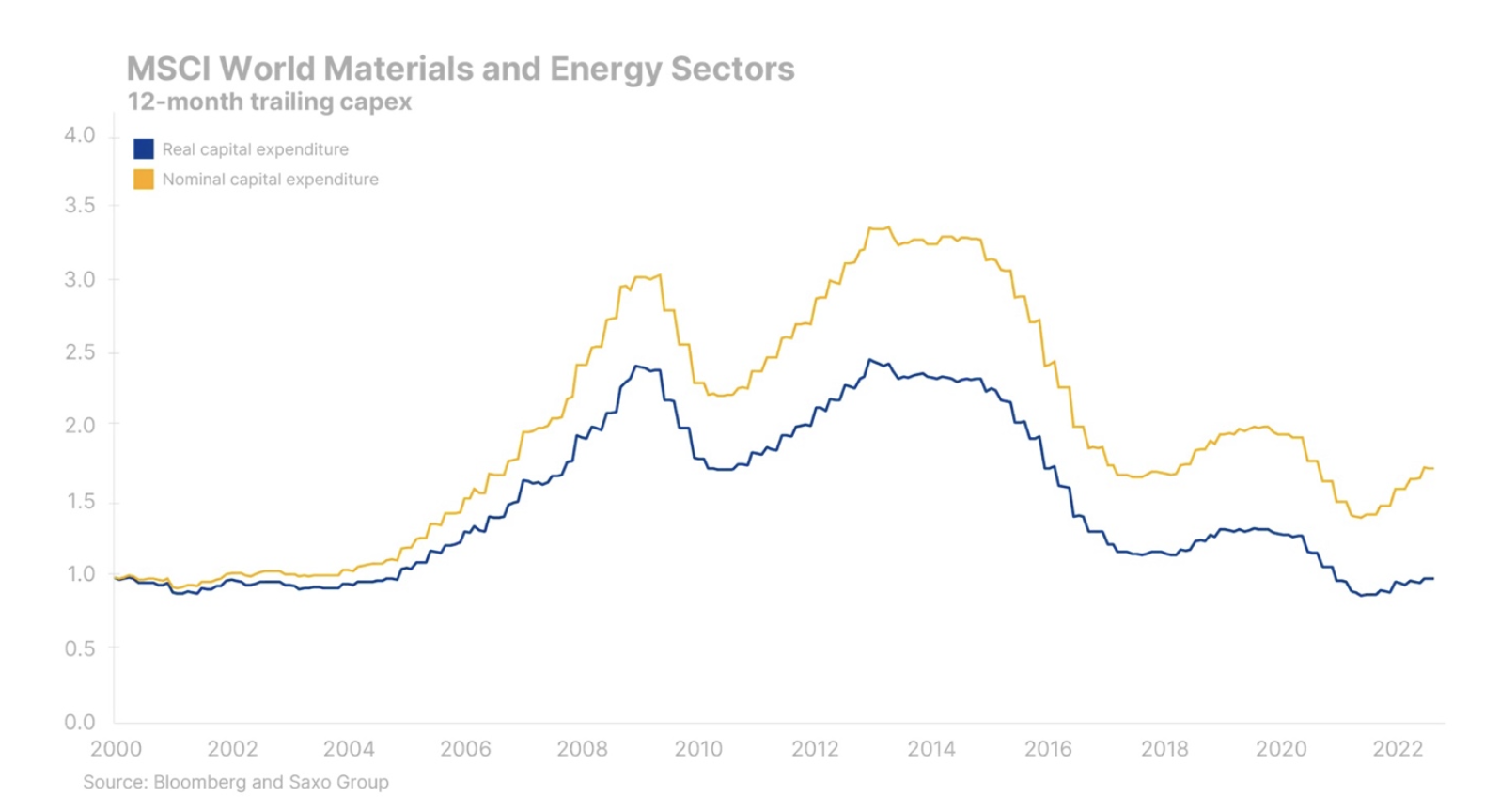

The energy crisis will slowly ease off as the world economy adjusts naturally to the shock and higher prices, but this adjustment may take many years. The challenge facing the world's largest economies is that the flexibility of fossil fuel supply is low and the green transition is accelerating electrification - putting enormous pressure on non-fossil energy sources. It almost seems like a fantasy, which is why the mining industry is needed to fill this gap and prevent energy costs from exploding. Keeping energy costs down requires investment, but unfortunately real capital expenditure is not rising sufficiently, prolonging the adjustment process and increasing energy prices.

The green transformation will accelerate

China has talked about self-sufficiency for many years, and Europe is hitting the same tones with regard to its energy and defense policies. Europe has already been a leader of green transformation and has the most energy-efficient economy in the world, but the energy crisis and independence from Russian oil and gas is still a painful process for it. However, there are opportunities associated with crises, and the current energy crisis will accelerate the energy transition in Europe. The Old Continent may become a world leader in the field of energy technologies, which in the future will lead to enormous success in terms of exports. While the United States has conquered the world in decades of digitization, re-establishing the meaning of the physical world is a chance for Europe to catch up with the United States. Over the next 10 years, Europe's energy and defense sector will undergo a radical transformation and will necessarily become much more competitive. In the short term, however, the European Union will limit market forces by setting price caps that protect the consumer from rising prices, but also extend the transition period, while increasing the financial risk for the government to absorb energy costs.

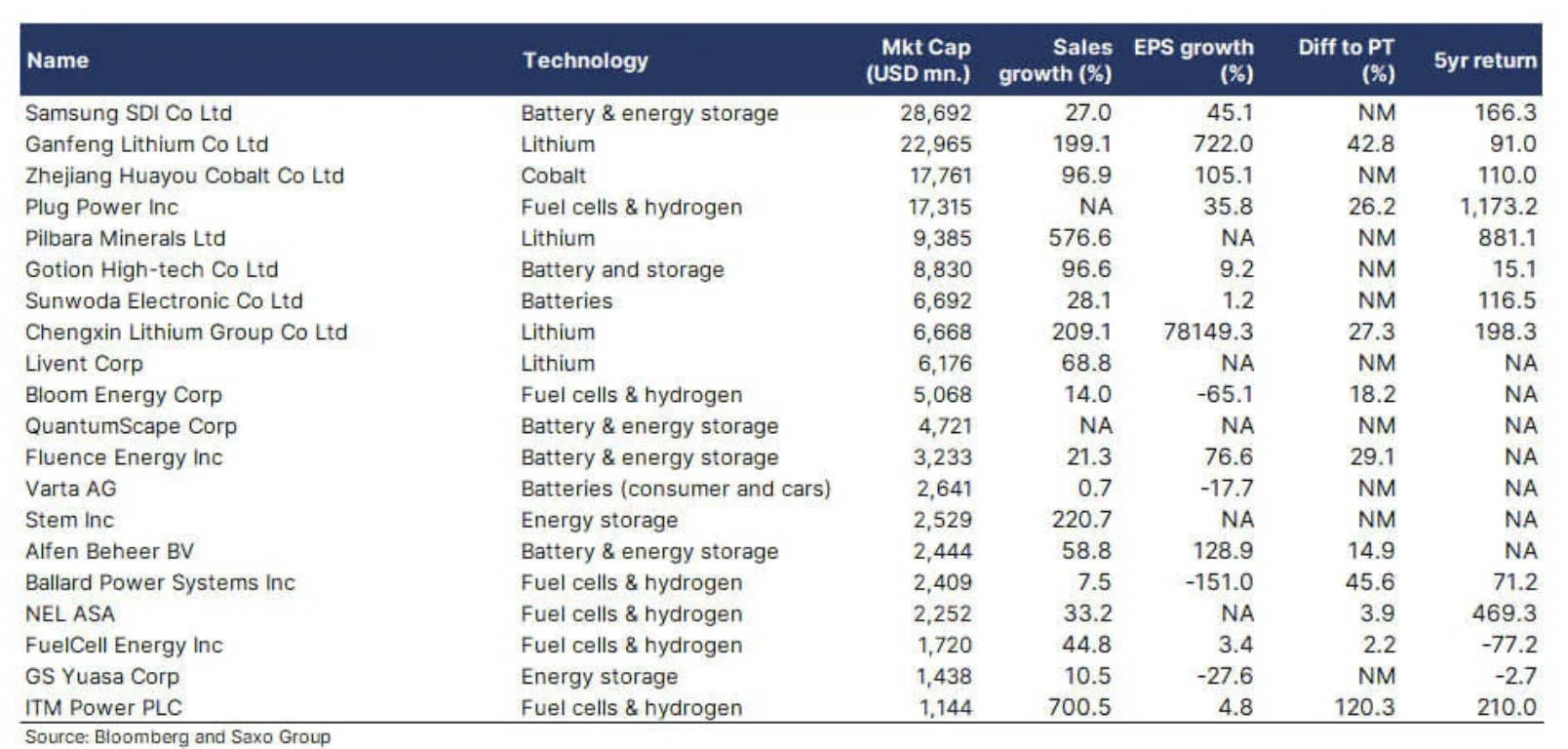

The green transition depends on energy storage as it creates an energy mix that will sometimes produce a significant surplus of electricity that needs to be stored. One important potential technology in this regard is Power-to-X, which converts excess electricity into hydrogen through the electrolysis of water. Other technologies include batteries, fuel cells and electric type vehicles vehicle-to-grid as network load stabilizers. The table below shows our basket of energy storage technologies. Its purpose is to compile an inspiring list of companies involved in specific technologies and is not an investment recommendation.

Deglobalization and its consequences for capital markets

The global energy crisis is the main media topic and it is directly related to the difficult winter that awaits the global economy. However, the real winter for the whole world will be brought not by the energy crisis, but by the increasing trend of deglobalization. The US government recently restricted Nvidia's sales of its most advanced AI-powered microprocessors to China over fear that they were used for military purposes. This decision was a consequence of the American law CRISPSwhich establishes Washington's broadest industrial policy since World War II and aims to rapidly expand semiconductor production in the United States. While the United States is taking the lead, Europe is taking action on semiconductors just as fast.

China has responded by referring to the "nationwide system" that has already been used twice - in the space program and in biotechnology during the pandemic. This time, the Middle Kingdom decided that it needed to accumulate more resources to become semiconductor independent. Meanwhile, the United States is expected to restrict semiconductor device exports to China, which will force China to build an entire semiconductor manufacturing chain.

Even though semiconductors are just one industry, the signals are telling. These movements follow the Trump-era trade wars - the war in Ukraine made it clear to us that the world is divided into two value systems. In the longer term, this will drive energy and defense policies as well as critical technologies such as semiconductors and, in general, transform global supply chains. Globalization has been the biggest driver of low inflation in the last 30 years and has been critical to emerging markets and their stock markets. Reversed globalization will create chaos in trade surplus countries, put pressure on inflation to rise, and threaten the US dollar as a reserve currency.

One of the underestimated aspects of deglobalization and Europe's quest for energy independence is the potential repercussions for Africa. Europe's desire to become independent from Russia in terms of resources means that Africa must fill this gap. As a result, Europe will begin to compete directly and in the long term with China for resources on the African continent, which is associated with further geopolitical tensions. India will be at the center of these events: can the world's most populous country take a truly neutral stance in deglobalization, or will it be forced to make difficult choices?

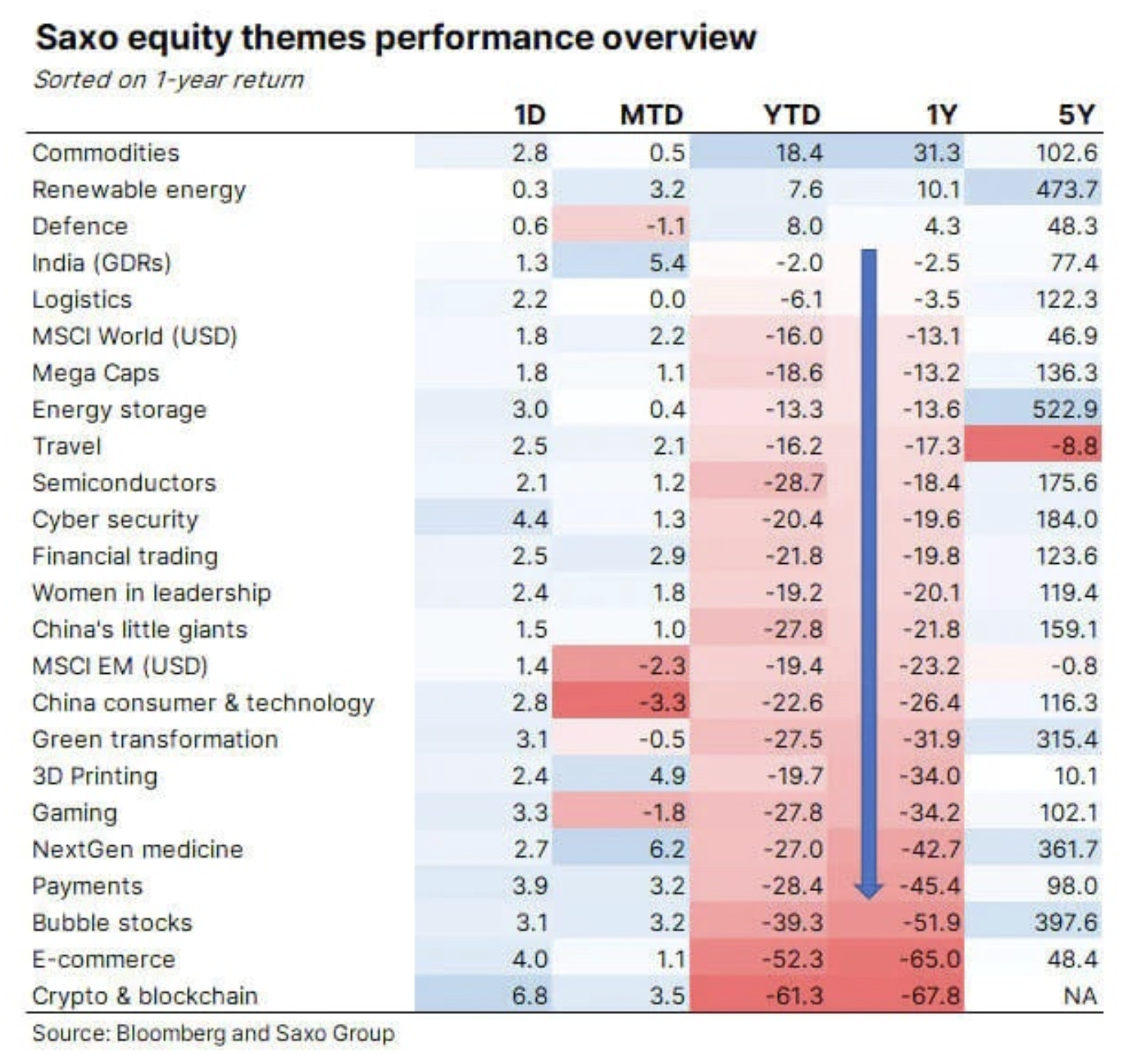

Based on the energy crisis, green transition, continuous urbanization and deglobalization, we continue to move towards thematic areas for action such as raw materials, logistics, renewable energy, defense, India, energy storage and cybersecurity.

Countries with high consumption and trade surpluses are at risk

The estimated 6,5 percentage point increase in primary energy costs represents a tax on economic growth and drains the private sector surplus in the form of lower disposable income for consumers and lower operating profits for corporate investment. High-end consumer stocks have responded to the pressure, underperforming the global equity market. The most sensitive element the consumer goods sector is the European luxury consumer goods sector, dominated by French luxury goods manufacturers and German car makers. The list below presents stocks of the top 10 European consumer luxury goods companies.

- LVMH

- Hermes International

- Christian Dior

- Volkswagen

- Inditex

- Essilor Luxottica

- Richemont

- Kering

- Mercedes-Benz

- BMW

The decline in consumption is associated with a corresponding decline in the production of consumer goods, which means that countries with a trade surplus such as Germany, China, Japan and South Korea are most at risk of a significant slowdown in consumption. All four countries face serious structural problems and their equity markets reflect these challenges in the current year.

Our main thesis is that the global stock market faces a potential collapse of up to 33% before stock prices hit the bottom. The final stage of this decline is likely to be the result of the combined effect of higher interest rates over an extended period of time, a compression of profit margins as companies can no longer pass on rising production costs to consumers without severely damaging revenues, and a likely recession in the real economy as a result of the energy crisis. The next six months will look like a long, dark winter in many ways, but rest assured that spring is always back and the brightest days in global stock markets are yet to come.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)