Crypto pension: an opportunity to shop?

Today it's time for the first summary of our retirement portfolio, based on investments in the most risky assets on the market: cryptocurrencies. Over the last month, a tornado swept across the markets, as was our case. Given the investment horizon, however, the glass is still half full.

Recall: a month ago we started our experiment, which will consist of regularly investing in cryptocurrencies

Crypto-retirement rules of the Forex Club Portal:

- we invest on the stock exchange Binance, which is not only the largest in the world, but also - so far - the most stable,

- every month we devote 60 euros (this is the minimum deposit threshold in Binance),

- we want to invest approx. half of the funds in Bitcoinas the "king of cryptocurrencies" and the undisputed flywheel of the entire market,

- in addition to BTC, we selected 3 other cryptocurrencies: LINK, ADA and BNB, in which we will invest at least until the end of the year,

- if it is possible, we deposit cryptocurrencies on "deposits" in Binance,

- at the end of the year we will decide if there are other cryptocurrencies in the portfolio,

- the investment horizon is at least 10 years.

First month: from heaven to hell?

A month ago, we started our experiment and we were able to immediately recognize the weakness of the mind of the average investor. What is it about? On checking the value of your portfolio from the very beginning! Who checks their sub-account at ZUS or in the third pillar of retirement every day (assuming, of course, that they have such an option)? We looked and, despite a very small amount, "cheered on the profits", which already exceeded 10 percent after the first days. Such an annual rate of return on a pension fund would be a hit.

The assumption of our portfolio, however, is not to be influenced by emotions, not paying attention to market fluctuations and regularly buying cryptocurrencies regardless of their price for the next 10 years. Therefore, checking the portfolio value frequently does not make much sense. Especially since then came the coronavirus ...

Actually, it was earlier, but only last month investors realized how much it could threaten the global economy. Falling stock indices and a huge decline in crude oil are not enough. The panicky flight from any investment to cash has also had an impact on the cryptocurrency market. The drops reached over 50% in many cases. However, when information about virtually unlimited reprinting of dollars as well as similar ideas in Europe emerged, investors looked more favorably at cryptocurrencies, especially those with a predetermined target number of units. Paradoxically, the financial crisis may show that it is fiat currencies that have less coverage "in reality" than non-inflationary cryptocurrencies. For many reasons, it is too early for such a conclusion, but it is slowly starting to break into the mainstream.

What does this mean for our portfolio?

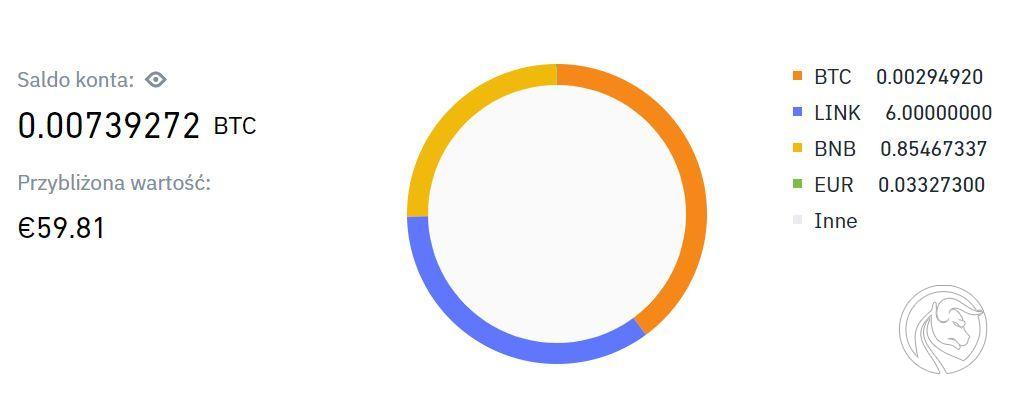

On the day of purchase, the valuation of our portfolio was 59,81 euros.

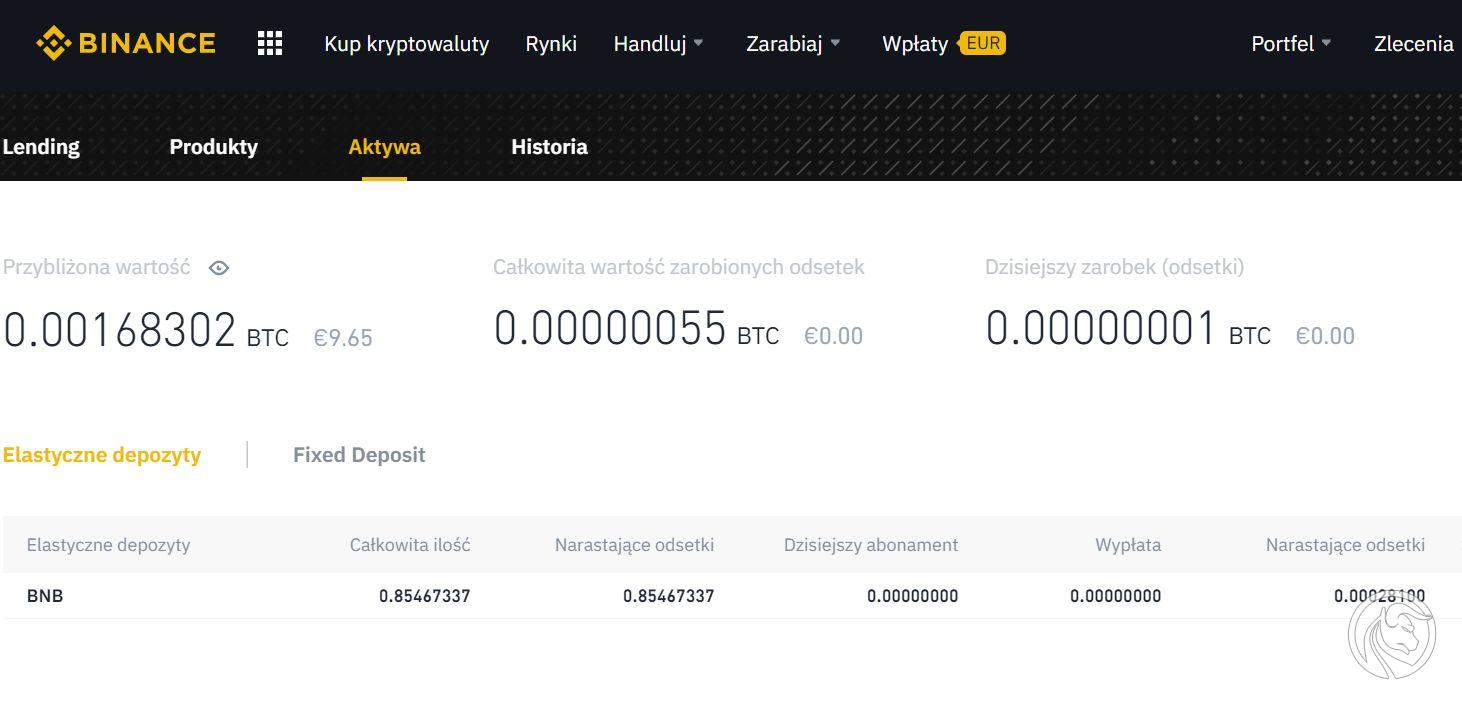

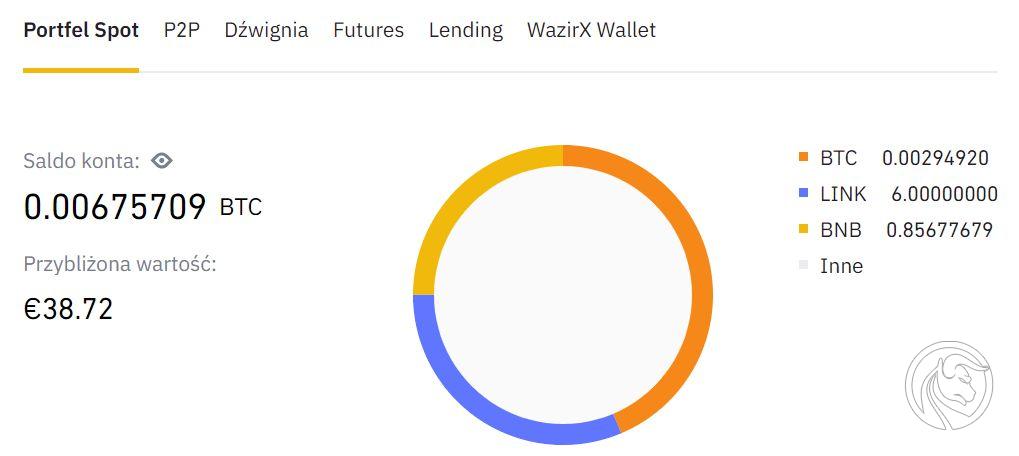

After huge declines in March and only partial recovery, it turned out that the value of the cryptocurrencies we collected is 38,72 euros. And this despite the fact that we earned Binance Coin on the deposit. On the day of opening the deposit we had 0.85467337 BNB, and at the end of March 0.85677679 BNB.

Loss in the first month: -35,2%

The loss in the first month is huge, but - as we wrote earlier - it can be very positive. We are at the beginning of the road, we only invested 60 euros and now the prices are much lower. So if we take into account the 10-year investment horizon and the assumption that cryptocurrencies will become more expensive in the long term, we treat it as a good opportunity for further investments.

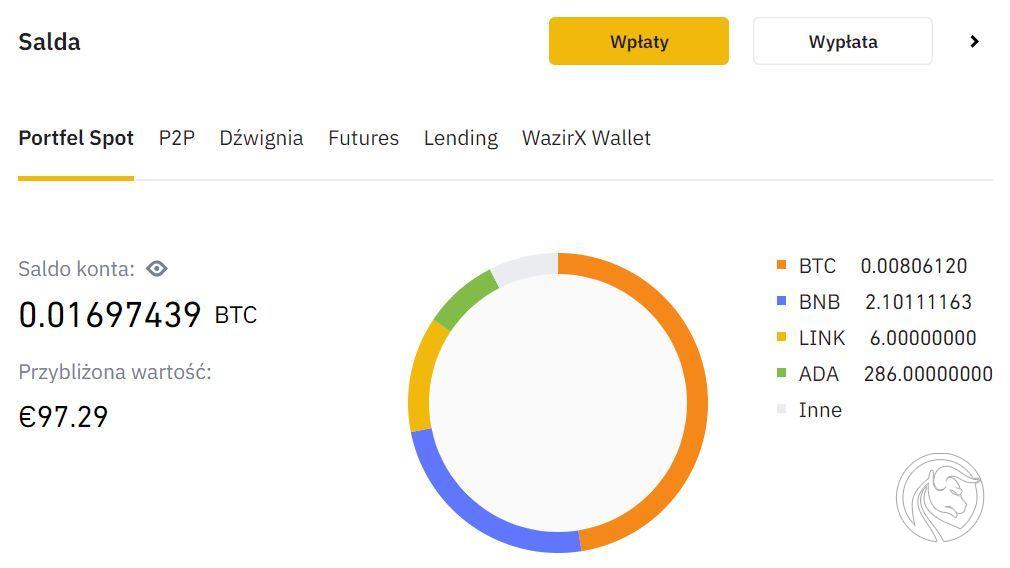

On April 1.04.2020, 60, we invested another tranche of EUR 0,25. We now have Bitcoin, Ada, Link and Binance Coin in our wallet, which are all the cryptocurrencies we want to buy this year. LINK and BNB immediately land on deposits (average annual interest from 0,9% to 97,29% - not much, but always something). Current portfolio value: EUR XNUMX.

Next month's summary!

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)