How to copy orders to other Forex platforms

Copying forex trades is an extremely useful trick, especially for people who trade multiple accounts simultaneously. It happens that traders in the heat of the fight against the market come up with various ideas. Sometimes circumstances force them to do so. One of such things can be the need to duplicate transactions between different accounts and even platforms.

Why do we want to copy transactions?

The reasons can be various, so we will only mention the most popular ones. In this article, we will explain to you the technical issues related to duplicating transactions to another account or even another application. We will tell you how to do it and pay attention to the risks associated with it.

The habit of the platform and the economic calculation

It very often happens that we have been using our services for many years broker offering a particular type of platform that suits us very well. We have our favorite indicators, chart settings, we know where each option is, and we've even got a handle on some keyboard shortcuts. You could say "it's perfect!" But then the calculation begins, which shows that the offered spreads differ a bit from the "market" spreads, and the commissions have not been lowered since ... Never :-). It quickly turns out that our broker is simply expensive. And it just so happens that yesterday we saw an advertisement from another company, which, admittedly, has a different platform, but comes out twice as well in terms of cost. But our good old broker is "only" expensive. So what to do? Then the trader comes to the idea of continuing to perform analyzes with him and conclude transactions on his favorite platform, but already on a demo account. It is much more convenient than constantly jumping between platforms and checking what is happening with our analysis on one, and then how our positions are on the other. So we set up an account with a competitive broker, copy trades and cut costs by 2% with very little effort. Voila!

Automatic strategy in X language

The same applies to a situation where we already have a great automatic strategy (or another tool for convenient, fast trading). However, for various reasons, such as the aforementioned costs or other persistence, we would prefer to move to a completely different platform. So we are faced with a dilemma - is it better to rewrite our entire strategy (or tool) into a different programming language, or have it rewritten to a programmer (additional costs), and then check everything on the demo for a month? Or maybe we just use the copier and leave everything as is? The choice makes itself ...

Sharing your strategy with others

If we are successful traders who are notoriously successful so much that it becomes boring, and at the same time we have friends who are always under the line, it happens that something like compassion arises in us :-). On the wave of this emotion, from goodness of heart, pity or simply from human empathy, we can come to the conclusion that we will provide insight to our colleague's account so that he can see what and how or simply allow him to duplicate our actions (under his responsibility bright). Of course, the situation can also be reversed and someone may someday want to share access to their account with us. All we have to do is pass the investor's password (only to the preview), so that we can avoid the risk that the friend will make mistakes :-).

diversification

An experienced trader knows that proper diversification is essential. It protects not only our capital but also in the long term it can optimize our profits. But it is primarily an increase in the level of security. Doing identical trades on several platforms or accounts is also a way to diversify. We spread the risk over different brokers, servers, deposit currency, and even access to different market liquidity (especially useful for high volumes). Therefore, it is safe to say that concluding identical transactions on several accounts makes sense.

Manual and automatic copying - tools

The headline may be slightly misleading, because it is difficult to talk about "manual copying" :-). Of course it is possible. It requires continuous tracking of more than one platform, fast fingers, and is limited to taking identical actions on the other account or platform. It's just that this method will work only when we trade long-term, we can sit at the computer all the time (if we trade through EA), and there are not too many transactions during the day (thanks to this, we also limit the number of mistakes 🙂).

The headline may be slightly misleading, because it is difficult to talk about "manual copying" :-). Of course it is possible. It requires continuous tracking of more than one platform, fast fingers, and is limited to taking identical actions on the other account or platform. It's just that this method will work only when we trade long-term, we can sit at the computer all the time (if we trade through EA), and there are not too many transactions during the day (thanks to this, we also limit the number of mistakes 🙂).

For this reason, tools have been invented that will perform this process automatically. These are the so-called copiers, copy tools, copiers, trade copiers, etc. etc .. He called, what he called - the task is clearly defined. There are quite a few tools on the web so there is plenty to choose from. Most are paid solutions, but you can also find free solutions (usually limited). Commercial tools are much richer in functions, which are often useful, and in some cases prove necessary.

An alternative way of copying transactions is to use portals that are created just for this purpose. It's just that their capabilities are often very limited, they involve limiting the use of one platform or generate additional costs (additional fee included in the spread / commission or subscription subscription).

Copy Forex Trading - How Does It Work?

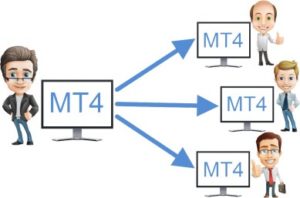

The principle of operation is simple. The copier manufacturer provides us with two tools in the form of an automatic machine - Master i Slave. The first one is run on the main account from which the transactions will be duplicated, while the second one can be used multiple times. In order for orders to be copied, both platforms must be running and connected to the Internet (a VPS will be useful). The solutions are different, but most often the machines must be run on the same computer. This allows them to communicate with each other in a simple and reliable way. There is also the possibility of communication via the software manufacturer's server, however, this is a less common solution.

The principle of operation is simple. The copier manufacturer provides us with two tools in the form of an automatic machine - Master i Slave. The first one is run on the main account from which the transactions will be duplicated, while the second one can be used multiple times. In order for orders to be copied, both platforms must be running and connected to the Internet (a VPS will be useful). The solutions are different, but most often the machines must be run on the same computer. This allows them to communicate with each other in a simple and reliable way. There is also the possibility of communication via the software manufacturer's server, however, this is a less common solution.

Automatic Master it is usually a simple tool that does not require configuration. It is more a way to use an account than something that we will actually use. What else in case Slave, which can already be drawn with interesting functions and it's actually the heart of the copier. But about that in a moment. Containing transactions on the account on which the tool is active Master we're opening the way to receive signals on accounts with plugged-in Slave. By clicking "buy" the machine duplicates the same action on the other account. If we click "close position" on Master the same will happen on Slave. Simple, but in practice it can be complicated :-).

Possibilities of copiers

Programming is a powerful tool that has amazingly developed trading opportunities. Copy Tools now they can handle many bills at the same time. Manufacturers sometimes limit their number to, for example, 4 or 8, but there are also those that do not have a limit. It is also possible to copy orders between different platforms, which means that when trading on the MetaTrader 4 platform, we can automatically duplicate our transactions, e.g. on traders and/ or JForex Dukascopy (and conversely).

Examples of copiers:

In most cases, regardless of the tool used, the speed of duplicating even the entire mass of transactions is satisfactory. Surely the human hand cannot compete with this.

On account Slave usually we can choose the way of capital management:

- copy the same volume as in your account Master,

- (not) copy transactions with a larger / smaller volume than indicated,

- use a position multiplier (eg 0.1 means that we will open an 10 transaction - a smaller one),

- or based on the percentage of our deposit (the value of the volume in your account Master is ignored).

A decent copy tool, which is what?

A decent copier should be able to "modify" the names of instruments or identify them automatically even in the event of some discrepancy. Otherwise, if our other broker uses different symbols, eg EURUSD.lmx, GBPUSD.micro etc., we have a problem. I do not mention the differences in the naming of stock indices or commodities (eg DE30, GER30, GDAXI ...). After all, it will be a completely different instrument for the program.

It also seems necessary to introduce an acceptable slippage or deviation within which we are ready to duplicate the transaction. When trading on macro data, it may happen that the quotes will be left behind on the Master account, as a result of which we will conclude a transaction (in our opinion) at a favorable rate. However, on the second platform it will be copied at a much, much worse price. Various types of security informing us about such situations, as well as others, e.g. a problem with the connection, increase the comfort of using this type of tools.

Risk of using copiers

There is no fun without risk. It is similar with investing :-). It's just that by investing with the use of copiers, we get new worries. There are no perfect solutions, so you have to be careful here as well. The aforementioned security features are not available in all copiers. Therefore, if we use one that does not offer them, we must be aware of several issues.

Connection problem

This may apply to the broker platform and server itself, as well as copier communications. Imagine a situation where we trade on a platform throughout the day Master (demo) noting a significant profit. At the end of the day, we want to check our profits on the account SlaveWhat's up? In the morning the connection was broken and nothing was duplicated. This is a quite optimistic scenario, because it can be much worse :-). It could also be that the position opened by us in the morning was copied but the problem with the connection occurred later. On account Master the transaction was closed with a small loss but the rate continued to run… And the position on the account Slave the loss increased.

Unreasonable operation of the copier

It may be that it is the broker's server on the account Slave temporarily lose the connection. If during this time we modify our transaction (eg, move SL to BE), not every copier will perform this task after reconnecting with the server. There is also a risk that if at the moment of the lack of connection we open the position at the X exchange rate, then the copier, after resuming communication between the platform and the server, will open this position to us, but after the X + 100 pips.

It may be different - on account Slave we closed the position by hand (not using the copier by making it on the account Master) or only on Slave our transaction was at least SL. A poorly designed copier may read this as "no position" and reopen it at the market rate.

Discrepancy in quotes

The broker is unequal to the broker - it has been known for a long time. However, it is best if their quotes in this case are as similar as possible.

READ ALSO: Differences in charts between brokers

If you copy transactions between brokers whose prices vary quite often (even for a very short time) then you have to take into account problems. There will be times when you opened a position at a price different than you planned. One account will be credited with the SL and not the other. The "acceptable slippage" filter will result in not all transactions being concluded.

Delays in execution

The notoriously late copying of transactions is pointless. Ultimately, we will lose out. If you notice that the entire copying process is taking a long time - diagnose the problem. The delay can be affected by the broker's server, VPS (if we use it), the copier itself, and our computer. Transactions should be copied in no more than one second.

All these problems can be dealt with. First of all, we must start by making an informed choice. Let's choose a copier with appropriate security, one that has the functions we need and is well designed. Let's test it first on demo accounts in different conditions. Next - let's choose a proven VPS, which does not always have to be expressive. It is often enough just to be reliable. When choosing a broker for copying, let's check its quotes. Lower spreads will work in our favor, but frequent gaps in prices, small amount of ticks or odds clearly out of line with our broker Master not any more.

All these problems can be dealt with. First of all, we must start by making an informed choice. Let's choose a copier with appropriate security, one that has the functions we need and is well designed. Let's test it first on demo accounts in different conditions. Next - let's choose a proven VPS, which does not always have to be expressive. It is often enough just to be reliable. When choosing a broker for copying, let's check its quotes. Lower spreads will work in our favor, but frequent gaps in prices, small amount of ticks or odds clearly out of line with our broker Master not any more.

Trust, but check

Do not leave the copier alone. Control from time to time whether everything works properly, both from the technical and commercial side (differences in the courses of execution of orders, discrepancies in quotes, etc.). This is especially important when trading real funds. If the tests were successful, after all, look from time to time on the other platform and see if everything is ok.

Copy Forex Trading - Is It Legal?

Of course! But only under certain circumstances. Brokers do not in any way forbid in their regulations (or at least I have not encountered such provisions) duplicating their transactions to other accounts on or off their platform. The problem with legality arises only when a third party provides us with the data for his account so that we can take care of everything. "They took care of everything", that is, they managed the process of copying transactions from our account to his. Financial supervision may consider this to be managing the account and thus the funds of another person. Especially if we received some kind of remuneration for it. Although the transactions were automatically duplicated, we ultimately decide what items are copied. We also decide what their volume will be and they will ultimately have an impact on the results generated on the account.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)